When it comes to Bitcoin and crypto, the stories surrounding it move in waves, especially since we are dealing with such young technologies. Bitcoin was launched in 2009 and has risen in price several times towards blow-off tops and subsequent crashes. There were different factors at play on each occasion, but the key stories can be identified.

In 2013 we had very early, tech-savvy adopters who picked up the new coin. In 2017, retail traders got caught up in the exuberance and a sense emerged that Bitcoin could be a kind of digital gold. And most recently, in 2021, we had the promise of institutional participation.

As we progress, the stories begin to work alongside each other. The Lightning Network, a Layer 2 payment protocol for Bitcoin launched in 2018, aims to enable better BTC functionality as an everyday currency. And BTC’s ability to become a store of value (or digital gold) attracted interest from companies like Tesla and MicroStrategy in 2021 when they acquired BTC. Let’s also not forget the nation-state of El Salvador, which also adopted BTC as legal tender in 2021.

That last story, institutional adoption, looks set to evolve as we enter the next phase of Bitcoin’s existence. Bitcoin’s halving is coming in 2024, and this technical event that happens every four years has so far corresponded with bullish periods (although there is debate over whether the halving itself is causing these shifts in market structure, or whether it is simply coinciding with a four-year cycle that is present for other reasons).

Currently, all eyes are on BTC ETF filings in the US from top asset managers, including BlackRock and Vanguard, awaiting SEC approval. These funds, if they can function, have the potential to usher in an era of true mainstream adoption of Bitcoin, and could open the gates to new capital flows.

BlackRock CEO:

2017: “Crypto is an index for money laundering”

2023: “Crypto will play a role as a flight to quality”

What a time to be alive!

pic.twitter.com/xW0pGwDVrC

— Genevieve Roch-Decter, CFA (@GRDecter) October 16, 2023

However, the US is not the fastest moving region when it comes to facilitating institutional involvement (in fact, the SEC often seems unwelcoming towards crypto). This year we’ve seen the crypto regulatory framework called MiCA get the green light in the EU, while Hong Kong is positioning itself as an Asian Web3 hub, and now in the world’s fifth largest economy, India, there have been some notable developments.

Building a crypto database

Aiming to take action by the end of the current fiscal year in March 2024, Indian authorities are working on a comprehensive database intended to cover all crypto exchanges, with the intention of enabling domestic authorities to enforce tax requirements to coerce and detect cryptocurrencies criminal activity. The proposed database aims to track not only public exchanges, but also those that fly under the radar on the dark web.

In 2021, India, as a member of the G20, pushed the Organization for Economic Co-operation and Development (OECD) to implement an international framework addressing crypto-related tax evasion, under which the OECD introduced the Crypto Asset Reporting Framework (CARF), and now India’s own emerging database will push to enforce standard financial norms in the crypto world.

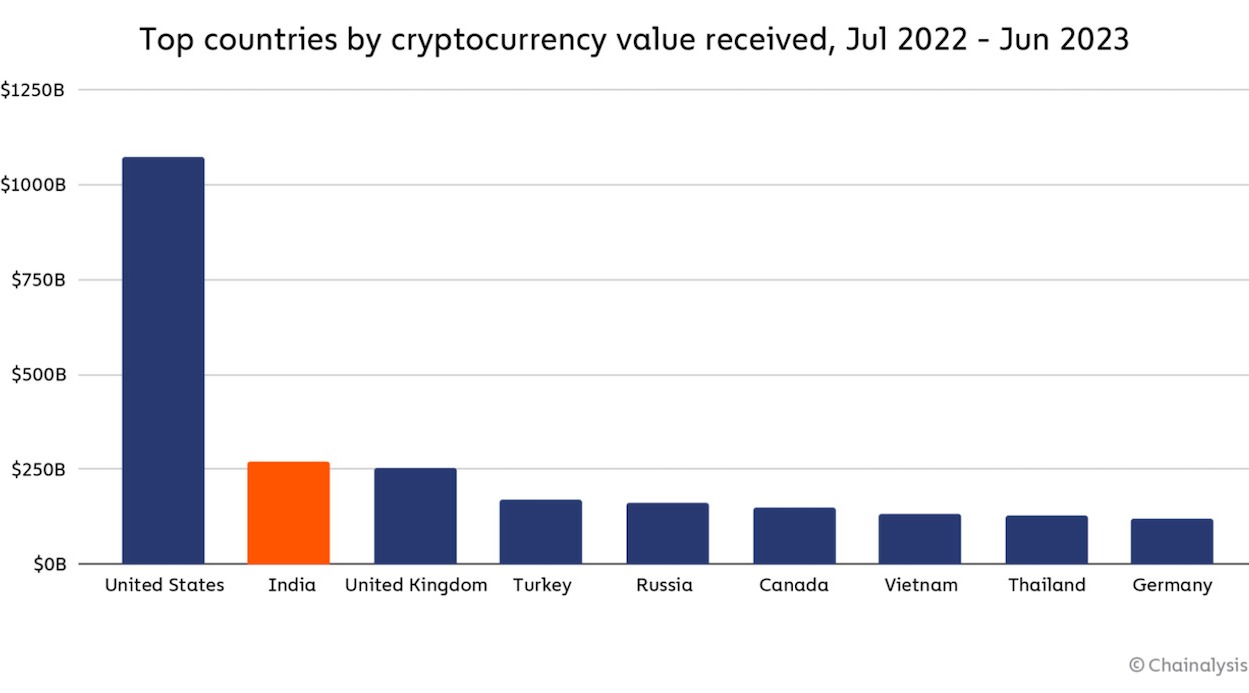

Moreover, this all comes as India is emerging as a global leader in true crypto adoption, as evidenced by its crypto transaction volumes, which are the second highest of any country.

Top Countries by Cryptocurrency Value Received

At Liminal, a provider of crypto wallet infrastructure and Web3 custody solutions, industry veteran Manhar Garegrat, Country Head for India and Global Partnerships, commented on the benefits of India’s inbound database: “A database will act as a foundation for creating a homogeneous ecosystem of companies operating within the digital assets industry and will enable constructive collaboration between companies with diverse Web3 products and services.”

He added: “The government of India has been one of the most vocal in talking about the need for global cooperation. This database will serve as a constructive step in that direction. This initiative will provide symmetrical information about companies that will empower users. to make an informed decision.”

Garegrat speculated on the details of what exactly the database might contain when he stated: ‘The database may also contain ratings of companies based on various parameters such as safety standards, evidence of reserves and performance history to create an environment of trust and transparency in the digital asset industry.”

Institutions need compliance

As we see, that tantalizing crypto story of the institutions’ arrival has already started to play out tentatively in 2021. There were subsequent pullbacks, and events like the scandal-ridden collapse of the FTX may have created temporary doubts, but in the long run term Overall, the direction of the movement is towards institutional involvement in crypto, through fund managers, private companies and public bodies.

However, solid cryptocurrency adoption (not just at the edge, but respectably intersecting with traditional finance and commerce) will require verifiable compliance and security. It has become clear that existing frameworks do not fully match the unique characteristics of crypto and that new tailor-made resources are needed. It also appears that India is now taking the lead in addressing such needs.