Crypto Giant Bitwise says that parts of the digital assets -ecosystem experience “furious bull markets”, despite the overwhelming sentiment in the activa class in general.

In a new Q1 report, Bitwise Chief Investment Officer Matt Hougan says that ‘frustrating’ would be the best word to describe the first quarter of 2025, but that it was still ‘historically positive’.

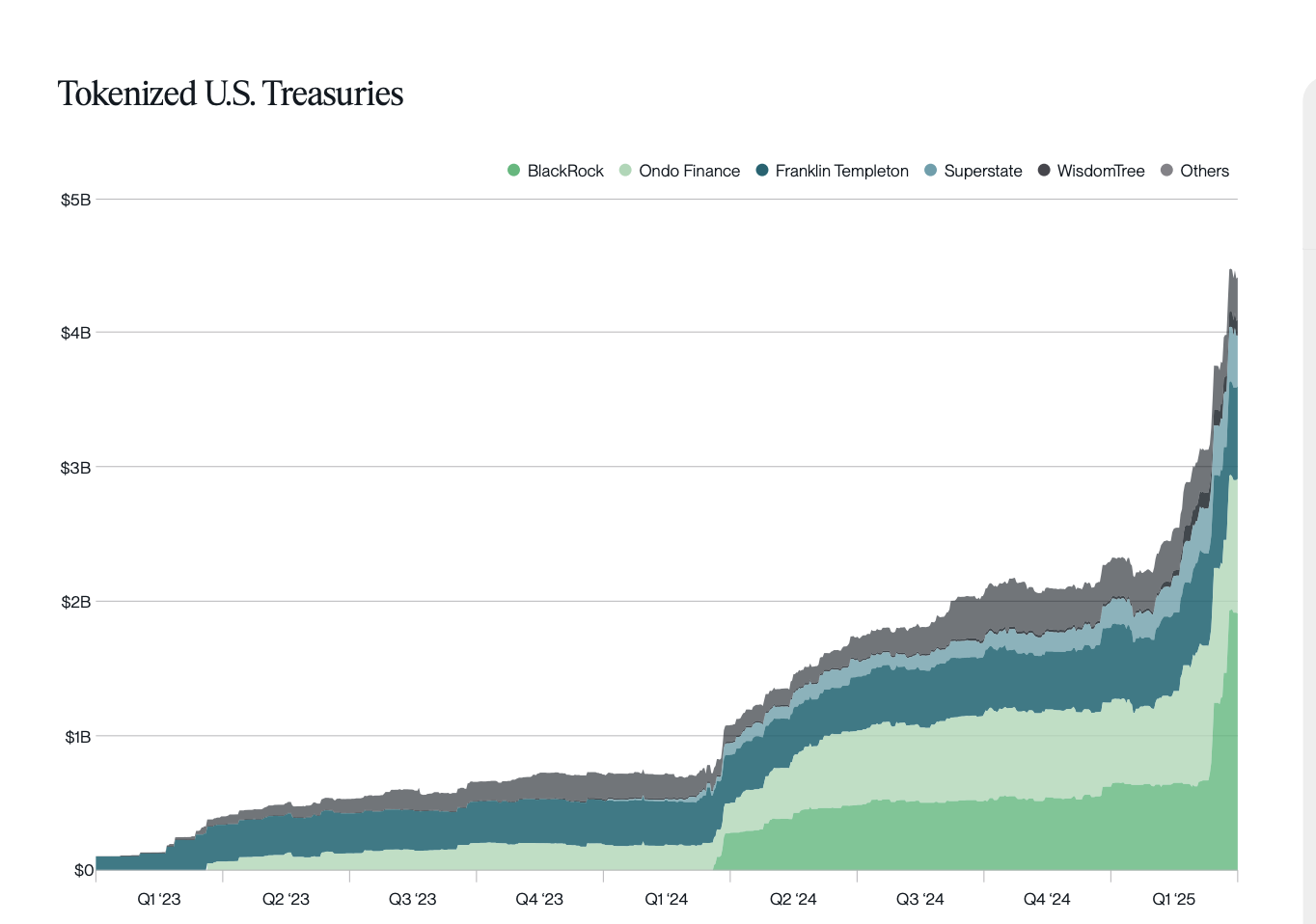

Hougan notes that on top of the rise in Stablecoin acceptance and Bitcoin Futures Trading volume, the tokenization of real-world assets (RWAS) has become parabolic in Q1.

“What attracted my attention is that, despite the prices of prices, parts of the crypto-market bullmarkets experience. For example: Stablecoins Aum (assets under management) rose to a record high of more than $ 218 billion, an increase of 13.50% quarterly over-over-quarter. Quarter-over-verbare also a ransactie volume.

As we go to Q2, I would expect that these and related areas will lead the market higher. “

The data from Bitwise have shown an explosive uptrend for RWAS in recent years, one that has been accelerated so far in 2025, largely powered by the tokenization of private credit and American treasury.

According to Bitwise Rivals ONDO Finance (ONDO) BlackRock for the tokenization of American treasuries, and other traditional finances (Trandfi) overshadows companies such as Franklin Templeton and Wisdomtree.

Bitwise also says that after years of tightening, central banks around the world a hinge of looser monetary conditions and an extension of M2 money amount, which had been historically ‘beneficial for risk provisions, in particular for digital assets’.

Read the full report here.

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Generated image: dalle3