- Resistance to $ 98,279- $ 100,080 remains the key to the Bitcoin rate towards $ 100,000.

- More wallets have bought BTC around this price range.

Bitcoins [BTC] The Koer process continues to attract the attention of both traders and investors, where critical support and resistance levels shape the next step.

The path Voorwaarts becomes clearer, with considerable accumulation zones and technical indicators that reveal the market sentiment.

Bitcoin shows a strong demand zone

Analysis of the in/out of the money data of In the block points to a critical demand zone. The data showed a demand zone between $ 94,800 and $ 97,700, with more than 1.3 million addresses that Bitcoin collected.

This cluster serves as a robust support level, where the current price of $ 97,860 floats within this reach.

If Bitcoin falls under this zone, the sales pressure could increase, which could possibly lead to a bearish. On the other hand, the resistance suggests from $ 98,279 to $ 100,080 that breaking above this level is essential for a persistent bullish momentum.

Technical indicators indicate stability in the midst of volatility

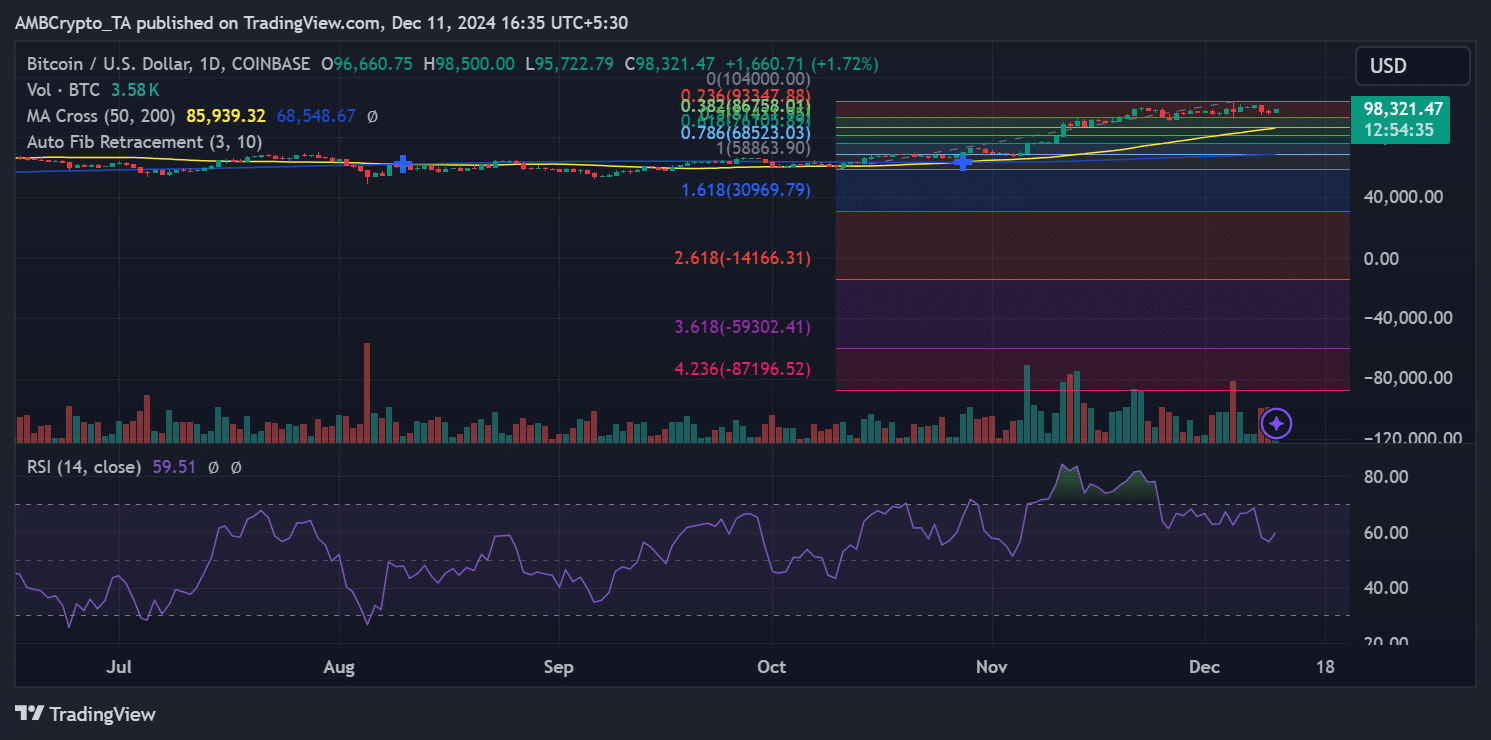

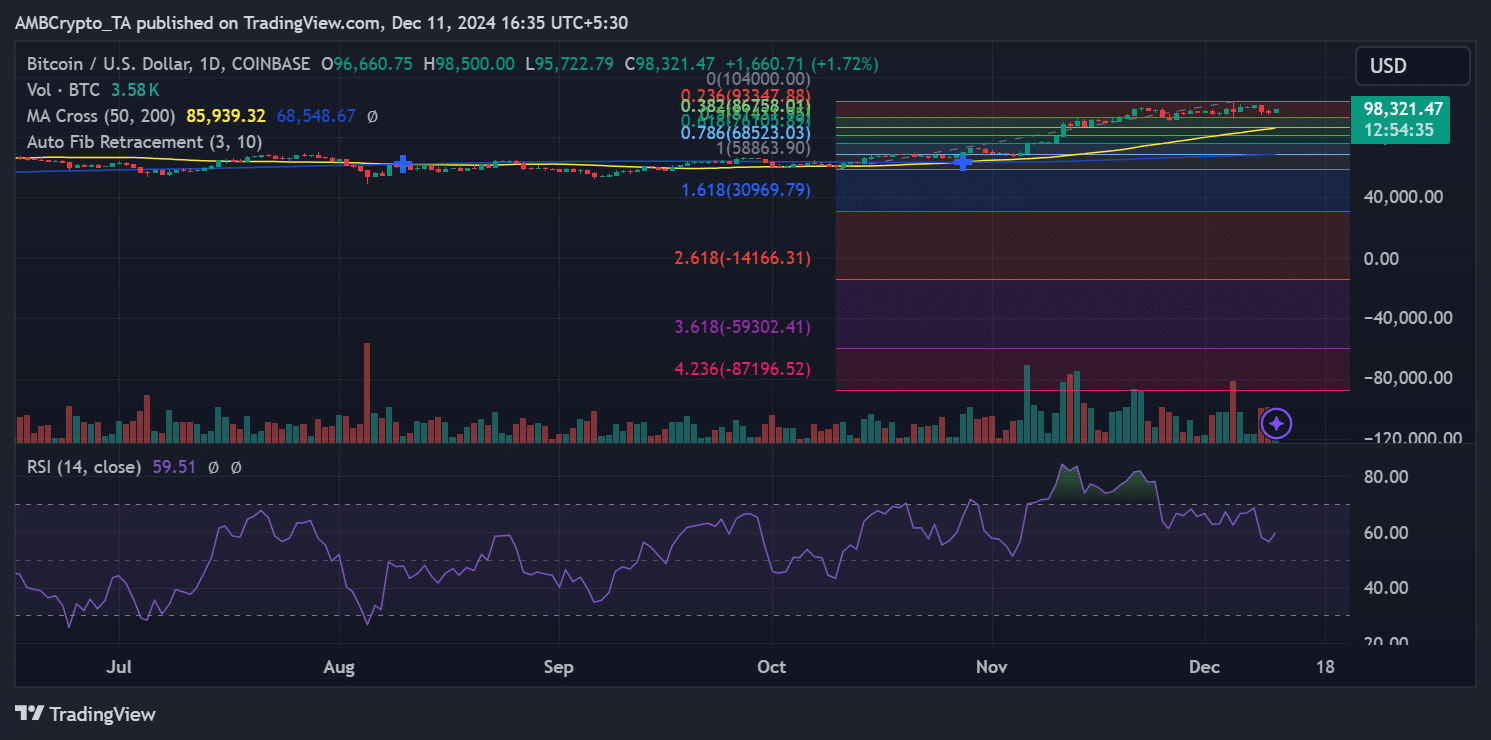

The price of Bitcoin is currently traded at $ 98,313, which reflects a steady increase, supported by the 50-day progressive average of $ 85,939. Important retracement levels from Fibonacci indicators emphasize $ 94,876 as an essential confluence area, in line with the demand zone.

Source: TradingView

Moreover, the RSI (14) is at 59.51, which indicates a neutral momentum, while consistent volume levels suggest active market participation. If Bitcoin preserves his position above $ 97,700, a boost towards $ 100,000 becomes increasingly plausible.

Accumulation patterns above $ 100,000 show the long -term potential of BTC

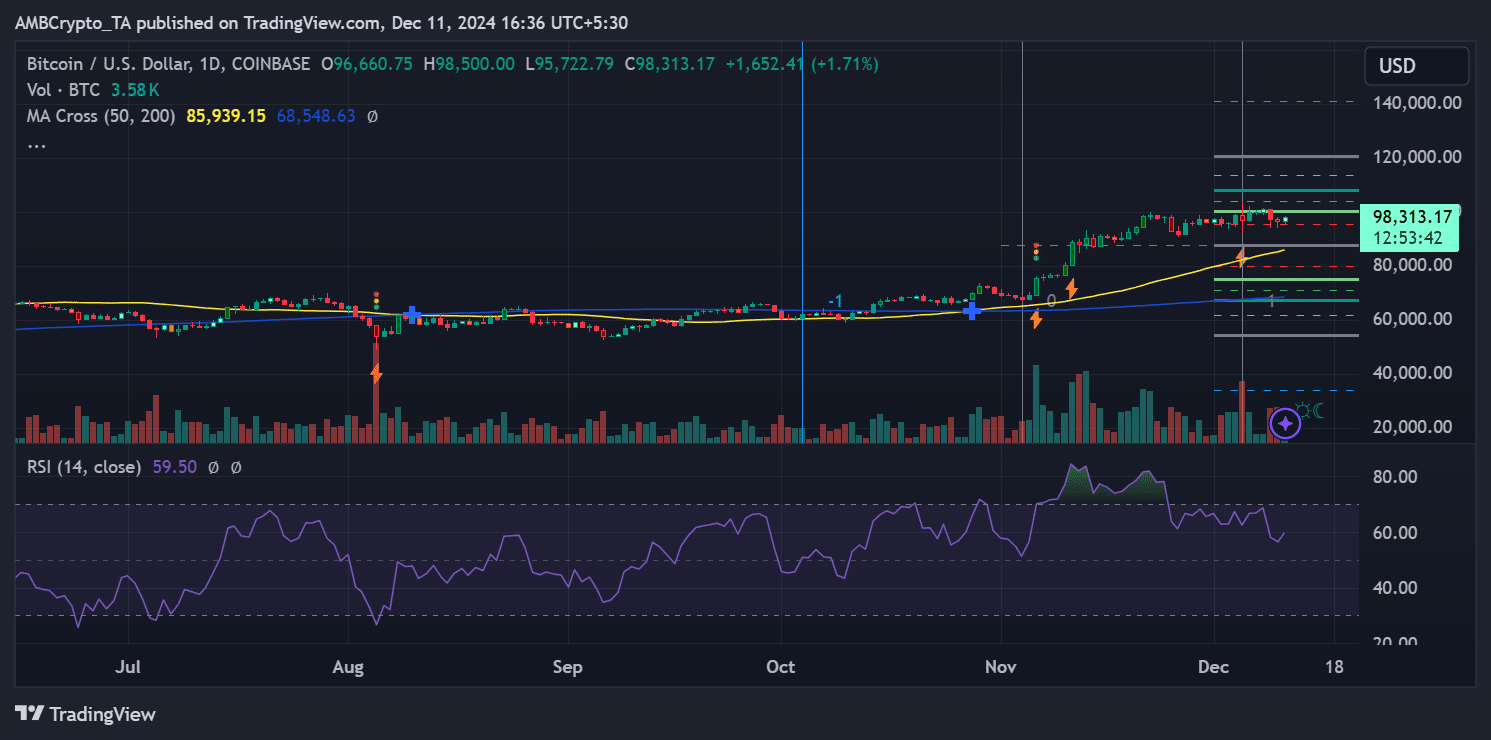

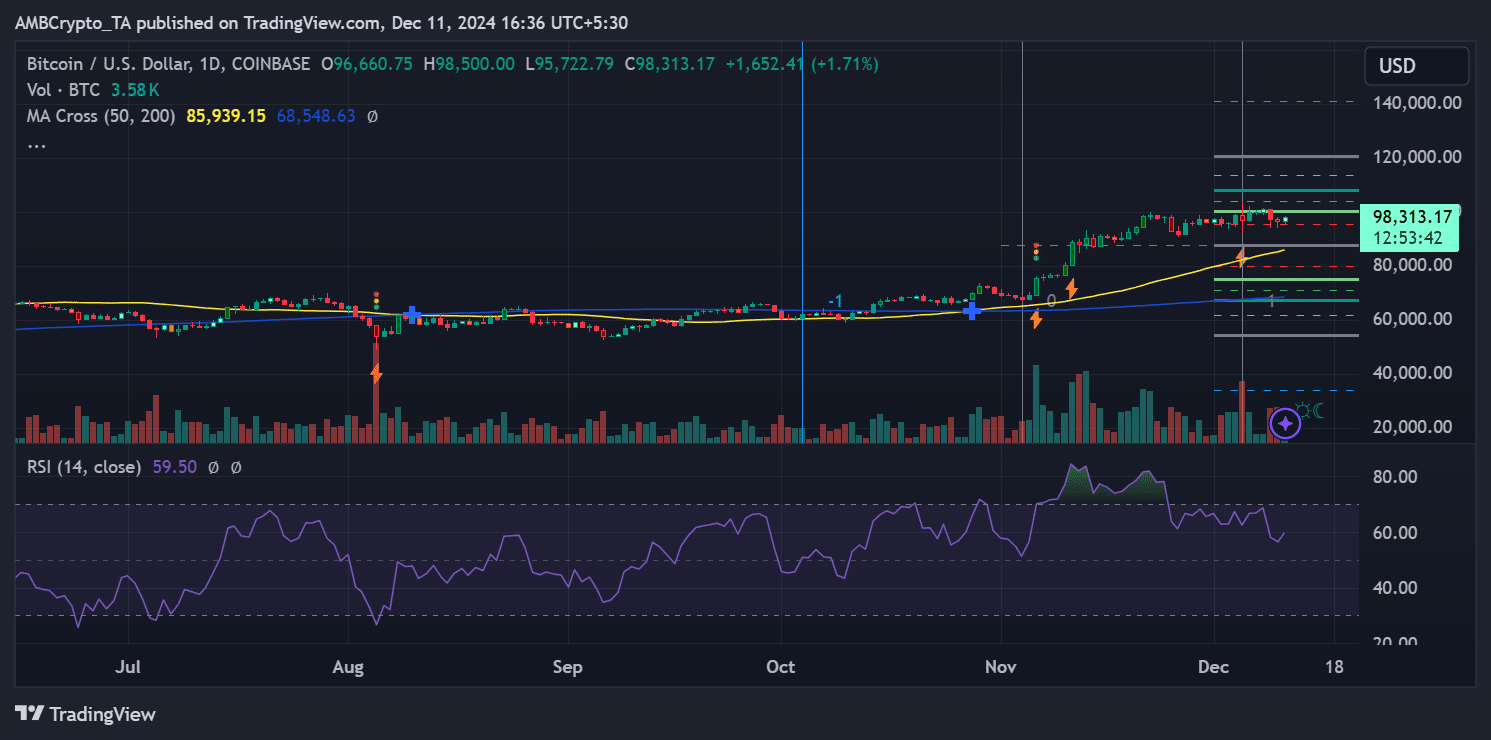

The broader market image shows that 482,000 addresses Bitcoin purchased between the current price and $ 100,000, which underlines the strong confidence in further upward trend.

Source: TradingView

The range of $ 94,800- $ 97,700, however, remains the critical demand area where the institutional and retail interests have come together.

These accumulation patterns indicate bullish prospects in the long term, provided that Bitcoin can hold on to his current momentum and the most important resistance levels that lie for us can overcome.

Read Bitcoin (BTC) Price forecast 2024-25

Bitcoin is at a crucial point, with considerable support of $ 94,800- $ 97,700, which forms a basis for further growth. Although immediate resistance at $ 98,279- $ 100,080 is a challenge, breaking this level could push BTC to new highlights.

Now that the data from the chain and the technical indicators are aligned, the next step of BTC will probably determine the process for the coming weeks.