ETH surpasses BTC

An in-depth analysis by AMBCrypto found that the percentage of ETH holders who kept their assets for more than a year increased from 59% in January 2024 to 75% in December 2024, according to InTheBlok facts.

This was in stark contrast to Bitcoin, where the share of long-term holders fell from 70% to 62.3% over the same period.

Source: IntoTheBlock

The growing retention rate for Ethereum indicated greater confidence among investors, driven by expectations of future network upgrades and broader usability.

Meanwhile, the decline in the number of long-term Bitcoin holders may reflect profit-taking or diversification strategies, signaling a potential shift in market sentiment as investors prioritize ETH heading into 2025.

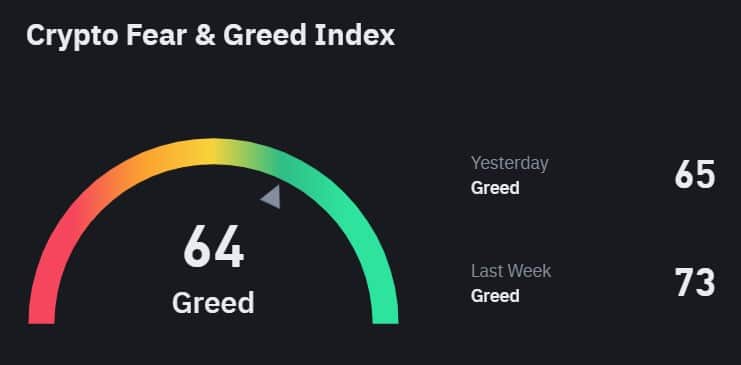

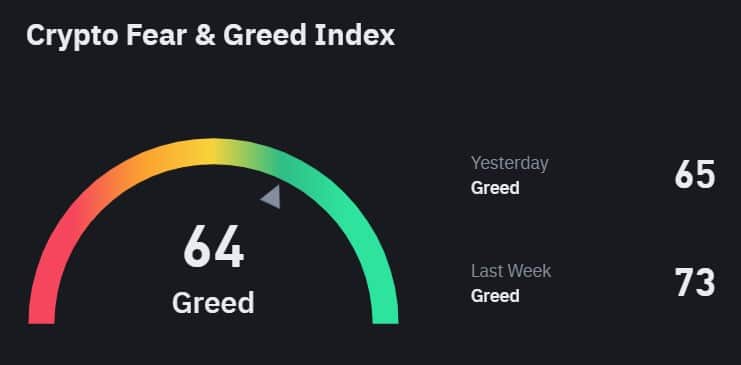

The Fear and Greed Index falls to a two-month low

Notably, losing HODLers was not the only problem the king coin faced. The Crypto Fear and Greed Index fell to 64 on December 31, the lowest level since October 15.

This decline reflected declining market optimism as Bitcoin plunged more than 12% over the past two weeks to trade near $93,000.

Source: Binance Square

After peaking at 94 in November – driven by excitement surrounding the pro-crypto election results in the US, the index remained above 70 for much of December before the recent pullback. The decline marked a shift from extreme greed to more cautious sentiment among investors.

While greed still dominated, the decline highlighted concerns about short-term market volatility as traders reacted to Bitcoin’s price movements and the mixed signals from the broader market.

Read Ethereum [ETH] Price forecast 2025-2026

BTC in an accumulation phase?

Despite the dip, investor James Williams believes Bitcoin is entering a crucial accumulation phase. In his latest X-post (formerly Twitter), Williams described current conditions as an opportunity for long-term positioning.

Williams predicted a period of consolidation in the coming weeks, potentially paving the way for a significant breakout. Williams is confident in Bitcoin’s long-term trajectory and views the current price action as part of a natural market cycle. He predicts a price of $131,500 or higher in the first quarter of 2025, calling such levels “inevitable.”

He emphasized that being patient during periods of consolidation often rewards investors, as such phases have historically preceded substantial upward movements in Bitcoin’s price.