- Over the past 24 hours, there has been a decline in the general cryptocurrency market.

- The prices of BTC, ETH and XRP may fall further in the short term.

With the crypto market overheating, the values of many leading assets have fallen over the past 24 hours. As a result, the global cryptocurrency market capitalization fell by 7% over the same period Coingeckos facts.

At the time of writing, the global cryptocurrency market cap was $2.7 trillion.

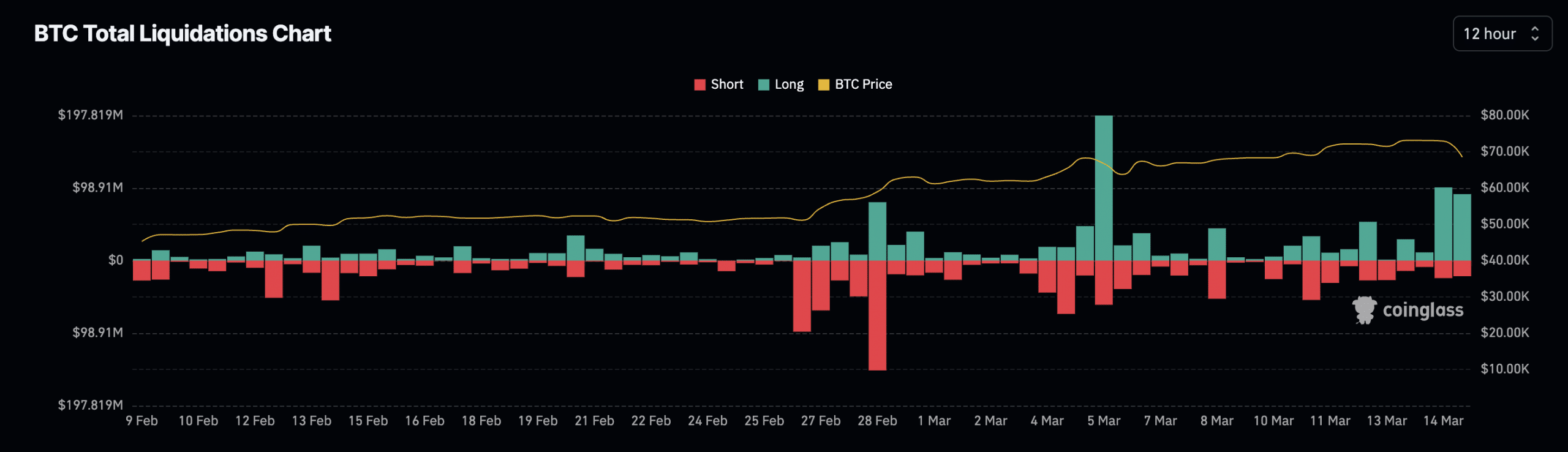

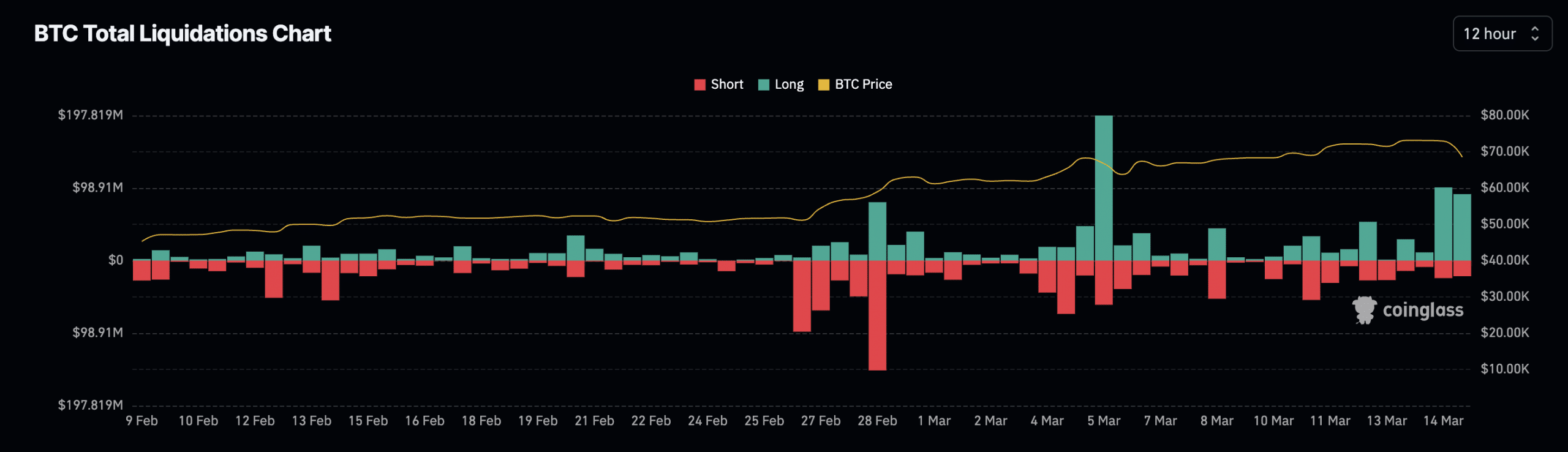

Long liquidations in the Bitcoin market

Leading coin Bitcoin [BTC] has seen its price drop by almost 10% in the last 24 hours. During the Asian trading hours of March 15, the coin’s price fell to a low of $67,000, marking a decline of 7%, before a brief recovery to $68,500.

According to CoinMarketCap data, the number one coin was exchanging hands at $67,742 at the time of writing, marking an 8% price drop in the past 24 hours.

However, during the same period, the coin’s trading volume increased by 55%, creating a bearish price/volume divergence. This indicated increased selling pressure amid high market activity.

This difference between an asset’s price and trading volume often occurs when many investors sell their holdings, possibly due to negative sentiment or concerns about future price movements.

Due to the sharp drop in Bitcoin’s price, long-term liquidations in the futures market for the coin increased. According to Mint glass’ According to data, more than $90 million in long positions have been cleared in the last twelve hours.

Source: Coinglass

A position is considered liquidated when it is forcibly closed due to insufficient resources to maintain it. Long liquidations occur when the value of an asset suddenly drops, and traders who have open positions in favor of a price increase are forced to exit their positions.

However, despite this decline, open interest on the currency’s futures continued to rise. This has increased by 2% in the past 24 hours. According to Coinglass data, BTC open interest at the time of writing was $37.25 billion.

Likewise, funding rates observed on crypto exchanges remained positive. The increase in open interest and positive funding rates showed that despite the current price decline, investors have chosen to remain steadfast in their belief that Bitcoin’s price would still initiate a rally.

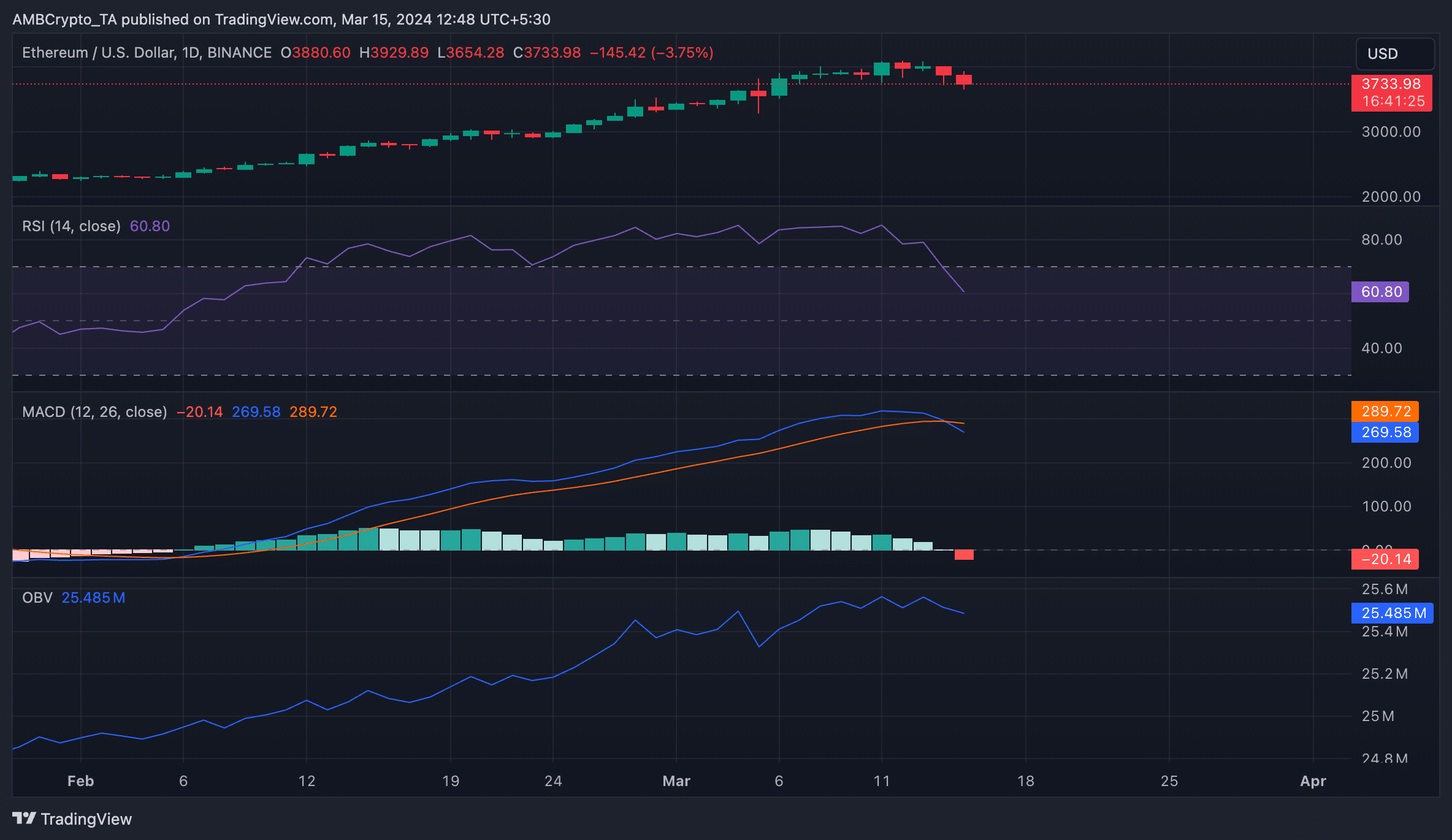

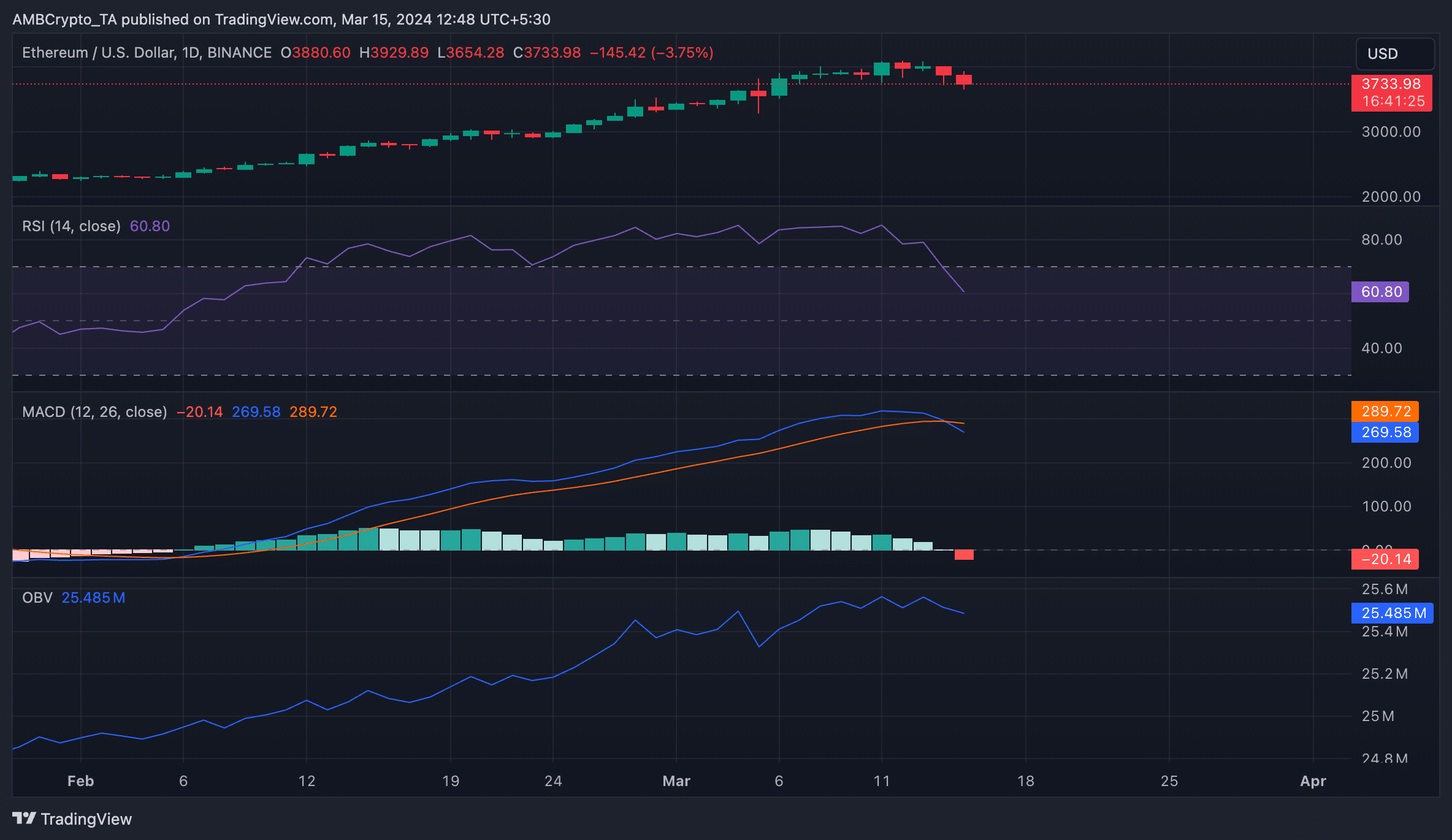

The bears want to regain control of the Ethereum market

Due to its statistically positive correlation with Bitcoin, Ethereum [ETH] has also suffered a drop in value over the past 24 hours. Exchanging hands for $3,708 at the time of writing, the coin’s price has fallen 7% over that period.

A review of ETH’s price performance on a daily chart showed a steady increase in the coin sell-off.

For example, measurements of the coin’s Moving Average Convergence Divergence (MACD) indicator showed that the signal line (orange) successfully crossed above the MACD line (blue) on March 14.

When an asset’s signal line crosses the MACD line in an uptrend, it is generally considered a bearish signal. This is because the signal line is a 9-day exponential moving average (EMA) of the MACD line itself. It acts as a trigger for buy and sell signals. When the price breaks above the MACD line, it indicates a possible shift to a bearish trend.

Normally, traders interpret this bearish crossover as a signal to sell or a warning sign of a possible downturn in the market.

Furthermore, the Relative Strength Index (RSI) was in a downward trend, indicating a decline in demand for ETH among spot market participants. Although it remained above the midline at the time of writing, its position indicated a decline in ETH accumulation.

Confirming the steady decline in ETH demand, on-balance volume (OBV), which measures the coin’s buying and selling pressure, is down 0.3% over the past 24 hours. When an asset’s OBV line falls, it indicates that sales volume is increasing, indicating downward price movement.

Source: ETH/USDT on TradingView

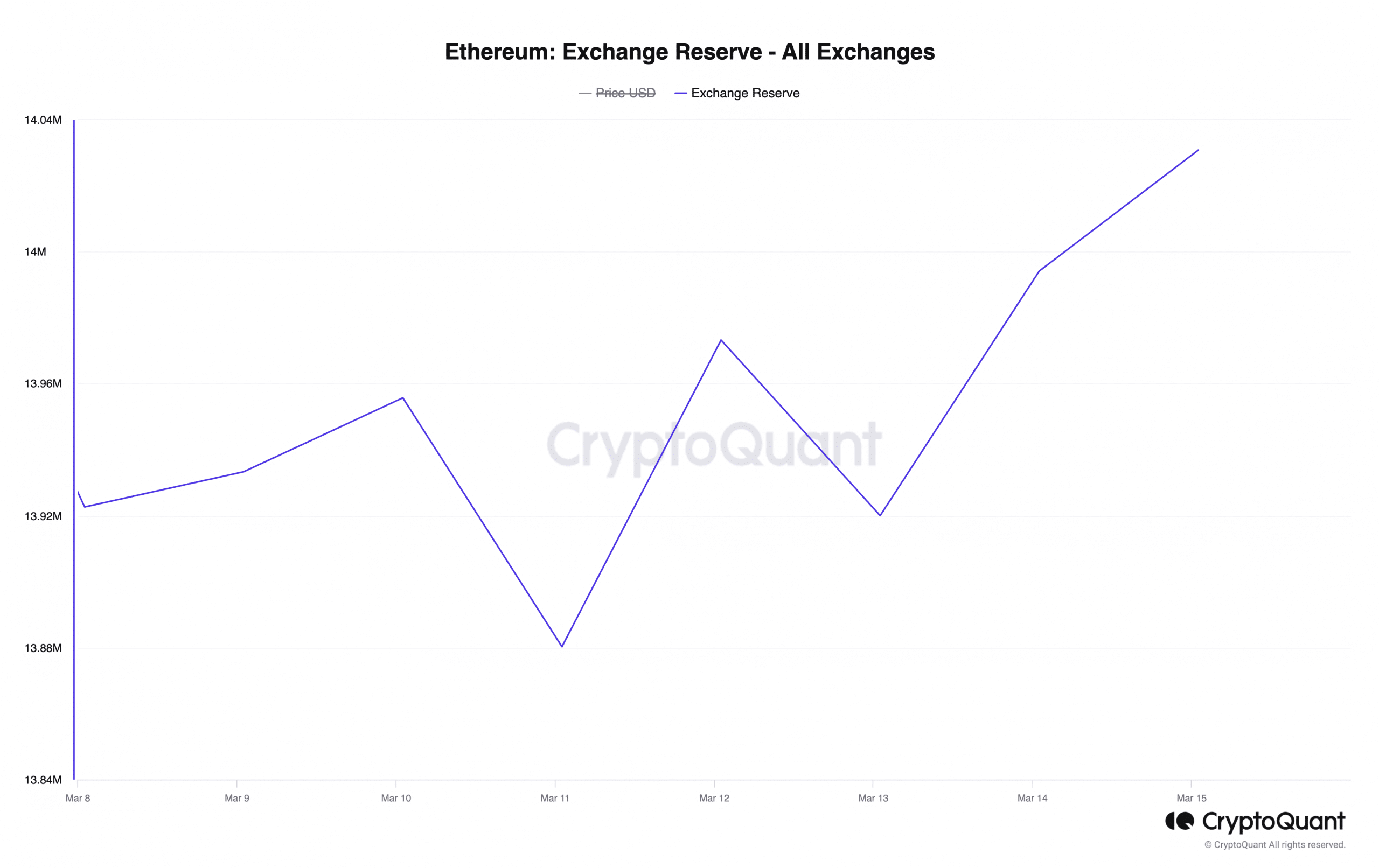

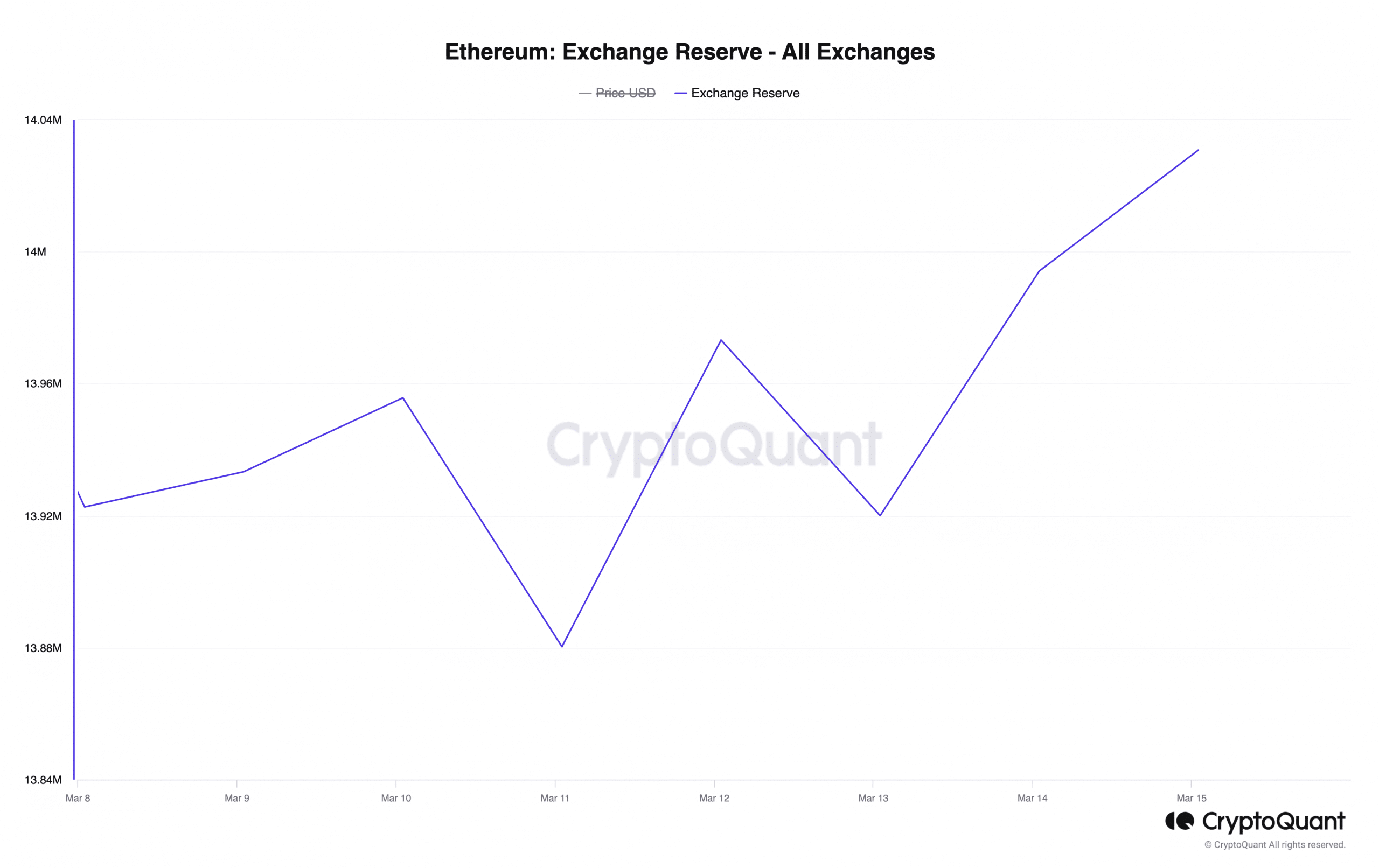

A review of ETH’s stock market activity over the past 24 hours confirmed the increase in profit-taking activity. According to CryptoQuant data, the currency’s exchange reserve increased by 1% during that period.

At the time of writing, 14 million ETH worth approximately $52 billion were held on cryptocurrency exchanges.

Source: CryptoQuant

XRP points to even more disadvantages

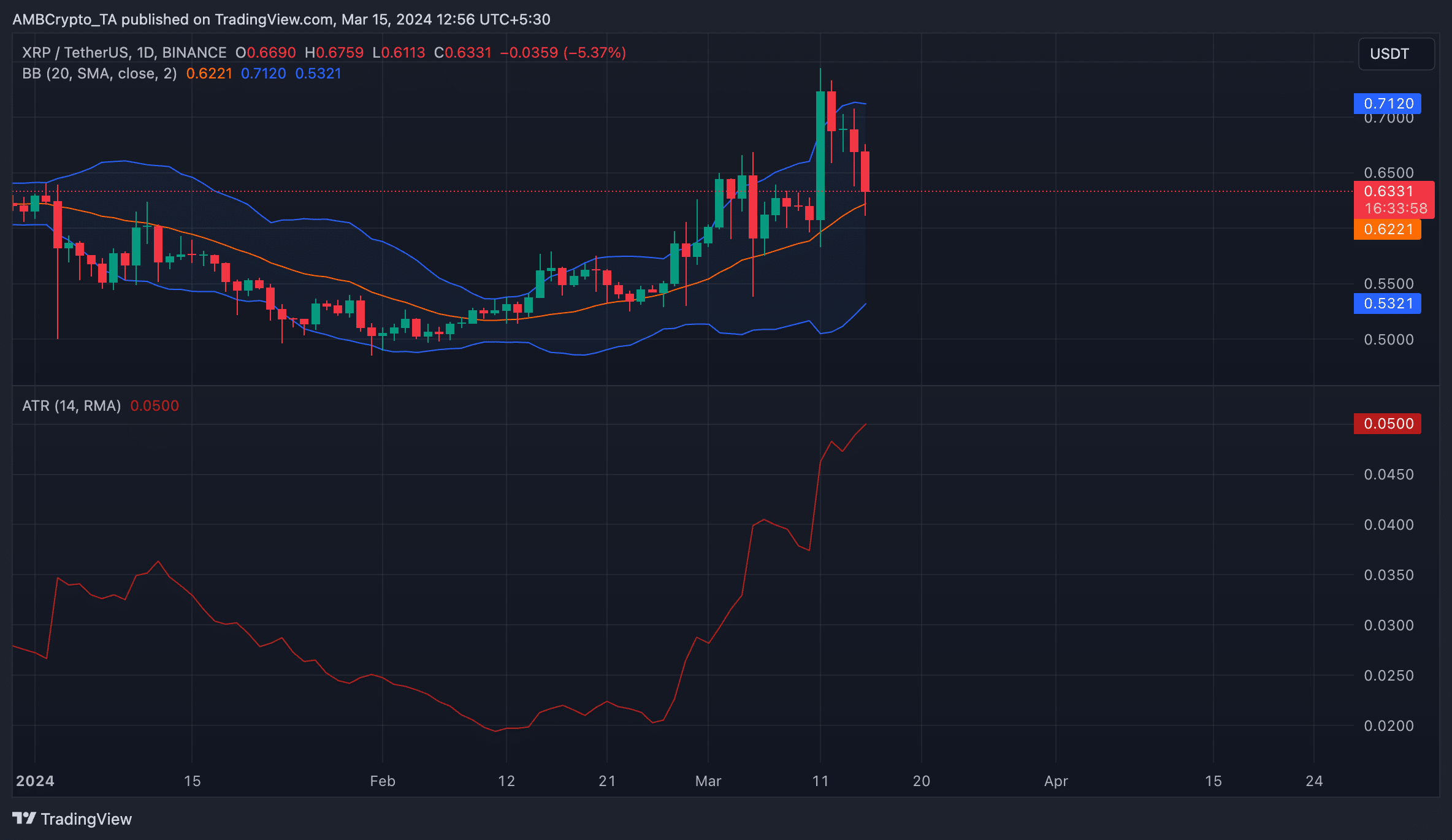

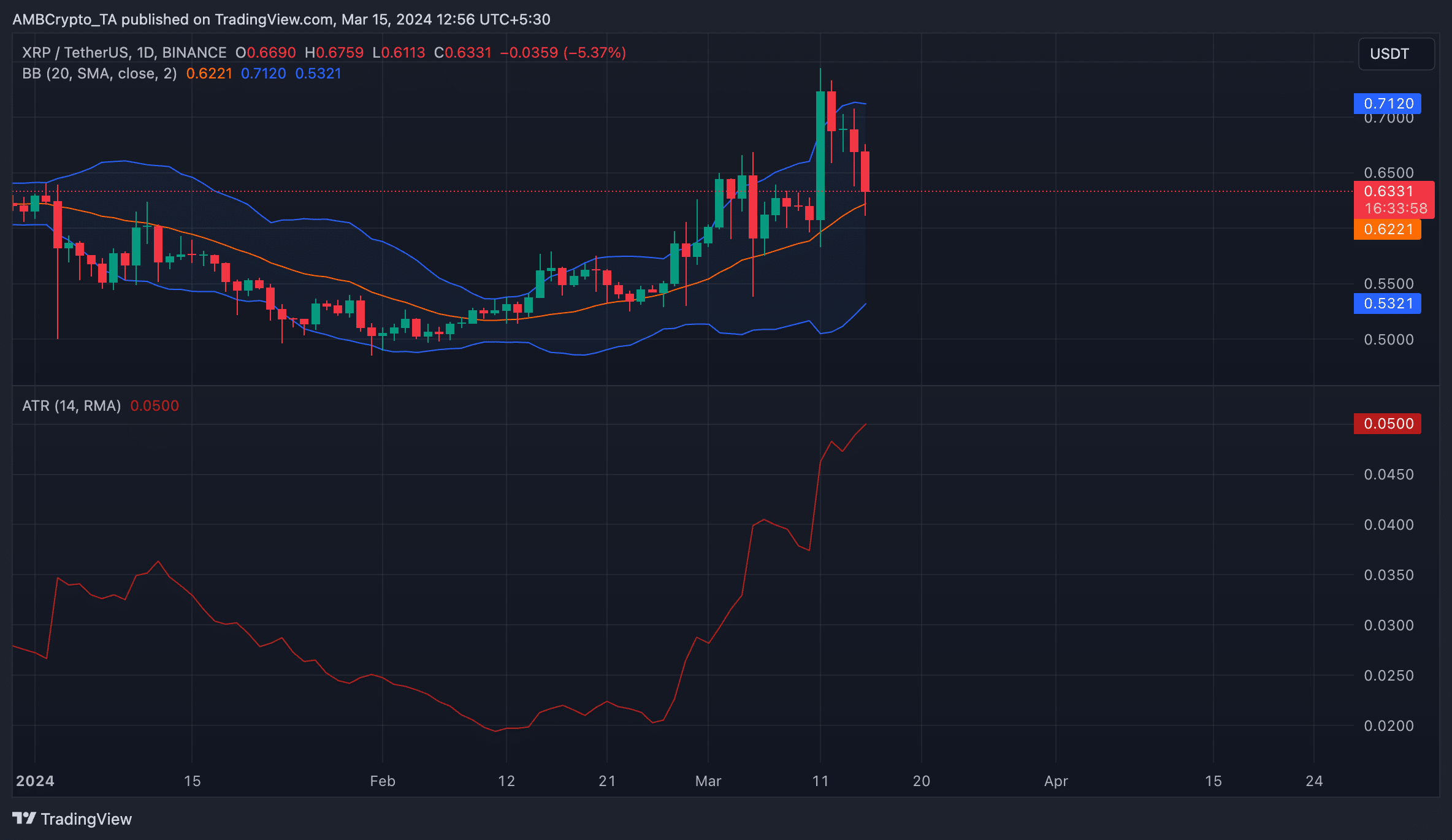

Ripple’s XRP saw its value drop 6% in the past 24 hours. According to CoinMarketCap data, the sixth largest crypto asset by market capitalization was exchanging hands at $0.63 at the time of writing.

AMBCrypto’s assessment of the token’s volatility marks on a daily chart suggested the possibility of further decline due to the significantly volatile nature of the market.

For example, a widening gap at the time of writing separated the upper and lower bands of XRP’s Bollinger Bands (BB) indicator. Typically, a widening gap indicates that price movements are becoming more volatile.

With a negative weighted sentiment of -0.073, the possibility of a downward price movement remained high.

Realistic or not, here is the XRP market cap in terms of BTC

Also confirming the highly volatile nature of the XRP market is the Average True Range (ATR), which measures market volatility by calculating the average range between high and low prices over a certain number of periods.

XRP’s ATR is up 25% in the last 24 hours. When this indicator rises in this way, it indicates an increase in market volatility.

Source: ETH/USDT on TradingView