- MicroStrategy and BTC were the top asset players in the world in 2024.

- Will the company’s bold BTC strategy pay off again in 2025?

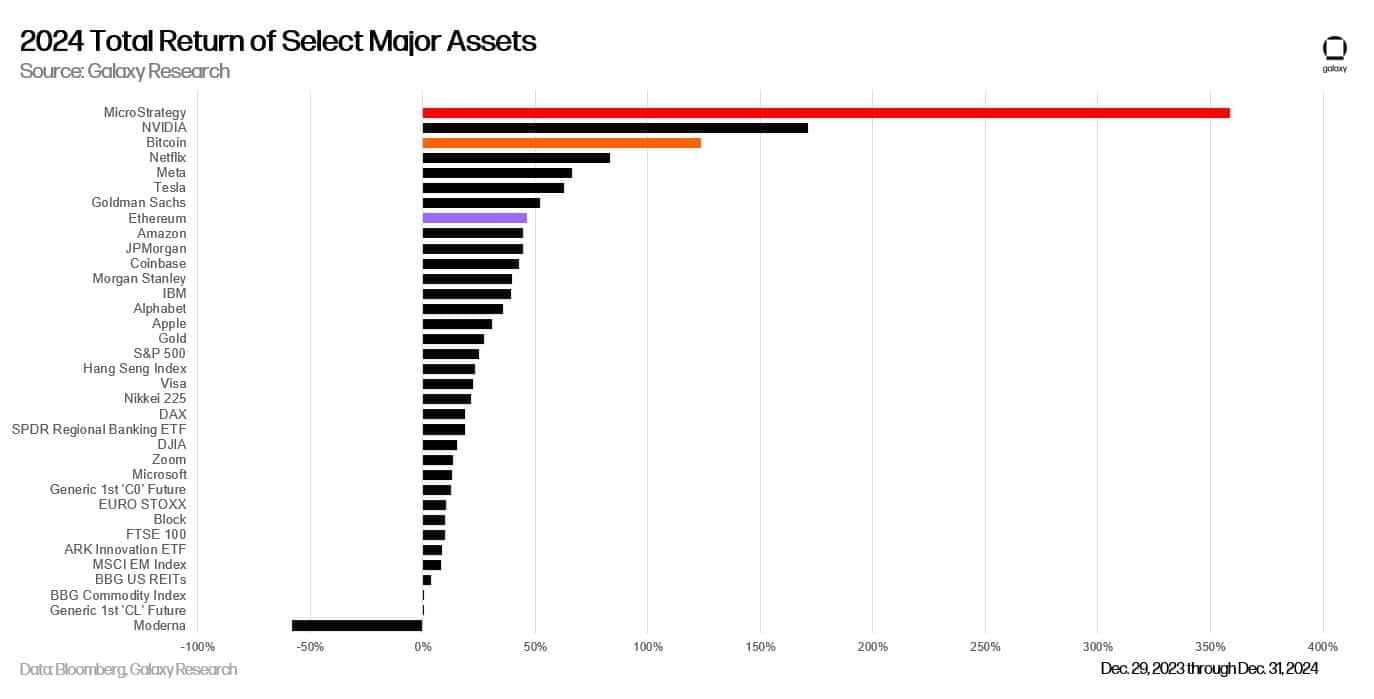

MicroStrategy is aggressive Bitcoin [BTC] The buying frenzy in 2024 appears to be paying off. According to Galaxy Research, the company’s stock, MSTR, was the best in terms of assets in the world in 2024, with an annual gain of 358%.

Source: Galaxy Research

MSTR shared the top spot with Palantir Technologies [PLTR]a software company that also offers data analytics solutions to cryptocurrency companies.

BTC finished in third place, while Nvidia came in second. Alex Thorn, head of company-wide research at Galaxy Digital, noted that the top two performers were related to BTC. He said,

“Even on a risk-adjusted (sharpe) basis, MSTR finished first and BTC third. Two of the top three assets in 2024 were related to Bitcoin.”

MicroStrategy’s BTC bet

MSTR’s remarkable annual performance was no surprise. The company’s founder and former CEO, Michael Saylor, is a BTC maxi who believes the cryptocurrency will always outperform most US stocks.

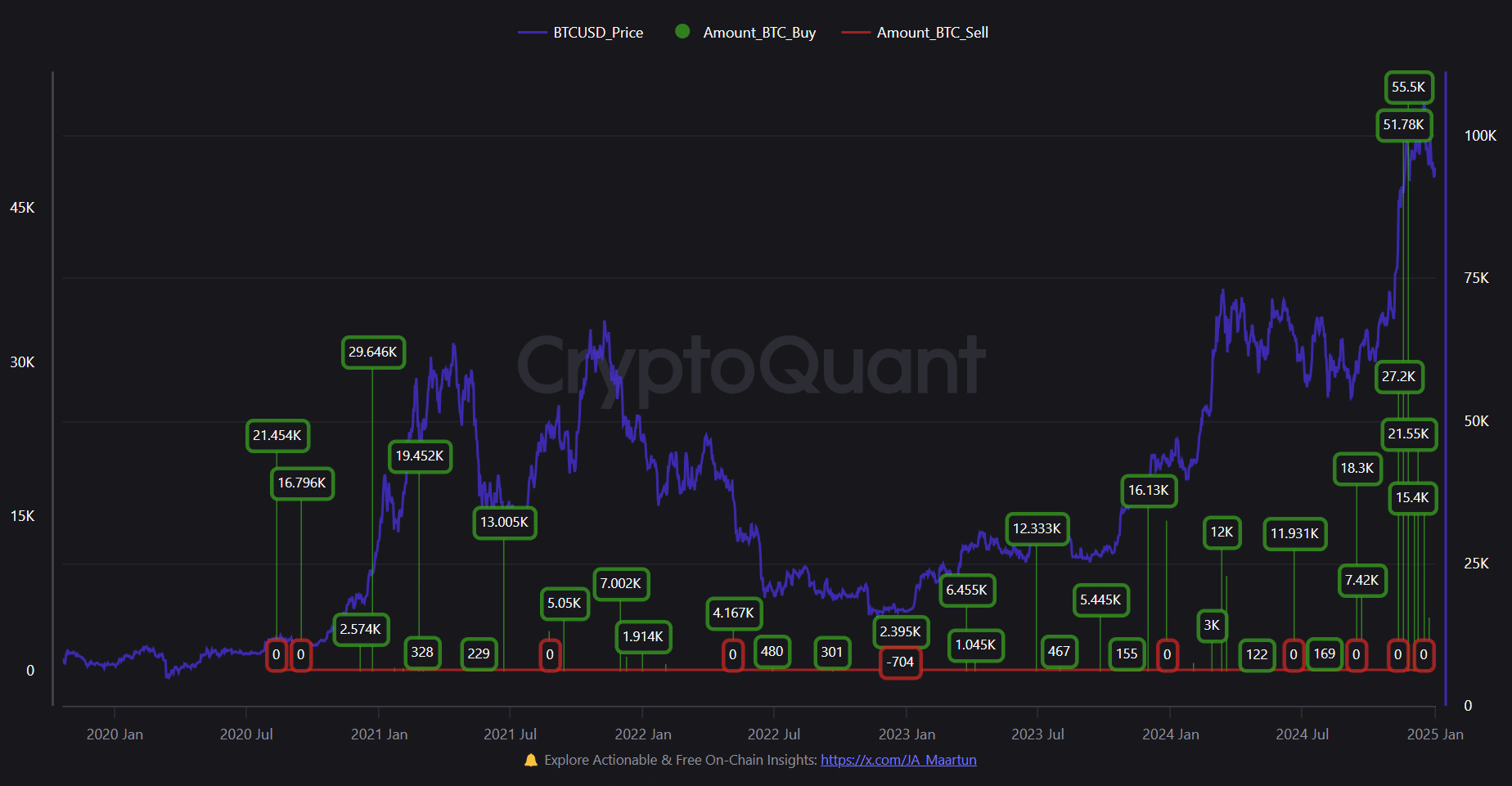

To capitalize on BTC’s growth, the company has acquired a significant portion of the cryptocurrency (446.4K BTC) and now controls 2.2% of the total supply as of the end of 2024.

Interestingly, the most aggressive buying spree occurred in the fourth quarter of 2024. In November alone, the company acquired more than 107,000 BTC in two transactions, worth more than $10 billion.

Source: CryptoQuant

While the pace of acquisitions slowed in December, the company is poised to launch a massive stock issuance program to accelerate its BTC strategy. It’s recently announced plans to increase the number of shares of MSTR to more than 10 billion to achieve its goals.

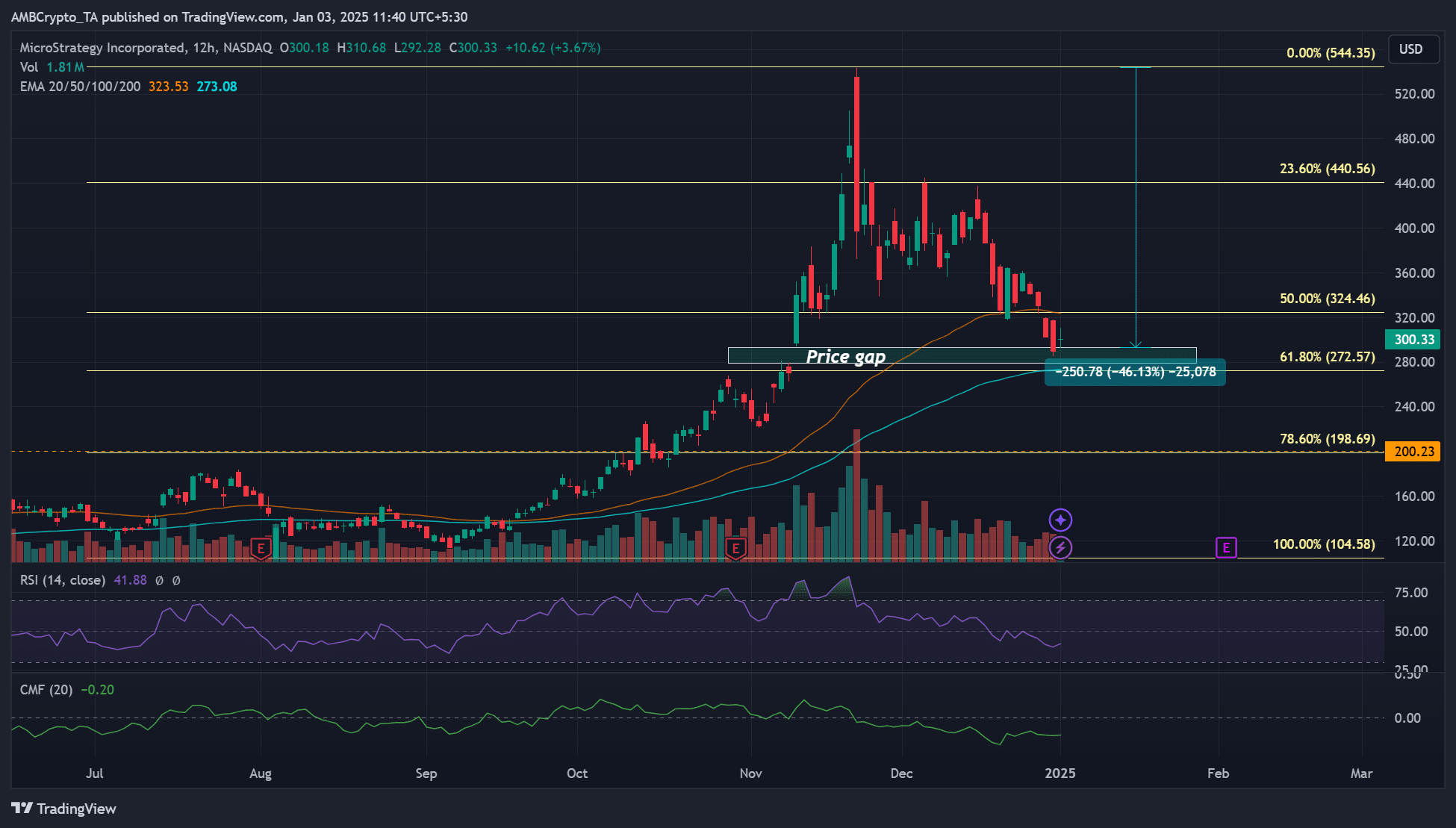

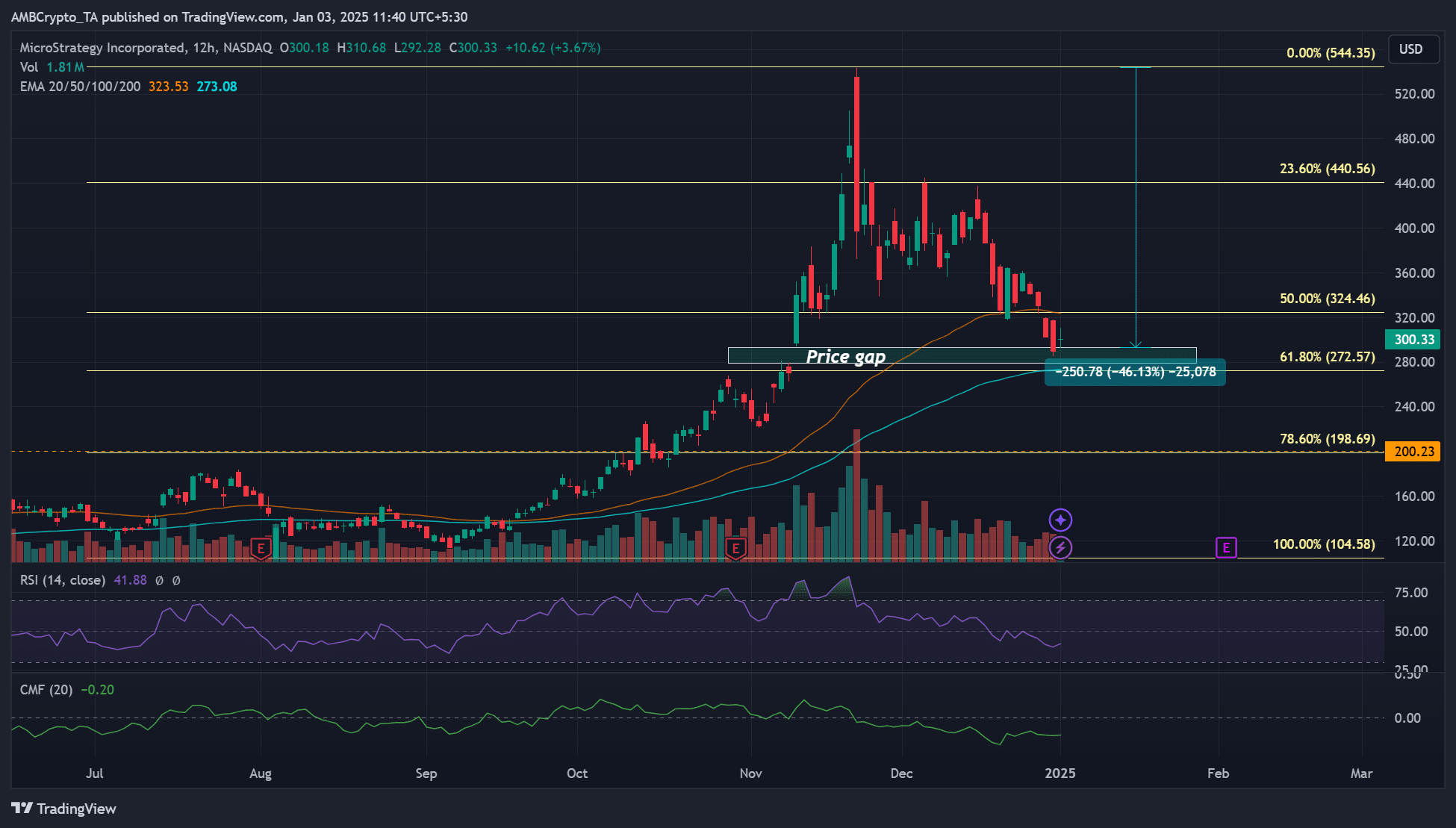

It remains to be seen whether MSTR’s bold bet on BTC will pay off again in 2025. Meanwhile, the stock fell 46% after a massive BTC sell-off during the holiday season.

Source: MSTR, TradingView

During the same period, BTC fell from $108,000 to a low of $92,000 before attempting to recover to $97,000 in early January.

However, the MSTR decline moderated due to the coincidence of a price differential and the gold ratio’s Fibonacci level of 61.8% (near $300).

Some market commentators believe that the recent low and weak sentiment could provide the best discount for buying MSTR.