Here are the pricing model lines that Bitcoin may need to stay above if the cryptocurrency’s bullish momentum is to continue.

These Bitcoin pricing models are currently close to the spot price

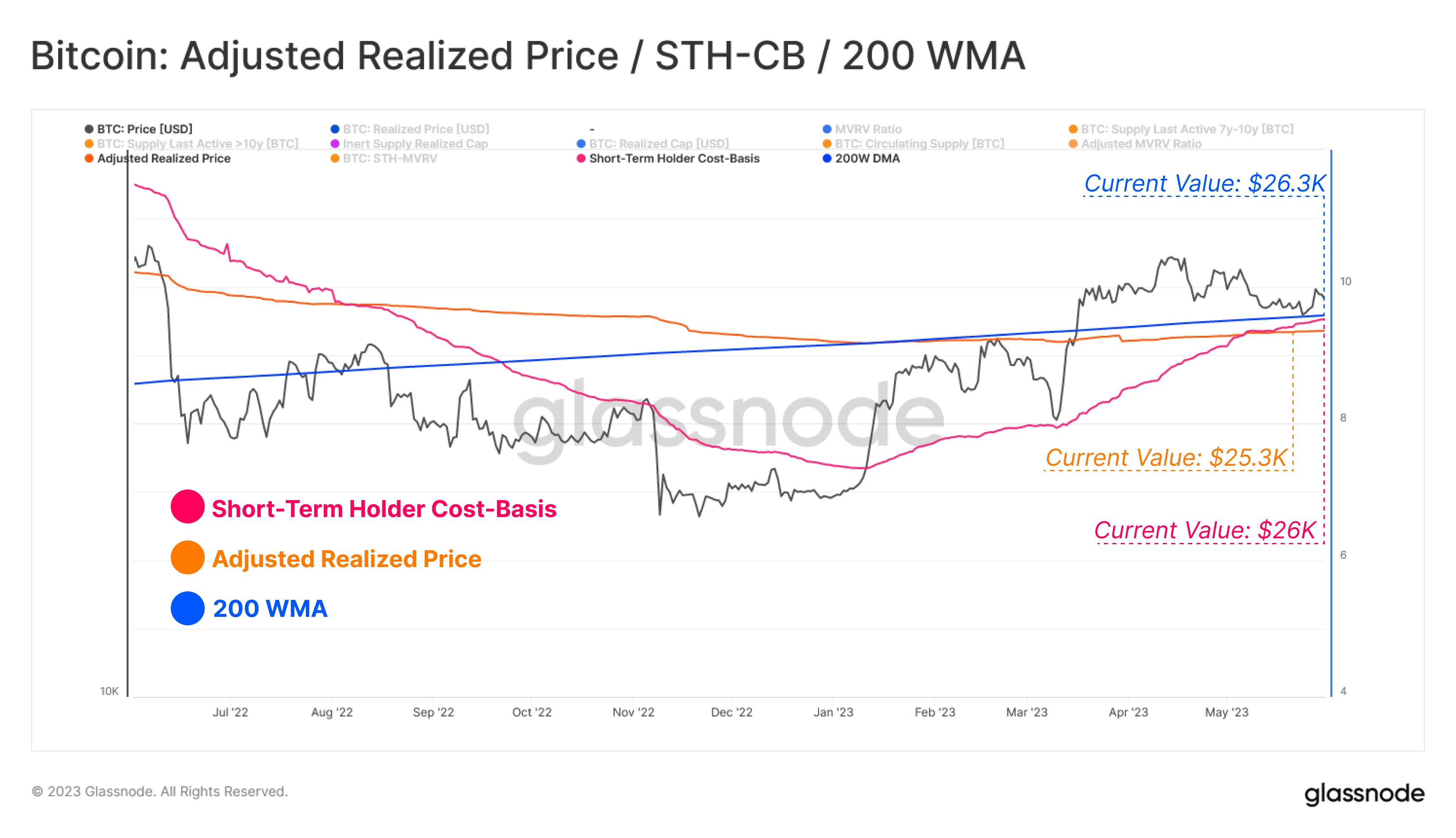

In a new tweet, the on-chain analytics company Glasnode has pointed out how the three pricing models, the adjusted realized price, the short-term holder cost basis and the 200-week MA, are all close to the value of the asset at this point.

To understand the first and second model here, one must first look at the “actual price”. The realized price is a pricing model derived from the realized limit, a capitalization model that assumes that the “true” value of each coin in the circulating supply is not the spot price, but the price at which it last moved.

When this ceiling is divided by the total number of coins in circulation, the average cost base or acquisition price in the market is obtained. This value, for which the average holder on the network bought their coins, is known as the realized price.

Now the first pricing model, the “adjusted realized price,” is a modification of this indicator that drops all holders who have not moved their coins more than seven years ago from the data.

Such an old stock usually consists mainly of the coins that have been lost (perhaps due to the keys of the wallet being inaccessible), which means that this part of the stock would not be relevant to the current market, hence the indicator it cuts off.

As for the second model of interest here, the “short-term holder cost basis”, this metric tracks the realized price of, in particular, those investors who have owned their coins for less than 155 days.

Here’s a chart showing how these Bitcoin pricing models have compared to the spot price over the past year:

The price seems to be just above these models at the moment | Source: Glassnode on Twitter

As shown in the chart above, the Bitcoin-adjusted realized price currently has a value of $25,300, while the cost basis for the short-term holder has a value of $26,000.

Historically, these models acted as both resistance and support for the price, depending on the broader trend. In bullish periods, they usually act as support, so it’s possible that if the price drops deep enough to hit them, a rebound could occur.

The third line on the chart, the 200-week moving average (MA), is a model that aims to find the base momentum of the four-year Bitcoin cycle. This line has also had some similar interactions with price as the other two models.

The 200-week MA is currently valued at $26,300, implying that it is currently closest to the spot price. It now remains to be seen how price interacts with these lines, starting with the 200-week MA, if enough extended withdrawals occur.

A successful retest of these lines would of course be a positive sign for the rally, but a drop below it could be a signal that a transition to a bearish regime has occurred.

BTC price

At the time of writing, Bitcoin is trading around $27,000, up 1% over the past week.

Looks like BTC hasn't moved much recently | Source: BTCUSD on TradingView

Featured image by Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com