- Binance’s delisting from WRX reflects unresolved disputes and regulatory risks, causing a 56% price crash.

- Market metrics confirm WRX’s bearish trend, with an oversold RSI and critical support near $0.0869.

In a dramatic turn of events, Binance decided to delist WazirX [WRX], Kaon [AKRO]And Bluzelle [BLZ] has led to a sharp decline in their values, with WRX falling 56% to $0.1006 at the time of writing.

The implications of this announcement extend beyond price action, putting a spotlight on the unresolved Binance-WazirX dispute and raising questions about the regulatory risks associated with these tokens.

What happened between Binance and WazirX?

The relationship between Binance and WazirX has been controversial since Binance claimed to acquire WazirX in 2019 but deny full ownership in 2022.

The conflict escalated following regulatory scrutiny of WazirX in India, leading to money laundering allegations and $235 million in hacking incidents. Recently, the Delhi High Court ordered a fresh probe into WazirX’s breach, adding to the stock market’s woes.

This delisting by Binance signals a further rift in the relationship. For WRX, WazirX’s native token, the delisting removes one of its crucial trading platforms, reducing its liquidity and investor appeal.

WRX’s Free Fall: What Do the Charts Say?

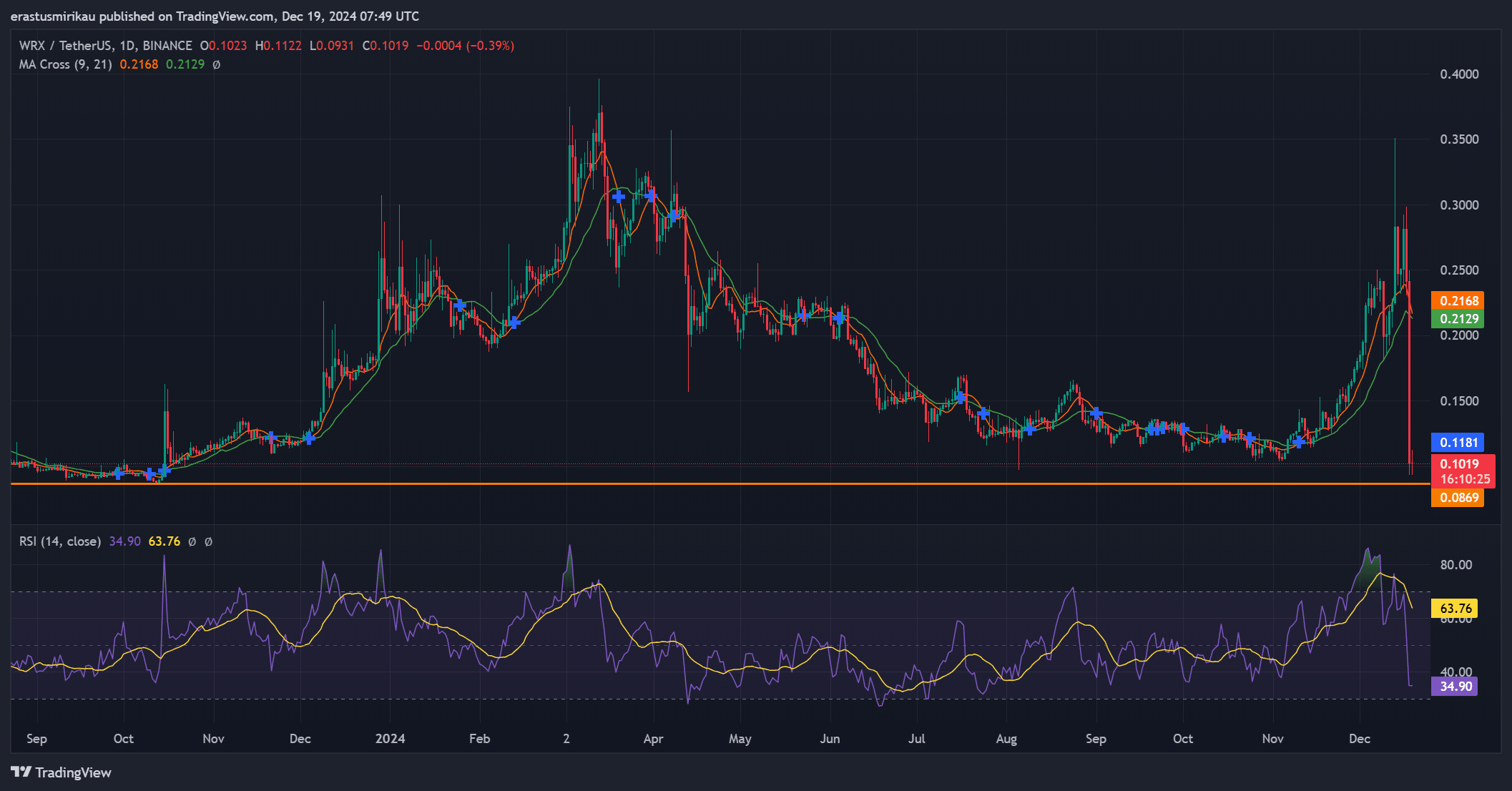

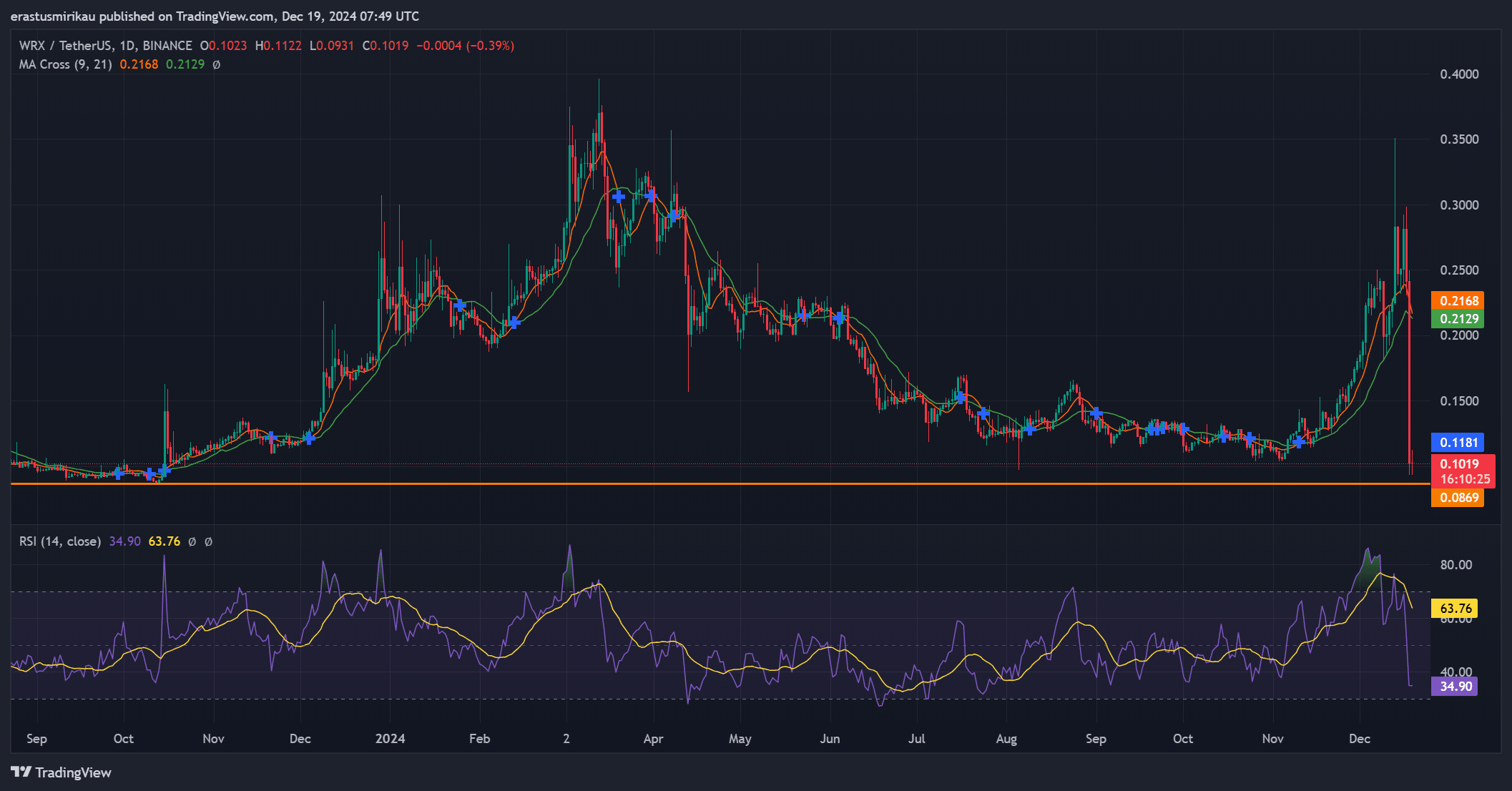

WRX’s 56% drop in 24 hours highlights the token’s vulnerability. At the time of writing, the token was trading at $0.1006, with a market cap of $38.42 million, down 56.27%. Trading volume increased by 550%, indicating significant panic selling.

From a technical perspective, WRX has broken through the key support levels, with immediate support at $0.0869 and resistance at $0.1181. The RSI (Relative Strength Index) fell to 34.9, reflecting oversold conditions.

The Moving Average (MA) cross (9, 21) shows a continued bearish trend at $0.2168 and $0.2129.

The delisting, combined with regulatory uncertainties, paints a bleak picture for WRX’s recovery. Investor confidence is at an all-time low.

Source: TradingView

Why did Binance take this step?

Binance’s decision reflects its broader compliance-focused strategy amid increasing regulatory scrutiny. WRX has been embroiled in legal challenges and ownership disputes, making it a liability for Binance.

This move follows increased global scrutiny of crypto platforms, with regulators demanding stricter controls to combat fraud and illegal activities. The removal of controversial tokens such as WRX demonstrates Binance’s attempt to limit risks and maintain regulatory goodwill.

What about AKRO and BLZ?

While WRX bore the brunt of the delisting, AKRO and BLZ also saw sharp declines. AKRO fell 38% to $0.00238, and BLZ fell 42% to $0.07099 at the time of writing.

Unlike WRX, these tokens have no regulatory disputes. Their decline appears to be market-driven as investors reacted to Binance’s announcement. However, their future remains uncertain, with reduced liquidity and exposure posing significant challenges.

The Binance-WazirX fallout serves as a cautionary tale for the crypto market, highlighting the importance of governance, transparency, and regulatory compliance. For WRX, recovery appears to be a challenge in the face of legal hurdles and reputational concerns.

Investors should proceed with caution and understand the risks associated with platform disputes and regulatory burdens.