The Discover Bitcoin ETFs have lived up to the hype, as these funds have accelerated institutional adoption of the flagship cryptocurrency, Bitcoin. This is further evident from a recent analysis that recorded how much Bitcoin Black rock and other issuers have been gathered this week alone.

Discover Bitcoin ETF issuers who bought more than 19,908 BTC this week

Facts from the on-chain analytics platform Lookonchain shows that the Spot Bitcoin ETF Issuers combined to buy more than 19,908 BTC ($860 million) this week. Meanwhile, it’s worth noting that Lookonchain’s data didn’t include WisdomTree’s BTC purchases in their analysis, suggesting the figure could be much higher if the asset manager’s purchases are also included.

Additional information obtained from Arkham Intelligence provided insight into how much Bitcoin Wisdom tree obtained this week for his Bitcoin fund. 74 BTC appears to have ended up in the portfolio address of the asset manager for its Spot Bitcoin ETF. The addition of these crypto tokens means everything Spot Bitcoin ETF Issuers combined to buy almost 20,000 BTC this week alone.

Interestingly enough, Bitcoin ETFs were recently reported to control 3.3% of Bitcoin’s circulating supply, highlighting their success since launch. Data from Lookonchain shows that these ETFs currently hold over 657,000 BTC (excluding WisdomTree).

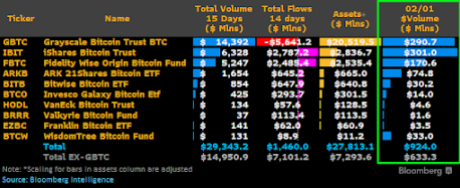

Also Matt Hougan, Chief Investment Officer (CIO) of Bitwise revealed how these funds saw a capital flow of $1.7 billion after their first fourteen days of trading. This is more impressive if he made a comparison with Gold ETFs, which raised $1.3 billion in a similar time frame. In another X messagehe talked about how these Spot Bitcoin ETFs have received $700 million in net inflows this week alone.

BTC price recovers above $43,000 | Source: BTCUSD on Tradingview.com

BlackRock finally trumps shades of gray

Bloomberg analyst James Seyffart mentioned in a X message that BlackRock’s IBIT appears to have become the first ETF to see more trading GBTC in grayscale one day. However, so far, Grayscale continued to record the largest daily trading volume IBIT had come close a couple of times.

From the data Seyffart shared, I BIT It appears that trading volume on February 1 was $301 million, while GBTC recorded $290 in trading volume. However, he further stated that total trading on the day was “a bit of a dud,” with all Spot Bitcoin ETFs together recording a trading volume of $924 million.

Interestingly, that was the first day that daily volume for Spot Bitcoin ETFs was less than $1 billion. However, the Bloomberg analyst did not provide any assessment of the cause of this relatively underperformance.

Featured image from US Global Investors, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.