The downfall of FTX has underscored the counter-party risks that exchanges can impose on the market. As traders and investors tread with heightened caution, there’s an evident demand for reliable metrics to evaluate the health of these platforms.

Using the FTX data set as a benchmark, Glassnode has rolled out three innovative indicators designed to pinpoint high-risk scenarios among the major exchanges: Coinbase, Binance, Huobi, and the now-defunct FTX.

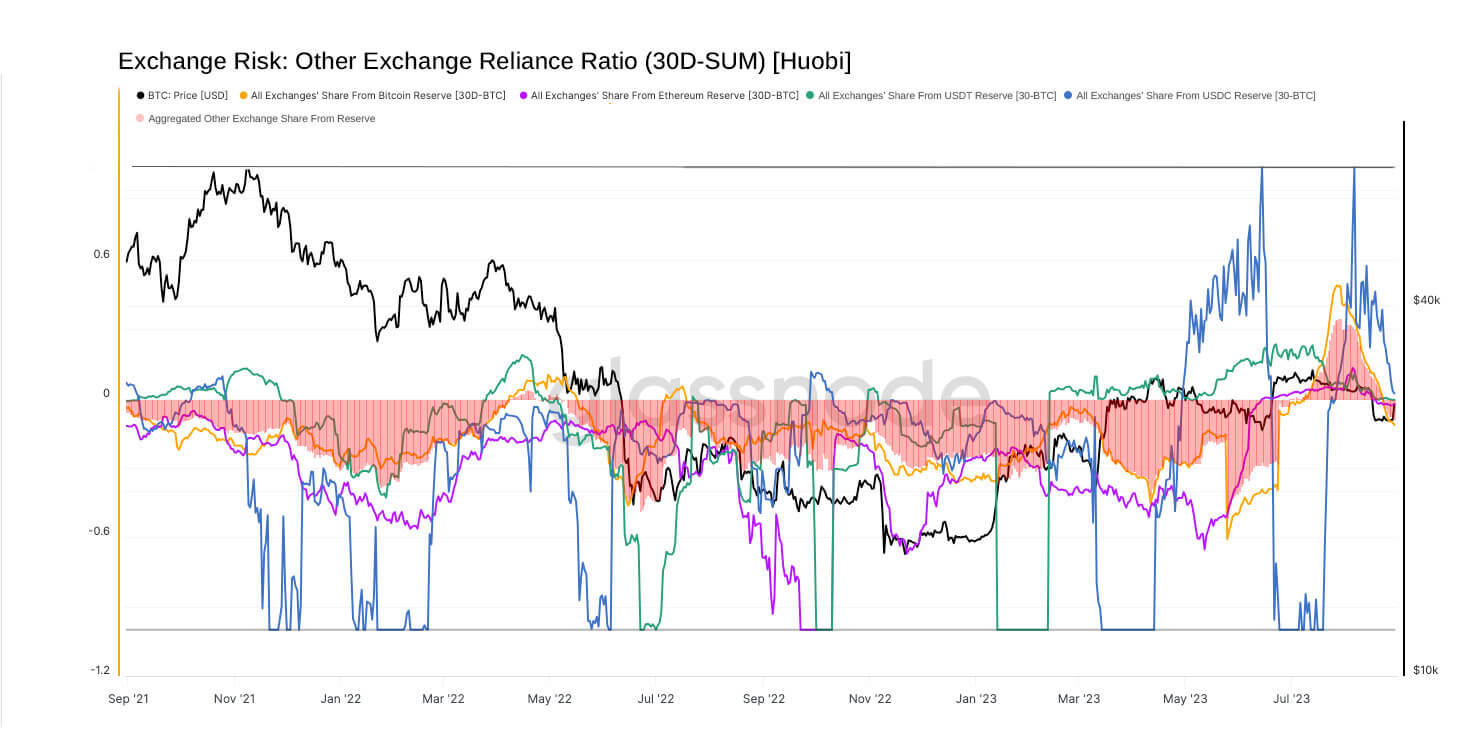

One of the indicators is the exchange reliance ratio, which shows when a significant portion of an exchange’s balance is regularly transferred to or from another exchange. A significant portion of an exchange’s balance being consistently moved to or from another platform might suggest a deep reliance or co-dependence on liquidity.

A positive ratio indicates net inflows to the exchange, while a negative one signifies net outflows. Prolonged periods of large negative values can be a red flag, indicating assets rapidly departing the exchange in favor of another platform.

While Binance and Coinbase exhibit a relatively low reliance ratio, indicating minor fund movements compared to their vast balances, Huobi’s data paints a different picture. Recent figures showed pronounced negative reliance ratios across all Huobi assets, indicating a marked increase in transfers from Huobi to other exchanges.

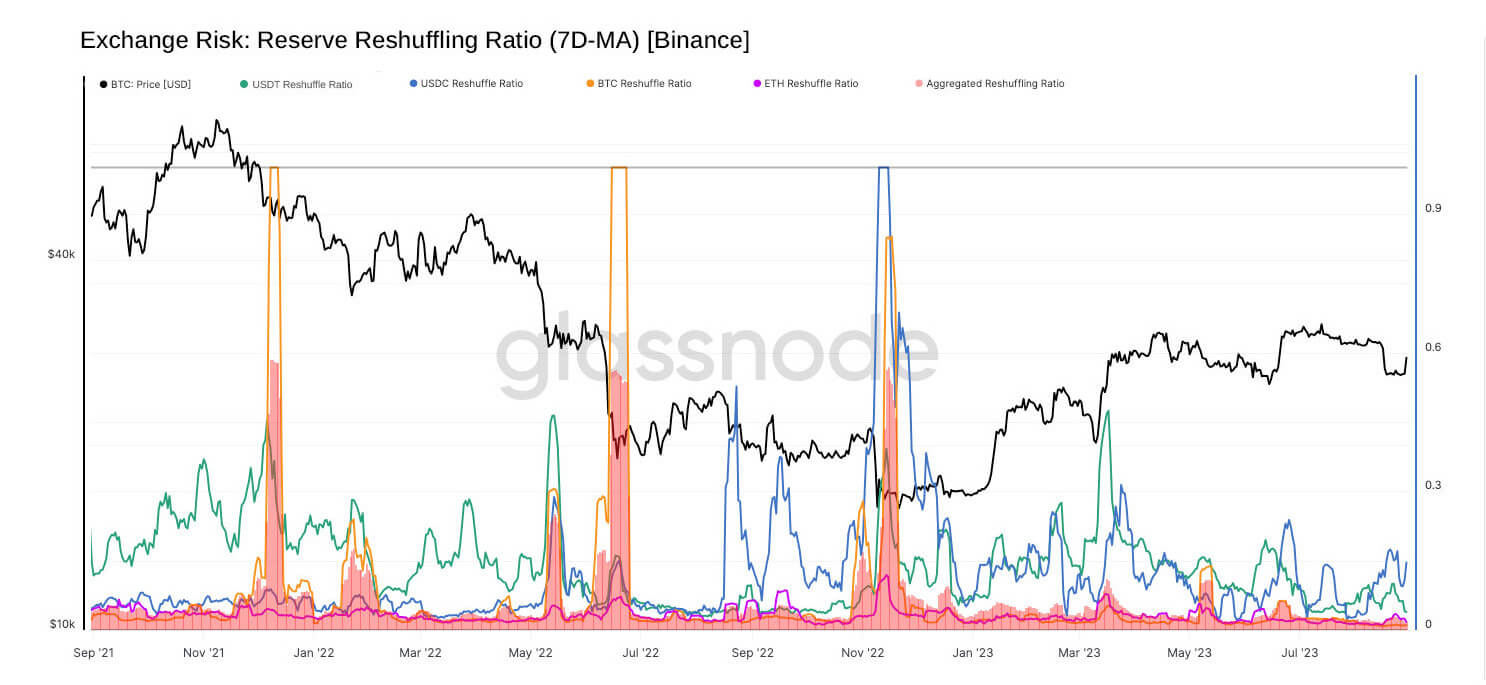

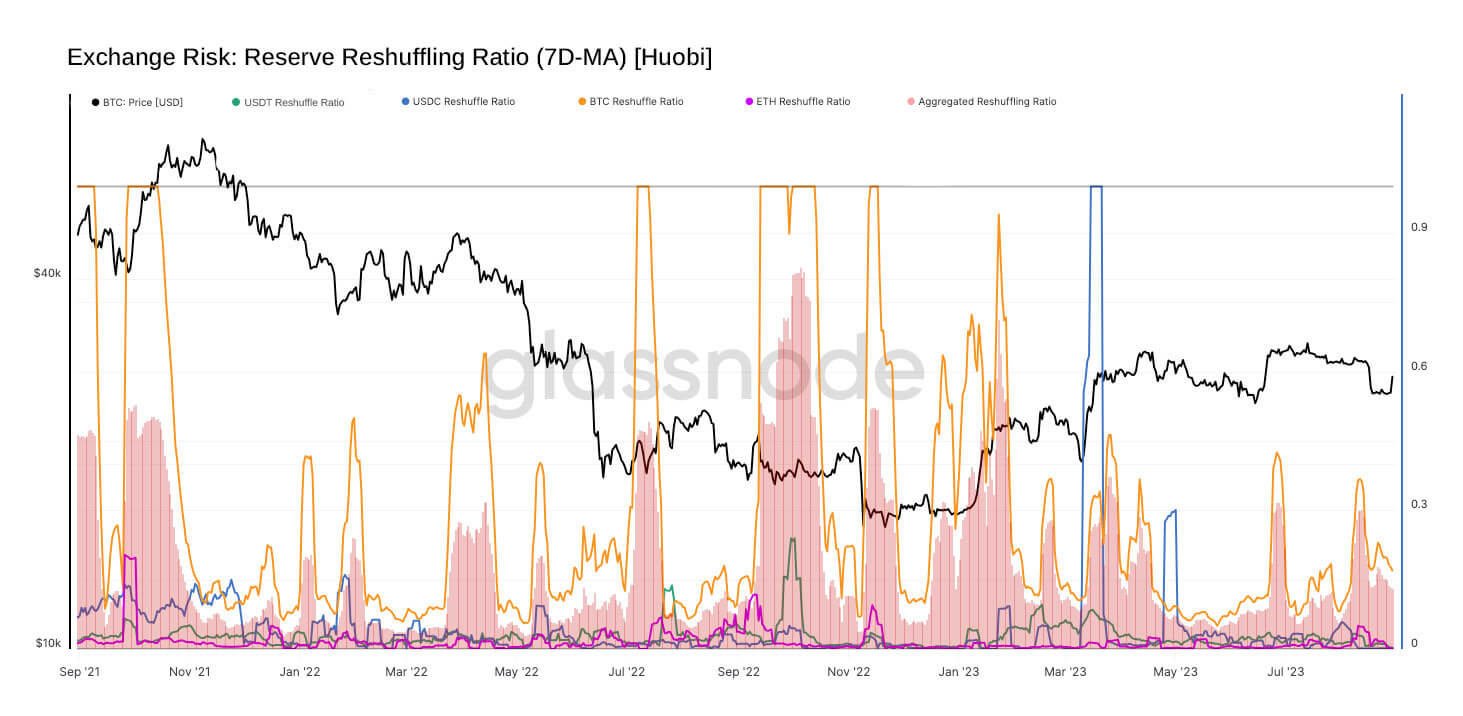

Huobi’s internal reshuffling ratio, which shows the proportion of an exchange’s balance transacted internally over a set period, mirrors that of Binance.

However, context is crucial here. Binance, the largest and most popular exchange on the market, dwarfs Huobi in every metric. Thus, the reshuffling spikes observed with Huobi could be magnified due to its depleting reserves.

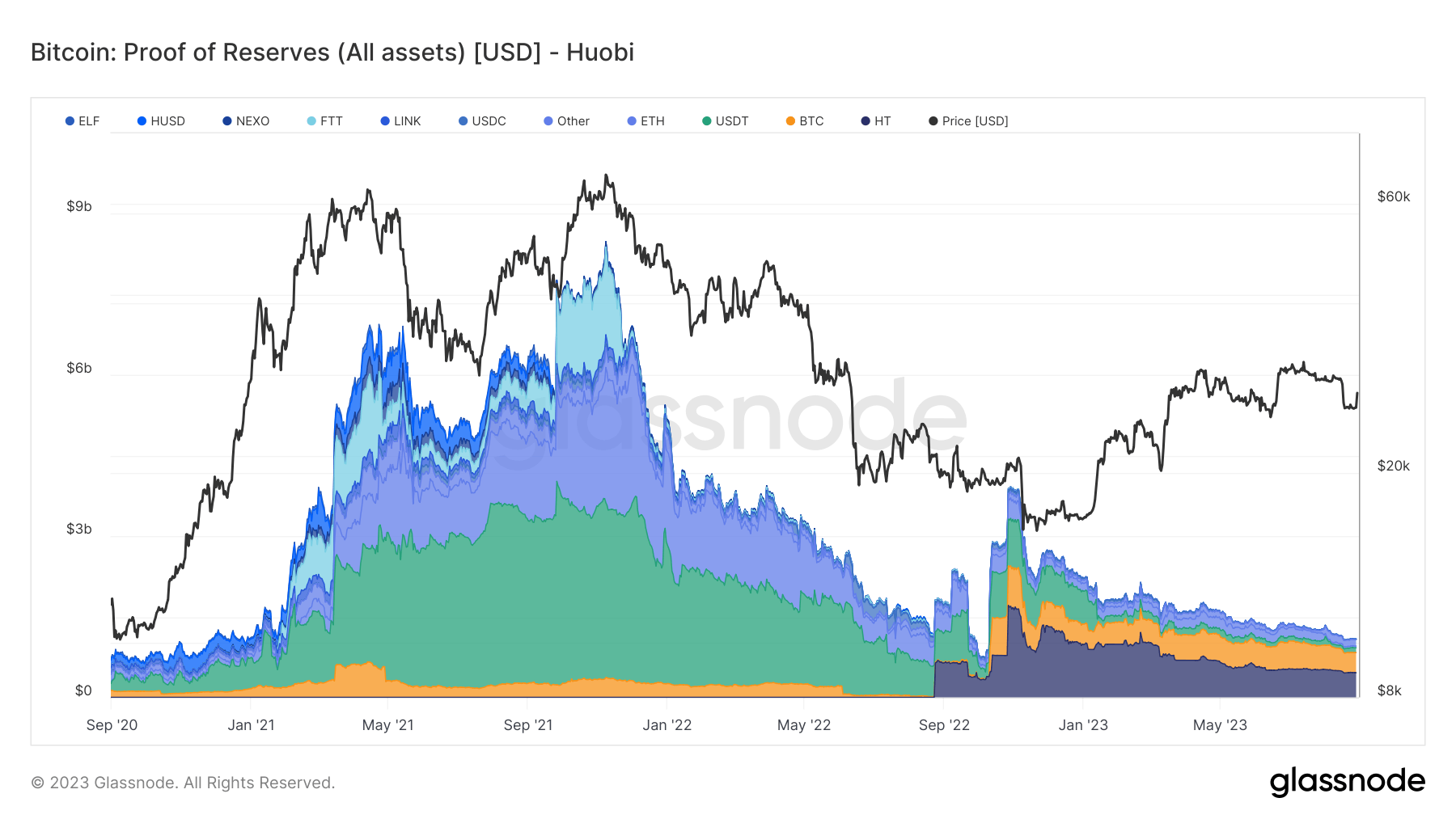

This connection between diminishing reserves and pronounced negative reliance ratios could be concerning. It suggests that assets are being moved internally with greater frequency and being transferred out of Huobi at a growing rate.

The correlation between Huobi’s dwindling reserves and its significant negative reliance ratios might indicate eroding confidence in the platform. While these metrics don’t definitively label an exchange as high-risk, the coming months will show if these indicators are passing anomalies or precursors to a more profound shift.

The post Huobi seeing increased outflows to competitors according to new reliance metrics appeared first on CryptoSlate.