- The BTC posture of Strategy crossed 500K and hit 2.4% of the total delivery.

- The company had $ 15 billion for debt issue and total capital of $ 39 billion to increase according to its 21/21 plan.

Strategy (formerly micro strategy) became the first public company to cross 500K Bitcoin [BTC] Holdings after the last purchase.

On March 24, Michael Saylor, founder of strategy, stated That the company has purchased an extra 6,911 BTC worth $ 584 million.

The total interests of the company have risen to 506,137 BTC worth $ 43.9 billion, which translated into 2.4% of the total BTC offer (21m coins).

To put this in perspective, 492,750 BTC would be mined between now and 25 March 2028, just before the next halving. Simply put, strategy more BTC than ever would be mined in the next three years.

Mstr as a Bitcoin -Bèta

Since the aggressive BTC approach from Strategy in 2020, the share, MSTR, is the largest beneficiary.

In the past five years, MSTRA won 2,115%, while BTC yielded 638%. It surpasses the world’s largest cryptocurrency with 3.3x.

Source: Cryptuquant

On month to date, MSTR was almost 25%, while BTC bounced by around 1%. The outperformance was very clear, even on a YTD (year-to-date) time frame.

MSTR increased by 12% in 2025, while BTC fell by 8%, which strengthened the share as the ultimate BTC -Proxy game.

That said, the last purchase was funded by a recent stock sales (both MSTR and STRK), sec submit shown.

“The Bitcoin purchases (6,911 BTC) were made with the help of revenues from the regular ATM and the Strk money machine.”

In short, the recent preferred supply sale (Strf) still had to be used. BTC analyst James van Straten noted That the company could acquire an extra 7K BTC in the coming days.

For the unknown, this was part of the 21/21 plan of the company to collect $ 42 billion in capital through share issue and debt financing for BTC purchases.

According to analyst RagnarThe company had $ 15 billion in debt issue that remained in the context of the plan, with a total capital of $ 39 billion.

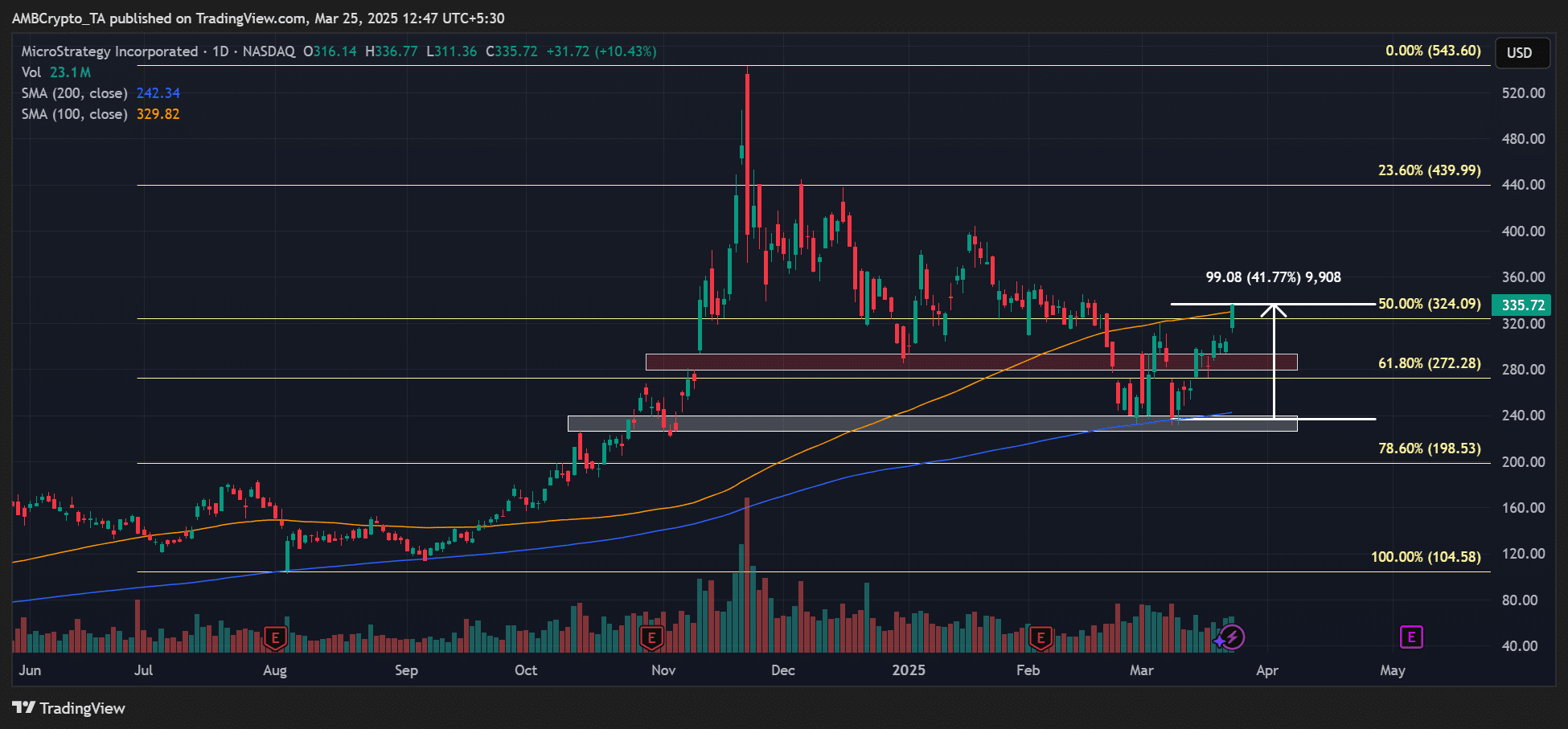

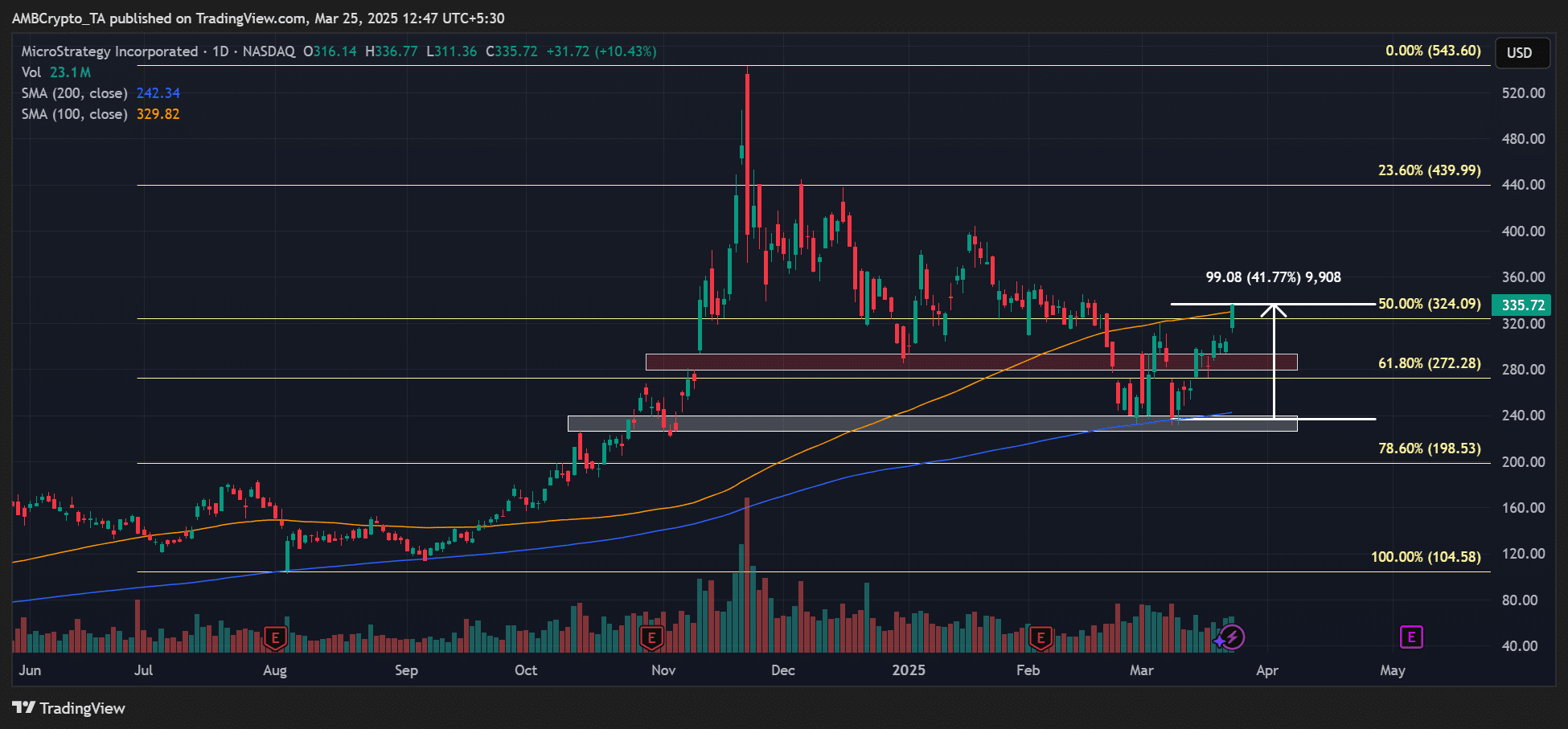

On the price diagram, MSTR Oscilled between 200 DMA (daily progressive average) and 100dma.

The 41% rally that was seen in the past two weeks tapped the upper range of 100dma (Orange). Whether an outbreak would happen, to be seen.

Source: MSTR, TradingView