The Bitcoin market is in turmoil again, and the trigger is an old acquaintance: no, not the US Federal Reserve, but the concerns and rumors about Tether’s stablecoin, USDT. Anyone who has been in the Bitcoin and crypto market for a while knows that rumors of USDT’s lack of support are part of every bear market. And this bear market seems to mean very “well” as the Tether FUD is now resurfacing in this cycle.

As NewsBTC reported earlier today, USDT has lost some of its peg to the US dollar as the Curve 3Pool has lost its balance. The reason for this is that whales sell USDT and trade it for both USDC and DAI. However, according to Tether CTO Paolo Arduino, the company is “ready to exchange any amount 1:1 to US dollars”.

Historically, USDT de-pegging is not an uncommon occurrence. Samson Mow, CEO of Bitcoin-focused company JAN3, writes:

Tether FUD is always the FUD bottom. It’s what they take out when there’s nothing left. Up soon.

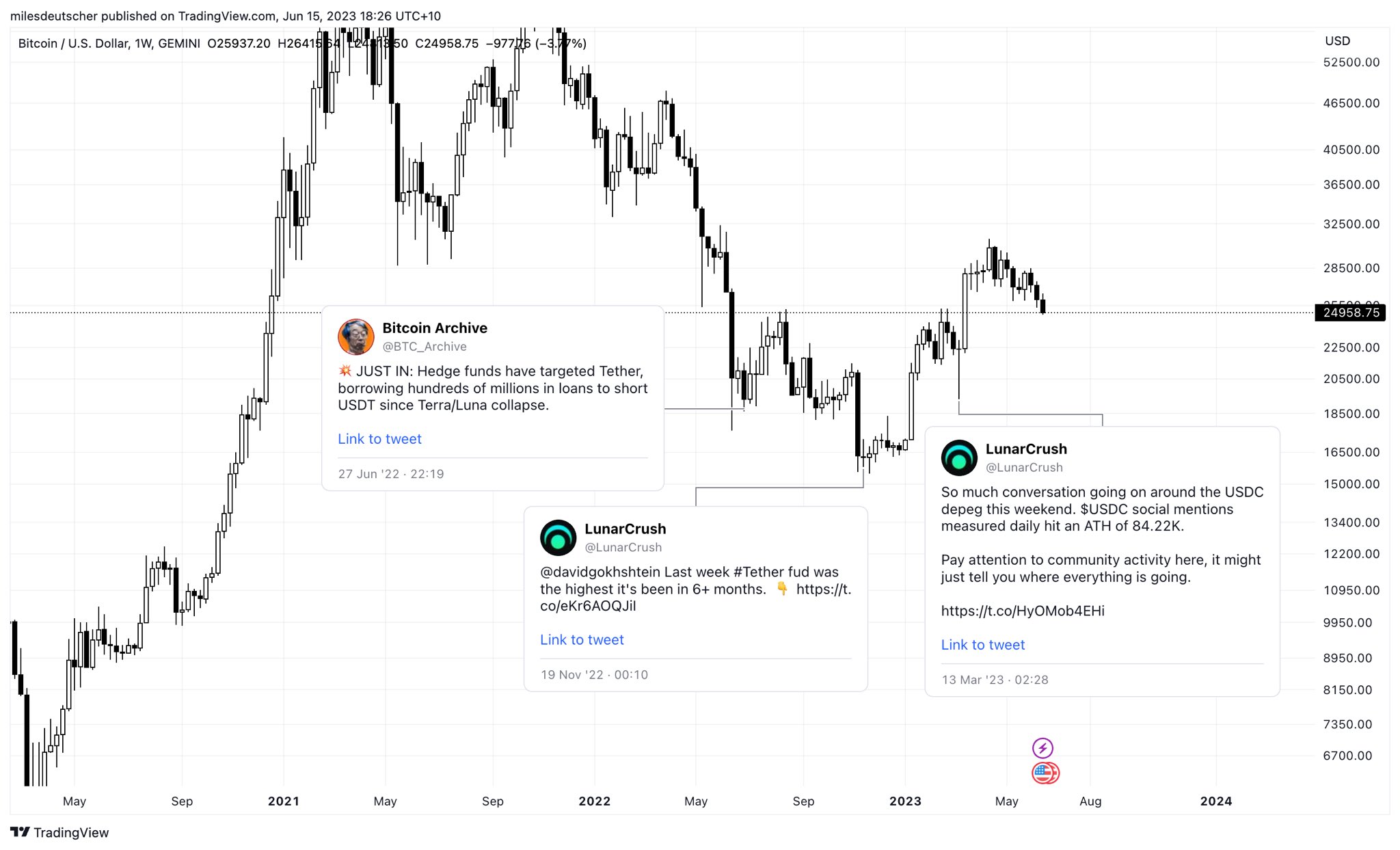

Analyst Miles Deutscher has a similar view. He explained, “Fun fact: Stablecoin FUD often marks local lows,” and shared the following chart.

Bottom signal for the Bitcoin price?

As shown in the chart, the Tether FUD first surfaced at the end of June 2022. At the time, news emerged that hedge fund Fir Tree Capital Management shorted Tether after the Terra ecosystem stablecoin Terra USD collapsed. However, contrary to speculation, Tether was able to handle all USDT redemptions even though USDT’s value had temporarily dropped to $0.9520.

In mid-November 2022, the cryptocurrency exchange FTX went bankrupt after competitor Binance withdrew from a purchase agreement. The Tether FUD reached a 6-month high and the price of USDT fell to $0.9970. Once again, Tether managed all redemptions as the market found a local bottom.

Most recently, USDC depegging in March this year provided the local bottom signal. The event was triggered by the collapse of stablecoin issuer Circle’s counterpart, Silicon Valley Bank (SVB). Crypto whales had also been trying to profit from the situation at the time, while other USDC holders sold out of panic.

Tether emerged from the latter situation as the clear winner and has been capturing large market shares from USDC ever since. Recently, Tether reported huge profits, some of which are invested in Bitcoin, as NewsBTC reported.

This is another reason why crypto expert Thor Hartvigsen believes that the chances of Tether not having enough money to settle all USDT redemptions are “pretty low”. addAccording to Tether, the company made $1.48 billion in profit in the first quarter alone, bringing its reserve surplus to $2.44 billion. They’ve continued to run down bank deposits (have less than $0.5 billion here) and have acquired more than $53 billion in U.S. Treasuries by 2022.”

Remarkably, the price of USDT has already returned to its default level at the time of writing. After the USDC/USDT price on Binance temporarily jumped to $1.0042, it was already back at $1.0019.

At the time of writing, Bitcoin price was in conflict with the Tether FUD, holding slightly above $25,000. However, the drop below the 200-day EMA (blue line) is somewhat critical. Most recently, BTC fell under this indicator known as the “bull line” during the USDC decoupling. Therefore, Bitcoin bulls are advised to execute a similar reaction as in March to avoid a further plunge.

Featured image from iStock, chart from TradingView.com