- An analyst emphasized that the hype could fall to $ 13 because it broke a symmetrical price action pattern.

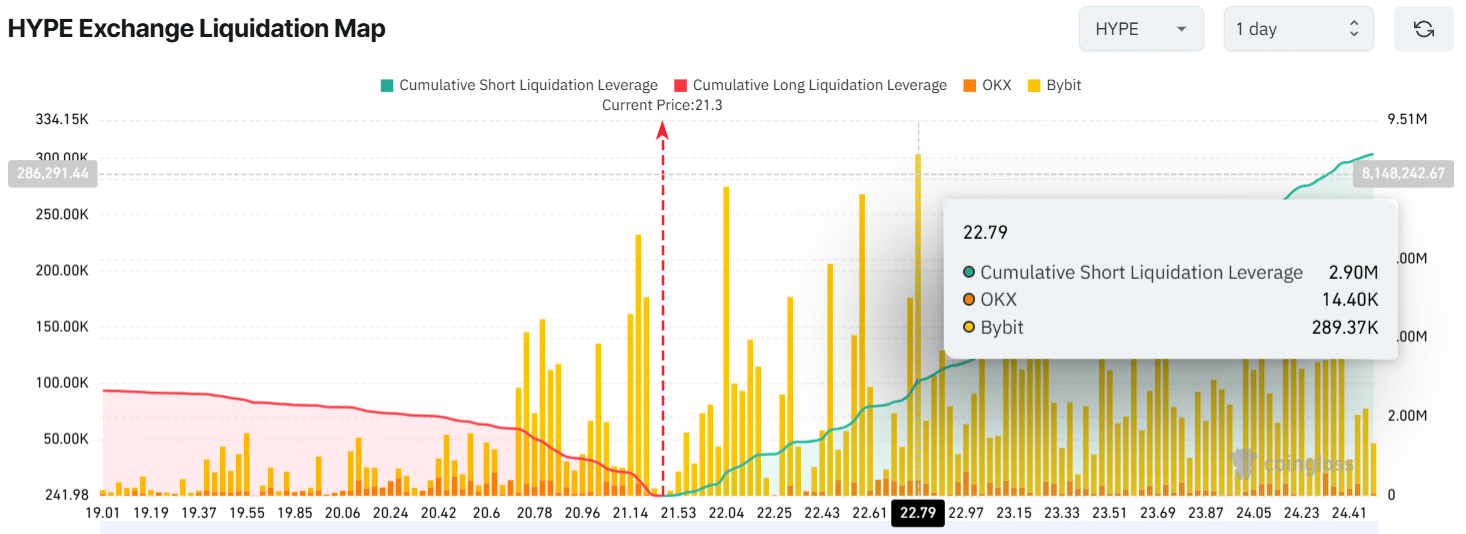

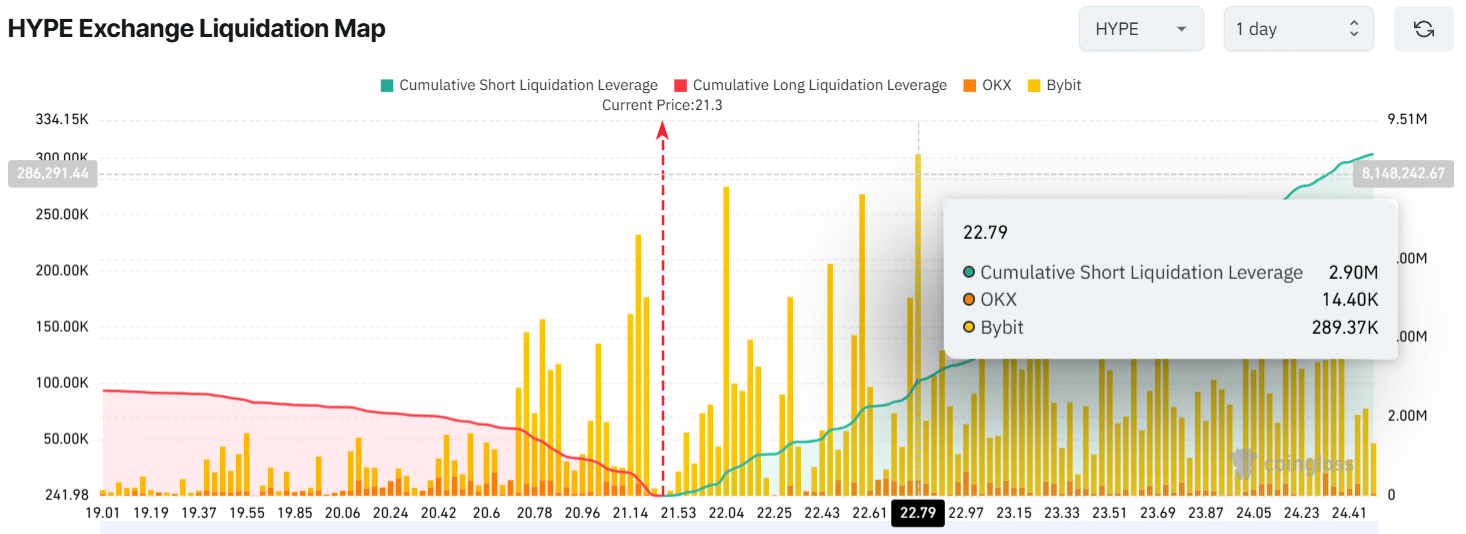

- Intraday traders become excess with $ 21.17 at the bottom and $ 22.79 at the top.

With a remarkable price decrease in the last 24 hours, hyperliquid [HYPE] At the top of the losing list and has now reached a crucial level.

This decrease in the hype seems to have moved the total market sentiment to the Bearish side due to the formation of Bearish price action.

Hype’s technical analysis and price promotion

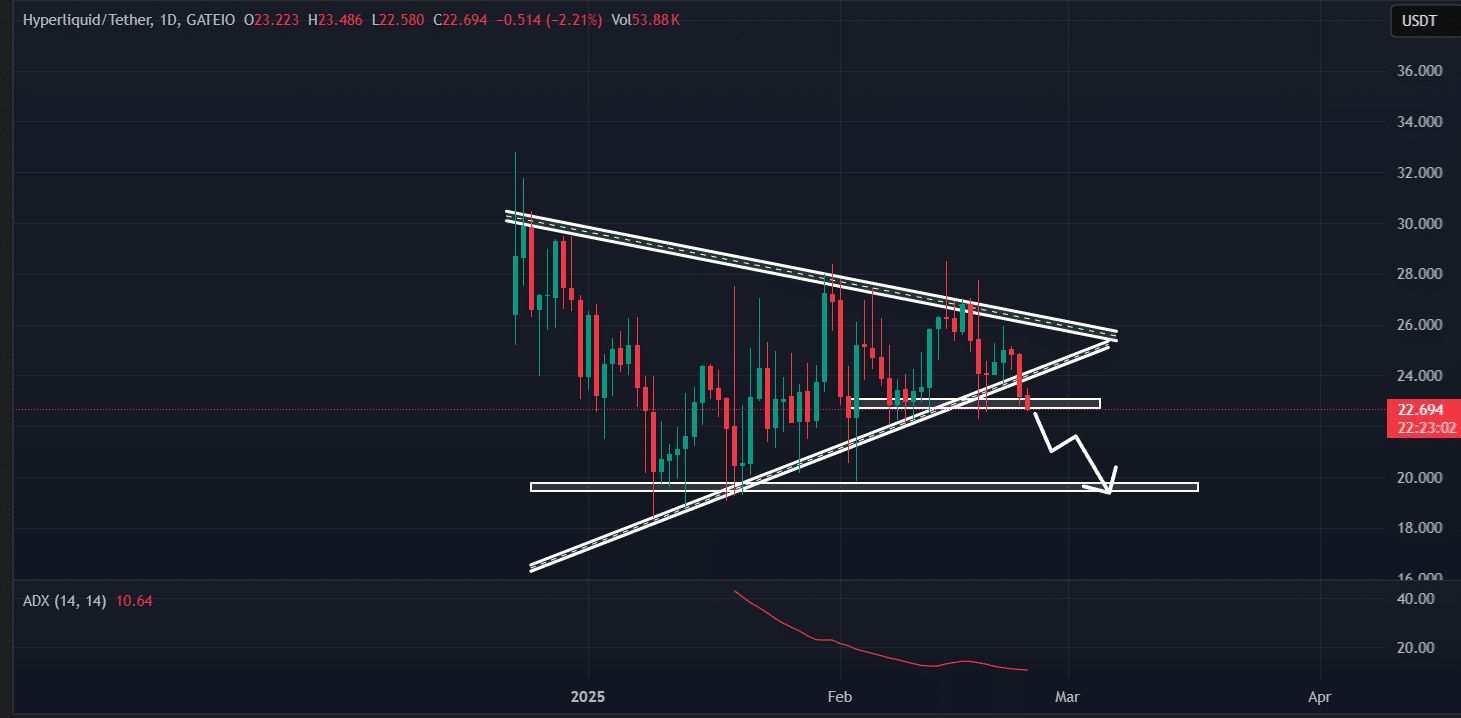

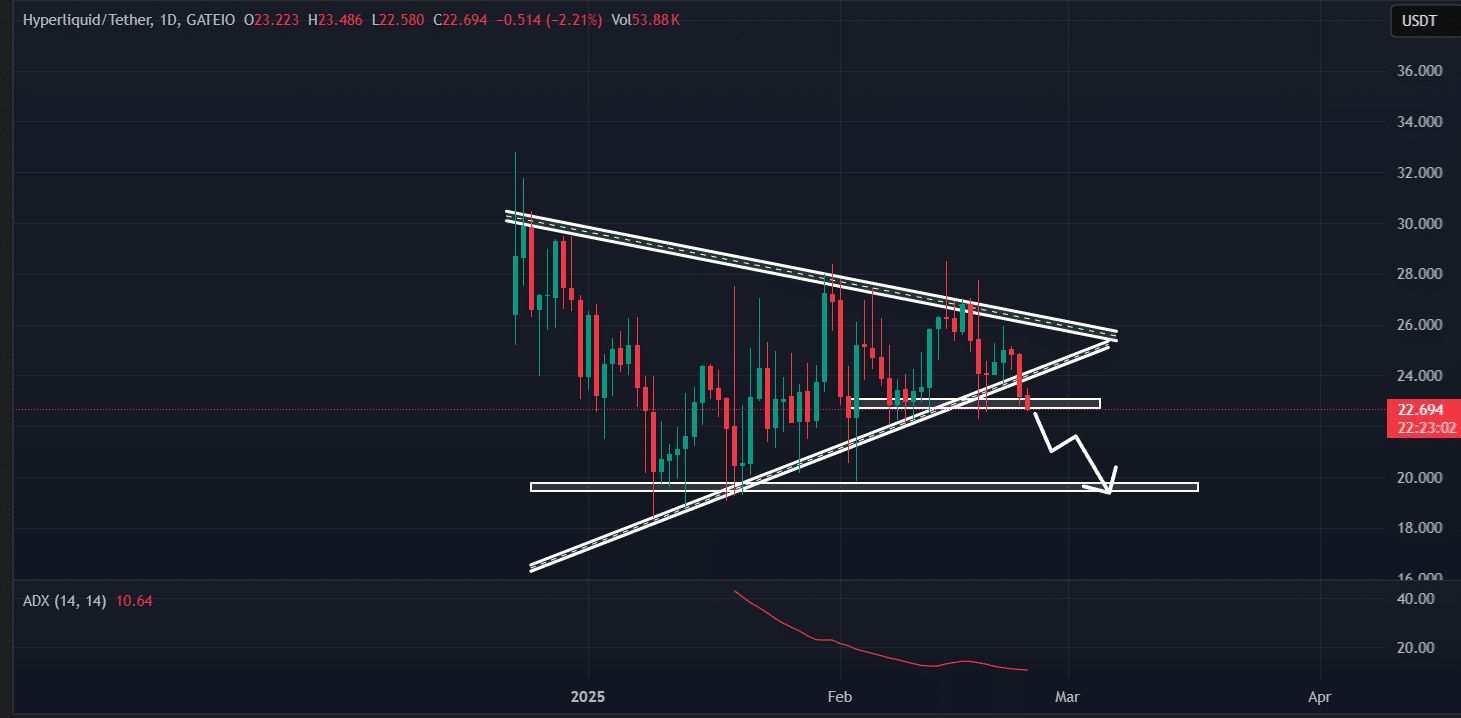

According to the technical analysis of Ambcrypto, Hype has recently been demolished from a symmetrical price action pattern. The break has further violated its crucial level of support at $ 22.70 with its recent price decrease.

This breakdown of an important support level has partially confirmed that it is actively ready for a huge decline.

Source: TradingView

Based on historical patterns, if the hype closes a daily candle below $ 22.50, it could fall by 14% in the coming days to reach $ 19.

Given the current market sentiment, it seems that hype could easily reach this predicted level.

Moreover, the average directional index of Hype (ADX) was at 11.20, at the time of the press, which indicates a weak strength in the asset. This trend can explain the strong downward momentum.

The Vision of the Analysts on the Hype Price Dial

After the recent price fall and breakdown, a prominent one Crypto analyst Made a bold prediction in a message on X (formerly Twitter).

The expert noted that if hype spends the symmetrical triangular pattern, it could actively fall to the level of $ 13 in the coming days, which fully fits in with the analysis of Ambcrypto.

Current price momentum

Despite these predictions, hype was traded in the vicinity of $ 21.50 at the time of writing and he experienced a price fall of more than 12% in the last 24 hours.

In the same period, trade volume increased by 95%, indicating increased participation of traders and investors. The Golf is high, compared to previous days.

The increase may also be due to the liquidation of long positions and releasing assets. It can also be due to potential accumulation caused by the price fall.

Hype traders over-pasted positions

Looking at the Bearish price action, according to the on-chain analysis company Coinglass, It seems that bears actively dominate actively. This may be due to the conviction that the prices will not meet soon.

Data from the liquidation map of Hype Exchange showed that traders are used too much for $ 21.17 at the bottom and $ 22.79 at the top. These levels are currently acting as support and resistance for the active.

Source: Coinglass

In addition, traders for $ 415k have built up long positions and $ 2.90 million in short positions.

This strongly indicates that short sellers have control, which strengthens the bearish prospects of hype.