- The total inflow in 2024 was 24% higher than the annual record of 2021.

- Bitcoin accounted for 97% of total inflows in 2024.

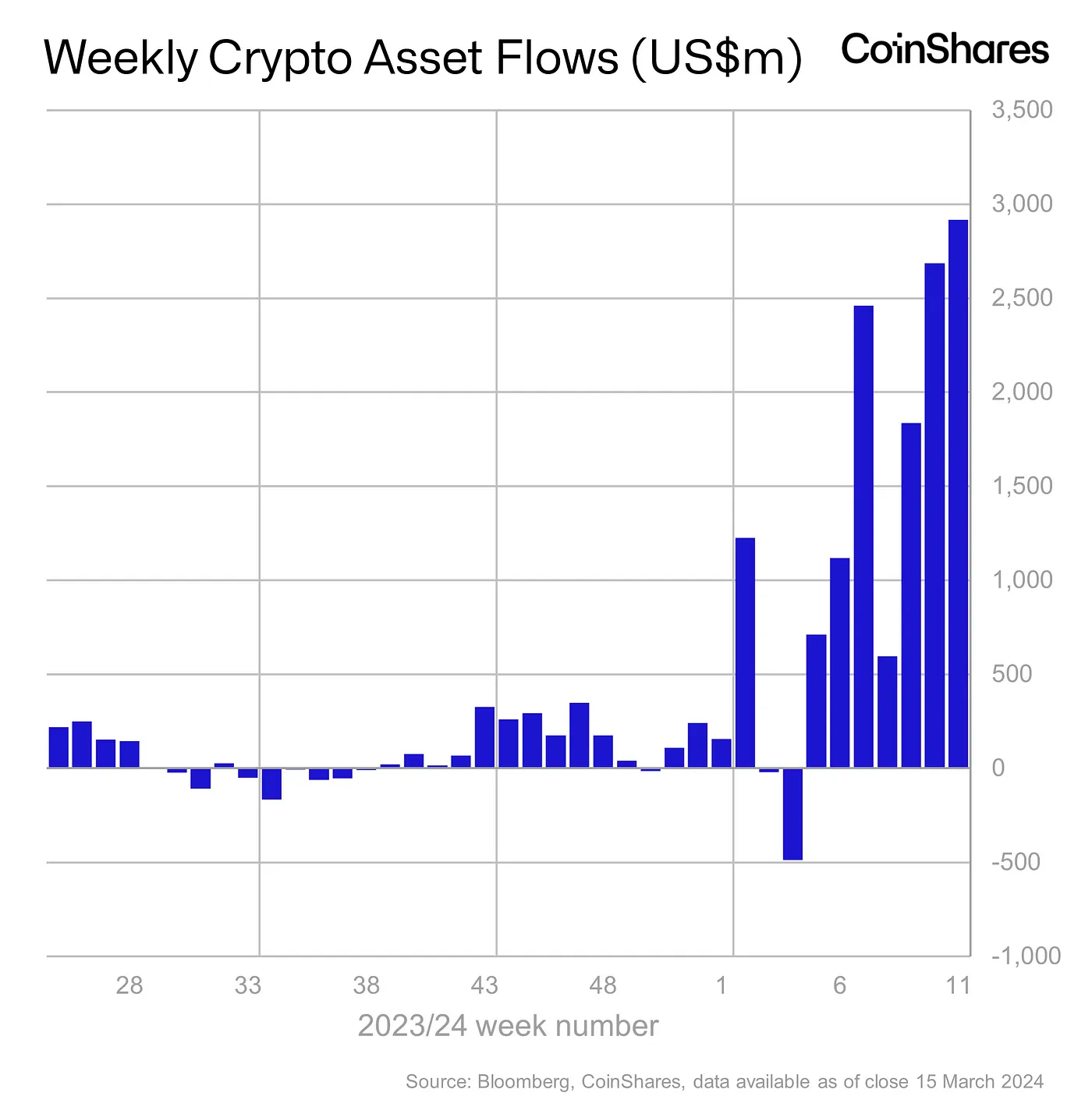

Inflows into digital asset investment products reached a new high last week, surpassing last week’s figures.

According to the latter report by crypto asset management firm CoinShares, institutional investors poured $2.9 billion into the cryptocurrency funds last week, extending the winning streak to a seventh week.

Source: CoinShares

2024: The record-breaking year

This increased year-to-date (YTD) inflows to a whopping $13.2 billion, 24% higher than the total inflows in all of 2021.

During the week, total assets under management (AuM) reached the magic $100 billion mark for the first time in history. However, the price correction at the end of the week saw the price drop slightly to $97 billion.

Please note that AuM is considered a key performance gradient of a fund. Higher assets under management generally attract higher investments.

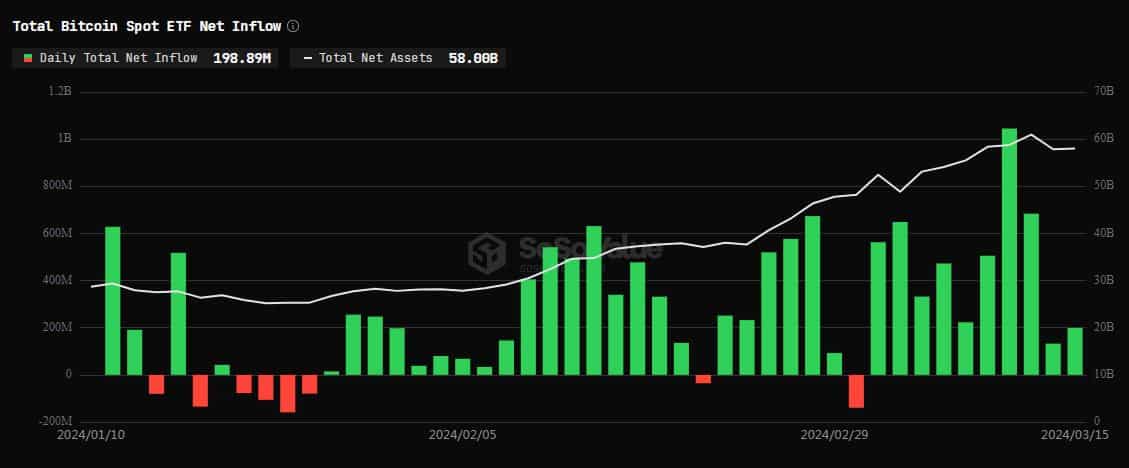

Demand for US spot ETFs continues unabated

As we saw in previous weeks, the spike was fueled by significant investments in the new spot Bitcoin [BTC] ETFs in the United States.

According to AMBCrypto’s analysis of SoSo value These issuers generated $2.57 billion in inflows last week, according to data.

Source: SoSo value

Much to the market’s relief, Grayscale Bitcoin Trust (GBTC) outflows once again lagged behind inflows into other spot ETFs, with BlackRock and Fidelity holding the bulk of the investments.

As of March 15, the combined AUM of all U.S. spot bitcoin ETFs was $58 billion, accounting for 4.35% of Bitcoin’s total supply.

Assessing the performance of different products

The largest institutional crypto product Bitcoin saw inflows worth $2.86 billion last week, bringing its YTD inflows to a whopping $12.86 billion.

Needless to say, Bitcoin has dominated the total inflows into the digital asset market this year, accounting for 97%.

On the other hand, there are popular smart contract-linked cryptocurrencies such as Ethereum [ETH] and Solana [SOL] experienced an outflow last week.

While $14 million was pulled from Ethereum-linked funds, Solana-based crypto products witnessed a capital exit of $2.7 million.