- 72 Crypto ETF archives signal growing institutional interest beyond Bitcoin and Ethereum.

- The new leadership of SEC under Atkins can accelerate ETF goods inspections and legal clarity.

As the broader crypto market is renewed, focuses on a wave of current ETF applications that can reform access to investors to digital assets.

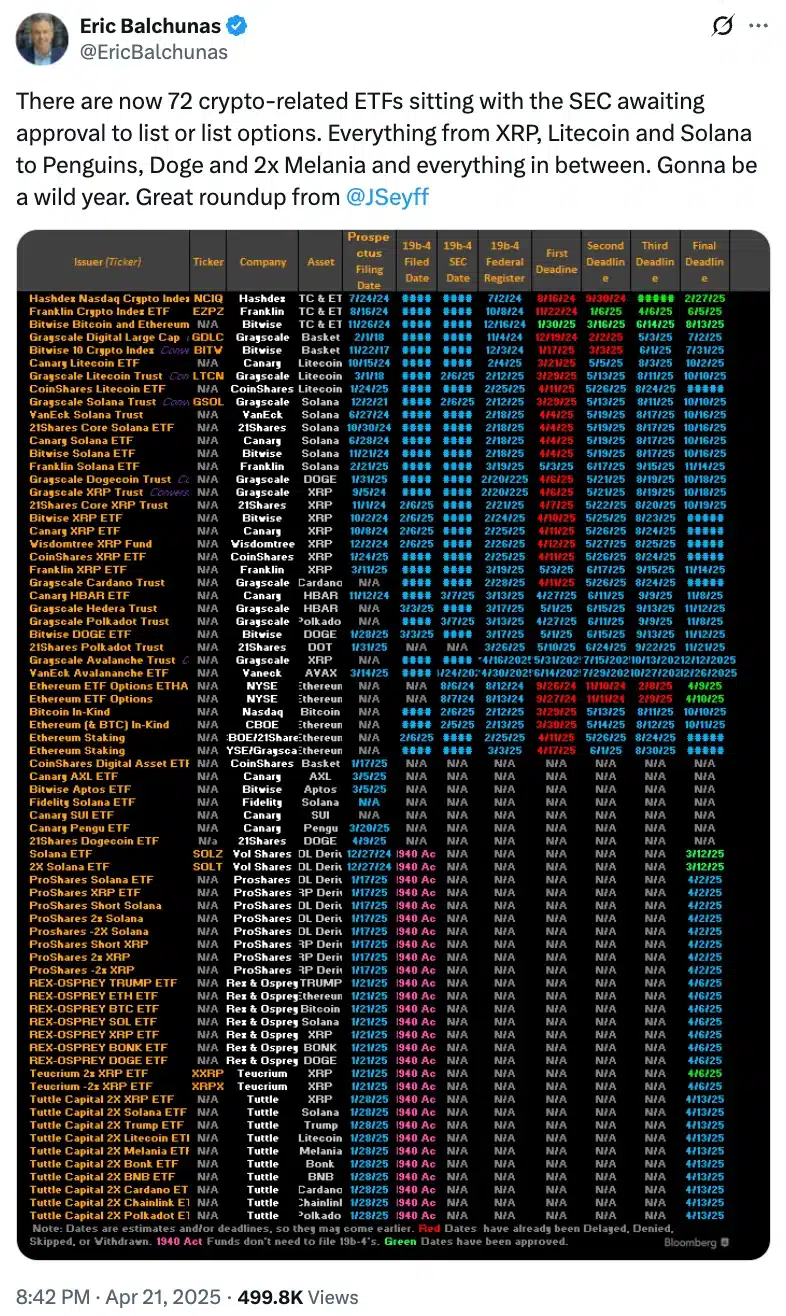

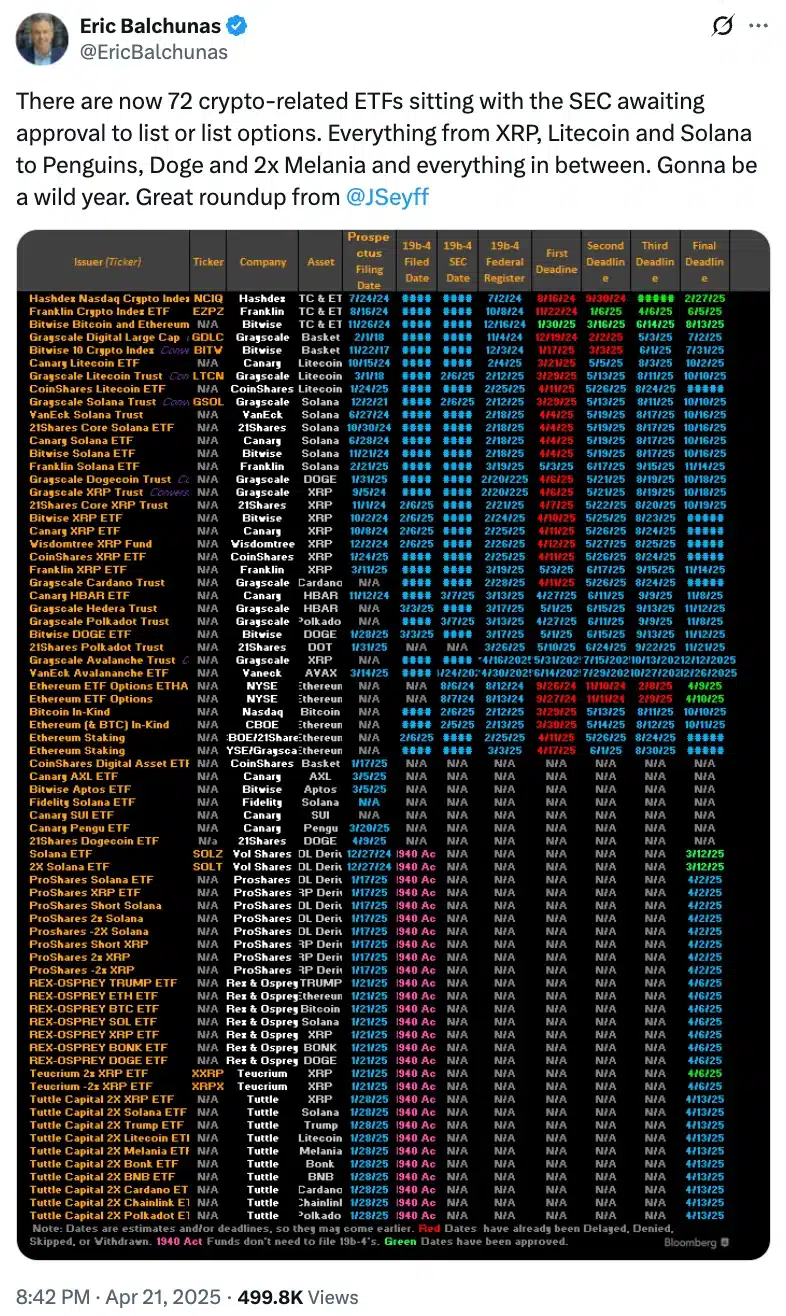

Eric Balchunas on hanging crypto ETFs

Bloomberg’s senior ETF analyst Eric Balchunas emphasized the increasing number of crypto-related ETF proposals pending sec-goods inspection.

The queue is currently 72 proposals. Colleague analyst James Seyffart has compiled the list, which confirms the substantial growth of applications.

Source: Eric Balchunas/X

These archives include a wide range of products, including spot ETFs, options -based offers and livered or reverse funds.

Especially large assets such as Ripple [XRP]Solana [SOL]Litecoin [LTC]and dogecoin [DOGE] are all represented.

Unexpectedly, XRP is at the top of the list of 10 files, with which they underline its rising popularity among funds in the midst of evolving market dynamics.

Despite the regular crypto ETFs, other ETFs will reach the path

Although regular cryptocurrencies dominate most of the ETF reports, there is a noticeable shift to products inspired by internet culture and speculative trends.

A new wave of risky offers, such as Leveraged and Memecoin theme ETFs, has emerged and the attention is paid to their daring approach.

A striking is the “Melania 2x” ETF from Tuttle Capital, which is an example of the rising appetite for newly-driven crypto-blot position.

The archives come from a varied mix of issuers, ranging from industrial veterans such as bitwise, gray and vaneck to newer participants such as Canarx, Coinshares and Tuttle Capital.

As expected, the assets in recent ETF reports were not randomly chosen; They reflect a mix of strong market capitalization, active user involvement and increased demand for investors.

Solana, for example, has attracted attention, not only for its price performance, but also for its fast blockchain and growing role in NFTs and Defi.

This evolving ETF landscape indicates that institutional interest is expanded beyond Bitcoin [BTC] and Ethereum [ETH]Wearing a more diversified approach to exposure to digital assets.

Will Paul Atkins use a different strategy than Gary Gensler?

That said, with the leadership of Paul Atkins, the SEC also seems ready to follow a more constructive approach to Crypto Regulation, with a renewed focus on offering clearer guidelines for digital asset markets.

Atkins notes the same and told the congress recently,

“A top priority of my chairmanship will be to collaborate with my colleague commissioners and the congress to offer a solid regulatory basis for digital assets through a rational, coherent and principle approach.”

Needless to say that the dedication of Atkins to resolve the long -term concerns of the industry is a sharp deviation from the more rigid attitude of his predecessor, Gary Genler.

This also increases optimism that a wave of ETF approvals could quickly accelerate the acceptance of the crypto in the US

While the US is taking off its crypto game, the international momentum is also building up.

Zuid -Korea, for example, is said to be considering the approval of Bitcoin ETFs when Japan continues with his own lighting of the regulations, which indicates a wider, global shift into embracing cryptocurrency investment products.