- Helium has posted one of the highest gains on the market, but has encountered a significant resistance hurdle.

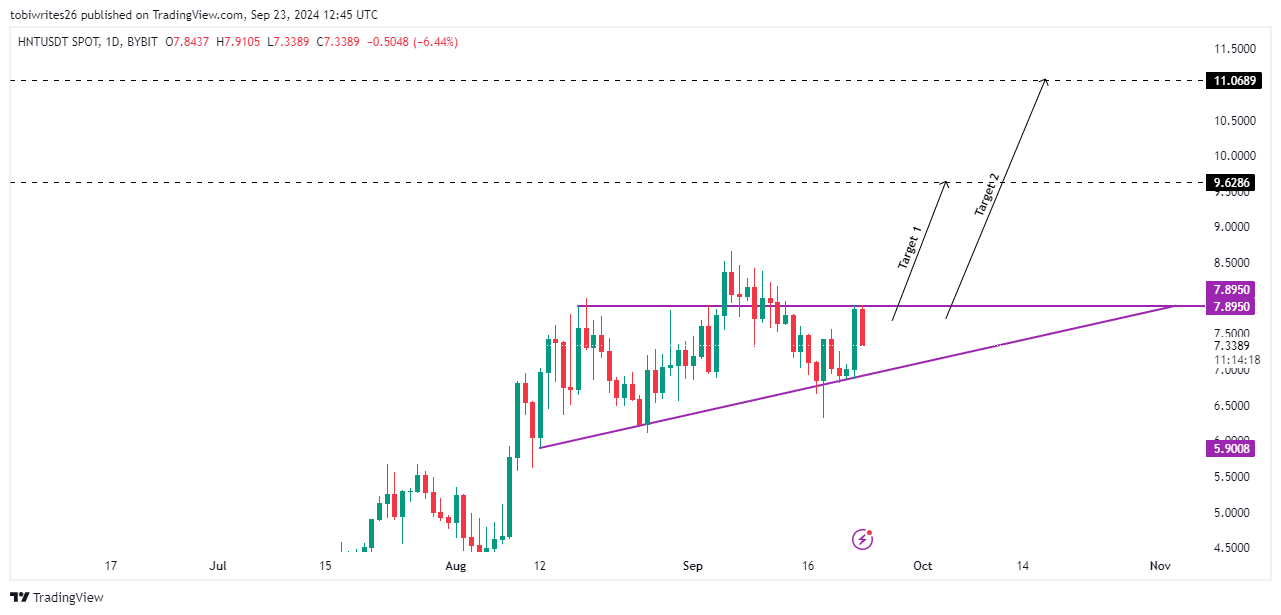

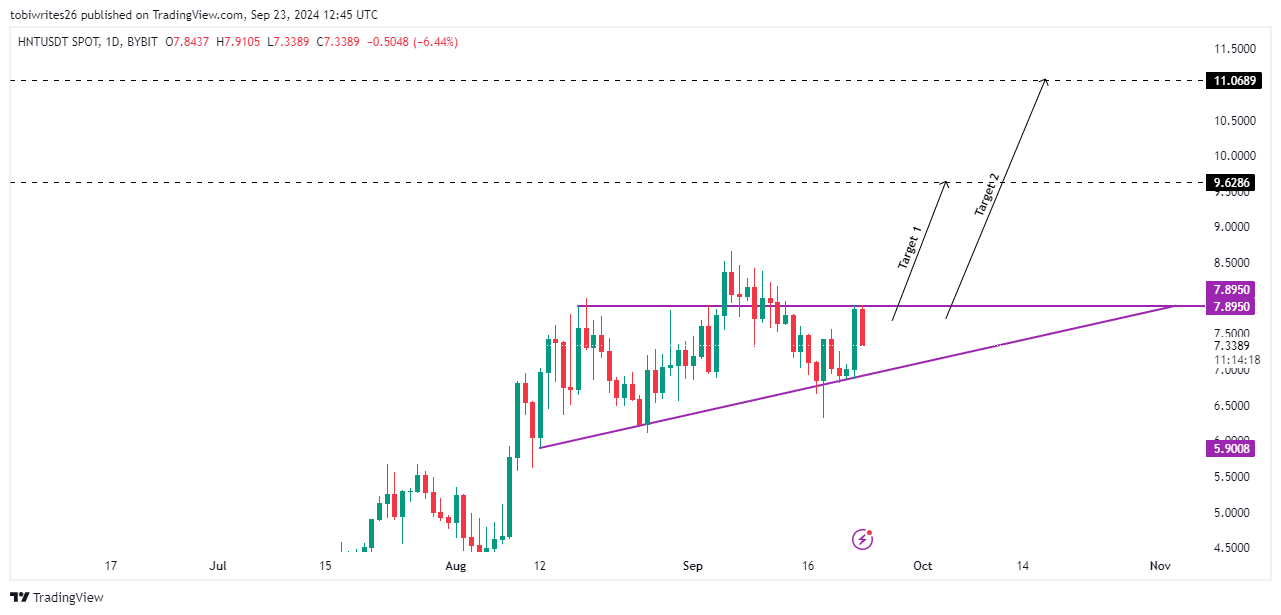

- This recent pullback from resistance is a strategic repositioning as HNT has been trading within an ascending triangle, indicating the potential for an upcoming rally.

At the time of writing: Helium [HNT] traded within an ascending triangle, defined by converging horizontal resistance and a sloping support line, indicating the possibility of a breakout to new highs.

Despite this setup, HNT has struggled to surpass the resistance level at $7,895, resulting in a partial retraction of recent gains.

Such retracements are typical of this pattern, often causing the price to fall back towards the support zone, building momentum for a final potential rally.

Source: TradingView

If this scenario plays out, HNT could aim for higher targets known for the liquidity clusters on the chart: $9,628 and $11,068.

Helium bulls are active as key indicators confirm market strength

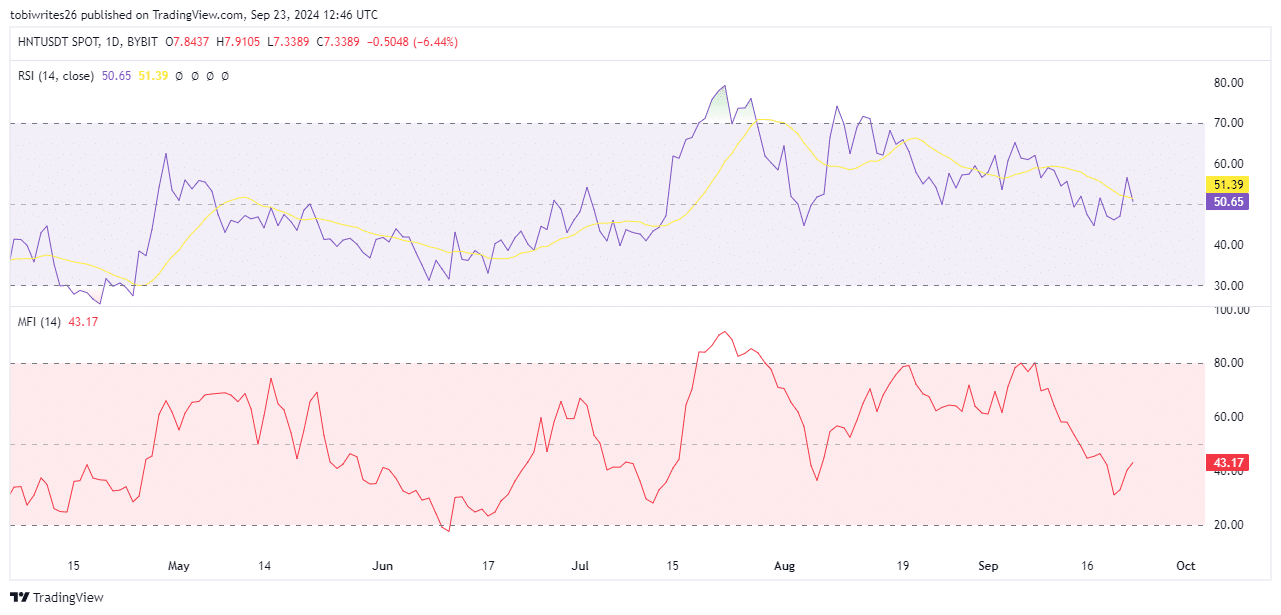

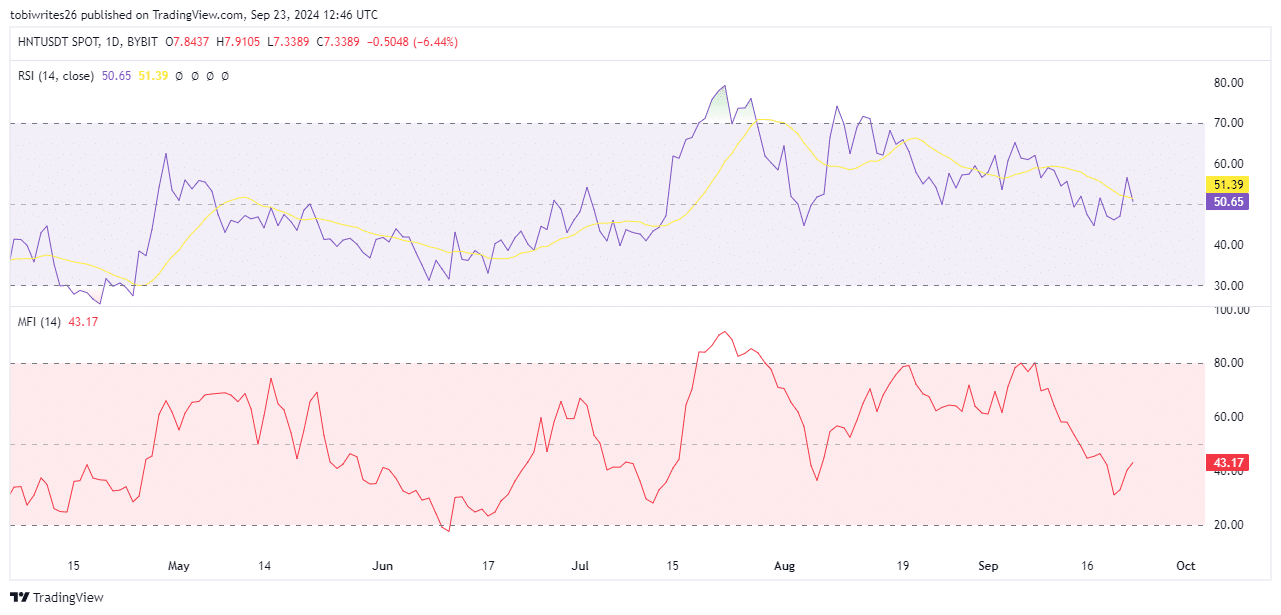

The presence of bulls in the market is confirmed by two important indicators: the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF).

The RSI, a momentum oscillator that measures the speed and change of price movements on a scale of 0 to 100, stood at 50.65 at the time of writing. This indicated that HNT was in a favorable position for a rally.

However, the RSI also pointed downwards, indicating that a short-term decline could occur before the expected upward move, which is consistent with the current technical pattern.

Source: TradingView

Similarly, the Money Flow Index, which measures the flow of money into and out of an asset, shows a large increase for HNT, indicating active accumulation of the asset.

Triple-digit volume increase positions HNT as trader favorite

HNT’s trading volume has seen a substantial increase of 136.5%, as noted by CoinMarketCapindicating active buying by traders, along with a corresponding increase in price.

Read Helium [HNT] Price forecast 2024–2025

Moreover, according to Mint glassthe Funding Rate remains positive, indicating that long traders are willing to pay a premium to maintain their positions. This reflected strong market optimism about future price gains.

If these positive numbers continue, HNT is likely to extend its upward trajectory towards the target level.