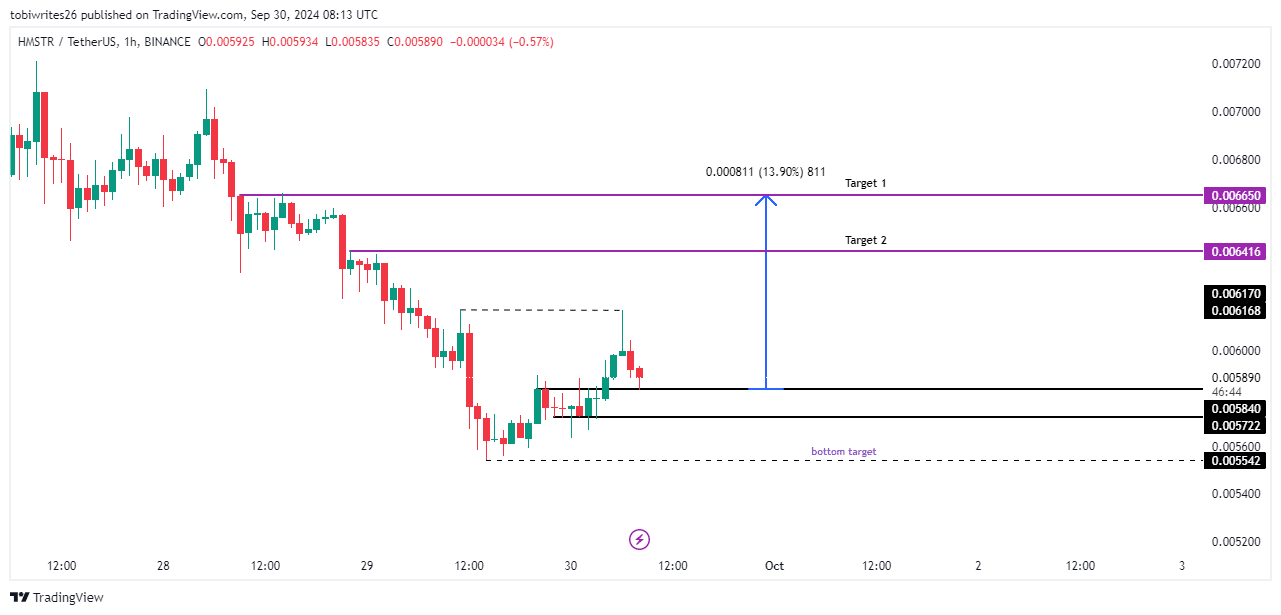

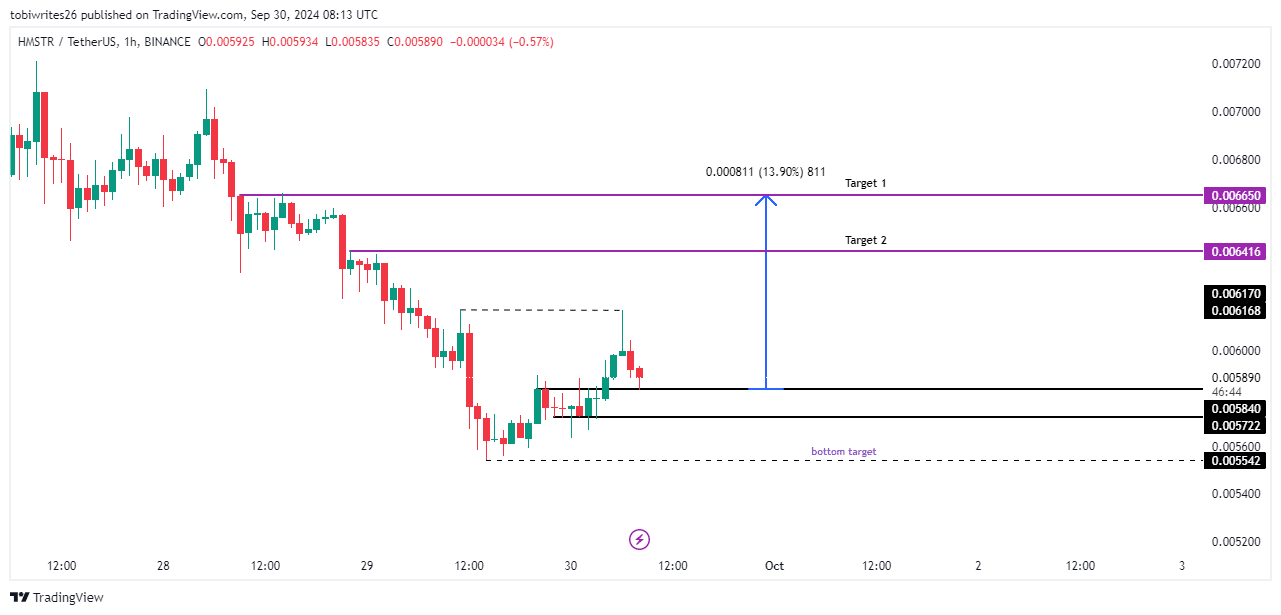

- HMSTR is positioned for upside as it trades within a key demand zone, paving the way for potential gains.

- If market conditions align, HMSTR could see an upside of 13.90%. However, there is still a risk of further declines.

Hamster fight [HMSTR] has suffered steep losses since its debut. Last week, the stock fell by approximately 40.34%, significantly reducing its market value.

In the last 24 hours alone, the stock fell 3.94%, which could be a strategic entry point for investors betting on a recovery.

HMSTR Enters a Demand Zone: Will Sufficient Buying Pressure Continue?

At the time of writing, HMSTR has entered a demand zone, marked by recent declines of 3.94%. This zone, ranging between 0.5840 and 0.5722, appears on the 1-hour chart and is expected to generate strong buying pressure.

If buying activity at this level outweighs the current bearish market trend, HMSTR could potentially rise by up to 13.90%, with a target of $0.006650. However, a more conservative target would be $0.006416.

Source: trading view

Conversely, if HMSTR cannot sustain support within this demand zone, it risks a further decline, possibly to $0.05542 or lower.

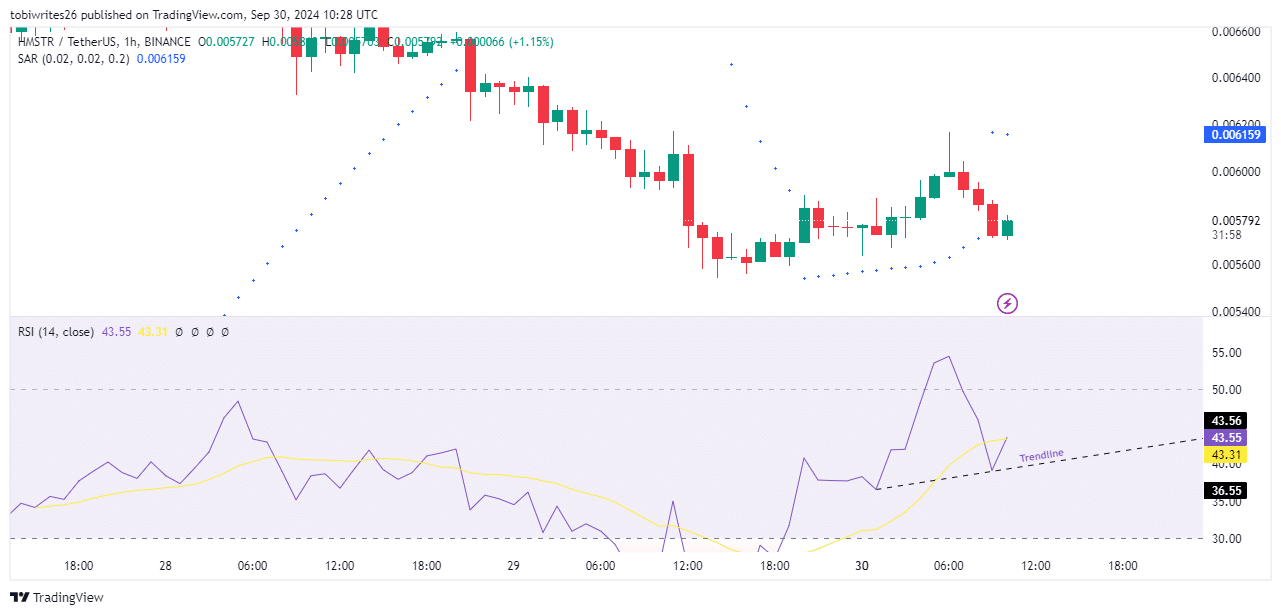

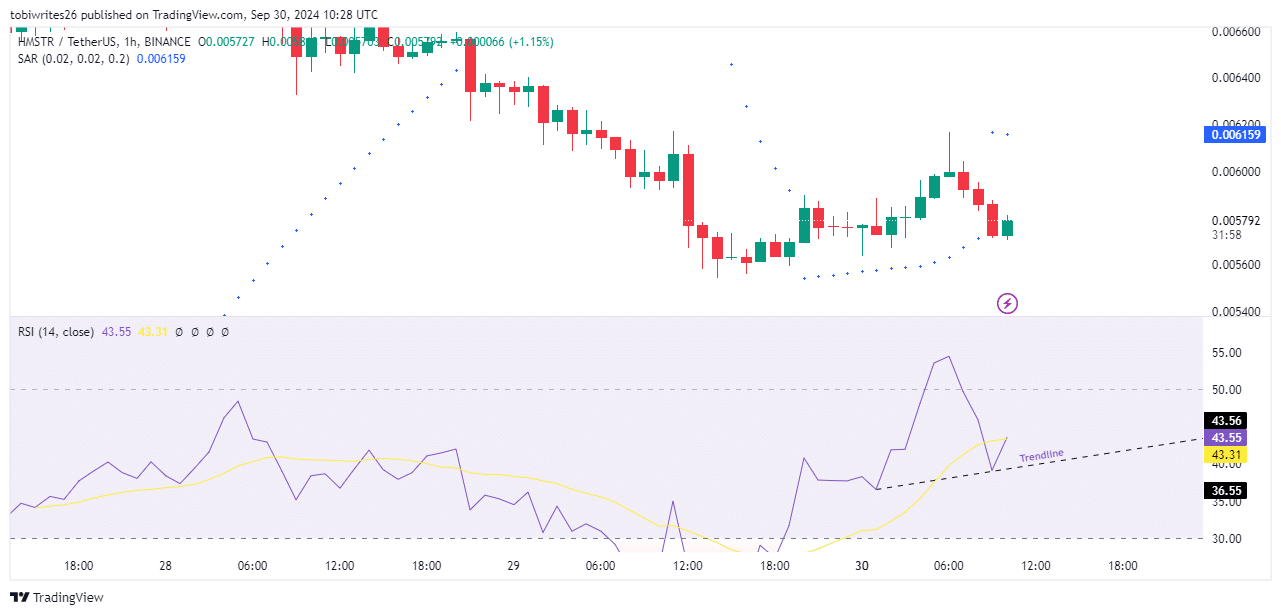

Mixed signals among market participants on the direction of HMSTR

According to the Parabolic SAR (Stop And Reverse), HMSTR is showing signs of turning bearish as evidenced by the dots forming above the price bars – a trend currently observed in HMSTR’s trading pattern.

The Relative Strength Index (RSI), on the other hand, presents a more optimistic outlook. After reaching the supportive trendline, the RSI has moved higher, indicating that momentum may still be bullish.

The RSI evaluates the direction of the market by measuring the speed and change of price movements.

Source: trading view

Based on this and current market conditions, AMBCrypto expects a potential upward trend, with the demand zone likely to remain strong, which is explained below.

Open interest indicates a bullish outlook for HMSTR

Open Interest, a metric for tracking unsettled derivative contracts on assets, can be an indication of market sentiment. High open interest usually means traders are adding to their positions, often reflecting bullish price movement.

According to Mint glass HMSTR’s open interest is up 6.81% over the past 24 hours, from $60.81 million to $17.37 million at the time of writing.

This significant increase indicates that traders are actively investing and betting that the price of HMSTR will rise further from current levels.

However, if overall market sentiment turns bearish, it could drive HMSTR’s price down even further.