- Cardano Futures Volatility cuts both sides – bullish or a risk if the circumstances deteriorate

- There is now a high FUD when Ada is approaching the pre-election levels

In the current Bearish phase, aggressive long positioning remains a strategy with a high risk, because the volatility continues to flood traders.

Cardanos [ADA] Price promotion reflects this trend. At the time of the press, ADA was 15.20% lower, which violated the critical level of support of $ 0.60. As a result, 60% of the traders who had previously been wiped out.

Now the risks are fully in force, activating step -by -step liquidations and further intensifying the downward pressure. In such a climate, Hodling sentiment will play a crucial role in defining Cardano’s future process. So what should you expect?

Cardano under derivatives

On April 6, a sharp red candlestick that marks an intraday movement of 12.38% on the 1D graph of ADA tailored to 69.36% long exposure to Binance -Futures. That is why BTC followed the support, Ada followed, which caused a long squeeze of $ 12.73 million.

Now the open interest (OI) has fallen by 17.73% to $ 571.36 million, which indicates the aggressive position and the liquidity on the sales side increases. If it is unfortunate because of the bullish requirement, this could further strengthen this settlement.

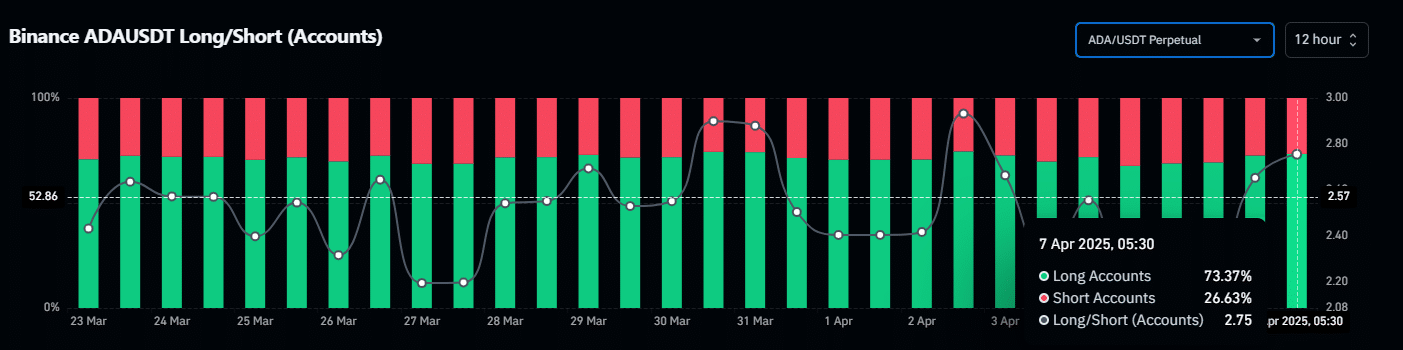

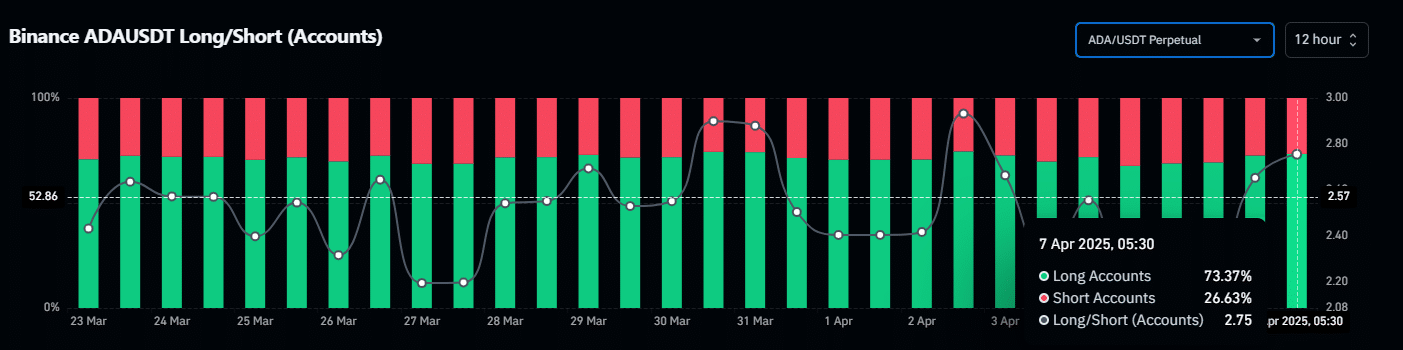

What are the opportunities? At the time of writing, the 12-hour long/short ratio of Binance Futures was crooked, with 73.37% of the positions for a long time. In the meantime, WhiteBit’s ratio leaned 92% long and added $ 16.18 million to directional exposure.

Source: Coinglass

ADA/USDT -PERPPS in particular amounted to an average of 65% long in March, but Ada closed the month after tapping $ 1.14 to 2 March. Since then, persistent sales pressure has kept Cardano in a downtrend.

Consequently, with derivative liquidity mounting and no significant question, millions have been wiped out in long liquidations. If this pattern applies, Ada can be on its way to re-view the pre-election levels.

Investor Psychology – Analysis of the FUD factor

At the time of the press, Cardano made a profit of 53% of his election day open for $ 0.33 on November 6, 2024. And YEt, with market-wide FUD intensification, retail investors will sell more often in panic to break life or safe profits before further compression.

In the meantime, whales position differently. ‘Buying the FUD’ can validate $ 0.50 as a strong local soil. And, given the current setup, the opportunities can prefer accumulation.

In particular, the largest ADA holders (100 million – 1 billion ADA) have made 120 million tokens since 6 April – immediately after the sharp decrease of 12% from ADA to $ 0.55.

Source: Santiment

In general, investor sentiment remains divided. If players with a deep bag continue to absorb the sales pressure, a strong stroking of $ 0.50 ADA could float back to $ 0.58- $ 0.60 in the short term.

Conversely, with millions in livered lungs On the balance sheet there are a breakdown below $ 0.50 by liquidation driven sale.

All eyes remain on whale-positioning or now they absorb sell-side liquidity over the spot and futures markets, the key will be to dictate the next major movement of Cardano.