This article is available in Spanish.

Bitcoin is now trading above the $65,000 price level for the first time in two months, leaving the $63,000 resistance level behind. This interesting rise has pushed Bitcoin up nearly 23% from its September 6 low of $53,400, making many holders profitable.

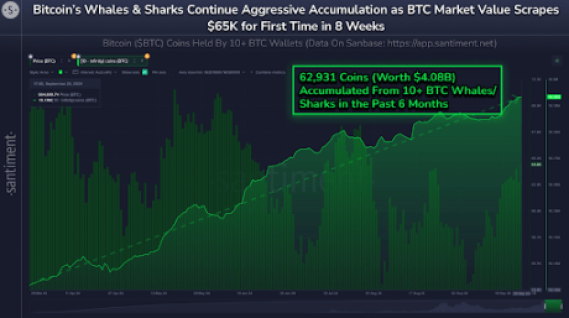

According to Santiment, this price action has been mainly fueled by increased whale and shark activity, with the on-chain analytics platform finding a massive accumulation trend among them.

Sharks and whales continue to accumulate BTC

Recent shifts in market dynamics worldwide have brought Bitcoin back to the forefront of investor portfolios since mid-September. According to data from Santiment, Bitcoin’s upward price movement is largely supported by increased investor accumulation. The on-chain analytics platform revealed that many wallets holding ten or more BTC have been steadily accumulating additional Bitcoin over the past six months. This consistent buying behavior has played a crucial role in stabilizing and supporting the price, especially during market corrections when Bitcoin faced downward pressure.

Related reading

Notably, these addresses have accumulated $4.08 billion in BTC over the past six months, and their combined holdings currently stand at 16.19 million. Santiment’s data also shows that this accumulation trend gained significant momentum in mid-September, just after the Fed cut its base rate, indicating a renewed wave of confidence among these Bitcoin investors.

Current State of Bitcoin

As noted by NewsBTC, September did has always been a crucial month for the price development of Bitcoin in the last quarter of the year. Interestingly enough, what seemed to be a bearish month for Bitcoin in the first two weeks has now been played out as a harbinger of a possible increase in the last quarter of 2024.

Related reading

At the time of writing, Bitcoin is trading at $65,470 and is up 2.6% in the last 24 hours. Institutional investors have resumed their investments in Bitcoin since the beginning of the week. This has been witnessed by the Bitcoin funds consecutive days of inflow since the beginning of the week. Notably, they received $365.7 million in net inflows over the past 24 hours.

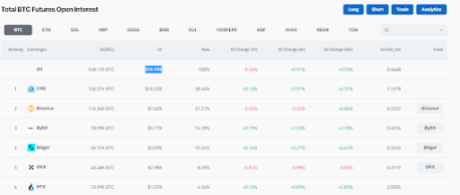

Bitcoin has also seen a notable increase in open interest as investors pile in. According to Coinglass, Bitcoin open interest now stands at $35.90 billion across multiple exchanges, reflecting a 3.53% increase in the past 24 hours. As Bitcoin’s price continues to capture the attention of traders around the world, the rise in open interest could act as a catalyst for further price increases.

The next step for Bitcoin’s price is a bullish break above the July high of $70,162. Surpassing this level and maintaining momentum could open the stage for Bitcoin easily breaking through to new all-time highs in October.

Featured image created with Dall.E, chart from Tradingview.com