- The explosive growth of DeFi played a big role in driving ETH adoption.

- Bitcoin had the most decentralized ownership, providing a buffer against price volatility.

Despite the ups and downs, the big universe of cryptocurrencies continues to captivate the imagination of the public and big corporate investors alike. Because of their perceived strengths and potential for big returns, seasoned traders actively analyze key on-chain metrics to better plan their investments into these assets.

Is your portfolio green? Check out the ETH Profit Calculator

Ethereum is the most held crypto asset, but…

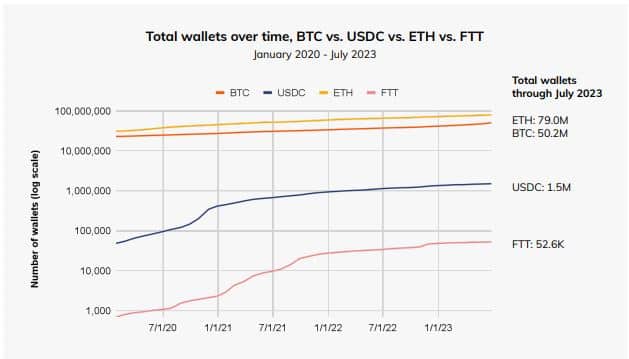

Ethereum [ETH], the second-largest crypto by market cap, was found to be the most widely distributed with nearly 79 million wallets holding the token as of July 2023, according to a report published by blockchain analytics firm Chainalysis. The king of crypto coins, Bitcoin [BTC], was held by a little more than 50 million unique holders.

Source: Chainalysis

A more widespread distribution of any asset indicates the holders’ sentiment around its utility or an expectation of future price increases. The explosive growth of decentralized finance (DeFi) in the last three years, most of which are built atop the Ethereum blockchain, played a big role in driving ETH adoption.

The considerably smaller wallet counts of stablecoin USD Coin [USDC] and the exchange token FTT reflected the crises which has engulfed the two tokens over the last year or so. While FTT’s demand stagnated following parent company FTX’s collapse, USDC was struggling from its exposure to the U.S. banking crisis.

Having said that, a wider distribution alone is not enough to shield an asset from price volatility risks. If a disproportionately larger chunk of the supply is held by few powerful holders, it could lead to market manipulation and a higher chance of price swings. Hence, the degree of decentralization in ownership becomes a crucial factor.

As per the report, Bitcoin emerged as the most decentralized asset, with nearly 0.009% of all wallets storing 50% of the supply. In contrast, Ethereum was a bit top-heavy with just about 131 entities, or 0.0002% of all wallets, owning half of all tokens.

Source: Chainalysis

Perhaps the biggest shock was that of FTT, with just one wallet accounting for 50% of the supply. Chainalysis noted,

“Independent of concerns around FTX as a company and the issues that led to its collapse, that level of supply concentration perhaps should have raised red flags to investors assessing the FTT token.”

Ethereum outshines other assets in trading activity

Now, holding a token is one aspect of adoption. But the real test lies in how actively it’s getting used to facilitate transactions. The monthly active wallet count comes in handy in making these assessments.

Like its large wallet count, Ethereum was also the most liquid crypto, with about 4.8 million wallets remaining active as of July 2o23. Bitcoin came in at a distant second with 1.9 million wallets actively trading the world’s largest crypto asset.

Source: Chainalysis

It was evident that Bitcoin’s trading activity has softened since the crypto winter of 2022. The unprecedented HODLing mentality exhibited in 2023 has also made a lot of wallets dormant.

In contrast, the DeFi summer of 2020 and the 2021 bull market made ETH a hot commodity. The token was used extensively to pay gas fees on the gazillion platforms built on the network.

Similarly, USDC’s growth trajectory highlighted its utility as a settlement tool on decentralized exchanges (DEXs).

Sentiment around Bitcoin changes

The above chart was also useful in understanding how Bitcoin is still predominantly used as a transactional token. Whereas, Ethereum’s smart contracts revolution has helped to stretch its bounds far and broad.

This was further exemplified if one were to take a look at the market composition of different assets. The lion’s share of ETH supply was locked up with DeFi protocols. Bitcoin on the other hand had none for obvious reasons.

Source: Chainalysis

Furthermore, Bitcoin’s supply on centralized exchanges has never gone beyond 20% of the total supply, while ETH has invariably stayed over 30%.

Read Bitcoin’s [BTC] Price Prediction 2023-24

These insights lent credence to the earlier observations made on the trading activity of Bitcoin. Another notable development worth mentioning was the sentiment around Bitcoin.

Of late, the clamor for king coin as a safe-haven asset, or an inflation hedge, has grown significantly. Naturally, people look to store it for long-term gains rather than quick profits. Hence, it shouldn’t come as a surprise if Bitcoin’s supply on exchanges plunges further in the near future.