Grayscale’s Chainlink Trust (GLNK) shares are trading at a significant premium of over 200% compared to the spot price of Chainlink’s LINK token.

Grayscale facts shows that GLNK shares are trading at $39, while the market value of the LINK token at the time of writing is $12.51. This means that GLNK’s value is three times higher than the underlying assets it owns.

Chainlink community ambassador ChainLinkGod first reported the increase in this premium on the social media platform

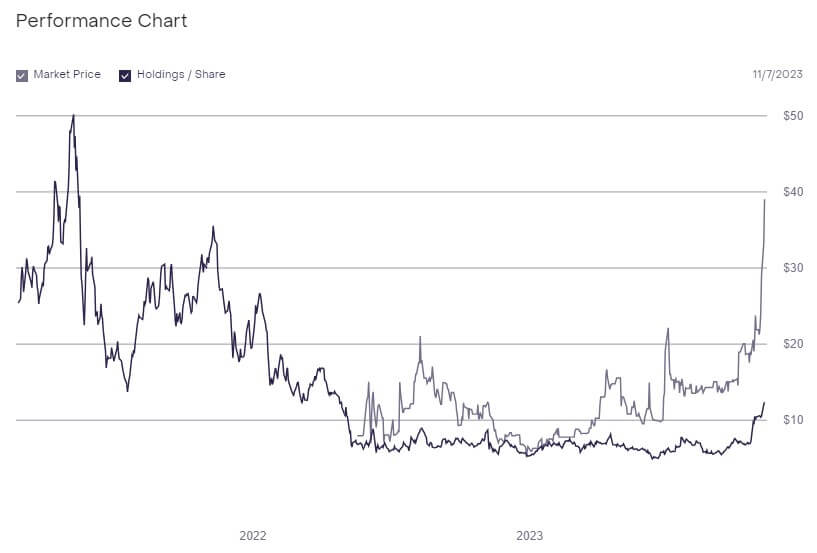

The chart below shows that LINK and GLNK were trading on similar terms earlier this year, before a premium gap emerged between the two assets in March.

Since then, the bounty has continued to grow, thanks to increased adoption of Chainlink and the use of its Cross-Chain Interoperability Protocol (CCIP) by major traditional companies such as South Korean gaming giant Wemade and global financial messaging network Swift.

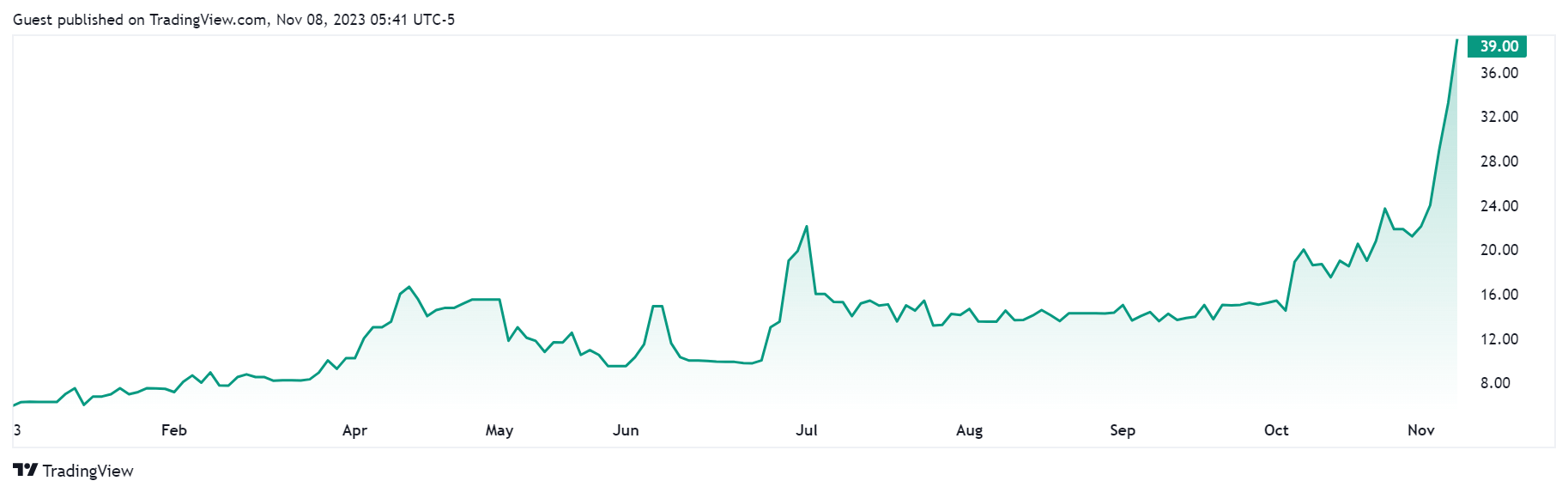

Data from Tradingview also shows that GLNK has maintained strong price performance throughout the year, up more than 250% in the last six months and almost 540% since the start of the year.

CryptoSlaat, citing CoinShares weekly update, recently reported that Chainlink-related crypto investment products enjoyed notable inflows over the past week, with $2 million invested.

Grayscale introduced its Chainlink Trust as a regulated product in May 2022, giving US investors exposure to LINK. Since then, the product has generated significant interest, with total assets under management currently valued at $3.9 million.

However, like other Grayscale Trusts, GLNK shares are not exchangeable for the underlying asset they track. This means that investors can only exit their positions by selling the shares to another party.

Meanwhile, LINK is also on a positive rally, reaching a yearly high of $12.65 on November 6 before returning to current levels.