TL; DR

Full story

A few weeks ago we wrote a piece about re-deploying liquids on Ethereum.

The premise goes as follows:

-

You can risk some of your ETH holdings (via staking) to earn ~5% interest per year.

-

Some providers give you ‘staked ETH’ tokens (also called stETH) when you stake with them – this way you still have liquid (affordable) crypto in your wallet.

-

By re-staking you can take that stETH and re-stake (risk) it to make money even higher gives back.

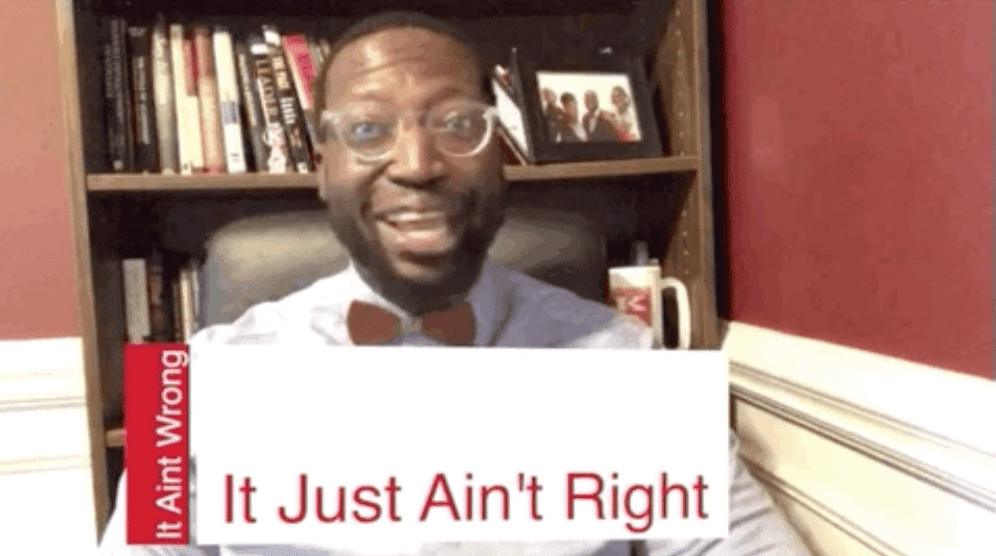

That sounded like a wild concept when we first heard it (you want users to double the risk?).

So wild, that we ended that original article by saying this:

On the one hand it is super exciting!

On the other hand, the promise of returns without money feels a bit ‘2008-esque’.

(We definitely need to do more research on it).

Well, we did more research – and…

Turns out we pressed the panic button prematurely!

Because if you lose your stETH, you won’t be able to redeem your original ETH, meaning you won’t risk double the risk of what you own…

Confused? The same. Think of it like this:

If you lock your bike (ETH) and lose the key (stETH) – it’s not like you’ve suddenly lost two bikes – it’s still only one (the difference is you can’t get to it anymore).

And so far, Ethereum redeploy platforms have absolutely exploded, reaching over $8 billion in value!

Give us a simple pie – we’ll stand corrected and ready to eat!