- Uniswap introduced a permissioned off-chain option for its supposedly permissionless wallet.

- While active addresses decreased, Android users are eagerly awaiting the wallet integration.

A reason Uniswap [UNI] has been able to gather many users is that the protocol allows connection to the exchange with a personalized blockchain wallet under full control of the users.

Realistic or not, here it is UNI’s market cap in BTC terms

However, there may have been a change in terms that appears to undermine the foundations of Decentralized Finance (DeFi), which Uniswap claims to hold dear.

Is Uniswap moving towards centralization?

On October 14, the protocol came under heavy criticism from yourfriendSOMML, a crypto insights provider on X (formerly Twitter). According to yourfriendSOMML, Uniswap has now introduced a Know-Your-Customer (KYC) option on its v4 and is also discontinuing the permissionless feature it offers on Uniswap X.

Disappointing NEWS:

Uniswap releases KYC verification in the form of a Hook for Uniswap v4.

UniswapX also uses a “permission required” off-chain server.

It starts as an ‘option’ and then we all know how it ends…

Uniswap is Fake DeFi.

— your friend SOMMI

(@your friend SOMMI) October 14, 2023

When the Automated Market Maker (AMM) launched Uniswap

But with a “permission required” option on its off-chain servers, Uniswap could lean toward replicating one of the reasons market participants avoid using Centralized Exchanges (CEXs).

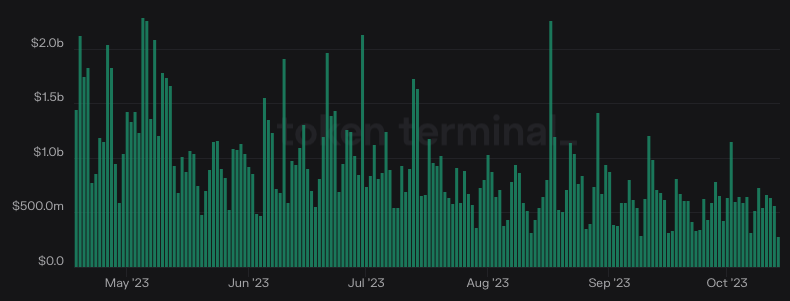

The revelation was also accompanied by criticism from the Uniswap community. In addition to the disapproval, the trading volume on the DEX has been affected. According to Token Terminal, Uniswap’s trading volume had fallen to $280.7 million at the time of writing – a drop of 50.9% in the past 24 hours.

Source: Token terminal

The decline in trading volume on the exchange means that there have been hesitant buyers and sellers. Uniswap may therefore also experience a decrease in costs generated by the protocol.

Activity decreases, but excluded prospects join

Just like trading volume, active addresses on the Uniswap protocol have decreased. According to Santiment, the seven-day active addresses had dropped to 756. But between October 13 and 14, the statistic was much higher.

Active addresses show the number of unique addresses transacting on a network. When the metric increases, it is a sign of increased interaction with the project. However, the decline suggests that market participants refrain from conducting transactions via the protocol.

How many Worth 1,10,100 UNIs today?

For network growth, on-chain data showed the metric also declined. At the time of writing, Uniswap’s network growth had dropped to 237. This drop is evidence that new addresses joining the network were not necessarily impressive. Therefore, Uniswap could not boast of an increase in traction.

Source: Santiment

Despite the criticism surrounding the KYC update, Uniswap seemed to excel in other areas. Lately the protocol launched its wallet for Android devices, and according to his post on

24 hours since launch, more than 130,000 people are on the waiting list

Ask AND(roid) you will receivehttps://t.co/kTxs0Ab6BJ

— Uniswap Labs

(@Uniswap) October 13, 2023