Polkadot (DOT), one of the prominent blockchain networks in the crypto space, experienced a 16% decline in market capitalization in the third quarter (Q3) of 2023, according to a recent report. report from Messari.

This decline came after a moderate downturn in the overall cryptocurrency market during the third quarter, despite favorable court rulings XRP and grayscale. Total crypto market capitalization fell by 5.8% Bitcoin (BTC) and Ethereum (ETH) fell 7.5% and 10.0% respectively.

Polkadot ends Q3 with a market cap of $5.2 billion

As reported by Messari, Polkadot’s market cap closed at $5.2 billion, making it the 13th largest cryptocurrency by market cap in Q3 2023 (currently 15th).

Polkadot’s financial structure is based on a weight-based compensation model, which differs from the gas meter model in other networks, such as Ethereum.

Transaction fees in Polkadot are determined and charged before execution, with the calculation consisting of a weight fee that reflects computing resources, a length fee based on transaction size, and an optional tip to incentivize block authors.

In the third quarter of 2023 Polkadot generated income amounting to $94,000, representing a decrease of 3% compared to the previous quarter. Messari suggests that Polkadot’s revenues tend to be relatively lower compared to its competitors due to the network’s structural design.

On the other hand, Polkadot’s native token, POINT, serves three primary purposes: governance, staking, and parachain bonding. During the third quarter of 2023, DOT’s strike rate increased 12% compared to the previous quarter, reaching 49%.

This increase has led to a reduction deploy rewards and a 12% annualized decline in nominal returns to 15%. According to Messari, the close alignment of Polkadot’s betting rate with the ideal rate demonstrates the effectiveness of the mechanism.

Polkadot’s OpenGov milestone

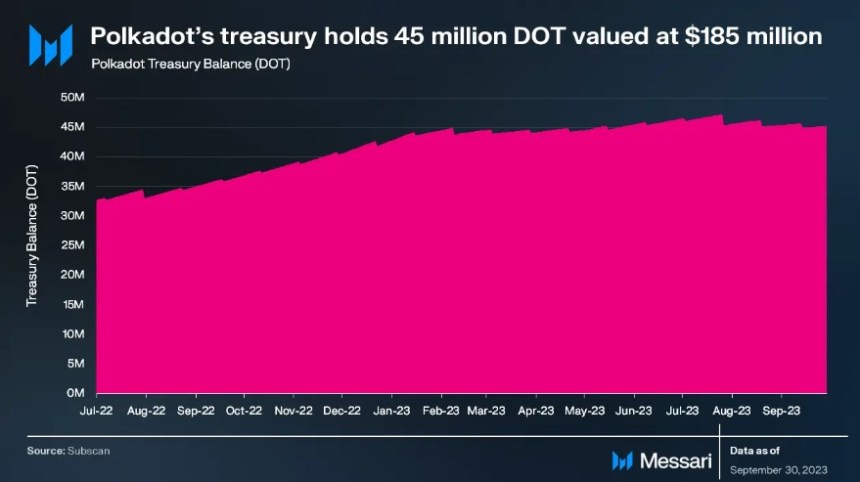

Polkadot’s treasury supported several initiatives in the third quarter, including software development, bounties, customer upgrades and community events such as meetups and hacker spaces.

According to Messari, the implementation of OpenGov on June 15 was a major milestone, revolutionizing treasury management and enabling simultaneous proposals with different requirements. At the end of the quarter, Polkadot’s treasury held approximately 45 million DOT ($185 million).

Additionally, Polkadot recently completed the official release of Polkadot 1.0, achieving a major milestone outlined in the Polkadot whitepaper.

The network’s code base has been fully ported to a repository managed by the community through Polkadot OpenGov and the Technical Fellowship. The roadmap for the next iteration, Polkadot 2.0, will be determined through community discussions and consensus.

Founder Gavin Wood has proposed ideas for additional mechanisms to allocate Polkadot’s block space and to create treaty-like agreements between multiple blockchains called “agreements.”

At the time of writing, the DOT token has been on a notable upward trend since October 19, closely following Bitcoin’s lead. Currently, the token is trading at $4,839, reflecting a notable increase of over 16% in the past fourteen days.

Featured image from Shutterstock, chart from TradingView.com