- Last week’s inflows into digital asset investment products totaled $326 million

- Bitcoin accounted for 90% of all recorded inflows

Digital asset investment products recorded inflows of $326 million last week. This represented the biggest week of inflows since July 2022, CoinShares found in a new report report.

As the report highlighted, the main catalyst behind the record inflows was optimism surrounding the possible approval of a spot-based Bitcoin ETF by the US Securities and Exchange Commission (SEC).

The bullish sentiments that enveloped the entire market in October meant that crypto funds recorded only one inflow during the four-week period.

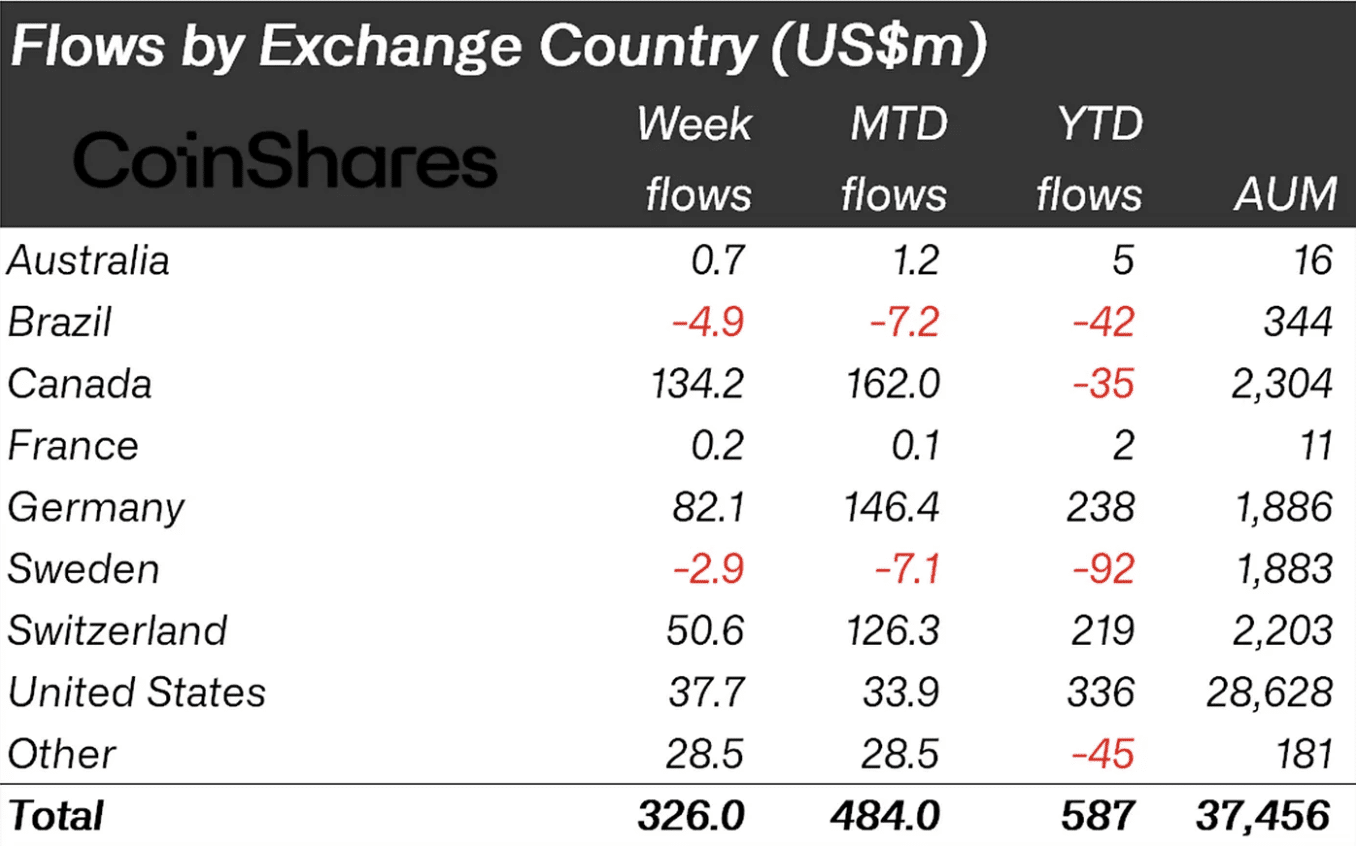

This brought the monthly flows “almost half a billion dollars”. Similarly, total assets under management for these digital asset products reached $37.8 billion, the highest figure since May 2022.

Regionally, the majority of flows into crypto funds last week came from Canada, Germany and Switzerland. Investors in these countries were responsible for inflows of $134 million, $82 million and $50 million respectively.

The United States accounted for only 12% of all inflows in the same period. According to CoinShares, this suggested that US investors may wait a little longer, possibly awaiting the ETF’s approval.

Asia in particular recorded the highest weekly inflow of $28 million.

Bitcoin leads, others follow

With $296 million added Bitcoin-backed investment products, the main currency accounted for 90% of the total inflows recorded last week. This brought month-to-date inflows to $407 million, up 263% from the previous month. last week inflow of $112 million.

In terms of year-to-date (YTD) flows, last week’s fund flow pushed the coin’s net inflows above $600 million. According to CoinShares, BTC net inflows last week amounted to $613 million. In the previous week it was less than $350 million.

Interestingly, despite BTC’s positive price performance in recent weeks, some investors have added funds to short Bitcoin positions.

CoinShares found,

“The recent price surge has also led to an inflow of $15 million into short Bitcoin investment products,”

Solana remains king in the alto verse

In the last weekthe $15.5 million recorded as inflows into Solana-backed products made it the altcoin with the most positive fund flows that week.

The coin repeated the same performance last week and saw an inflow of $24 million. This brought the coin’s year-to-date inflows to $66 million and net inflows since the beginning of the year to around $100 million.

According to CoinShares:

“The improving optimism also saw significant inflows of $24 million into Solana, while some other altcoins saw inflows. This optimism did not include Ethereum, which saw another $6 million in outflows.”