Crypto winter caused a deep freeze in the NFT market, causing sales and royalties to plummet. But the impact of Blur taking over the market arena by handing out generous incentives and introducing a radically reduced royalty structure has made things even tougher for other companies in the space.

That’s especially when it comes to top NFT studio Yuga Labs, which was once valued at $4 billion. The maker of celebrated collections like Bored Ape Yacht Club and Mutant Ape Yacht Club announced last week that it is laying off staff – and this could well be a result of revenue drying up.

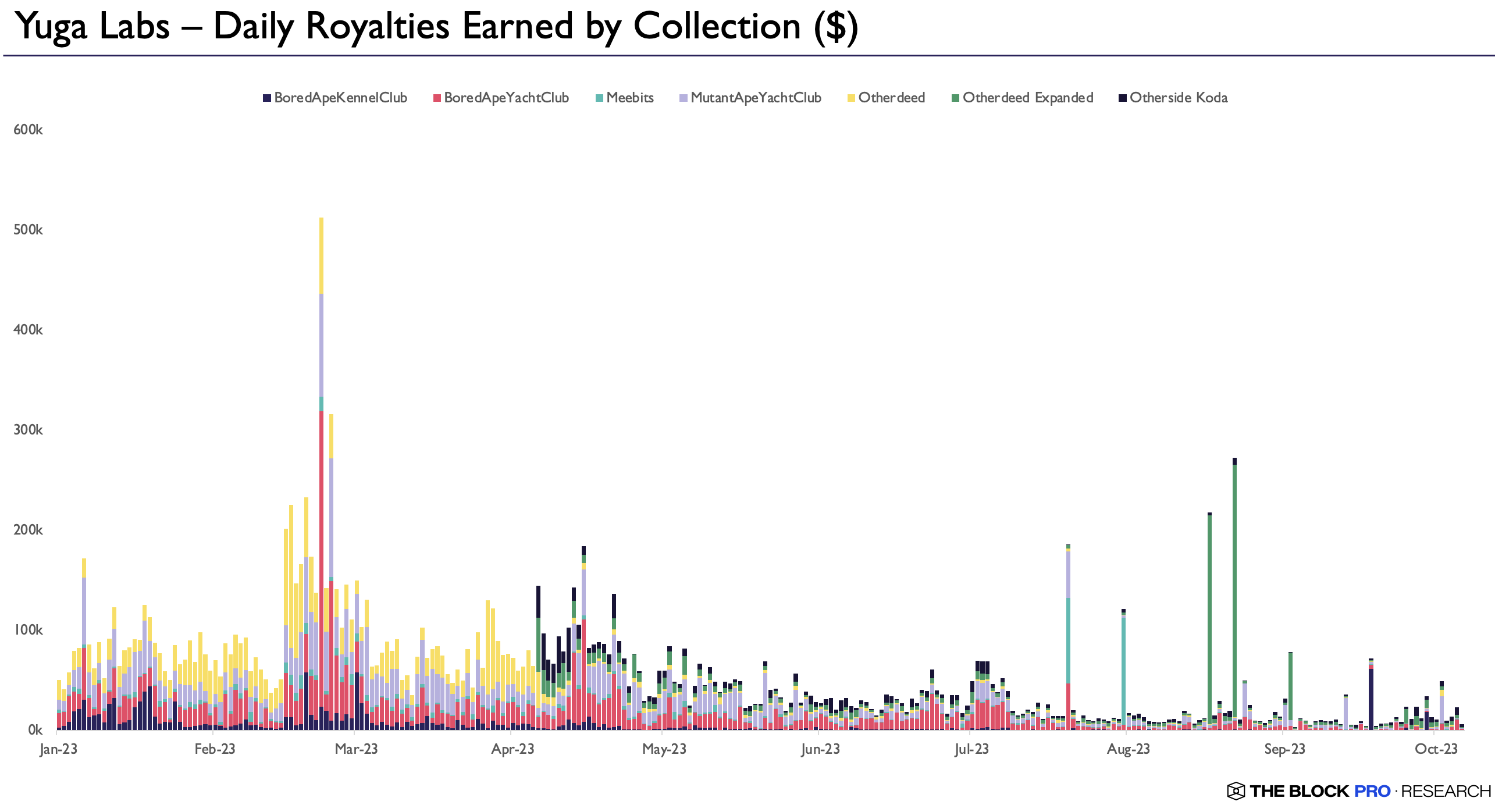

As traders flocked to Blur as NFT prices fell across the board, Yuga Labs’ already declining royalty revenue fell off a cliff. It fell to $2.5 million for the third quarter ending in September, down from $8.7 million in the first quarter of this year.

A look at the amount of royalties paid to Yuga Labs every day since January 2023. Image: The Block Research.

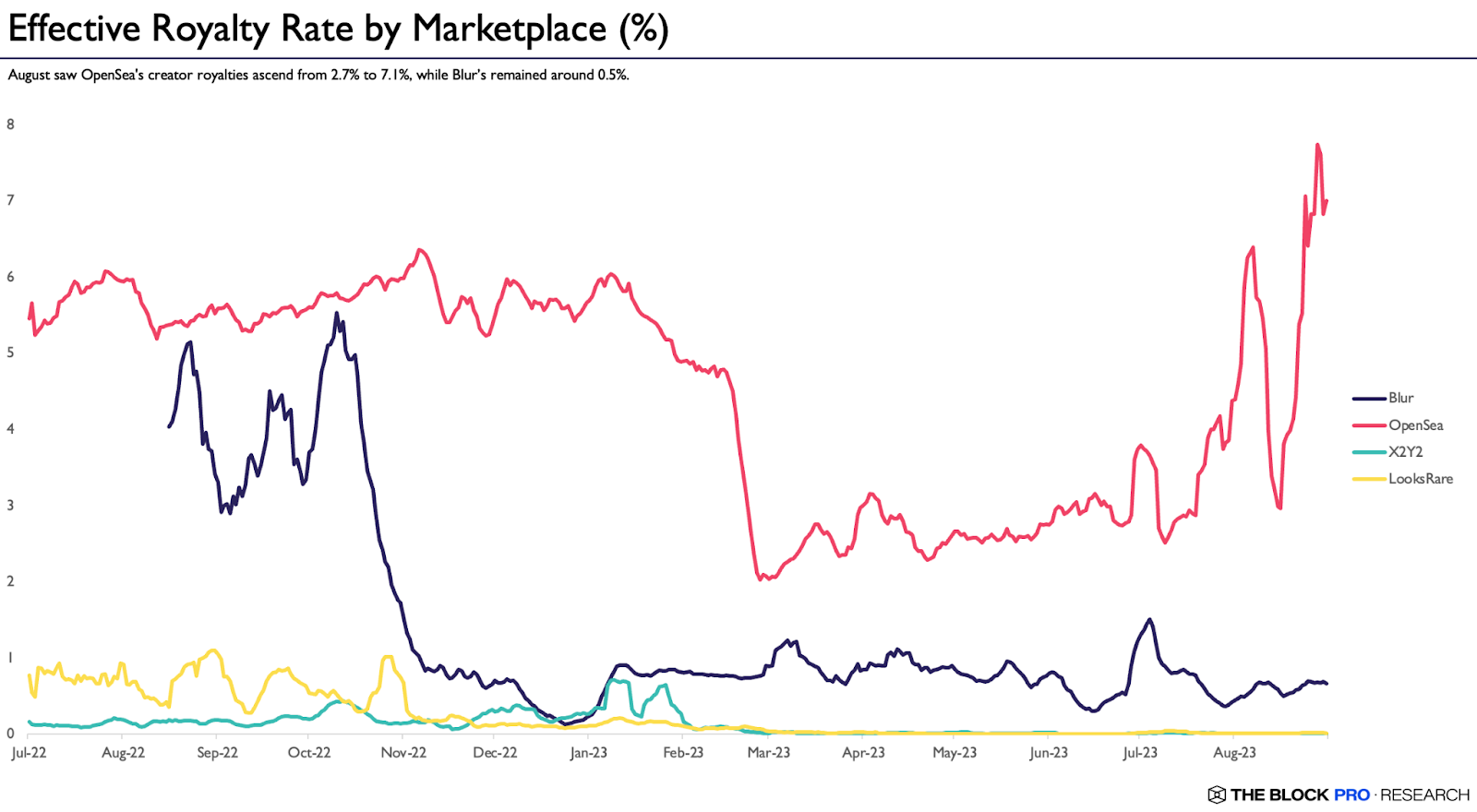

“Blur’s calculated entry into the NFT world with a minimum 0.5% royalty fee, coupled with attractive airdrops and bidding incentives, struck a compelling economic chord with traders,” said Brad Kay, analyst at The Block Research. “By lowering transaction fees, it boosted merchant profits and siphoned significant user activity away from higher-fee platforms like OpenSea, where Yuga Labs previously thrived.”

“This shift led not only to a sharp contraction in Yuga Labs’ royalty revenues, but also to a fundamental reconfiguration of the NFT market,” Kay added.

How did we get here?

For years, OpenSea handled the bulk of the NFT trade, paying a 2.5% royalty fee on each sale to the collection’s creator. Top shelf collections can generate millions of dollars every month.

Blur then offered both traders generous bonuses for using its platform over others – with tokens handed out based on activity – and introduced a somewhat irresistible 0.5% royalty fee. This was possible because royalties for creators are very difficult to enforce in the chain. This initially led to resistance to the idea of lowering royalty payments, which ended in a race to the bottom as other marketplaces followed suit.

The effective royalty rate per NFT marketplace. Image: The Block Study.

With the generous bonus tokens it offered to traders and an affordable 0.5% royalty fee, Blur quickly overtook OpenSea as the leading marketplace for NFTs on Ethereum late last year. OpenSea tried to break Blur’s new market dominance by lowering the minimum rate to 0.5%, but this move failed to bring about a turnaround.

Yuga Labs has said it will not allow trading of some of its newer NFTs on OpenSea in the future, after the marketplace made paying maker fees optional. It has also blocked some trading on Blur.

Yuga Labs and Blur did not immediately respond to requests for comment.