Bitcoin’s open interest can often be an indication of where the BTC price could go depending on whether or not the metric is rising or falling. This time around, Bitcoin open interest has risen dramatically, hitting a 19-month high in the process. Using historical data, it is possible to extrapolate what this means for the crypto price, especially as investors remain very bullish.

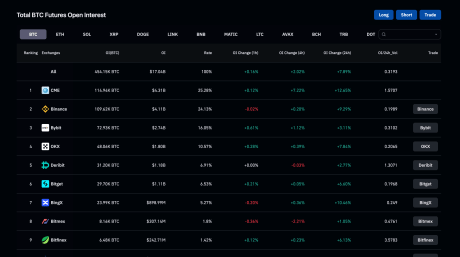

Bitcoin Open Interest Rises to $17.04 Billion

In an interesting turn of events, open interest in Bitcoin has risen rapidly on several exchanges. In the last 24 hours alone, this metric rose by a cumulative 7.89% across all exchanges in the space, bringing total open interest to 454,150 BTC, worth a whopping $17.04 billion.

For now, most of the open interest in Bitcoin is concentrated on the CME, Binance, and ByBit exchanges. But perhaps even more interesting is that these open interest levels represent the highest level in 19 months.

Source: CoinGlass

According to the data presented on the CoinGlass website, the last time Bitcoin open interest moved this way and to this high was in March 2022, before the historic Terra LUNA crash that sent the market into a prolonged bear market.

This means that the last time Bitcoin open interest rose this much was at a time when investors were still in the grip of bull run euphoria. As such, the historical performance of the BTC price at the time in relation to open interest could serve as a guide to what might happen next to the price of the digital asset.

BTC price finds support at $37,400 | Source: BTCUSD on Tradingview.com

Historical data says that the BTC price will rise

Similar to the current trend, Bitcoin open interest had risen from around 38,000 BTC to over 44,000 BTC in a month, and the BTC price quickly followed suit. This trend caused the price to rise from $38,700 to over $47,000 in March 2022 before the month was over.

Judging from this historical performance and assuming Bitcoin sticks to this trend, the rally may be far from over. The BTC price is also at a similar price level of $37,500 and a similar increase could push the price towards $45,000 before the month is out.

However, there is also the possibility that open interest will peak at this level and start to decline. Once this happens, the BTC price could start to fall in the same way it did in April 2022 as open interest falls. A similar crash would send the price back down to $27,000.