- BTC has a silver lining; the sharper decline may have washed away weak hands.

- Meanwhile, PEPE could still steal the spotlight.

This month, Bitcoin [BTC] has attempted to break the $65,000 resistance twice, with both attempts followed by sharp pullbacks.

The latest decline, which sent BTC down to $58K – the lowest in more than two weeks – has raised concerns about a deeper correction.

AMBCrypto was trading at $62,662 at the time of writing and warns that if a similar pattern continues, Bitcoin could face further downside pressure.

However, there is a silver lining. The sharper pullback may have wiped out weak hands, possibly leading to renewed interest from stronger buyers.

This cleansing effect often leads to new accumulation, paving the way for a recovery.

While Bitcoin has been struggling, memecoins are loving it PEPE have seen a resurgence. PEPE has risen by more than 5% in a week.

Typically, memecoins thrive during periods of market uncertainty as traders look for high-risk, high-reward opportunities.

But PEPE’s performance could still be tied to Bitcoin’s price action.

BTC shows short-term potential

Currently, it appears that BTC is heading for a short-term correction desires regaining control of the market.

This scenario creates an ideal short squeeze situation, where short sellers are forced to buy back BTC, driving the value of each token higher.

However, this does not guarantee a recovery strong enough to position BTC for a bull run to $70,000.

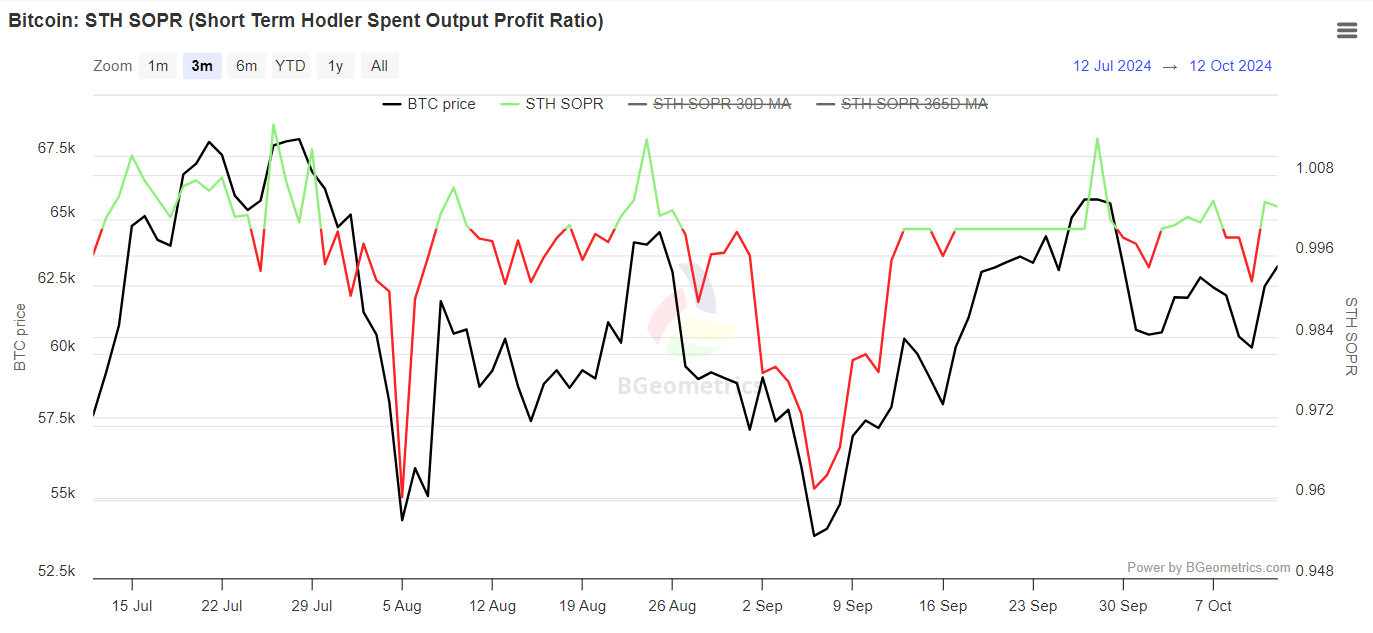

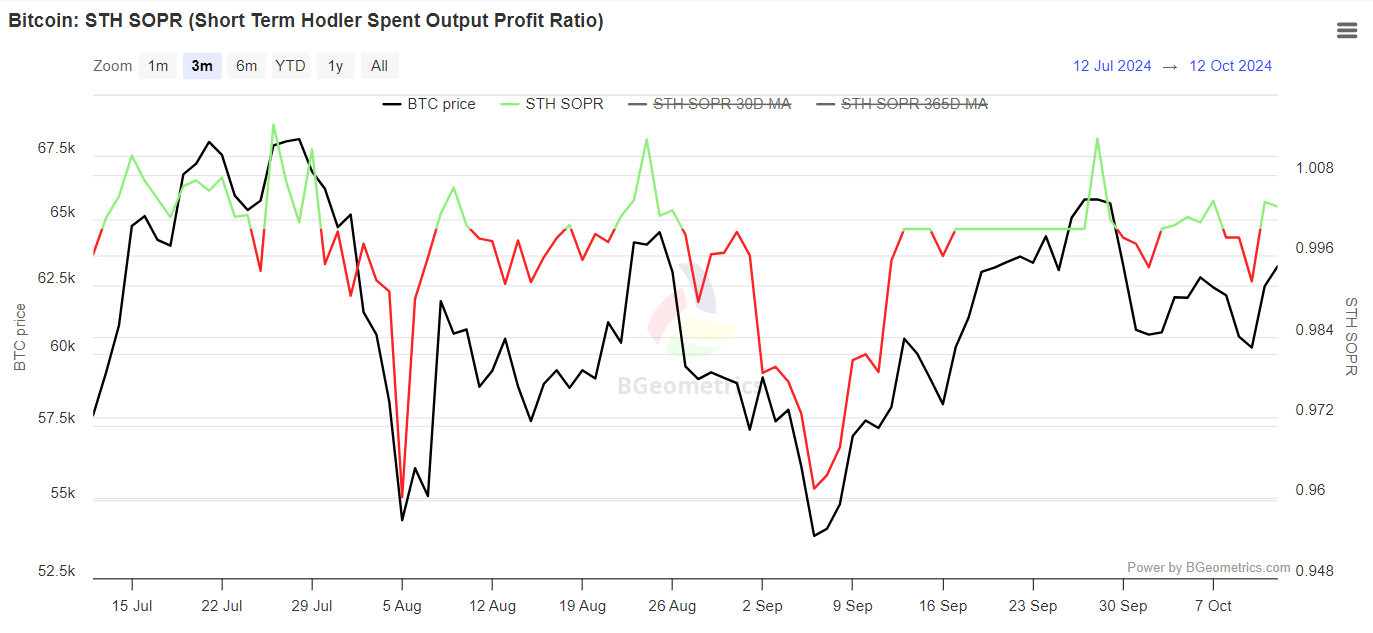

Over the past week, long-term holders have moved less than average, while sellers who have held BTC for less than 155 days have started selling their holdings, as indicated by the green wig.

Source: BGeometrics

In the context of a bull market, increased selling often signals a potential market top. As more investors take profits, concerns are growing about a deeper pullback that could push BTC back below $60,000.

Conversely, if $62,000 proves to be a market bottom – with longs dominating, LTHs remain stable, and others If we look at this as a dip to buy, it could signal the start of an accumulation phase.

It is crucial to keep a close eye on these actions; any small deviation in these trends could limit the chances of a recovery, which currently seems likely.

PEPE may remain in the green

Historically memecoins have seen dramatic rallies during Bitcoin corrections as traders look for high-volatility opportunities in a shaky market.

However, they are also highly sensitive to Bitcoin’s broader market direction.

If BTC can hold its current levels and start to rise, PEPE could experience a short-term correction as traders shift their focus back to BTC and other high-cap assets.

On the other hand, if Bitcoin continues to falter, PEPE could benefit from a new memecoin cycle, potentially pushing it to new all-time highs.

While many newly launched memecoins have recorded double-digit increases, PEPE could also remain in the green.

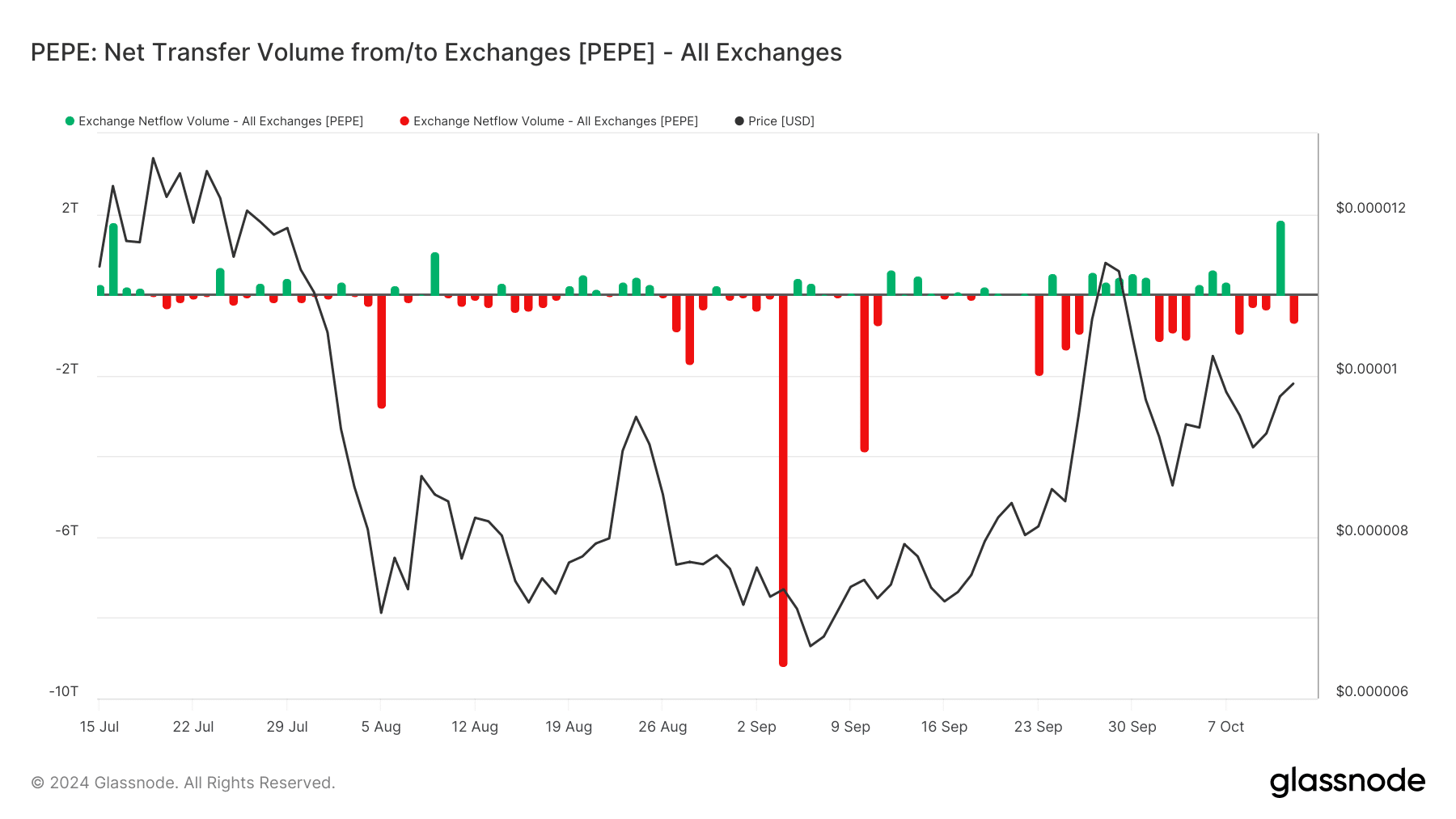

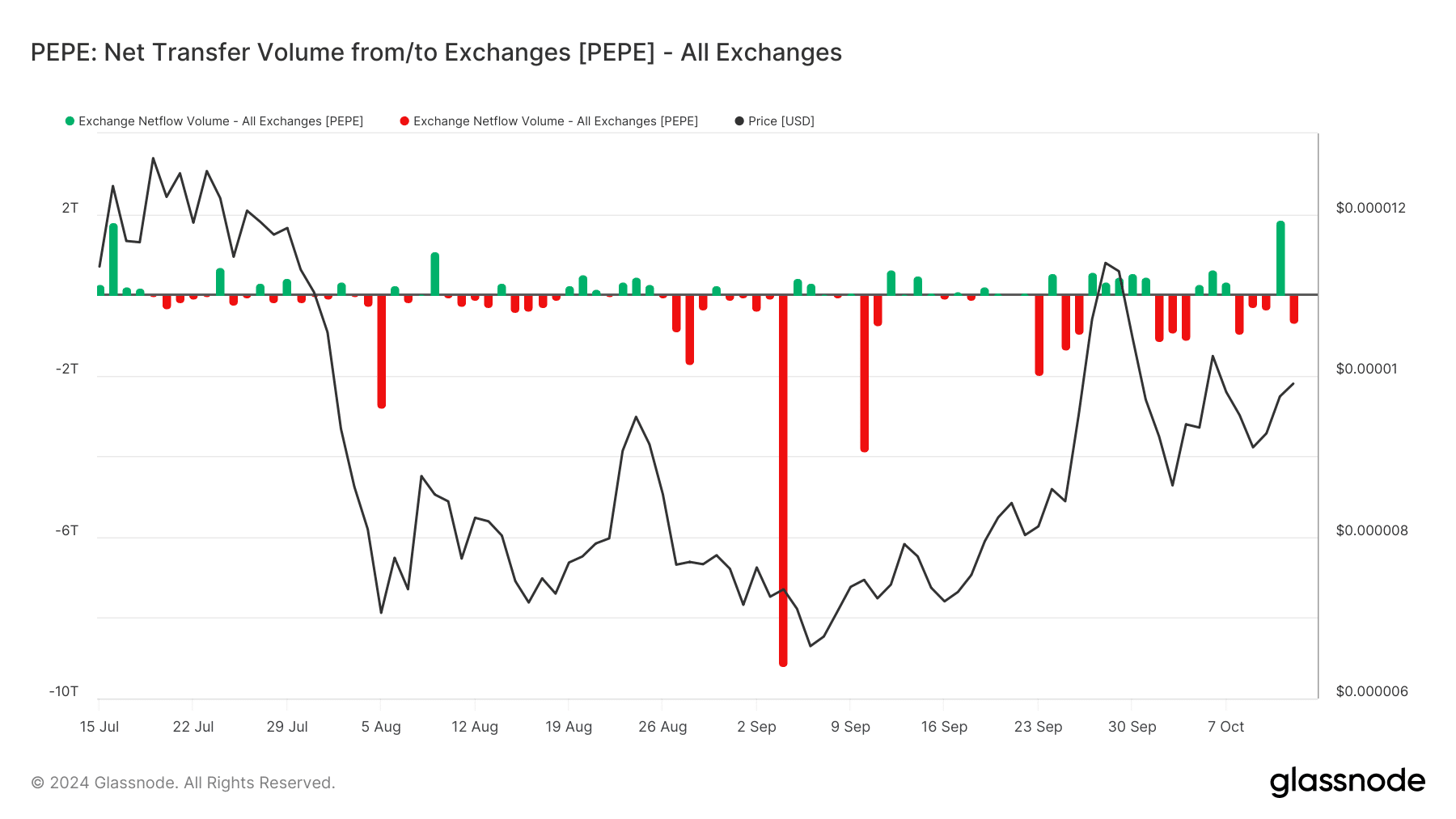

Source: Glassnode

Over the past three days, PEPE rose above $0.000010 but struggled to hold that level.

A massive influx of 1.8 trillion PEPE tokens deposited on exchanges – the highest in three months – has made it difficult for bulls to maintain momentum.

This highlights how volatile memecoins can be. Interestingly, as BTC retreats, PEPE is once again experiencing an increase in net withdrawals, which historically signals a market bottom.

For a successful bull run, consistent net outflows are crucial. If this trend continues as BTC regains dominance, it could dampen renewed optimism around PEPE.

Realistic or not, here is the market cap of PEPE in terms of BTC

Overall, the market seems to favor memecoins at the moment. The coming days will be crucial in determining whether BTC can regain strength, or whether PEPE will continue to steal the spotlight.

If so, PEPE could break the $0.000010 resistance soon.