- Fantom’s momentum was in overbought territory at the time of writing and could see a pullback

- The strong demand during the $1 breakout was a bullish sign for the long term

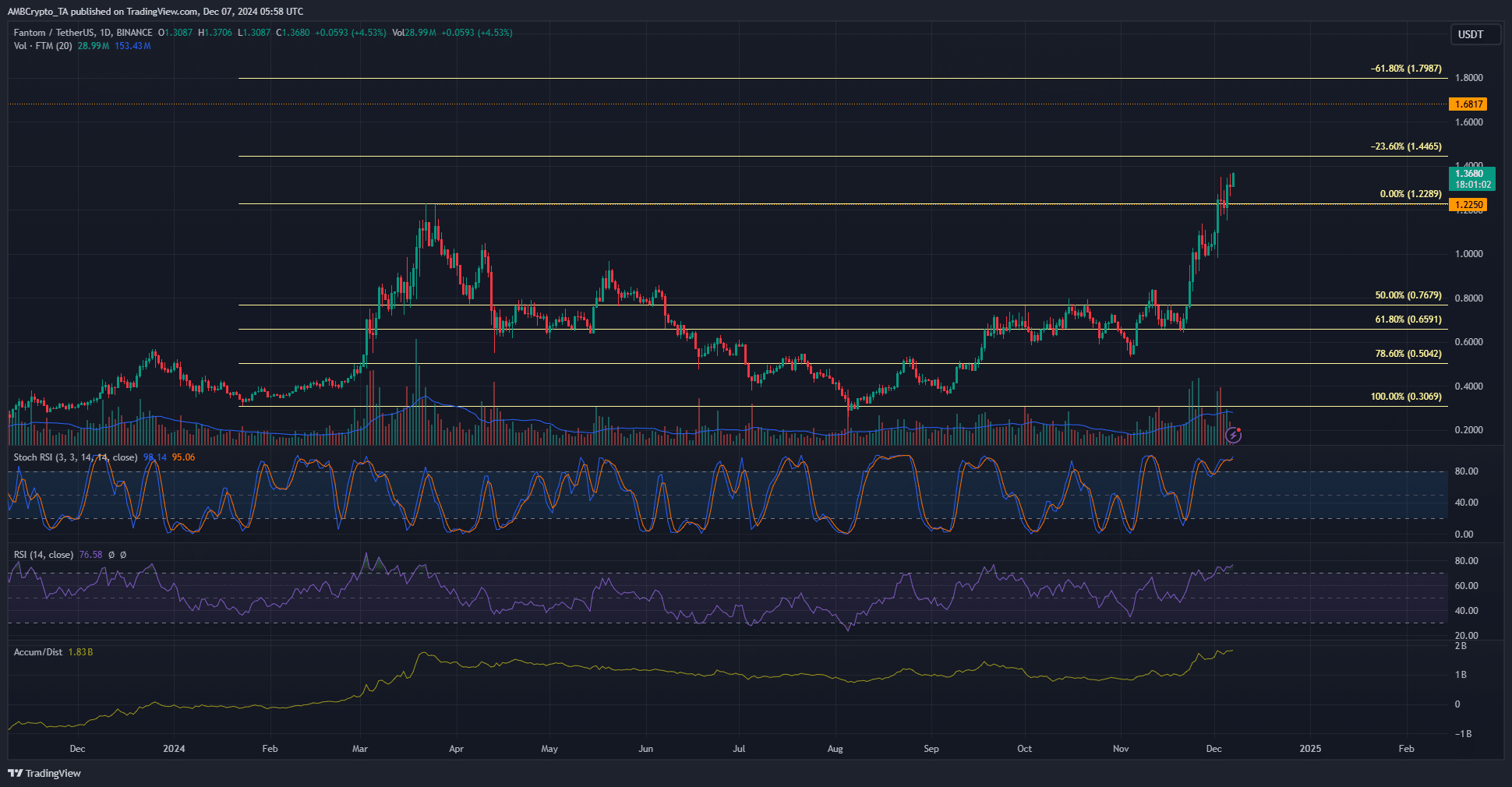

Fantoms [FTM] Bulls managed to regain the $1.22 level as support and possessed the power to drive the price even higher. FTM can be expected to test the $1.44-$1.5 resistance zone soon.

With Bitcoin [BTC] Early in its existence and recently breaking the $100,000 mark, further gains can be expected in the altcoin market in the coming months.

Time for an FTM withdrawal?

Source: FTM/USDT on TradingView

On the daily chart, the breach of the $1 level was a huge boost to bullish belief. The same level was retested as support on November 28. During this breakout, trading volume grew to reflect the buying pressure behind FTM.

The A/D indicator got a boost from rising trading volume. The indicator reflected increased demand as Fantom’s price continued to rise. Over the past five days, the $1.22 level has also turned to support.

This was the March high before the altcoin entered a six-month downtrend. The next resistance levels were $1.44, $1.68 and $1.79.

The Stochastic RSI was in the overbought area, just like the RSI on the daily chart. This did not indicate an immediate pullback, but could be interpreted as a sign that the market could become overloaded. In just over two weeks, the economy has increased by 105%.

The 23.6% resistance at the extension level at $1.44 could temporarily turn off the bulls.

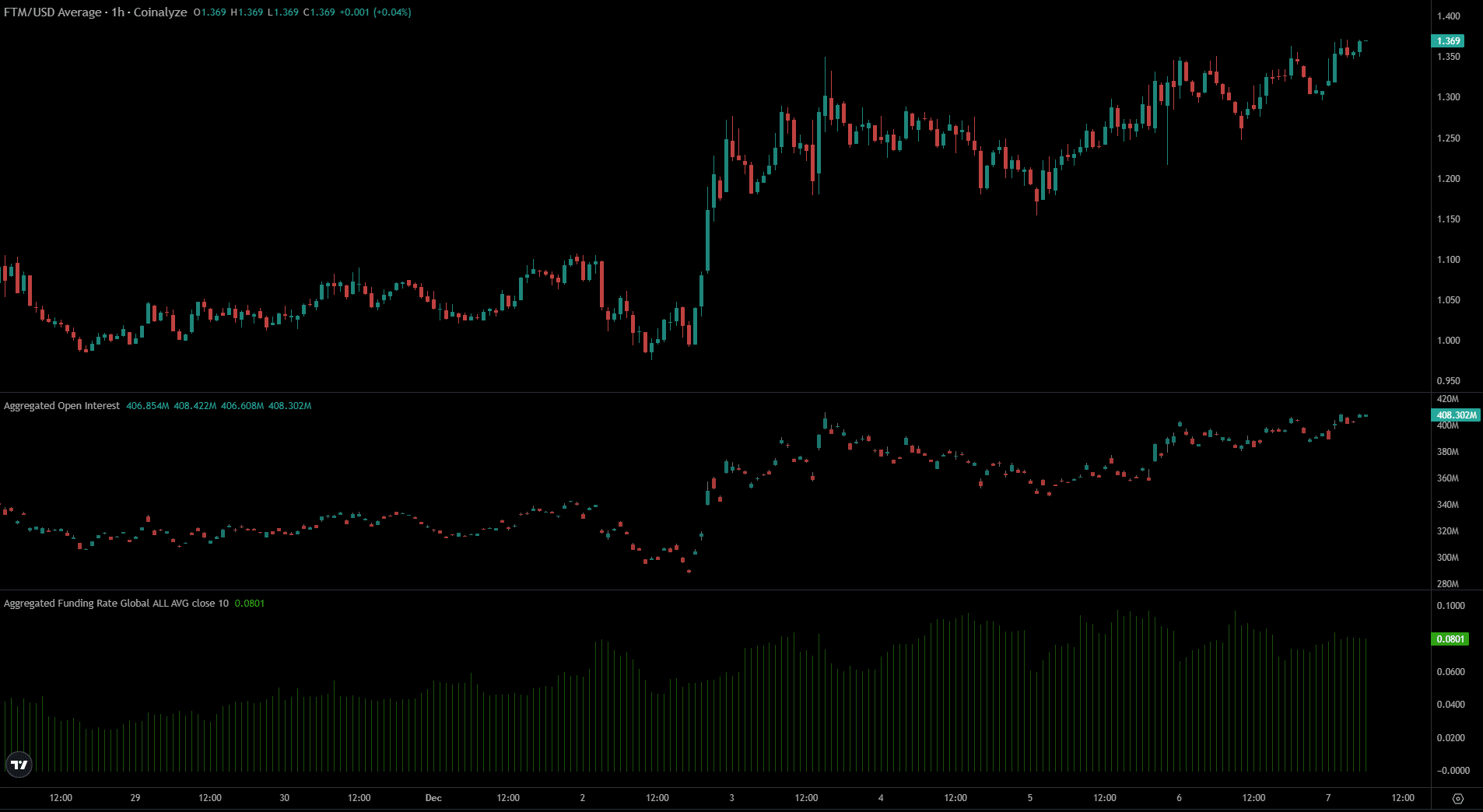

Speculative interest continued to grow

FTM’s Open Interest also rose, arm in arm with the price. This indicated strong bullish sentiment in the futures market.

Read Fantom’s [FTM] Price forecast 2024-25

Funding rates have been trending higher over the past week, showing a greater difference between spot and futures prices. This divergence has been fueled by an increase in the number of speculative participants and is a sign of positive conviction in the short term.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer