- The momentum of 3 months of BTC has turned green, but comparable setups have ended in sharp reversations.

- Financing percentage and RSI suggest a growing optimism, but volume and resistance of $ 105k demand caution.

Bitcoin [BTC] is back in the green on a timeline of three months, which shows a possible shift in the market momentum. But although the Uptick has caused carefully optimism, experienced traders do not yet celebrate.

In the past such setups have led to sharp reversations, so that traders were kept carefully.

With Bitcoin, which is approaching the critical zone of $ 104,000- $ 105,000, will the rally hold or quickly fade in the coming days?

Bitcoin: Why the momentum of 3 months matters

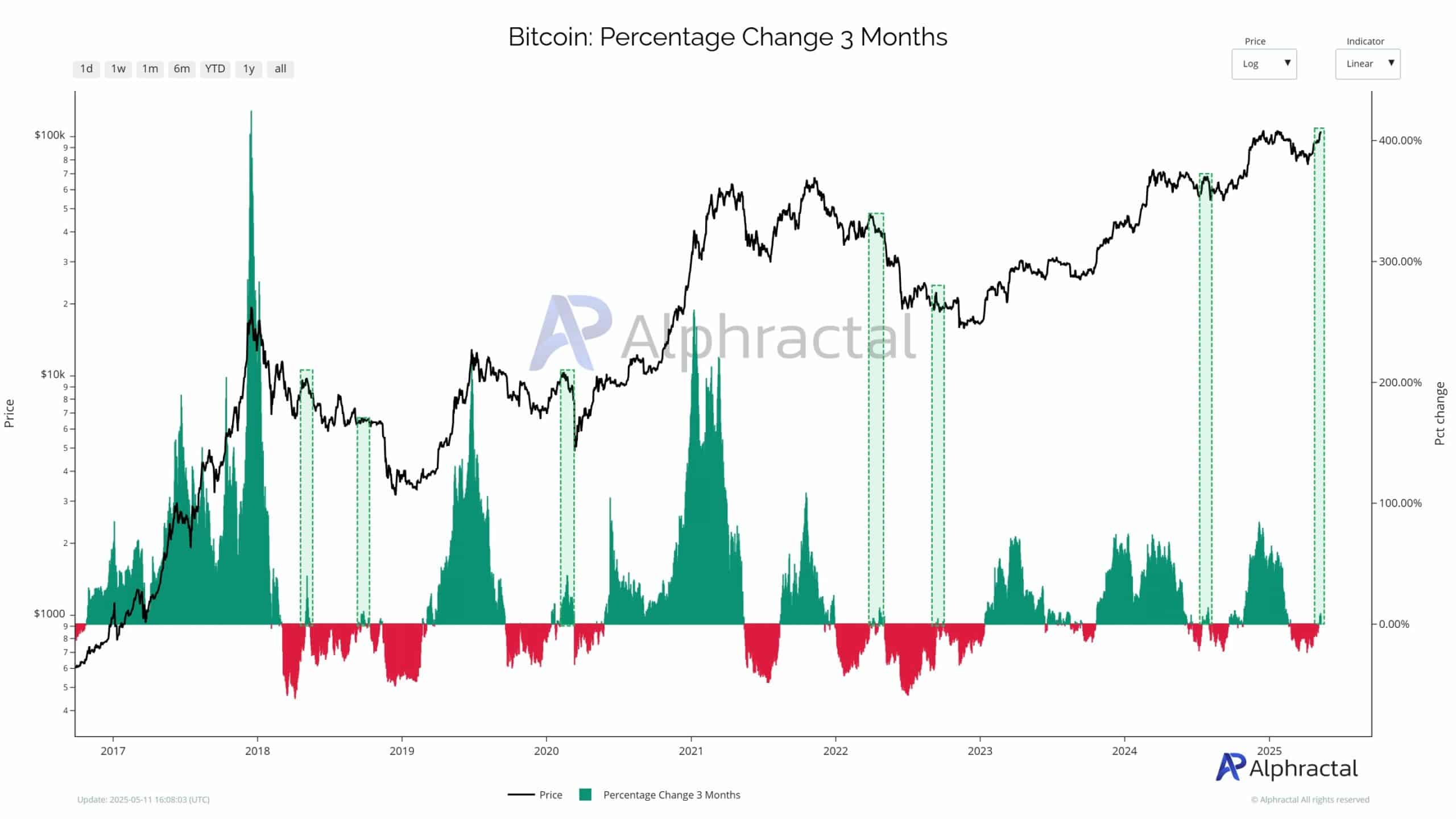

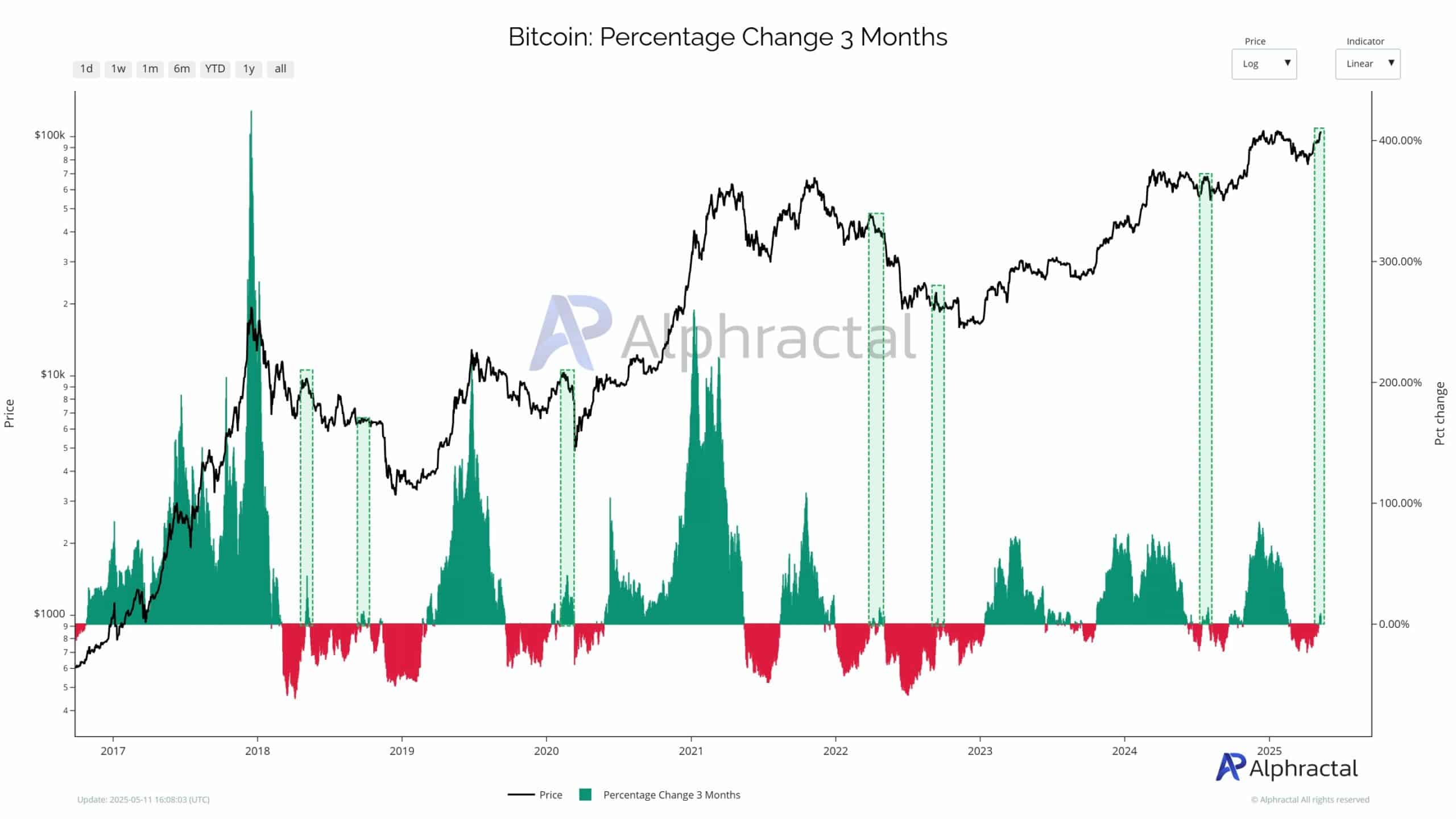

Recent data show Bitcoin’s Percentage of 3 months Turn Disalent to positive territory – a signal that precedes large market movements.

Although this increase may indicate the brewing momentum, it is not always bullish.

Source: Alfractaal

Cycli Vooruitlang unveiling that similar green flips often took place just before a sharp rug pulls, in which traders were overwhelmed. The graph shows these percentage changes under the BTC price line, which clearly marks moments of abrupt reversations.

In short: the current setup requires caution. Momentum is building, but without sustainable follow-up, especially above the level of $ 104k $ 105k, it can again be a bullfall in disguise.

Historical precedents and trader’s sentiment

The positive flip cuts both sides historically.

At the beginning of 2018, mid -2019 and at the end of 2021, comparable green reversations preceded sharp decline, so that momentum traders catch draw points in painful carpet. Today’s attitude is similar, making caution essential.

In addition to this background, the aggregated financing speed has steadily risen, with a peak at 0.0132 at the time of the press.

Source: Coinalyze

This indicates a growing bullish sentiment, because traders lean for a long time, although not yet at euphoric level. If the financing percentage continues to climb, the market can become volatile.

The 104K-105K barrier

Bitcoin tested the $ 104k $ 105k resistance zone at the time of the press, with momentum indicators who showed uncertainty.

The RSI reached 74.46 Overbought territory, which suggests a possible withdrawal, unless bulls maintain pressure. In the meantime, the BBV remained subdued, indicating that volume does not fully support the rally.

Source: TradingView

Both the 50-day and 200-day SMAs are comfortable below, which shows that long-term support remains intact.

If BTC transmits $ 105k with strong volume, an outbreak to new highlights is possible. But without a volume group, rejection and consolidation will remain probably.