- ARK Invest has sold Coinbase, GBTC shares worth $5.8 million.

- The Bitcoin rally was driven by the excitement surrounding BlackRock and GBTC getting closer to the launch of their BTC ETFs.

Cathie Wood’s ARK Invest is in the news again due to recent transactions worth millions of dollars. A Twitter handle monitoring ARK’s daily trades highlighted these trades.

Cathie Wood and Ark Invest’s trading activity as of today 10/23 pic.twitter.com/3SilCpHQFG

— Ark Invest Daily (@ArkkDaily) October 24, 2023

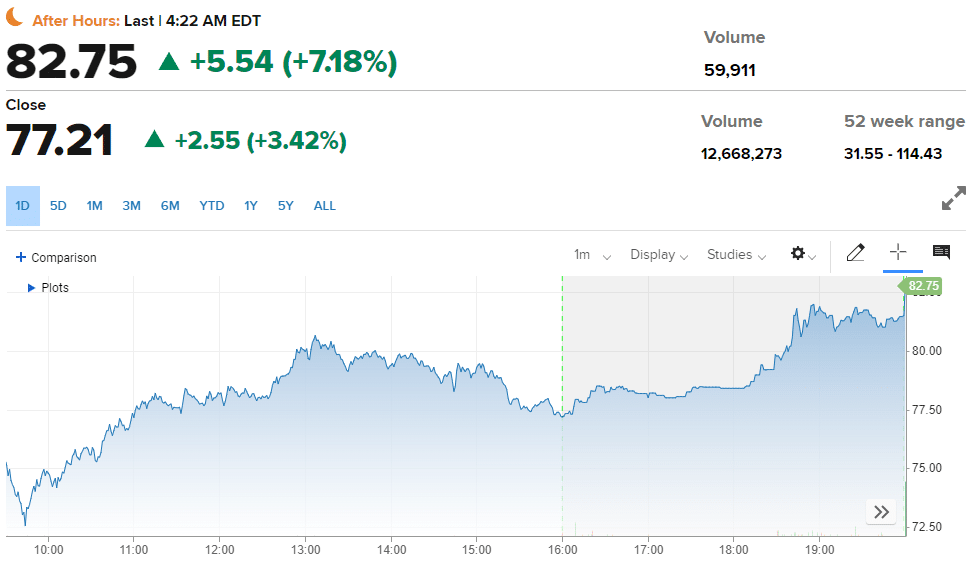

On October 24, ARK Invest sold 42,613 shares of the cryptocurrency exchange Coinbase [COIN] worth $3.3 million through ARK Next Generation Internet ETF and ARK Fintech Innovation ETF. The share used to be priced at $77.21 at closing.

Source: CNBC

Last month, Coinbase CEO Brian Armstrong confirmed that his platform was implementing Bitcoin’s [BTC] Lightning Network payment protocol. Cathie Wood welcomed the move.

Bitcoin is the world’s digital monetary system, and Lightning is Bitcoin’s payment layer. Coinbase’s integration with Lightning will give its 100 million users a stepping stone to faster and cheaper bitcoin transactions. Hats off to Coinbase! https://t.co/zJ5HqHvyrz

— Cathie Wood (@CathieDWood) September 13, 2023

ARK also sold 100,739 shares of Grayscale Bitcoin Trust [GBTC] worth $2.5 million through ARK Next Generation Internet ETF. The share used to be priced at $24.70 at closing.

Source: CNBC

Meanwhile, Robinhood Markets, Inc. [HOOD] caught ARK’s attention when the asset manager purchased 259,628 HOOD shares worth $2.38 million. CAP used to be priced at $9.17 at closing.

Source: CNBC

Enthusiasm around Bitcoin ETFs is driving a bull run

ARK Invest executed these trades when the price of Bitcoin reached nearly $35,000 on October 24.

Source: BTC/USD, TradingView

Market enthusiasm surrounding two Bitcoin Exchange Traded Funds (ETFs) led to the recent rally.

The first case involved New York-based global investment giant BlackRock. Eric Balchunas, ETF analyst at Bloomberg, notified the crypto community that the Depository Trust & Clearing Corporation (DTCC) had listed Blackrock’s iShares spot Bitcoin ETF.

The ticker will be IBTC, he added.

The iShares Bitcoin Trust is listed on the DTCC (Depository Trust & Clearing Corporation, which clears NASDAQ transactions). And the ticker will be $IBTC. Again, all part of the process of bringing ETF to market. h/t @martypartymusic pic.twitter.com/8PQP3h2yW0

— Eric Balchunas (@EricBalchunas) October 23, 2023

The second case concerns grayscale investments. Notably, Grayscale’s case against the US Securities and Exchanges Commission (SEC) was concluded on the same day.

The DC Circuit Court of Appeals ultimately ruled, forcing SEC to vacate its rejection of GBTC’s conversion to a spot Bitcoin ETF.

Although the regulator can still reject the application after a new assessment, Grayscale has already announced that it will take the case to court again.

Notably, ARK is one of many applicants waiting for the SEC to approve its spot Bitcoin ETF. Two weeks earlier she submitted an amended application, with additional information.

ARK had first filed for a spot Bitcoin ETF in 2021. Since then, the SEC has denied all her applications.