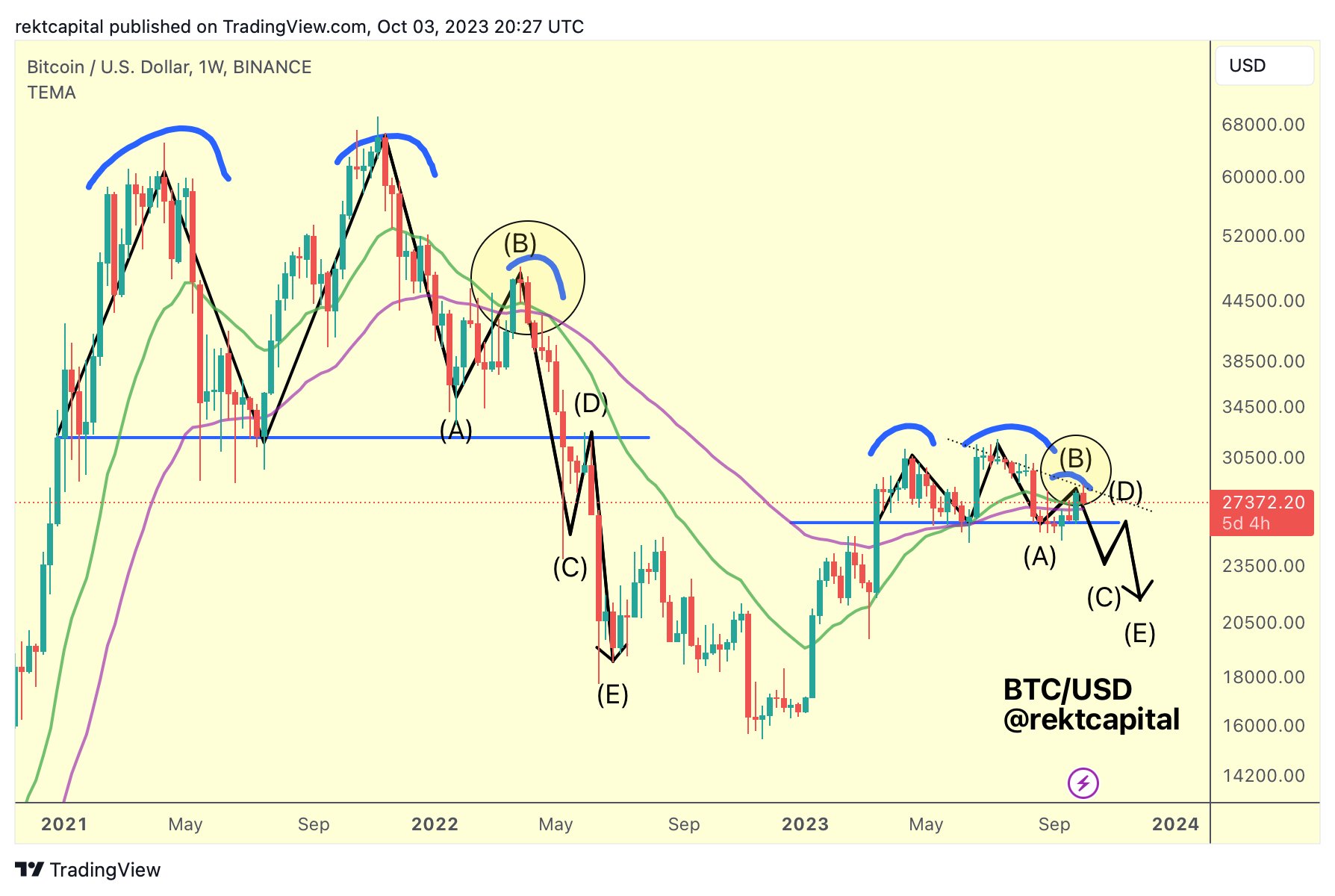

A detailed analysis by renowned crypto analyst Rekt Capital has highlighted a recurring bearish fractal in Bitcoin’s historical price data, raising the prospects of a possible crash below the $20,000 mark. This pattern, which was infamous in 2019 and 2022, appears to be reemerging in the current 2023 market.

For those unfamiliar, the fractal indicator identifies potential turning points on a price chart by to emphasize repetitive price patterns. Simply put, a bearish fractal suggests a potential price decline. Such a pattern occurs when there is a peak price with two consecutive lower high bars/candles on the flanks. An up arrow typically marks a bearish fractal, indicating the potential for price decline.

This is why the Bitcoin price could fall below $20,000

The essence of this bearish pattern starts with a double top. Contrary to expectations, this double top is not validated with a dip below a significant support level. Instead, the price typically experiences a relief rally, forming a lower high, only to crash below the aforementioned support.

This support then turns into a new resistance level, causing the price to drop further. This series was observed in both 2019 and 2022, and the current market scenario in 2023 reflects the early stages of this pattern. Rekt Capital suggests the market may be in the middle of this bearish fractal, with uncertainty over where the relief rally could end.

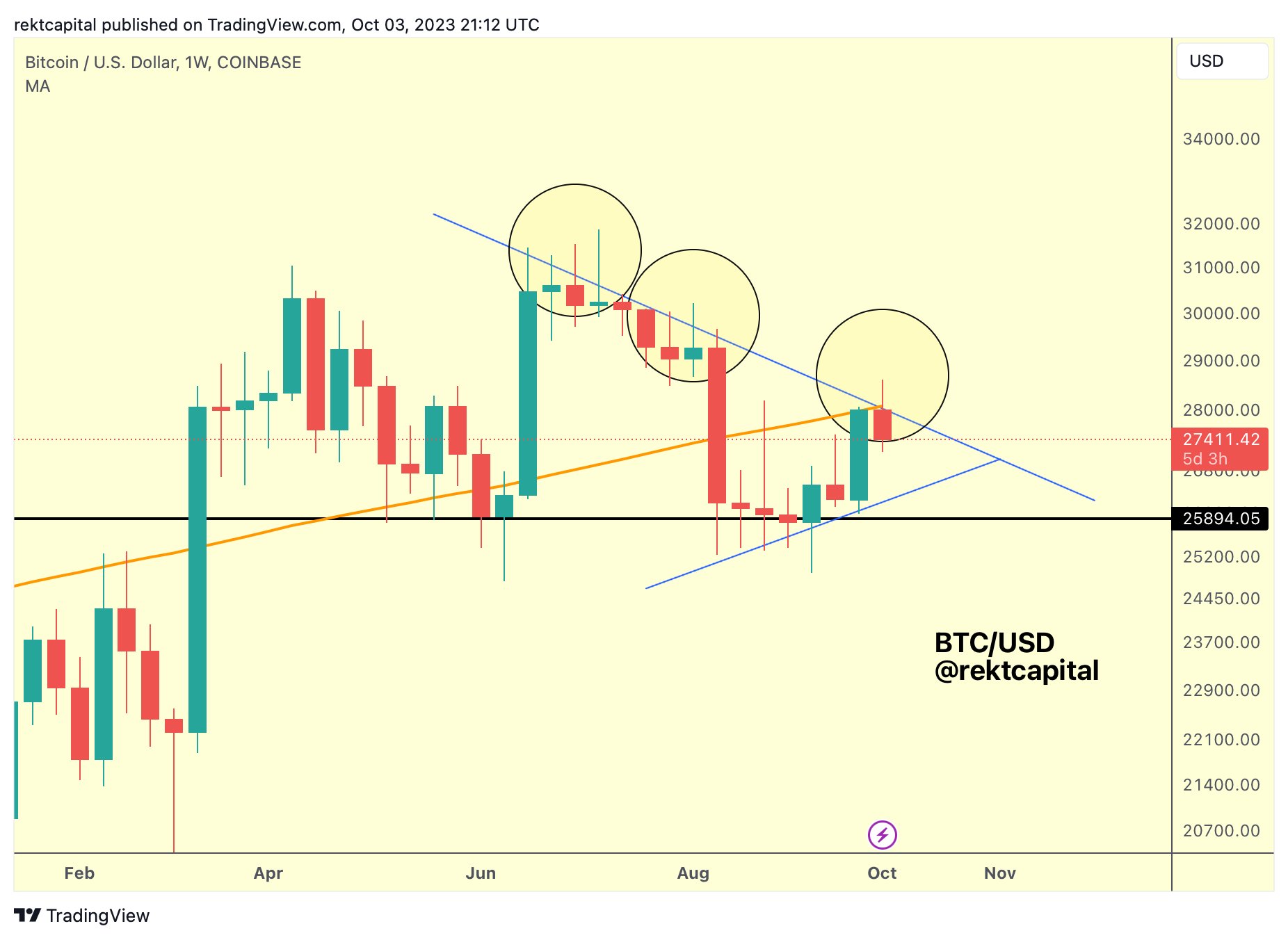

From early April to late August, BTC formed a double top pattern in the weekly chart. However, Bitcoin price remained above the neckline at around $26,000. Then, BTC started its relief rally in mid-August, pushing its price up to $28,600. “We’re probably in A to B [phase of the] bearish fractal,” the analyst added.

Digging deeper into possible scenarios, the analyst believes Bitcoin’s price could rise to around $29,000 before falling further. Some key events to watch for include potential overextensions beyond the bull market support band. If Bitcoin fails to retest this band and hold it as support after the breakout, the bearish fractal will remain valid.

Another important point to keep an eye on is to revisit the lower high resistance. Even if the price crosses this resistance, a subsequent rejection would keep the bearish outlook intact. However, there are criteria that could debunk this bearish perspective: the bull market support band (blue) consistently holding as support, a weekly close above the lower high resistance ($28,000), and breaking the yearly highs of $31,000.

Regarding other technical indicators, Rekt Capital highlighted that Bitcoin recently reached the 200-week MA. However, this moving average (MA) appears to be acting as a current resistance. Moreover, the 200-week MA lines up with the lower high resistance, which marks a crucial moment for Bitcoin’s price in the near future. Despite its macro-bullish stance on Bitcoin, Rekt Capital warns that Bitcoin has yet to overcome the lower resistance at $28,000 on the 1-week chart.

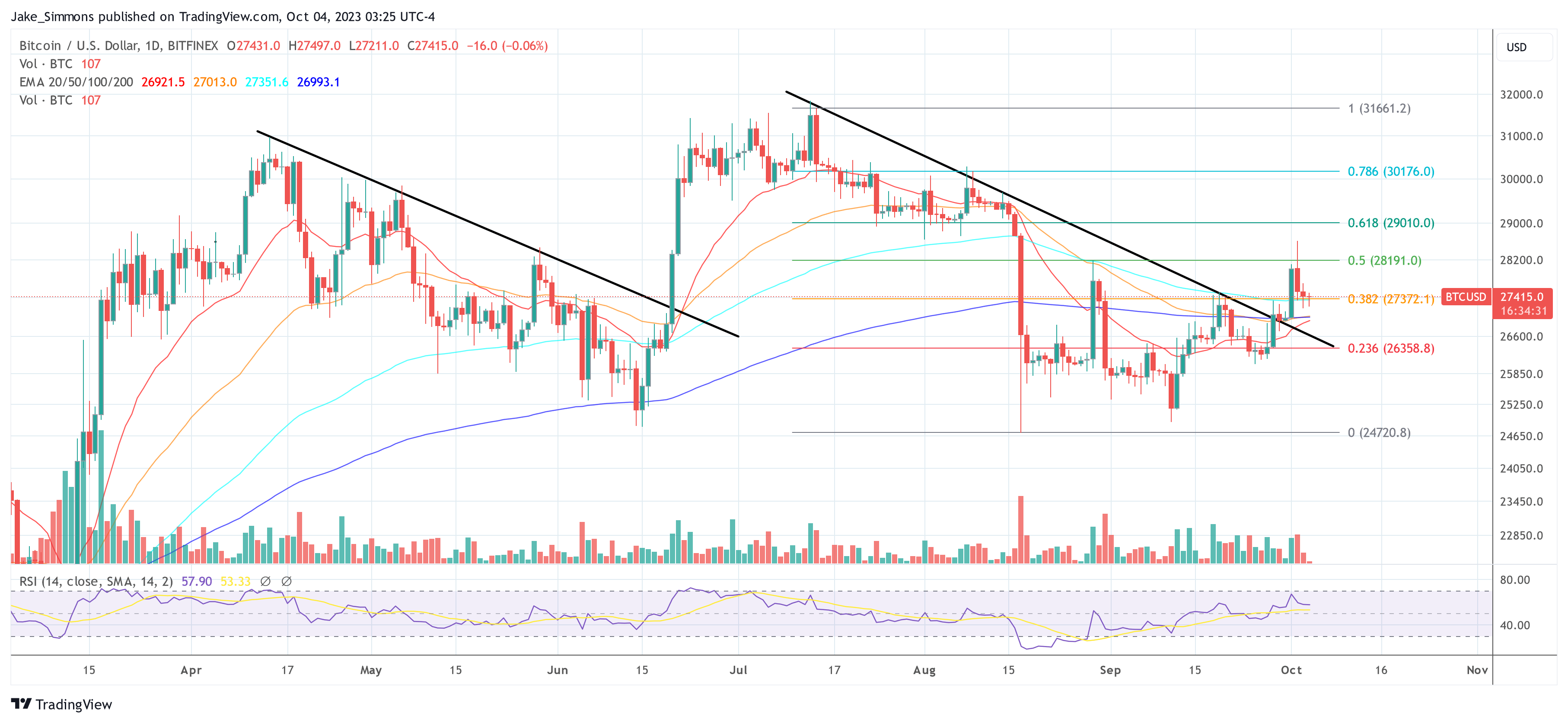

On the daily chart, Bitcoin is hovering slightly above the 38.2% Fibonacci retracement mark. For Bitcoin to avoid a decline below the established trendline (shown in black), it is crucial that Bitcoin maintain a position above $27,372.

Featured image from Shutterstock, chart from TradingView.com