- Blur’s TVL peaks at an ATH of $162 million.

- As Blur’s TVL skyrockets, its active addresses and new user count declined.

In a recent update, Blur [BLUR] shared a remarkable achievement. Surprisingly, this new milestone didn’t come from the NFT realm the platform was known for, but came from a completely unexpected source.

Blur records highest ever TVL

In a recent Blur update, the platform exhibited his latest achievement by reaching a major milestone in Total Value Locked (TVL). The post revealed that it had reached an all-time high in TVL, marking a remarkable journey of progress.

Analysis of the TVL statistics of Defillamait became clear that after the launch of his token on February 14, his TVL rose to around $124 million.

Subsequently, there were fluctuations in the TVL, but on May 11 a positive trend set in, propelling it to new heights. At the time of writing, the TVL stood at around $162 million, surpassing the previous all-time high of $160 million.

This achievement highlighted his entry into the Decentralized Finance battle.

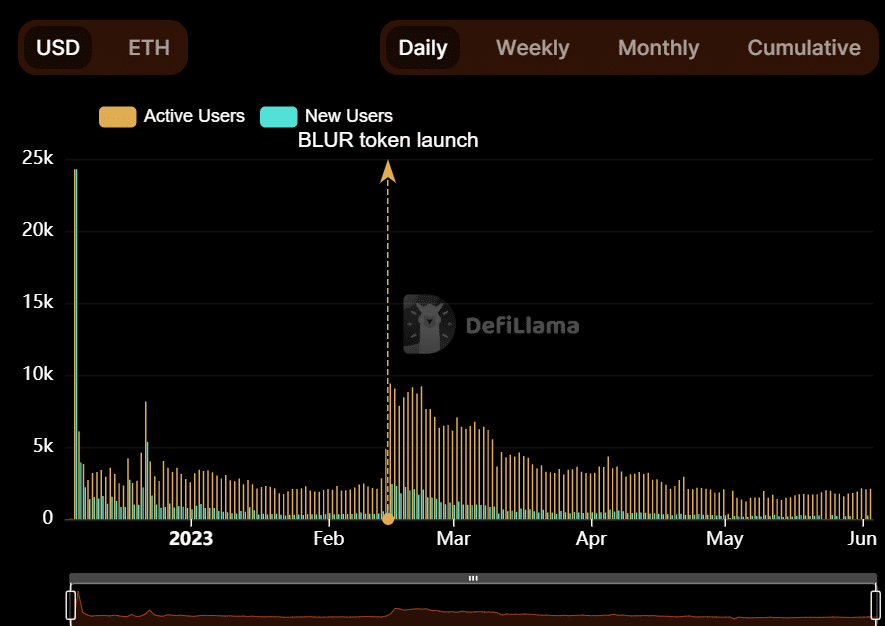

Active addresses and new users will drop after the launch of BLUR

While the Total Value Locked (TVL) reached an all-time high, there was a noticeable decrease in the number of active addresses and new users on the Blur platform. This decrease was clearly reflected in DefiLlama’s data.

Although there was a slight increase in active addresses around May 28, it remained significantly lower than in previous weeks. At the time of writing, there were about 2,100 active addresses in the past 24 hours.

Source: DefiLlama

In addition, the number of new users showed signs of declining, with no new user activity recorded on some days. The statistic had remained relatively stable and as of June 2, only 239 new users had been registered.

Number of sales and volume versus Open Seas

In the competitive landscape of the NFT market, Blur made a significant impact. It challenged OpenSea’s dominance, as evidenced by data from Dune analysis.

The chart illustrated that both platforms were the prominent players in the market, while other platforms had smaller shares. At the time of writing, Blur had a higher trading volume than OpenSea.

It had a volume of 4,755 ETH, while OpenSea had 1,426 ETH. This meant that Blur held about 69.4% of the total volume, while OpenSea accounted for 9.7%.

In addition, both platforms showed strong sales figures, with OpenSea retaining a slight advantage.

As of current analysis, OpenSea recorded 9,038 sales, while Blur reported 6,172 sales. This translated to a 50% share for OpenSea and 34.2% for Blur at the time of writing.

Realistic or not, here is BLUR’s market cap in terms of BTC

The BLUR price development

The recent development around the BLUR token had a positive impact on its price, as can be seen in the daily timeframe chart. On June 2, at the end of the trading session, there was a 5.69% increase in value.

At the time of writing, it was trading at around $0.50, making a gain of less than 1%. Despite this recent uptrend, the price of the token was still below the short moving average, which acted as a resistance level around $0.56.

Source: TradingView