- Hedera is expected to flip the $0.08 zone from resistance to support in the coming days.

- If HBAR witnesses continued demand, a move towards $0.11 is likely.

Hedera [HBAR] was in a long-term downtrend until November 4. Since then, the bullish momentum has taken hold of Bitcoin [BTC] and most of the rest of the crypto market pulled Hedera prices higher.

The token’s daily trading volume increased by 86% and stood at $498.5 million at the time of writing. HBAR has regained its bullish structure: how high can the current rally go before a retracement occurs?

The two resistance zones to watch

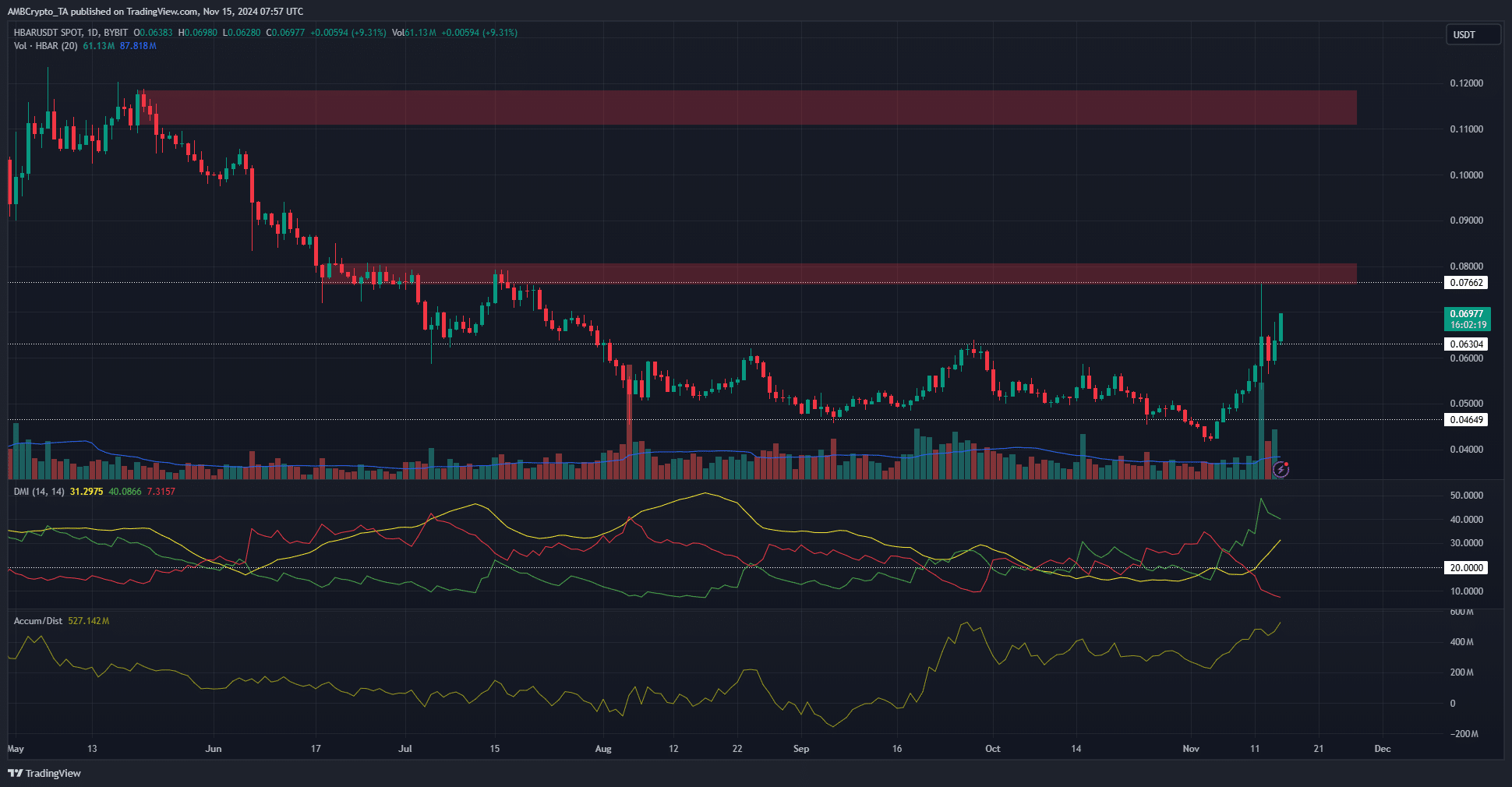

Source: HBAR/USDT on TradingView

HBAR was in a strong uptrend. The daily structure was bullish and the $0.063 level was broken. This level has been resistance since August. The recent gains caused the DMI indicator to show that the altcoin was in a strong uptrend.

Supporting this idea, the A/D indicator was also in an uptrend. It noted increased buying pressure over the past ten days. The recent rally was driven by steady demand.

Due to high volatility on Tuesday, November 12, HBAR tested the resistance level at $0.0766 and was rejected. Since then, the price has risen above $0.063.

The $0.08 zone was a severe resistance zone in June and July. Similarly, another significant resistance zone at $0.11 was observed further north. The latter was a bearish order block on the daily chart.

Buying opportunity for HBAR traders?

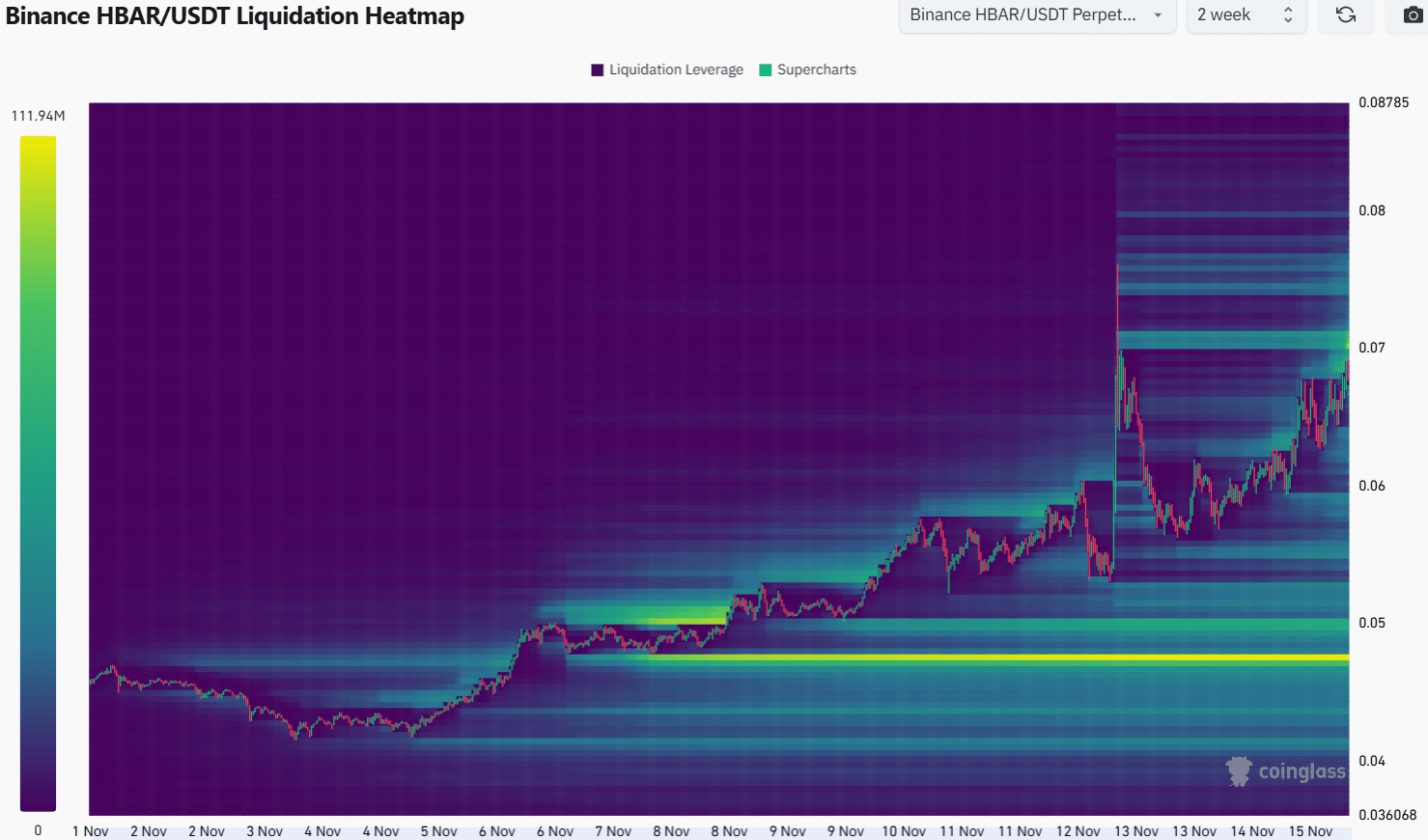

The downtrend of the past few months and the strength of the recent rally meant that there were no sizable long liquidation pools above $0.063. The closest was $0.07-$0.0711. This region will probably be visited soon.

Is your portfolio green? View the Hedera Profit Calculator

The volatility a few days ago was enough to increase liquidity in this region, even though the market was bullish. This is not strange. Liquidations of short positions tend to build around local highs.

For traders, this build-up of liquidity was a sign that after wiping out this liquidity, the HBAR could also fall to $0.064 before resuming upward movement.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.