- Hedera was able to gather up after days of a falling trend as the SMAS signal ‘buy’ in the short term.

- Hbar could see a potential price reverse if the purchasing pressure takes place beyond the Ichimoku cloud resistance.

Hedera [HBAR] has increased 3.63% in trade volume in the last 24 hours, because the price on the press of around $ 0.18 oscillated, per Mint market cap.

Since the beginning of the month, Hbar acts in a downward trend, fed by a strong bearish Momentum.

With the price on an important support and demand zone, the market wonders whether the bulls could take the lead, which leads to a bouncer back.

HBA Technical setup and demand zone

Looking at the 4-hour graph, Hedera has consolidated in a downtrend and formed a falling triangular pattern. At the time of writing, HBar acted at $ 0.18396, an important support zone.

The currency has tested the $ 0.182- $ 0.185 support zone and sent back several times, which prevented further down. This suggests that demand in this zone increases as buyers and reverse the trend.

According to Tosexpress On X (formerly Twitter), an outbreak or breakdown from this pattern will confirm the next direction of HBar.

Source: X

Will the Bulls come in?

In the past two weeks, HBar has not been kept in the trend of a considerable price above this demand zone, because exhaustion follows the price rebounds.

However, traders expect a meeting after an outbreak or breakdown in this demand zone in its decreasing triangular structure.

Hedera’s short -term momentum, MacD and advancing averages signal “buy” as the trade volume rises, which indicates increased purchasing pressure.

With the RSI at 40 (lower neutral zone), there is more buying potential, indicating that the bulls step carefully.

Open interest rises – can this lead to a trend conversion?

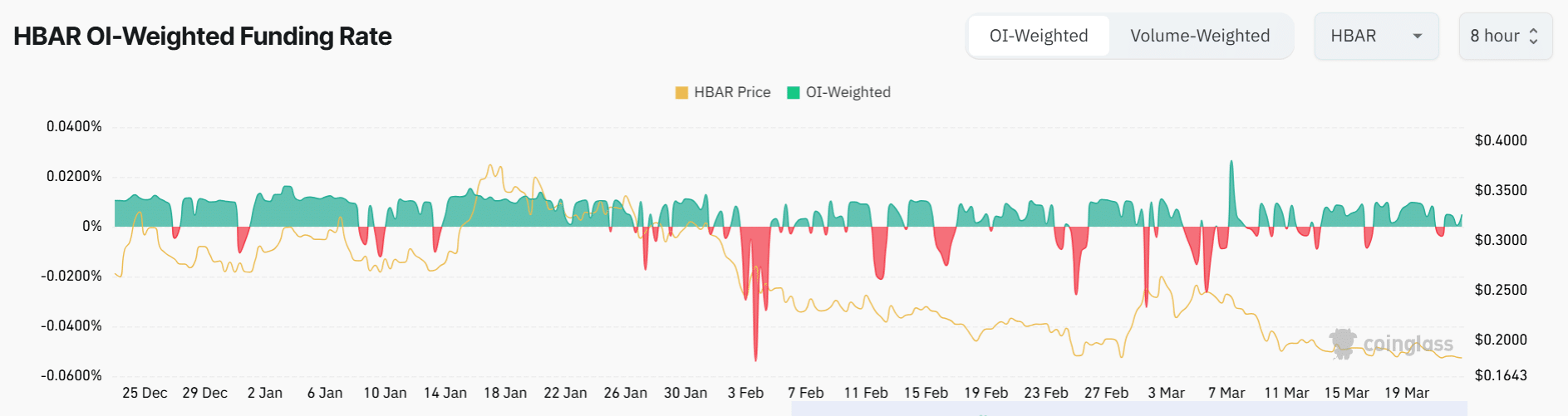

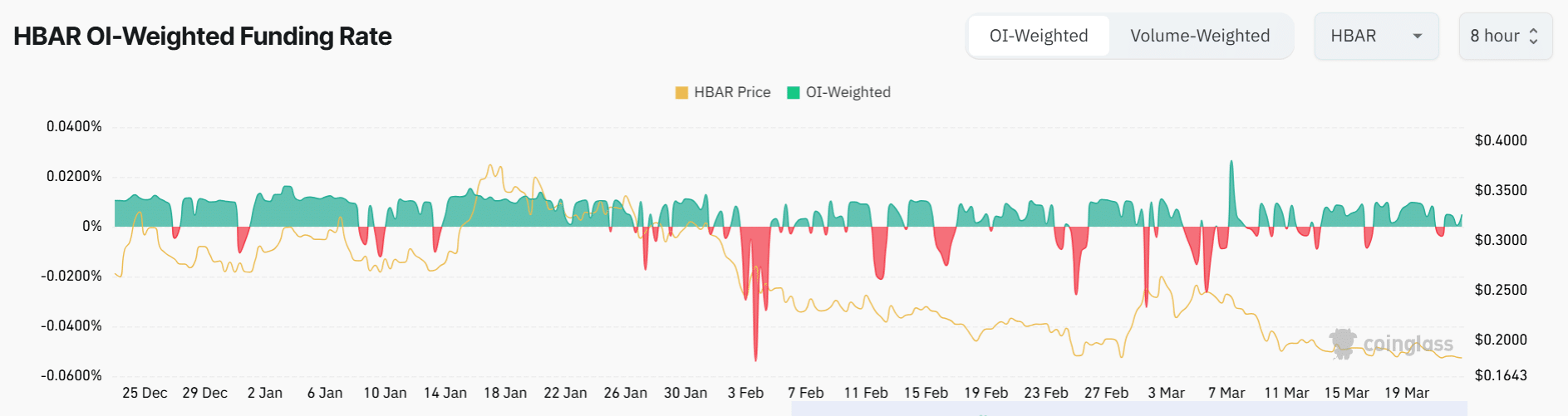

The 24-hour open interest rate of HBBer has risen by 4.5% because the financing interest of the Open Ronde (OI) became positive for the past 48 hours until the time, by CoingLass data.

This meant renewed interest and trader optimism on the most important support zone.

Source: Coinglass

At the time of the press, the 24-hour long/short ratio was 1.7 and had risen to 1.9 in the lower period of time, which suggests that an increased question, per Coinyze.

So what now?

The market seemed to wait for Hedera’s confirmation to the Key Support Zone of $ 0.18. A trend removal is possible if the coin breaks above its falling trendline and overcomes the Ichimoku cloud resistance.

With a strong purchasing pressure, Hbar’s chances of maintaining an upward trend can shift from moderately to high in the medium term. One must look out for the next step in this pattern formation for further insights.