Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Bitcoin is still acting around $ 103,000, although the upward momentum it started in May is showed a delay in the last seven days. Although A short -term volatility is currently playing, the long -term prevention is undoubtedly Bullish.

Related lecture

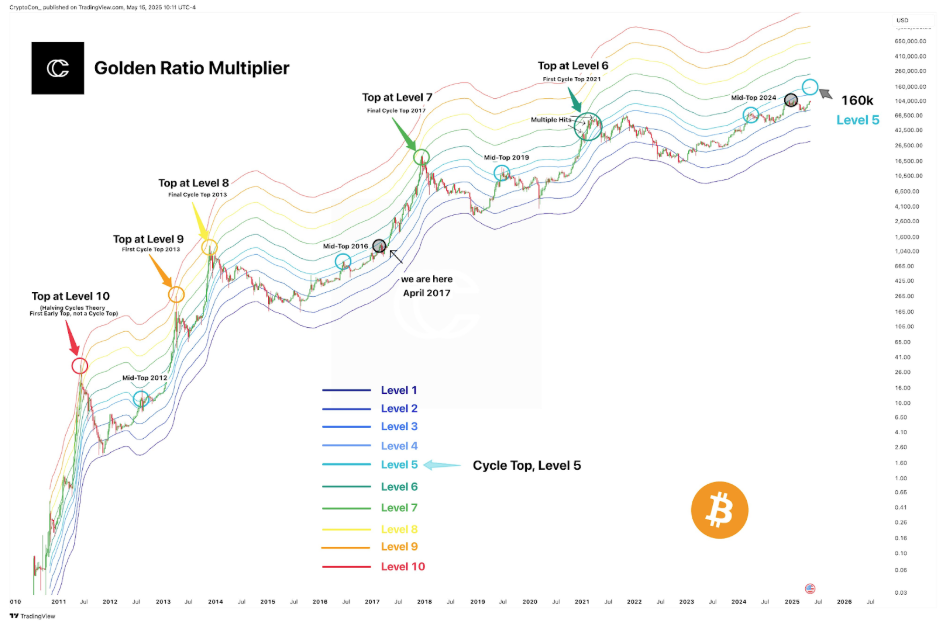

Some analysts are looking for Long -term cycle inducators for the direction. Such a tool, the Golden Ratio Multiplier, which called the Bitcoin top in 2021, has surfaced again with another interesting top for the current Bitcoin cycle.

Golden Ratio Multiplier identified 2021 TOP, now points to a new peak

To one Post on social media platform X, The popular crypto analyst Cryptocon emphasized the reliability of the Golden Ratio Multiplier in predicting the price of Bitcoin in every cycle. The Golden Ratio Multiplier is a logarithmic model that includes Fibonacci derived multiplicators to anticipate Bitcoin’s macro trends.

In particular, this statistics was one of the few to call the April 2021 cycle in real time, the same as the prey tops of 2017 and 2013. This cycle has already marked the model a significant peak in March 2024, although the crypto analyst did not interpret this as a mid-top.

Cryptocon explained that Bitcoin’s price action has already reached this cycle level 4 of the multiplier graph, but this is not the last peak. “We have already hit this cycle level this cycle, but this was for the cycle mid-top in March 2024, which means we do it again,” he wrote.

The tire 5 -band is now around $ 160,000 and stays up trend. Cryptocon drew a parallel for the past and noted that the structure of the current cycle shows strong similarities with the period 2015 to 2017, when Bitcoin saw a gradual structure followed by an explosive outbreak.

Based on this comparison, the current market phase is seen as equivalent to April 2017, Just before Bitcoin went a meeting in the months that followed.

Golden Multiplier Ratio suggests that $ 160k is the next big target

The graph at Cryptocon’s Post sketches a familiar image with the Golden Multiplier ratio. Each band, ranging from level 1 to level 10, is based on a multiplier level that is derived from the progressive average of 350 days. Bitcoin gone at different levels: level 10 in 2011, level 9 and 8 in 2013, level 7 in 2017 and level 6 in 2021. The peak of the current cycle should probably be level 5, but the Bitcoin should be The price has yet to come.

Related lecture

If the market continues to respect this structure, Bitcoin could prepare for a meeting in the direction of the level 5 figure of $ 160,000 somewhere later in the year, which could mark the last high of this cycle. The current reach of around $ 103,000 is perhaps The calmness for the last outbreak. “Slower structure, then all at the same time,” said the analyst.

At the time of writing, Bitcoin acted at $ 102,971.

Featured image of Unsplash, graph of TradingView