Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

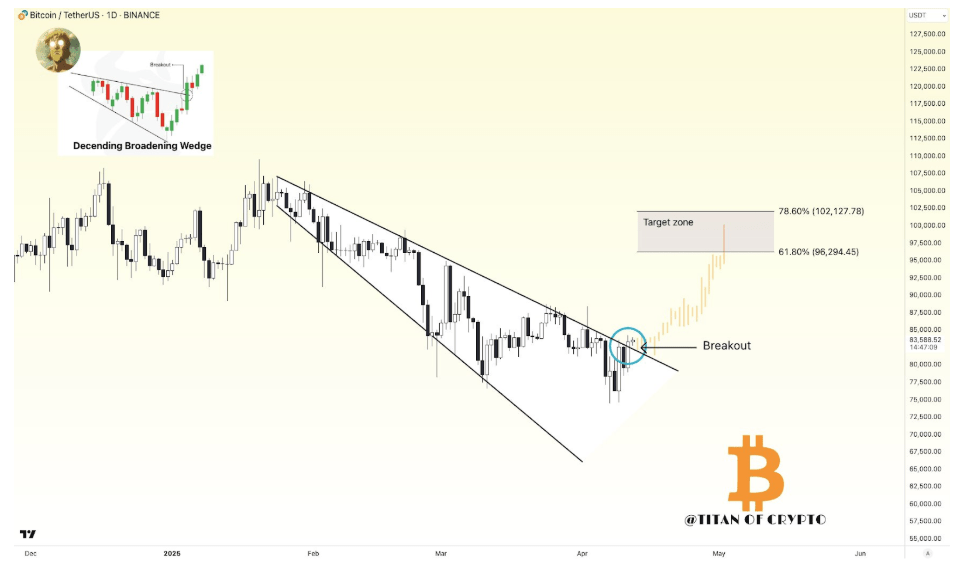

Bitcoin is broken from a technical formation that can place it on the right track in the direction of a decisive test zone between $ 96,200 and $ 102,100. If confirmed in the coming days, the movement would represent a great price development in Bitcoin’s continuous market structure. A crypto analyst has emphasized this zone as a zone where the Bitcoin process could extend to new highlights or face the next rejection.

Related lecture

DALLING WITH BEEDGE BREAKOUT KNOWED A POD TO $ 100,000

The Bitcoin price action in the last 24 hours is emphasized by a return to $ 85,000, because the purchasing pressure began to crawl into. Interesting is that this purchasing pressure above the upper trend line is broken from a falling widning widening. This pattern is usually considered a reversal signal and its outbreak implies a strong upward continuation if validated.

The outbreak of the formation was noted in An analysis posted on Social Media Platform X by Crypto analyst Titan from Crypto. In particular, the price diagram that is shared by the analyst shows that the wig formation has taken place in the last three months in daily candlesticks. De Wig began to form after the peak of Bitcoin above $ 108,000 at the end of January and gradually increased.

At the time of the analysis, the price of Bitcoin had already made Two daily candlesticks close above the upper trend line of the wider -wig. According to the analyst, the breakout will probably be confirmed this week. If confirmed, this will open the stage for a run above the price level of $ 100,000 again or at least $ 96,200.

In particular, Titan van Crypto emphasized the region between $ 96,200 and $ 102,100 as the next target zone. The analyst emphasized that this reach can act as the actual test of the power of Bitcoin, because it will reveal whether the outbreak leads to continuation or stalls in rejection.

Image From X: Titan Crypto

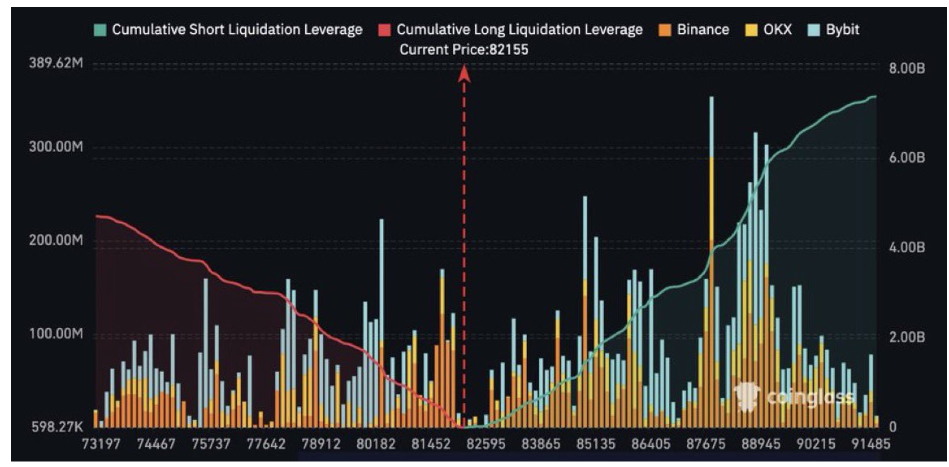

Leverage building points up to $ 8 billion short squeeze potential above $ 90,000

Crypto -analysts Sensei also comment on The current price structure of Bitcoin and noted that a move to $ 90,000 could activate an enormous liquidation event. Based on data from Coinglass, more than $ 8 billion in short positions would be vulnerable as Bitcoin rose above $ 90,000 again.

The cumulative short liquidation graph of Coinglass shows a large wall of lever for a short interest that is concentrated under that level at large stock markets such as Binance, OKX and Bybit.

Image From X: Sensei

Related lecture

The data reflects a significant unaccepting in the market for derivatives, with short positions that dominate to the $ 90,000, above which the purchase of liquidation could intensify. If Bitcoin pushes in this zone, the resulting cascade of liquidations between short positions can offer the momentum that is needed to push the Bitcoin price to the $ 96,200 to $ 102.100 target zone.

At the time of writing, Bitcoin acted at $ 84,706.

Featured image of Freepik, Graph of TradingView