beginner

In my opinion, Bitcoin is still the best cryptocurrency to start your crypto investment journey with. Unlike most altcoins, it is pretty straightforward in what it does and represents. Not to mention, it is the most widely and easily accessible cryptocurrency.

Bitcoin investment may seem daunting to beginners, especially given the complex terms and unpredictable market movements. Like all other investments, Bitcoin carries risk. Its price can fluctuate quite significantly, which means you could potentially gain or lose money quickly. But with proper understanding and caution, it’s possible to navigate the world of Bitcoin investing without any trouble!

What Is Bitcoin?

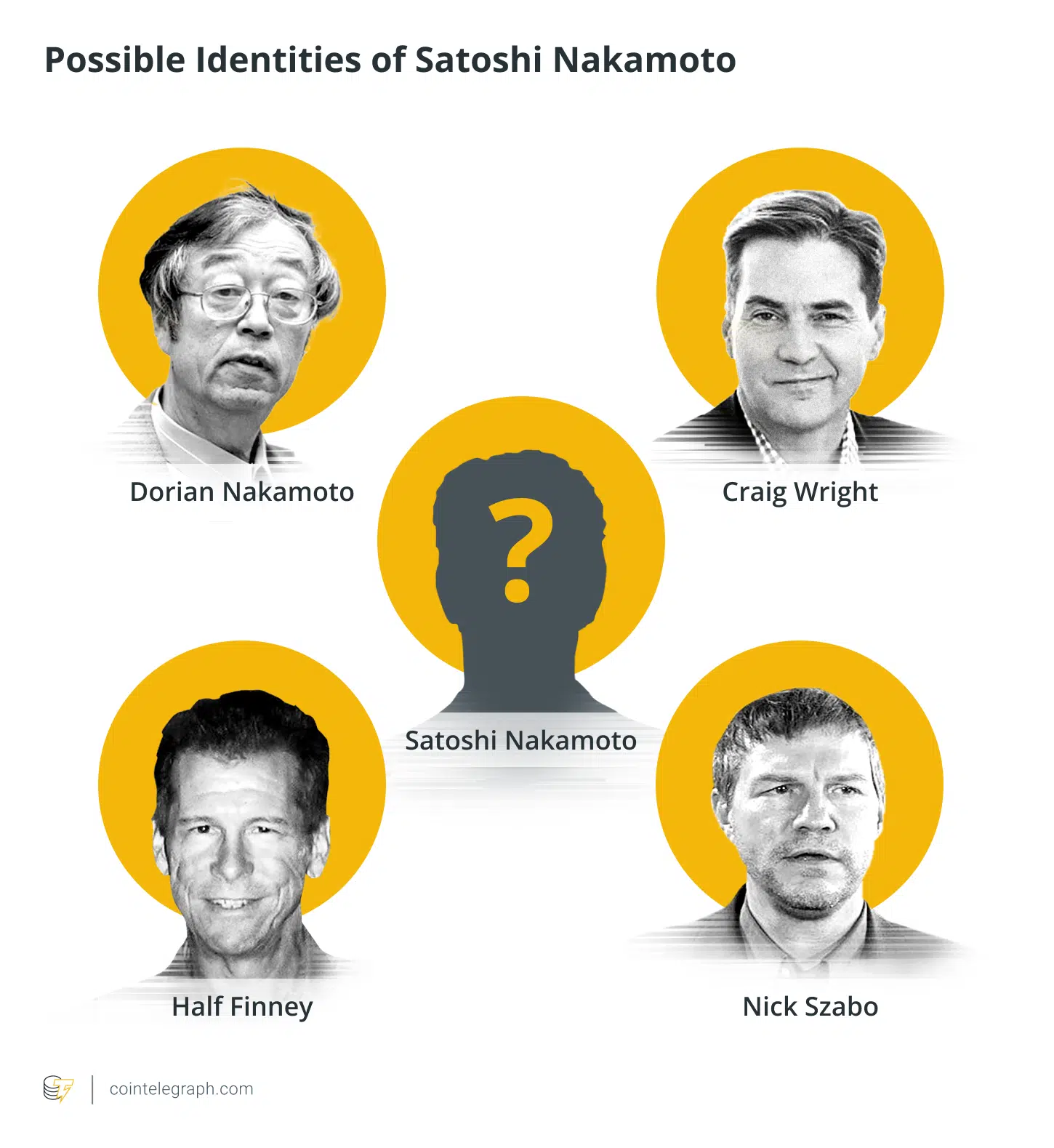

Bitcoin, often denoted as BTC, is a digital or virtual currency. It’s like an online version of cash that was invented in 2008 by an unknown person or a group of people who used the name “Satoshi Nakamoto.” Bitcoin started as a paper published on the internet, outlining the concept of a “peer-to-peer electronic cash system.”

The creation of Bitcoin brought to life the idea of cryptocurrency. In simple terms, a cryptocurrency is a decentralized form of currency, existing entirely online, that uses cryptography — a method of protecting information by transforming it into an unreadable format, known as encryption — for security.

Unlike traditional currencies, such as the dollar or euro, which are controlled by central banks, Bitcoin operates on a decentralized network of computers spread around the world. This decentralization means no single institution controls the Bitcoin network. It’s a democratic form of money, so to speak, controlled by the people who use it.

How Much Does It Cost to Buy Bitcoin?

Here’s the current price of Bitcoin.

How Does Bitcoin Work?

At the heart of Bitcoin is a public ledger called a blockchain. This ledger contains every transaction processed, allowing the user’s computer to verify the validity of each transaction. This complete transparency helps maintain the integrity of the system.

People known as miners use powerful computers to solve complex mathematical problems that validate each Bitcoin transaction. Once a problem is solved, a transaction is added to the blockchain, and a miner is rewarded with a small amount of Bitcoin. This process is known as Bitcoin mining.

Unlike a traditional bank account, a Bitcoin wallet requires no paperwork. A Bitcoin wallet can be set up in minutes from your computer or smartphone. You can receive Bitcoins in your digital wallet from anyone else who has a wallet. Every transaction made with Bitcoin is stored in the blockchain.

What Makes Bitcoin Valuable?

There are a few key reasons why Bitcoin is valuable.

- Scarcity. The total number of Bitcoin that can ever exist is limited to 21 million. This artificial scarcity is coded into the Bitcoin algorithm.

- Decentralization. Bitcoin isn’t governed by a central authority, like a government or a financial institution. Its value can’t be manipulated by these entities.

- Utility. Bitcoin transactions can occur between parties without a middleman, such as a bank. These transactions are typically processed faster and with lower fees than transactions of traditional banking systems or money transfer services.

- Potential for high returns. Bitcoin’s value has historically seen high levels of volatility. This volatility creates the potential for high returns, though it also increases risk.

- Anonymity and privacy. While all transactions can be traced using blockchain technology, the identities of people involved in transactions aren’t disclosed.

Bitcoin’s value isn’t inherent, as with gold or oil. In fact, it comes from the belief and agreement of its users and traders. This is true for all forms of currency. What sets Bitcoin apart is its blend of scarcity, utility, and independence from traditional economic systems, making it a unique financial phenomenon.

As a result, however, it can be hard to predict Bitcoin’s price, and quite often, it ends up being dependent a lot on the general attitude of the market. As we have seen before, many Bitcoin holders are prone to panic and have “weak hands,” meaning they tend to sell off their coins when the BTC price starts to decline, driving the entire value of the asset lower.

The Risks and Benefits of Investing in BTC

Before looking at the risks and benefits of investing in Bitcoin, you should first determine whether it’s even worth it for you to invest in BTC — or any other crypto at all.

Many people get sucked into making crypto investments out of FOMO, which often leads to nothing but losses. Before joining the ranks of crypto investors, ask yourself the following questions:

- Why didn’t I buy Bitcoin earlier when it was cheaper?

- Why am I buying it — to hodl or to make a quick buck?

- If it’s the latter, then why do I think I will be able to sell it later at a higher price?

- Do I understand what Bitcoin and the crypto market are?

- Am I OK with the risk? Can I afford to lose all the money that I’m going to invest in Bitcoin?

Your answers to these questions will help you understand whether you should invest in Bitcoin or not.

I would personally advise against entering the crypto market if you are vulnerable to gambling. The nature of the cryptocurrency is speculative to a high degree, presenting a high-risk, high-reward dynamic that can potentially harm people prone to gambling addictions. Please remember to be careful and avoid making financial decisions that can cause you to lose all your funds — or, worse, go into debt.

Now, let’s take a look at the actual risks and benefits of investing in Bitcoin.

Benefits of Investing in Bitcoin

- High potential returns. Compared to traditional investments, such as the stock market, Bitcoin and other crypto assets have shown a significantly higher potential for returns.

- Liquidity. Bitcoin trading occurs 24/7 on various cryptocurrency exchanges, providing high liquidity and the ability to trade at any time.

- Future of currency. Many believe that digital currency is the future, and investing in Bitcoin now could yield significant returns as digital currencies become more widely adopted.

- Inflation hedge. With its supply capped at 21 million, Bitcoin could act as a hedge against fiat currency inflation.

Risks of Investing in Bitcoin

- Price volatility. Bitcoin is known for its price volatility. The price can fluctuate widely in a short period, which could lead to significant losses.

- Lack of regulations. The crypto market is still relatively new and lacks the regulatory framework of traditional financial markets.

- Digital threats. As a digital asset, Bitcoin is susceptible to hacking, technical glitches, and other cybersecurity threats.

- No guaranteed return. As with any investment, there’s no guaranteed return. The value of Bitcoin is highly dependent on demand, and if demand falls, the value may plummet.

What You Will Need to Invest in Bitcoin

To begin your cryptocurrency investment journey, you will first need a few things:

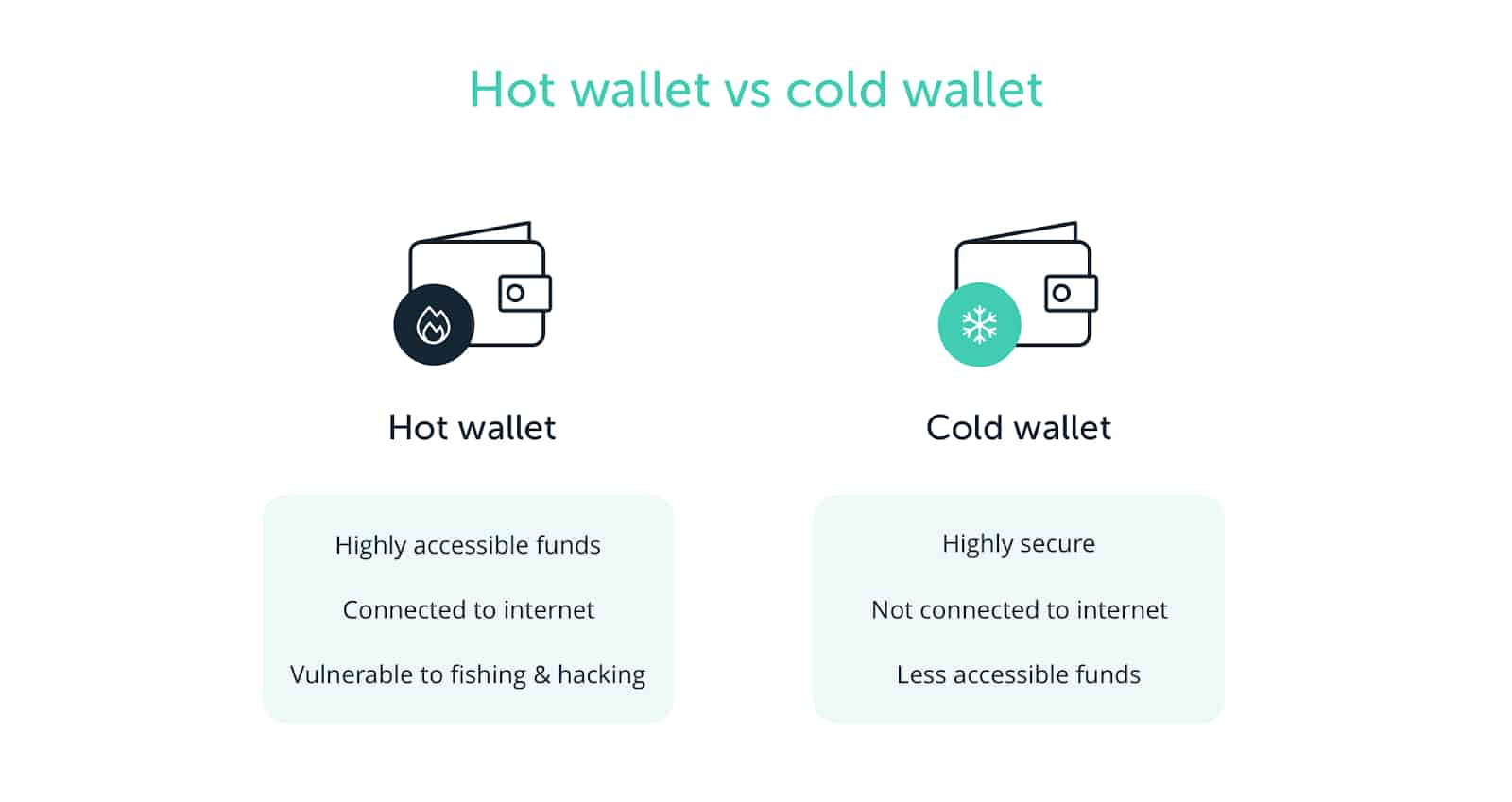

- Crypto wallet. To store your Bitcoin, you’ll need a hardware or a hot wallet.

- Suitable crypto exchange. You’ll need to find a cryptocurrency exchange where you can safely and securely buy and sell Bitcoin.

- Payment Method. Most major exchanges accept different payment methods, including bank transfers, credit card payments, or even other cryptocurrencies.

- Risk tolerance. Crypto investments are volatile assets, and investing in them carries risk. Ensure you have a clear understanding of your risk tolerance before you begin.

Hot vs. Cold Wallets

When it comes to storing your Bitcoin, you have two options: hot wallets and cold wallets.

A hot wallet is connected to the Internet; that’s why it allows you to easily access your Bitcoin to conduct transactions. However, this type of wallet is vulnerable to online threats. Some good hot wallets are Exodus, ZenGo, and Jaxx Liberty.

A cold wallet, also known as a hardware wallet, is a physical device not connected to the internet, providing an extra layer of security. Cold wallets are a good choice if you plan to hold Bitcoin as a long-term investment, though they might not be as convenient for frequent trading or transactions. If you’re looking for a reliable offline wallet, you can get Trezor or Ledger.

Whichever type of crypto wallet you go for, make sure you never share your keys with anyone.

The Best Crypto Exchanges For Beginners

Choosing the right crypto exchange is crucial. Here are a few of the best cryptocurrency exchanges for beginners:

- Coinbase. Known for its user-friendly interface, Coinbase is a great platform for novice users. It offers a wide variety of cryptocurrencies for trading.

- Binance. With one of the largest selections of digital currencies, Binance is a good choice for those looking to explore beyond Bitcoin.

- Changelly. Changelly is a great platform for crypto beginners — it has an intuitive, user-friendly interface and provides users with free guides on all things crypto. Changelly’s fiat-to-crypto marketplace aggregates offers from a wide variety of providers, ensuring you won’t have to scour the internet for the best Bitcoin prices.

When choosing an exchange, factors such as security features, trading fees, and available cryptocurrencies are worth consideration. All platforms offer their own unique benefits, so it could be useful to try a few of them out first with smaller amounts.

Best Ways to Invest in Bitcoin

Here are a few strategies for investing in Bitcoin:

- Buy and Hold. Given the price volatility of Bitcoin, some investors choose a long-term approach, buying Bitcoin and holding onto it, banking on its price appreciation over time.

- Trading. Some investors engage in crypto trading, trying to profit from price fluctuations in the Bitcoin market.

- Dollar-Cost Averaging (DCA). This strategy involves investing a fixed amount in Bitcoin at regular intervals, regardless of its price, which can help mitigate the effects of volatility.

Remember, no strategy guarantees success, so it’s important to invest only what you can afford to lose.

Is It Smart to Invest in BTC Right Now?

Although Bitcoin has seen some incremental price growth lately, there haven’t been any “crypto booms” for quite a while. The BTC price is relatively stable at the moment, which is both a blessing and a curse: yes, it isn’t crashing, but it also isn’t presenting any opportunities for making those explosive profits the crypto market is famous for.

A good (and easy) way to determine whether Bitcoin is worth buying at the moment is to look at market analysis charts like the TradingView widget below. If it shows “Buy,” that means the price of Bitcoin is likely to rise soon, while the “Sell” signal tells us there is a potential for a downward trend to appear shortly.

Please note that the situation can change at any time. It’s important to remember that trying to predict and outsmart the market will always be a gamble, no matter if it’s the crypto or stock market we’re talking about. The former, however, is a lot more volatile. That’s why when it comes to cryptocurrency investment, it is generally advised to keep your FOMO in check and try investing bit by bit over a longer period of time.

Conclusion

When contemplating investing in any asset, it is always a good idea to consider how it will fit into your existing portfolio. And if you don’t have one yet, think about what other assets — fiat currencies, precious metals, virtual currencies, and so on — you will have to buy up to mitigate the risk and achieve your profit goals.

An easy way to make a foolproof portfolio is to invest in a high-risk, high-reward asset alongside gold or other precious metals. Ultimately, whether you should buy a hundred dollars worth of Bitcoins right now depends on what you think about this coin and crypto in general and its future potential.

Please note that the contents of this article should not be seen as investment advice. Good luck on your crypto journey!

FAQ

What is a good Bitcoin wallet?

A good Bitcoin wallet is one that balances security, accessibility, and user-friendliness. For instance, the Exodus wallet is highly rated for its sleek interface and support of a vast number of cryptocurrencies, making it ideal for beginners. Another great option is Ledger, a hardware wallet that stores your Bitcoin offline and, therefore, is less susceptible to hacking.

However, the ultimate choice depends on whether you favor convenience over security or vice versa, as online wallets (like Exodus) allow easy access for Bitcoin purchases, while hardware wallets (like Ledger) provide superior protection for these potentially risky assets.

What is the best way to buy BTC?

The best way to buy BTC often depends on individual needs and circumstances. However, generally, the most secure and convenient way to purchase Bitcoin is through a well-established cryptocurrency exchange like Coinbase or Binance. These platforms allow you to buy, sell, and trade Bitcoin directly using your local currency or other cryptocurrencies.

Payment methods can vary, but most platforms typically accept debit cards, bank transfers, and even PayPal in some regions. Remember, each transaction may be subject to a transaction fee, which can differ between exchanges.

How to start investing in Bitcoin?

Starting your Bitcoin investment journey involves a few steps. First, determine how much you’re willing to invest, keeping in mind that Bitcoin and other cryptocurrencies are speculative and risky assets. Second, set up a secure digital wallet where you can store your Bitcoin. Next, create an account with a reputable cryptocurrency exchange where you’ll make your Bitcoin purchases.

Then, you can start buying Bitcoin, but be aware of the current market trends and how much Bitcoin is worth at the time of purchase. Be mindful when selling Bitcoin, too, as timing is crucial in this volatile market. It’s also worthwhile to consider options like Bitcoin Exchange Traded Funds (ETFs), which allow you to invest in Bitcoin without actually owning it.

Where can I invest in Bitcoin?

You can invest in Bitcoin on various platforms. Cryptocurrency exchanges are the most common platforms for buying and selling Bitcoin. Some popular ones include Coinbase, Binance, and Kraken. These platforms allow you to trade Bitcoin directly and usually support a wide array of other cryptocurrencies. Additionally, certain traditional brokers and stock trading apps are beginning to offer Bitcoin and other crypto assets.

Lastly, Bitcoin ETFs offer an alternative way to invest in the value of Bitcoin without having to manage and secure the digital currency yourself. Be sure to choose a platform that aligns with your investment strategy and provides adequate security measures.

Can I lose money on Bitcoin?

Yes, absolutely. No matter what Bitcoin investing strategies you use or how secure your wallet and exchange are, there’s always a risk of losing your funds. However, you can minimize those risks.

We give a few general tips on how not to lose your money while exchanging crypto in our article on refunds. Spoiler alert: It’s hard to refund crypto and Bitcoin transactions, so make sure to double-check all info you enter when making a purchase!

Can investing in Bitcoin make you wealthy?

Well, it depends on when you’re going to sell Bitcoin and how much it will rise in the future. That said, Bitcoin is no longer at that stage where you can make millions or even thousands of dollars by investing as little as $10 in it — if that’s what you’re after, you will be better off betting on the success of random shitcoins.

However, there’s another way to become wealthy by investing as little as $100 in Bitcoin or any other popular cryptocurrencies: doing it on a regular basis, just like how you’d top up your savings account.

Is $100 enough to invest in Bitcoin?

Whether $100 is enough or not depends on your end goal. If you want to reap enormous gains, then $100 might not be enough. But if your goal is simply to get some profit or to jump onto the Bitcoin train, then it is more than sufficient.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.