- Hyperliquid, when stacked against its rivals, stands out as the future of crypto fee generation.

- With its unique integration of spot and derivatives exchanges, Hyperliquid truly sets itself apart from its competitors.

If there is one coin that made December the breakout month, it is Hyperliquid [HYPE].

With an impressive 290% rise over the past month, HYPE has breached major psychological resistance levels and claimed a new all-time high of $35.

This outbreak is the result of a combination of factors. Externally, when the market turned away from Bitcoin [BTC] and other top altcoins, investors flocked to HYPE as a mid-cap to watch.

But what really sets HYPE apart is its growing competitive edge, with clear advantages in several areas.

Hyperliquid, the dominant face in crypto fee generation?

As a newcomer to the layer-1 blockchain ecosystem, Hyperliquid has quickly made its mark. The impressive increase is clearly visible on the daily chart.

But that’s not the whole story. Industry heavyweights like Ryan Watkins, co-founder of Syncracy Capital, already are to predict that Hyperliquid could soon become the dominant force in crypto fee generation by 2025.

While this bold prediction is not yet fully supported by data, it has caught the attention of many. To understand the potential behind this vision, AMBCrypto took a deep dive into the story surrounding HYPE and its future.

An important part of the Hyperliquid platform is the decentralized exchange (DEX). In this context, crypto fees are generated when users trade currencies on the platform.

So if you see higher fees, it means more traders are flocking to Hyperliquid, indicating growing adoption. However, despite all the initial hype, there is a twist in the story.

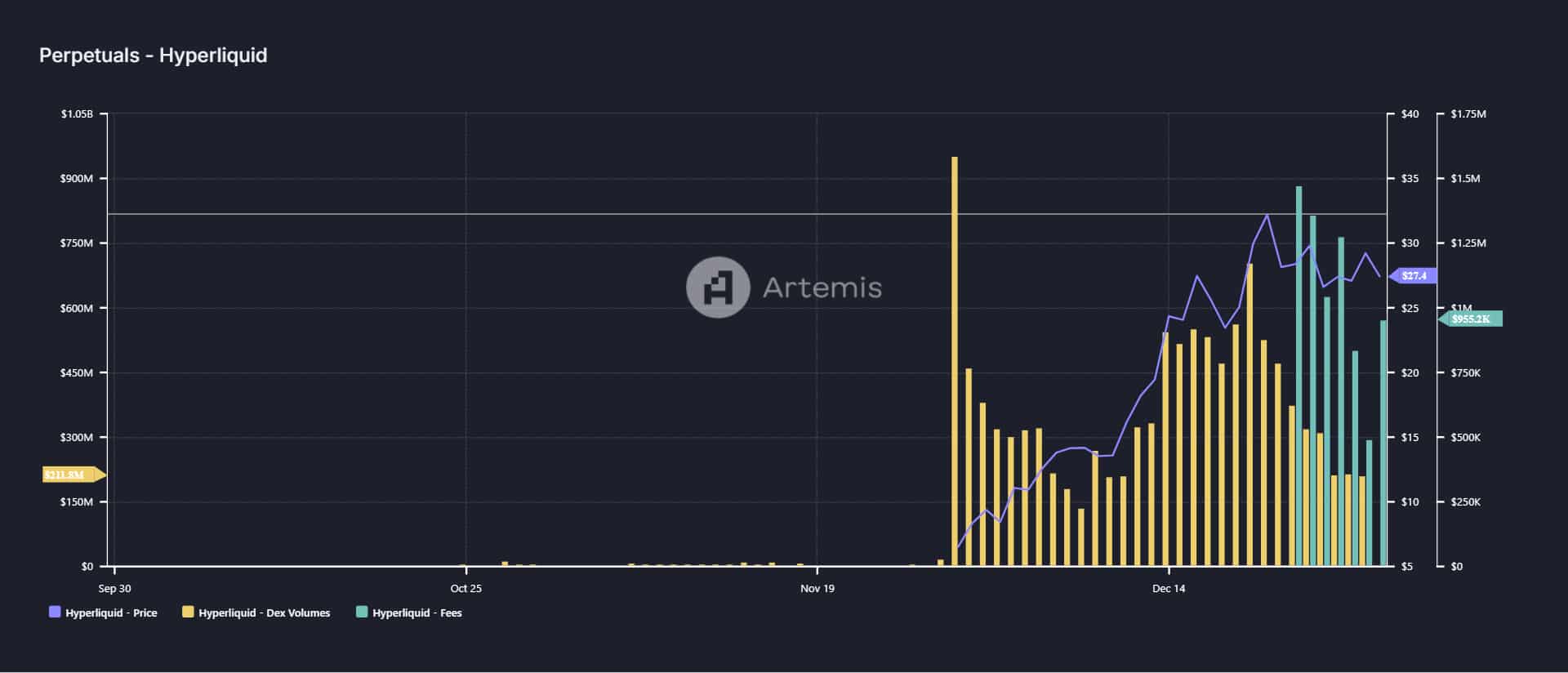

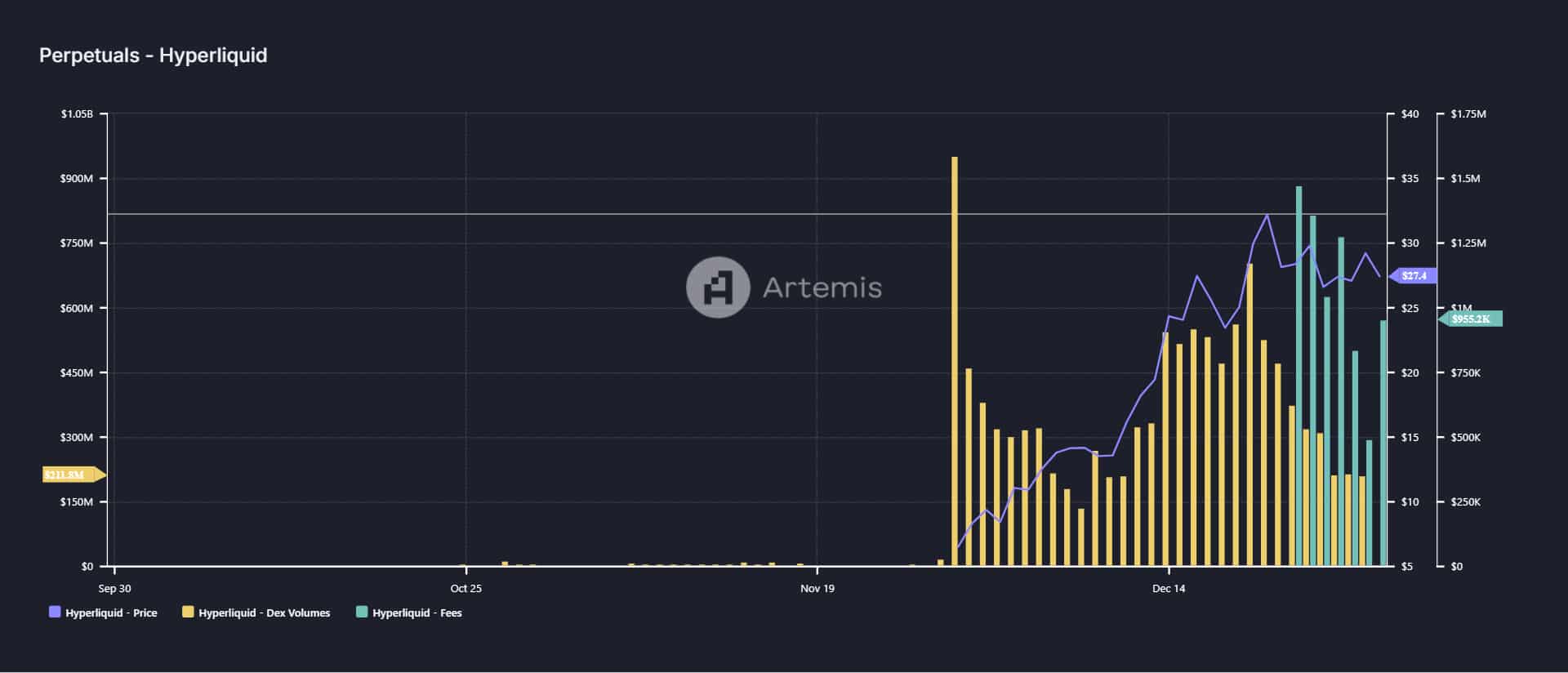

Source: Artemis Terminal

DEX volume on Hyperliquid has fallen sharply. What once rose to an impressive volume of $952 million in crypto trading has now fallen to just $211.8 million, reflecting a staggering decline.

As a result, the platform’s revenues have also fallen from $1.5 million to $955,000, seriously compromising its operating costs.

But amid this turmoil, Hyperliquid’s resilience stands out. In a market full of turbulence, the country is managing to weather the storm better than many other companies competitors – a clear silver lining.

What can you expect next?

There’s no doubt about it: HYPE is closing 2024 on an incredibly bullish note. With a growth of 780% YTD, it has firmly claimed a spot in the top 20 cryptocurrencies.

To top it all off, as the year comes to a close, HYPE has soared in the crypto derivatives market, with an impressive half billion in revenue. open interest (OI) within just one month of launch.

What’s even more exciting is that HYPE is powered by Hyperliquid’s cutting-edge technology, which could help it dominate crypto fee generation by 2025.

By combining key areas of crypto – spot and derivatives exchanges and blockspace (HyperEVM) – Hyperliquid is setting HYPE up for long-term success.

This tech stack allows HYPE to provide a seamless experience on both spot and derivatives exchanges.

In other words, by combining the strengths of both, it offers its users a unique convenience – a key factor that sets it apart from the competition.

Realistic or not, here is the HYPE market cap in terms of BTC

So given its strategic focus on the core of the crypto ecosystem – the exchanges – Hyperliquid has built a highly profitable business, which is precisely why experts predict it could surpass its rivals in terms of monetization by 2025 reimbursements.

With its unique business model and the declining DEX volume of its competitors, this seems more likely by the day.