- Bitcoin whales unloaded 30,000 BTC worth $1.83 billion

- Despite a 23% drop in large trades, 80% of holders still had profits at the time of writing

The price of Bitcoin has become very volatile in recent days. As expected, this volatility led to interesting behavior from many market holders.

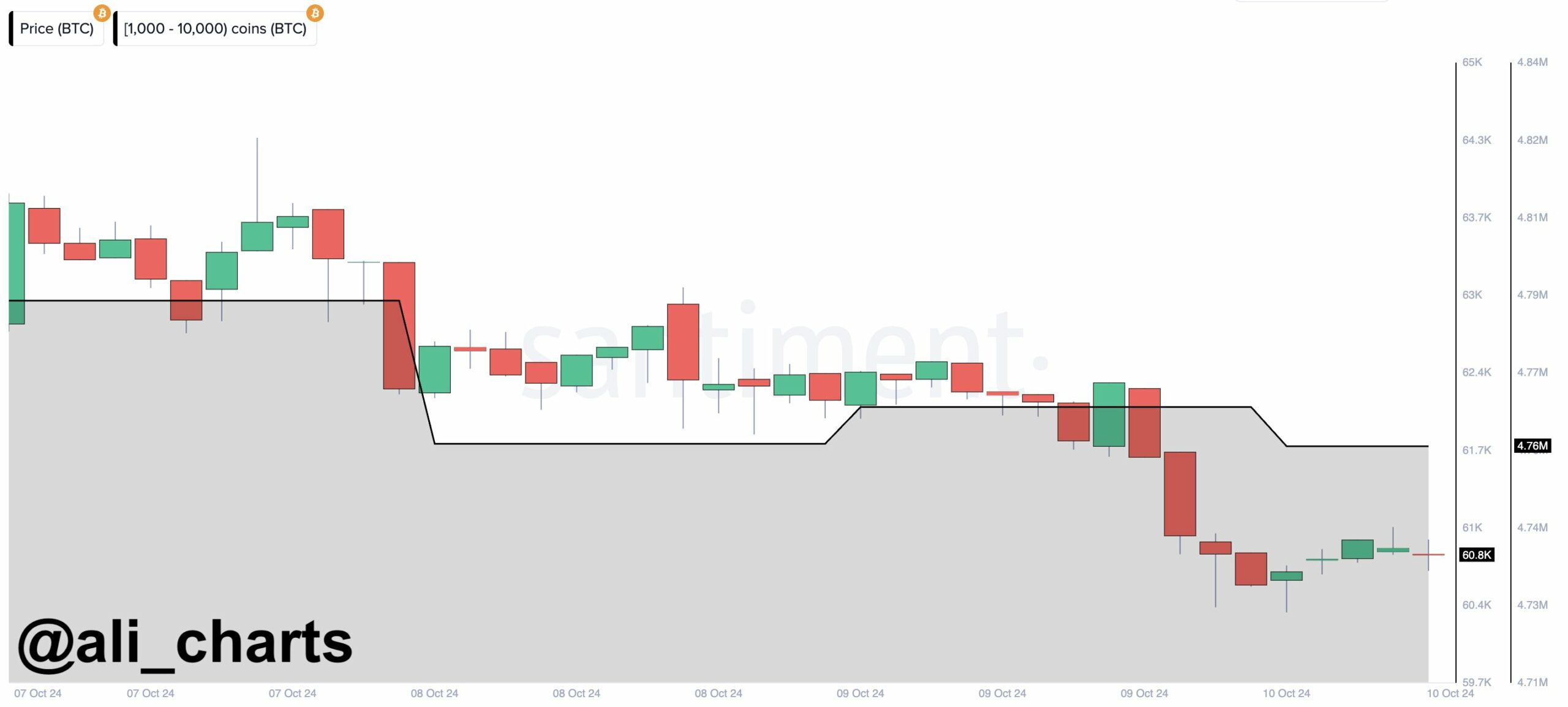

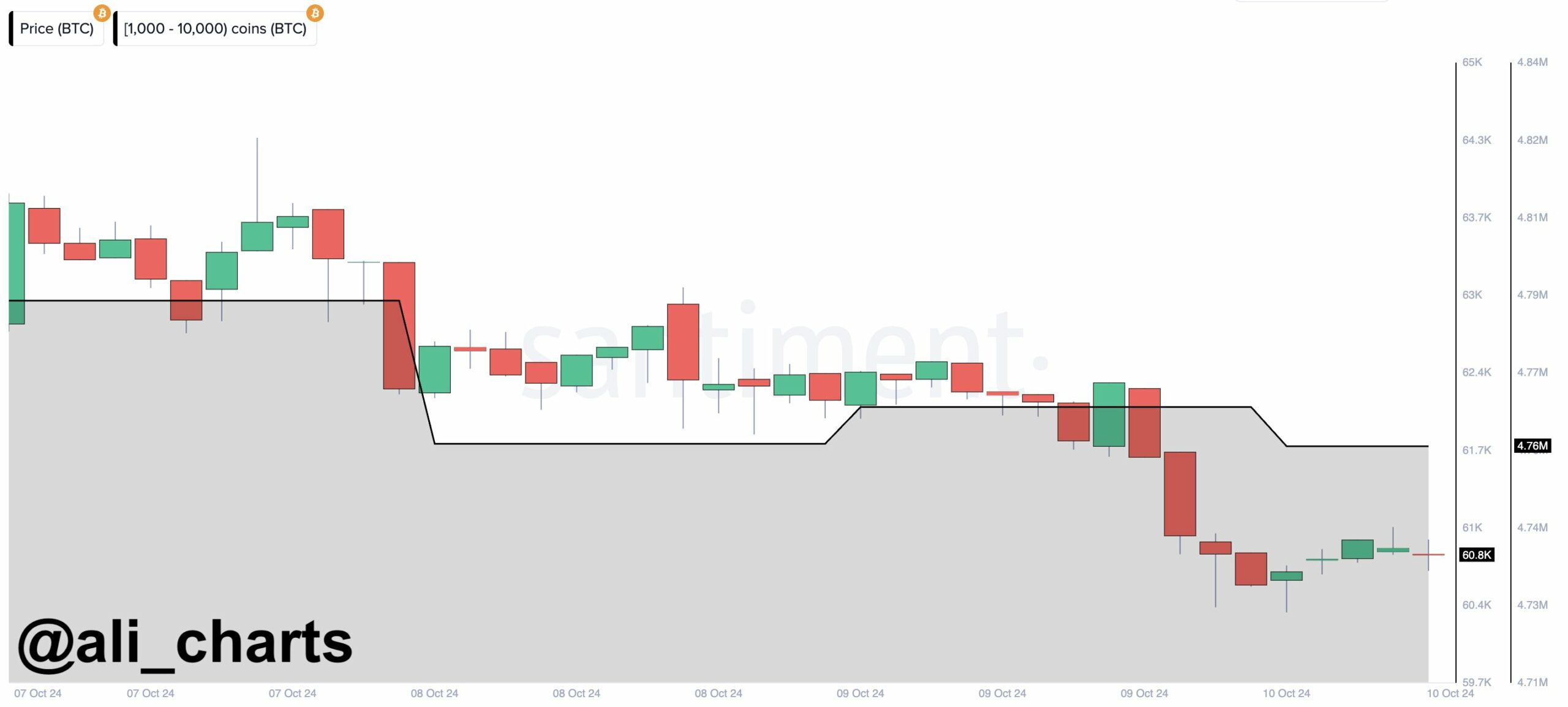

Think about this – a popular analyst recently revealed that a number of whales reportedly sold or redistributed approximately 30,000 BTC worth $1.83 billion in the last 72 hours alone.

In light of the magnitude of such a move, there will undoubtedly be speculation about Bitcoin’s next move. Hence the question: will BTC continue to fall or is this just a fake breakout before the cryptocurrency really starts to rise?

Whales make waves, but profits save

As far as market attention is concerned, whale movements are always in focus. And this week is no exception to that rule.

The sale or redistribution of 30,000 BTC in just 72 hours has caused a lot of unrest in the market. As expected, many are now speculating that this could lead to further downward pressure.

A significant $1.83 billion worth of Bitcoin has changed hands, and market participants are trying to figure out if this is part of a larger strategy.

Source: Santiment

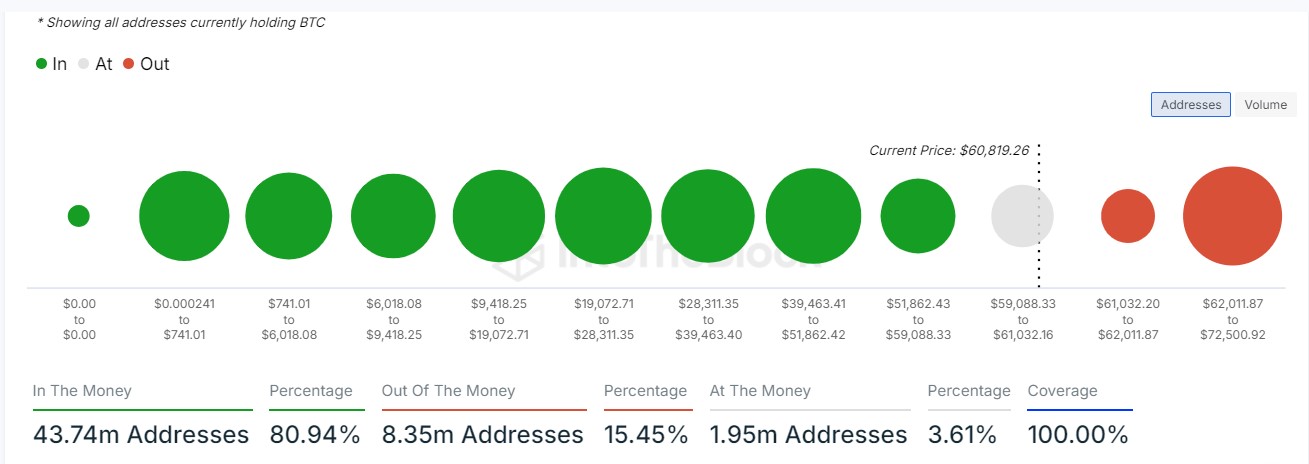

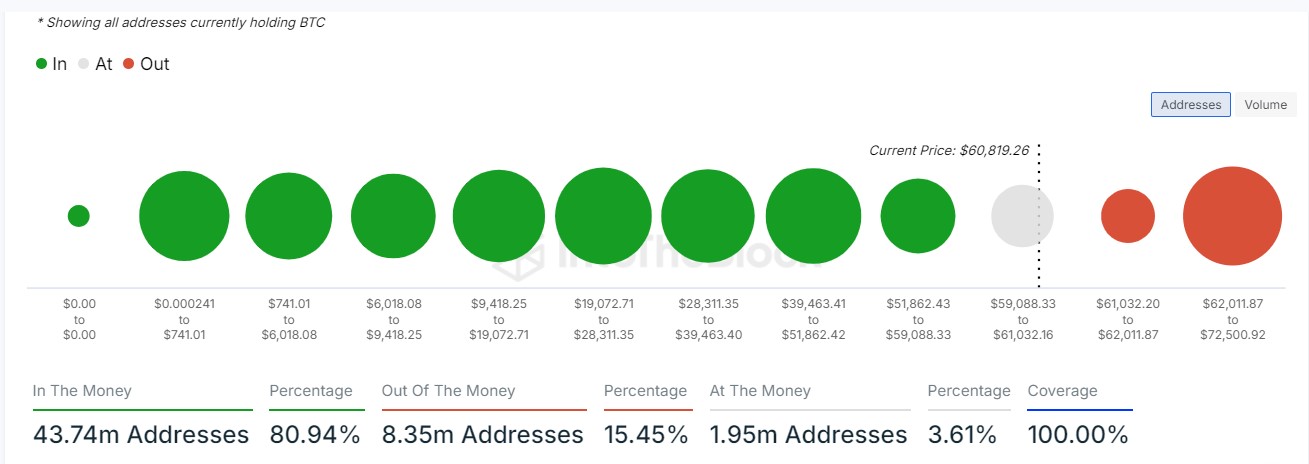

However, it is important to note that this massive redistribution occurred at a time when 80% of Bitcoin holders were still making profits.

This simply means that despite the sell-off, many investors purchased BTC at lower prices. This gives them less incentive to sell in panic.

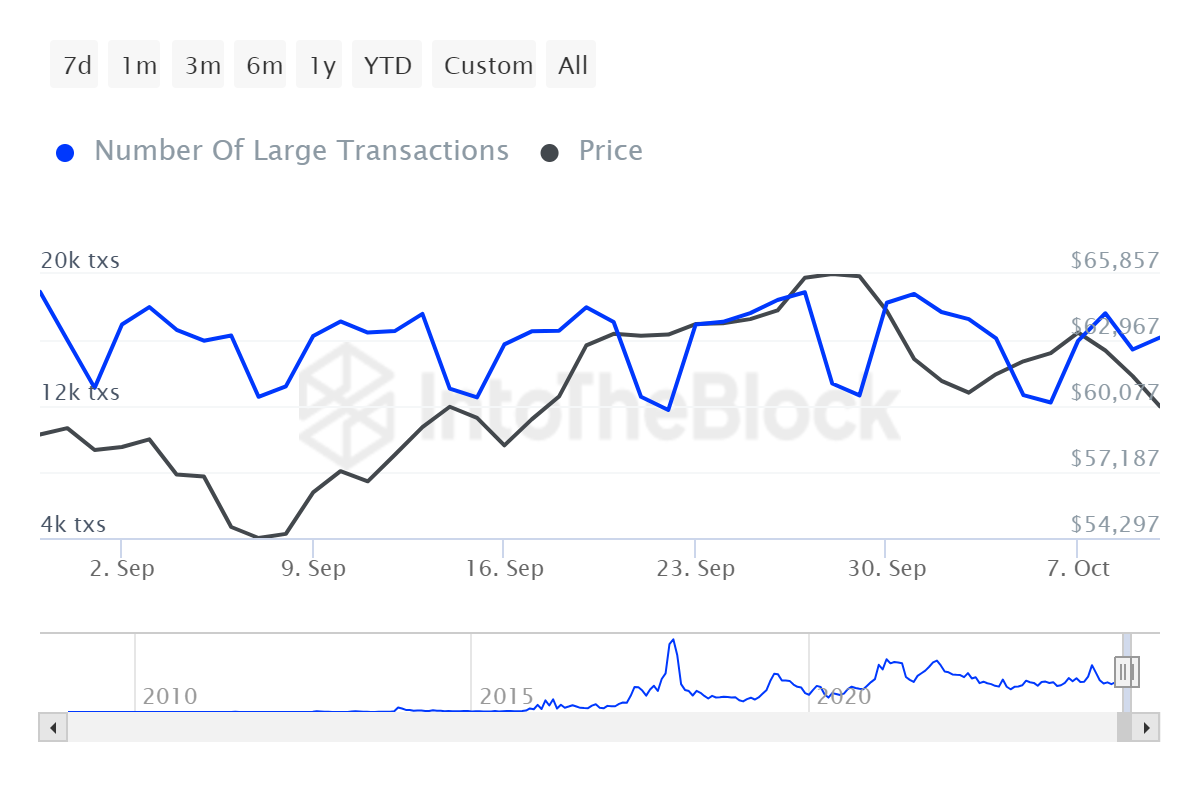

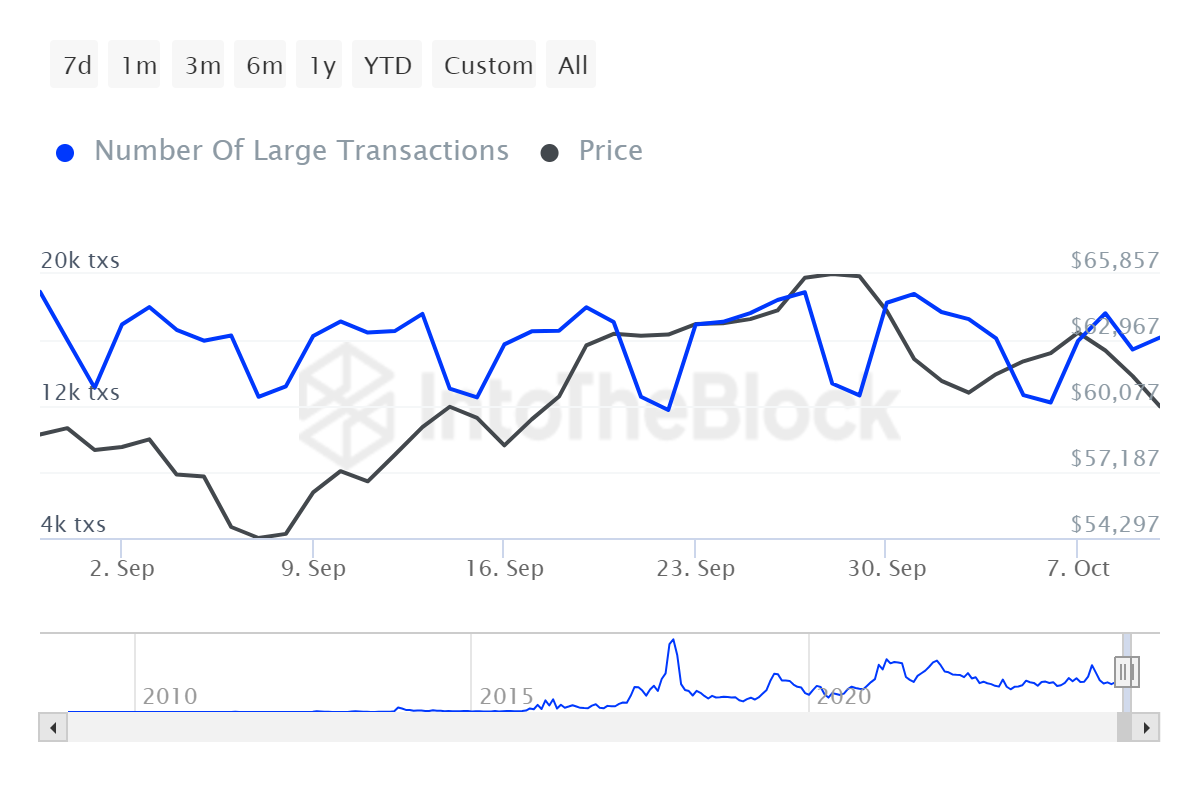

Source: IntoTheBlock

Large transactions are declining while Bitcoin holders remain strong

AMBCrypto further analyzed IntoTheBlock’s large transaction data to track whale dynamics at this crucial market stage. The data indicated a 23% decline in large Bitcoin transactions, which generally represents reduced market activity among institutional players and high-net-worth individuals.

Despite this, a majority of Bitcoin holders continue to make profits. This can be interpreted as a sign of holders’ reluctance to sell in this market environment.

While large trades may have slowed, there is no sign of major panic among the broader group of holders.

Source: IntoTheBlock

Inflation adds fuel to speculation

Complicating matters further, US inflation was higher than expected at 2.4%. As a rule of thumb, when inflation is stronger, investors usually turn to safe assets like Bitcoin.

This could offset short-term selling pressure from whales and offset speculation that this recent dip could be a temporary dip before the broader rally.

Will Bitcoin Fall Further?

The confluence of whale activity and higher-than-expected US inflation is creating uncertainty in the Bitcoin market.

While some analysts argue that whales are trying to fake a dip before a big rally, others believe the short-term selling pressure could lead to further price declines.