Abstract:

- The opening temporary by Grayscale in a lawsuit in opposition to the U.S. Securities and Alternate Fee referred to as the regulator’s resolution “capricious” and “discriminatory”.

- Gary Gensler’s federal company rejected the digital asset supervisor’s software to transform its $12 billion Bitcoin spot belief right into a Bitcoin exchange-traded fund.

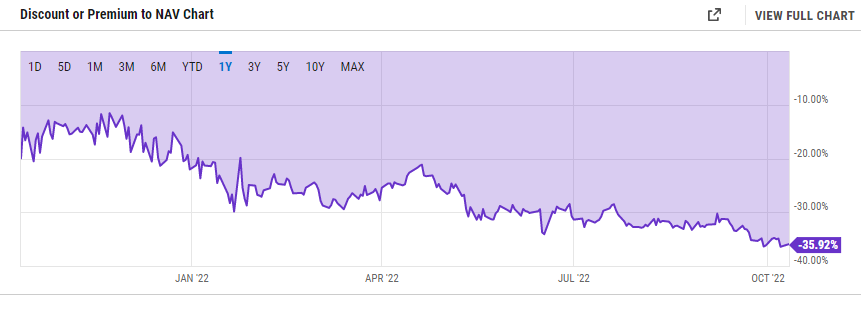

- The swap in fund construction may assist stem the rising GBTC low cost, returning the fund’s BTC providing to “web asset worth”.

- The SEC cited fraud dangers and market manipulation as the first causes for the choice.

A lawsuit has been launched by Grayscale Investments LLC in opposition to the U.S. Securities and Alternate Fee over the regulator’s resolution to reject a Bitcoin exchange-traded fund (ETF) software.

Grayscale, the biggest digital asset supervisor at press time, submitted a bid to transform its $12 billion Bitcoin (BTC) spot belief to an ETF. The asset supervisor launched its GBTC providing in 2013 and utilized to restructure the fund in October 2021.

Notably, the GBTC low cost has grown considerably and hit a report 36.2% in September. The swap from a BTC spot belief to a Bitcoin spot ETF may slash the Grayscale low cost. A decreased low cost would deliver the providing nearer to web asset worth, per experiences.

Spot And Futures-based ETFs Face The Similar Dangers – Grayscale

The opening temporary within the lawsuit in opposition to the SEC notes that the regulator has arbitrarily approached functions for futures and spot-based ETFs regardless of each choices dealing with an identical dangers.

SEC rhetoric relating to Grayscale’s ETF has insisted that fraud dangers and market manipulation considerations are the primary the explanation why the regulator has rejected the agency’s software. The agency argued that the SEC’s logic is contradictory and “unfair”.

The Fee Arbitrarily Decided That the Proposed Rule Change Was Not Designed To Stop Fraud and Manipulation, Even Although the Bitcoin Futures ETPs That the Fee Has Authorised Are Uncovered to Precisely the Similar Dangers of Fraud and Manipulation because the Belief’s Proposed Spot Bitcoin ETP.

CEO Michael Sonnenshein stated again earlier within the yr that authorized motion in opposition to the U.S. regulator was below consideration ought to the SEC reject his agency’s ETF software. The corporate has additionally referred to as on American-based buyers to push for a BTC ETF.