- Tightening liquidity and the worry about FTX’s liquidation caused Bitcoin enthusiasts to be cautious.

- A widespread sell-off could lead to a price increase over time, evidenced by historical data.

For the first time in almost three months, Bitcoin [BTC] dropped below $25,000 as panic and uncertainty spread throughout the market.

How much are 1,10,100 BTCs worth today?

The coin, which initially proved to be one of the best-performing assets of the year, has now found itself struggling to catch up with the momentum of other digital currencies outside the crypto market.

To be candid, the reasons are not far-fetched, and the research arm of Deutsche Digital Assets did well to explain the grounds. Top of the list was the anticipated liquidation of the remaining assets of FTX.

Bitcoin moves into bearish territory

According to Deutsche, bearish sentiment has been cast all over Bitcoin and the crypto market. The firm, in its report, also mentioned that the press time sentiment was much more below the optimism the market had during the positive development of the ETF applications.

In its 11 September insight, Deutsche mentioned,

“Last week, crypto assets posted another weak performance amid the anticipated liquidation of FTX’s crypto asset holdings.”

Recall that BlackRock’s progress on the Bitcoin ETF triggered the coin’s rise beyond $30,000. Although the BTC price decreased significantly a few weeks later, the Grayscale partial win over the U.S. SEC also pushed BTC above $28,000.

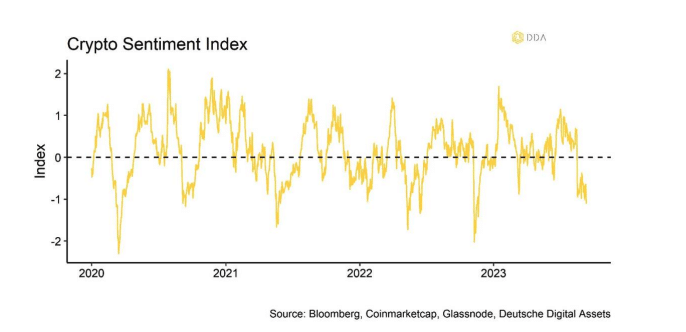

To defend its opinion of bearish dominance, the crypto assets exposure provider employed the crypto sentiment index. Similar to the Bitcoin fear and greed index, the metric identifies the perception in the market by considering asset flows, volatility, and actions taken by participants.

At the time of writing, the index was in the fear region. This means that a large part of the market is pessimistic about the short-term performance of BTC. Hence, there is a widespread restrain from buying BTC at the press time price.

Source: Deutsche Digital Assets

Furthermore, Deutsche explained that the drop in global Exchange Traded Products (ETPs) flows. As another sign of a move into bearish territory, the report noted that,

“The bulk of the net outflows occurred within Bitcoin and Ethereum funds (-72.5 mn USD and -12.8 mn USD, respectively).”

Not every increase deserves applause

On the positive side, Deutsche noted that the surge in Bitcoin active addresses was a welcome development. It also highlighted that many hedge funds had increased their exposure to Bitcoin and other crypto assets.

However, BTC on-chain transfers were at a very low point, meaning macroliquidity was tightening. Therefore, it is possible for Bitcoin’s market cap to decrease in the coming days. On the derivative side, Open interest seems to be picking up again.

Open interest is the total number of open futures contracts at the end of a trading day. When Open Interest increases, it means liquidity in the derivatives market is also rising. Conversely, a decrease in the metric indicates a surge in contract closure.

However, trader Daan Crypto said that the open interest after a squeeze may not be a good sign for Bitcoin. While referring to previous similar scenarios, Daan noted that BTC could go on a full retrace.

#Bitcoin Open Interest rising rapidly again after the squeeze.

This happened as well during all the previous moves up where a lot of positions came in later, price refused to move, started turning and we went for a full retrace.

Not again pls sirs. pic.twitter.com/PhI9ZapnrO

— Daan Crypto Trades (@DaanCrypto) September 12, 2023

Hope for BTC in the end

But he also opined that the retracement could be avoided. Daan posted on X (formerly Twitter) that BTC’s ability to rise above $26,100 could be the catalyst the coin needs to escape retracement. His post read,

“My hope is that the fact that the move started during the Asia session, causes for a rare full trending day. Above 26.1 or so I think we’d be safe from a full retrace for a while. Bulls got to keep the momentum going while they got it on the lower timeframes.”

In the interim, CryptoQuant author BaroVirtual elucidated that Bitcoin could return to its bull phase soon. According to him, BTC was in an intense accumulation phase, as indicated by the short-term holders (Spent Output Profit Ratio) SOPR.

The SOPR indicator provides insight into macro market sentiment, profitability, and losses taken over a particular timeframe. It also reflects the degree of realized profit or loss for all coins moved on-chain.

Typically, values of the SOPR greater than 1 imply that holders are selling at a profit. But when the metric is negative, it is a sign of accumulated losses by short-term holders.

Source: CryptoQuant

Realistic or not, here’s BTC’s market cap in ETH terms

With the metric hovering around the negative zone, BaroVirtual explained that it was similar to the condition around May to September 2021, March 2020, and October to December 2019.

He concluded that,

“The indicated periods of the 155-day RoC negative histogram coincide with bursts of short liquidations (USD) of one force or another, suggesting some sell-off at or near the bottom. After that, Bitcoin tends to increase in price over time.”