Digital asset manager Grayscale has deposited billions of dollars of Bitcoin into crypto exchange Coinbase since adopting spot BTC exchange-traded funds (ETFs), on-chain data shows.

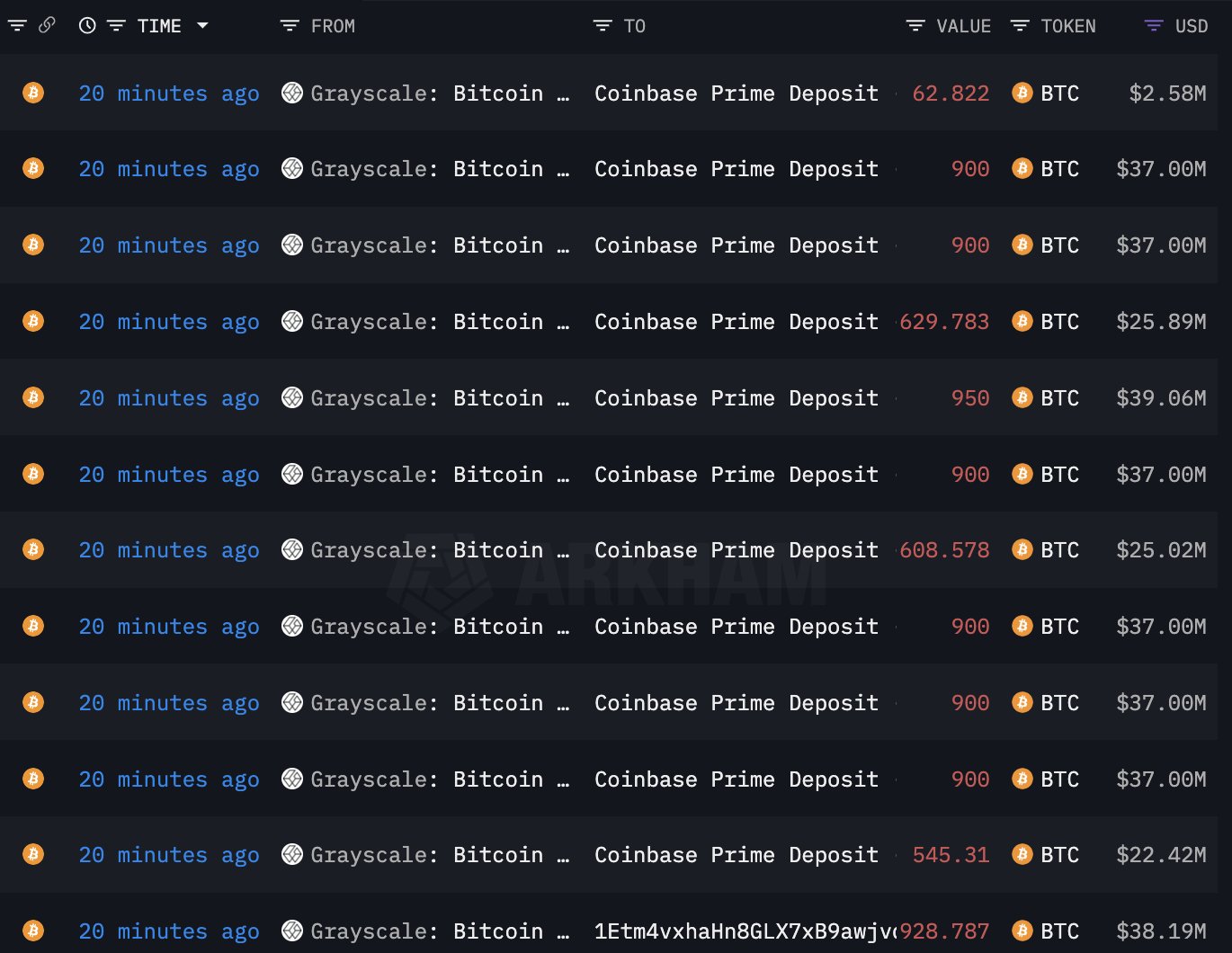

Blockchain tracking firm Lookonchain says Grayscale on Friday deposited $410.9 million in BTC into Coinbase Prime, the crypto exchange’s platform aimed at institutional clients.

The deposit was added to an already large flow of BTC deposits from Grayscale, which according to Lookonchain now totals more than $4.64 billion since the ETF approvals. Even after the massive deposits, Grayscale remains the third largest holder of Bitcoin with 502,043.26 BTC worth $20.67 billion.

While Grayscale’s Coinbase deposits are likely putting selling pressure on Bitcoin, data collected by crypto analyst InvestAnswers suggests ETF launches are generally bullish for the crypto king.

Say InvestReply,

“THE GOOD NEWS:

1) Blackrock has almost $2 billion in assets under management and beyond [Friday] will have 50,000 BTC

2) Fidelity is growing faster than Blackrock, Fidelity customers like BTC more

3) If you remove shades of gray, an average of $550 million dollars flows into BTC ETFs per day

4) If you remove Grayscale, these ETFs will have sucked up 140,000 BTC

5) The ETFs alone suck in 15.5x the daily Bitcoin supply created

6) Bitcoin hit a low earlier this week – now FOMO (fear of missing out) times.

At the time of writing, Bitcoin is trading at $41,984.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney