- HYPE’s market cap now exceeds $7 billion.

- The deposit on the platform is now double the pre-TGE.

Hyperfluid[HYPE] has seen over $1 billion in USDC deposits since the launch of its own token, HYPE, almost doubling its reserves to $2.2 billion.

This influx has driven the platform’s Total Value Locked (TVL) to an impressive $3.4 billion, indicating strong investor engagement and renewed ecosystem momentum.

USDC dominates Hyperliquid’s asset composition

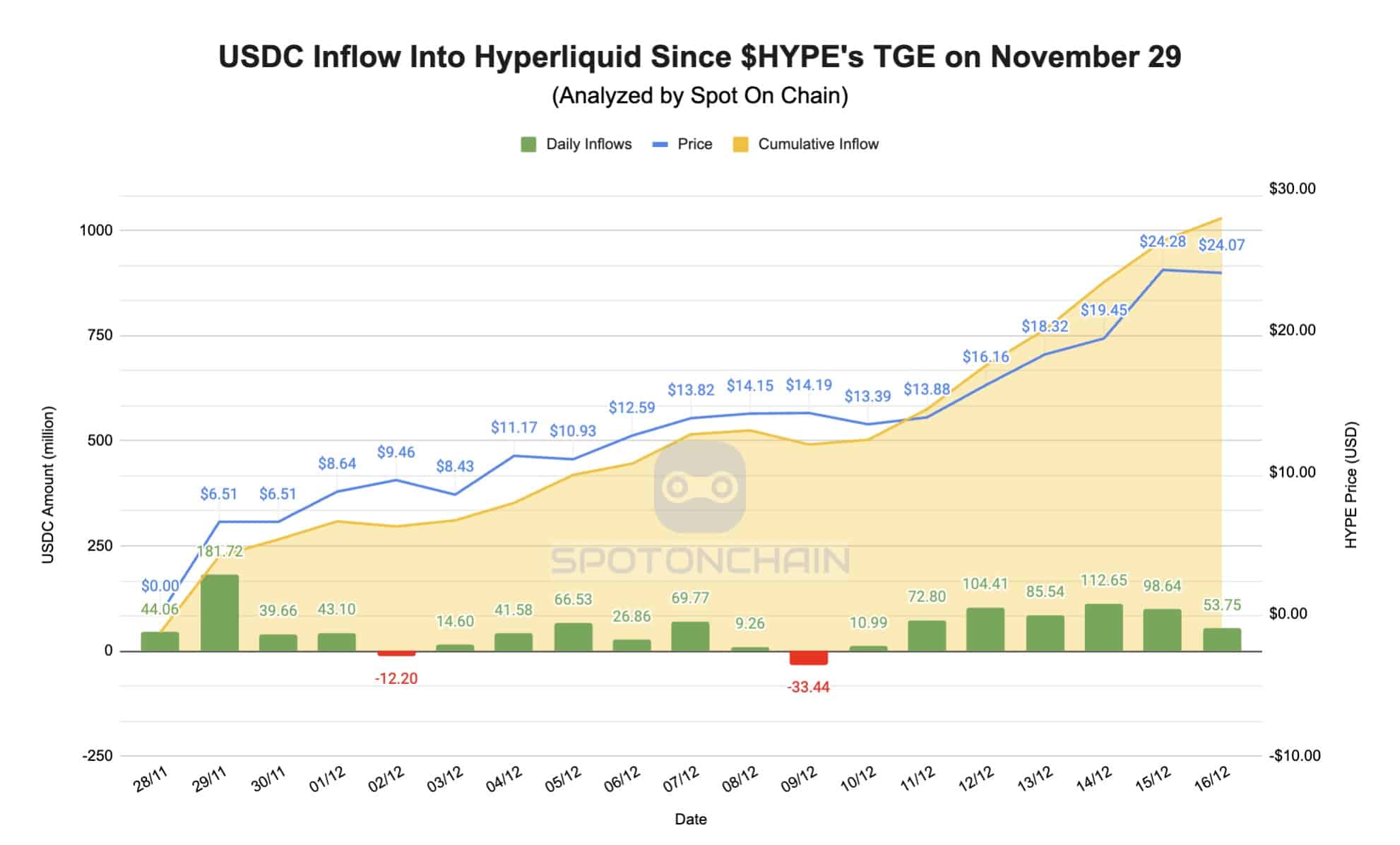

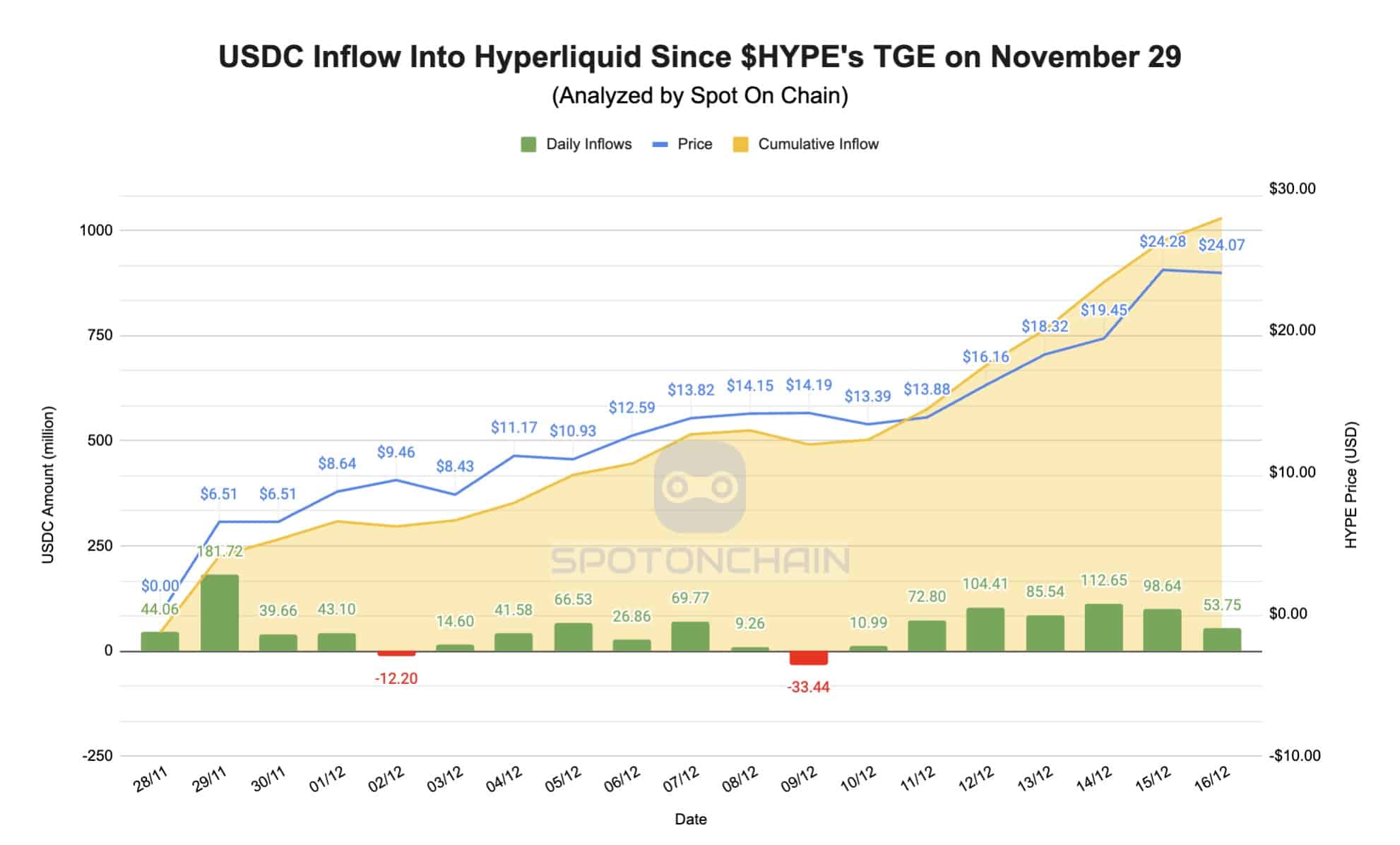

Hyperliquid has witnessed significant inflows of over $1 billion in USDC since the launch of its native token, HYPE, according to data from SpotOnChain.

The token generation event (TGE) marked a pivotal moment for the platform and saw unprecedented growth in deposits. Currently, the Hyperliquid Network holds approximately $2.2 billion USDC, nearly doubling pre-TGE levels.

Source: SpotOnChain

While Hyperliquid’s bridge contains other assets, USDC dominates its reserves, which make up almost 100% of total deposits.

Ethereum, the second largest asset on the platform, lags far behind at less than $400. This wide disparity highlights USDC’s role as the key asset driving on-chain liquidity.

TVL skyrockets to over $3.4 billion

Hyperliquid’s Total Value Locked (TVL) has seen a notable rise, due to increased platform activity following the launch of the HYPE token. Data from DeFiLlama shows that TVL increased from $196 million on November 29 to over $3.4 billion today.

Source: DefiLlama

This dramatic growth closely mirrors the HYPE TGE and subsequent listings on various exchanges, indicating strong investor engagement and renewed interest in the Hyperliquid ecosystem.

The increase in TVL underlines the native token’s impact on driving user participation and capital inflows.

The HYPE token maintains bullish momentum

The HYPE token has shown impressive performance, trading at $28.48 after rising 4.47% in the past 24 hours. This price increase reflects the inflow of USDC into the network, reinforcing the growing demand for the token.

HYPE has risen from $10 to $28 in a matter of weeks, breaking key resistance levels and signaling strong investor confidence.

The current uptrend indicates continued bullish momentum; However, the rapid increase raises concerns about possible overheating.

While moving averages and Relative Strength Index (RSI) data are still insufficient for accurate analysis, market sentiment indicates that $30 could act as the next psychological resistance level.

On the other hand, the critical support is at $20, which provides a cushion in case of profit-taking or market corrections.

Can Hyperliquid sustain its growth?

Hyperliquid’s explosive growth, fueled by the launch of HYPE tokens and USDC inflows, paints an optimistic picture for the platform. The sharp increase in TVL and price reflects investor confidence and increased activity.

However, caution is advised, given the steep route.

– Realistic or not, here is the HYPE market cap in terms of BTC

As Hyperliquid continues to capture the market’s attention, the platform’s ability to maintain this momentum will depend on maintaining liquidity, expanding use cases for HYPE, and attracting new participants to its ecosystem.

The coming weeks will be critical in determining whether this growth is a short-term spike or the beginning of long-term success.