NFT

Technology is revolutionizing the art world and offering investors new opportunities and challenges. The emergence of fractional shares of fine arts and NFTs has created a unique intersection of art and technology, leading many to wonder which investment option holds more promise.

Here we dive into the world of art investing to better understand the potential of fractional shares of fine arts and NFTs.

Fractional Shares of Fine Art: Democratizing the Market

Fractional shares of fine art allow investors to own an interest in high-quality works of art without buying them outright. This innovative approach democratizes the art market and makes it accessible to a wider range of investors.

Leading Fractional Art Platforms:

- Masterpieces

- Yield Street

- Particle collection

On these platforms, investors can buy a share in an artwork and share ownership with others. Investing in fractional shares offers several advantages over NFTs:

- Lower Entry Costs: Investors can participate in the art market without the significant upfront capital required for traditional art investments.

- Portfolio diversification: Partial ownership offers a way to diversify one’s investment portfolio, reducing risk and potentially improving returns.

- Access to expert curation: Platforms use art experts to select and curate artworks, providing investors with high-quality pieces.

However, sub-shares also carry risks. Liquidity can be limited as shares are not always easy to sell. Moreover, it is not guaranteed that the value of shares will increase. Investors must rely on platform management for art selection and maintenance.

A notable example of a successful fractional art investment is Jean-Michel Basquiat’s 1982 painting “The Warrior,” which was sold on the Masterworks platform. Shares were initially offered for $20 each and the artwork later sold at auction for over $41 million, generating a 32% return for investors.

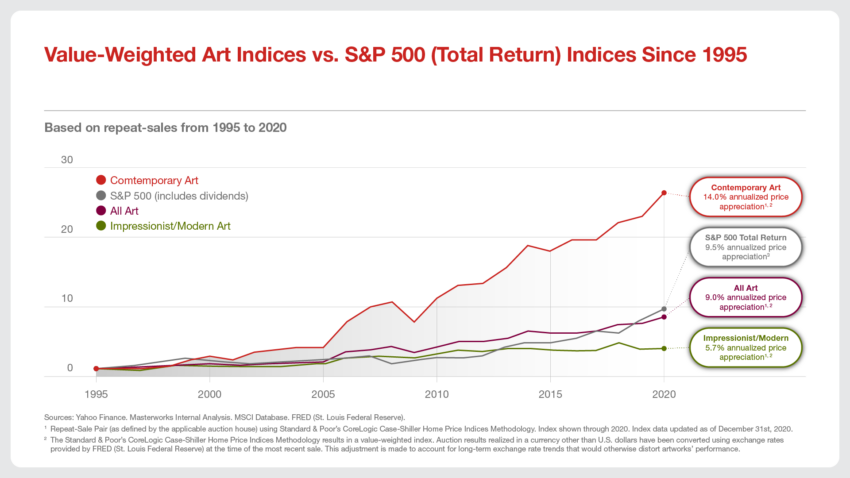

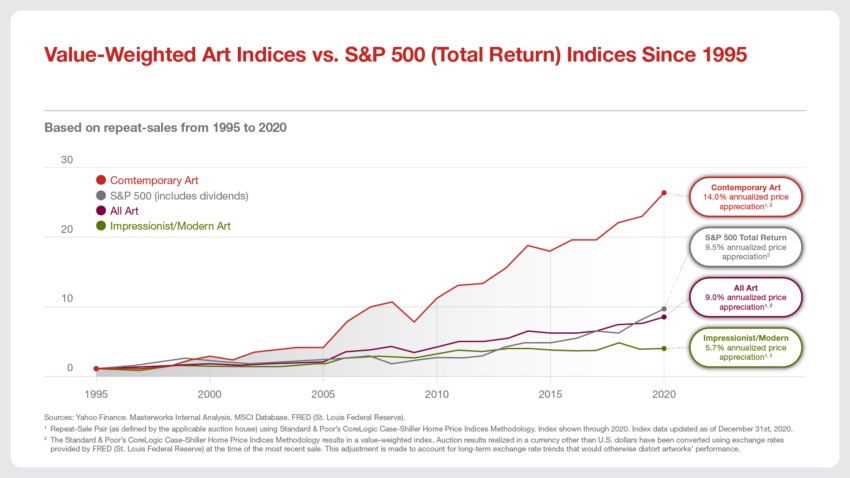

Strong performance in the historic art market rivals the S&P 500. Source: Investing.com

NFTs: Unlocking Digital Creativity

NFTs (non-fungible tokens) have gained a lot of popularity in recent years. These digital tokens, built on blockchain technology, allow artists to mint unique digital works of art. Which can then be bought, sold or traded.

NFTs offer several advantages:

- Verifiable scarcity and provenance: NFTs are unique digital assets. Their scarcity can be verified on the blockchain, ensuring authenticity and preventing counterfeiting.

- Global Market Access: The digital nature of NFTs allows for seamless global transactions, connecting artists and collectors worldwide.

- The potential for high returns: Some NFTs have fetched astronomical prices, such as Beeple’s “Everydays: The First 5000 Days,” which sold for $69 million at auction house Christie’s.

However, NFTs also present challenges. Their value can be very volatile and the market is still in its infancy. In addition, the legal and regulatory frameworks surrounding NFTs are evolving, creating uncertainty for investors.

Blockchain: The Backbone of Digital Art Investment

Blockchain technology plays a vital role in shaping the future of art investment. This ensures security for both fractional ownership and NFTs. Its decentralized nature and transparency help fight fraud, improve origin tracing and streamline transactions. Consequently, blockchain technology fosters trust in the digital art market.

For example, platforms such as SuperRare and Async Art rely on blockchain technology to establish the provenance of digital artworks and enable secure transactions between collectors.

The Long-Term Value Debate: Fractional Equities vs. NFTs

When it comes to long-term value and potential returns, both fractional shares and NFTs have their advantages. Fractional stocks provide access to established and emerging artists, guided by historical share price gains. However, the market can be influenced by external factors such as economic fluctuations and changing tastes.

NFTs, on the other hand, are a newer asset class with limited historical data. Some NFTs have achieved astronomical prices, but predicting future trends remains a challenge. The digital nature of NFTs also raises questions about long-term preservation and relevance.

For example, while a traditional artwork such as that of Picasso Lesson Ladies d’Alger may have a predictable valuation rate, the value of an NFT like CryptoPunk #7804, which sold for $7.6 million, is less certain due to its newness and the rapid pace of change in the digital art world.

Balance between risk and reward

Ultimately, the decision to invest in fractional shares or NFTs depends on an investor’s risk tolerance, interests and objectives. Fractional stocks offer a more traditional approach, with potential exposure to blue-chip artwork and a track record of appreciation in value. On the other hand, NFTs provide an advanced investment opportunity that can provide significant returns but come with higher risks.

For example, an investor with a conservative approach might prefer fractional shares in established artists like Monet or Banksy, while a more adventurous investor might gravitate towards the world of NFTs and explore digital artists like Pak or XCOPY.

As the art market continues to evolve, savvy investors will keep a close eye on developments, looking for opportunities to capitalize on the unique potential of both fractional shares and NFTs. Understanding the pros and cons of each helps investors make informed decisions, balancing risk and reward as they strive for success in the art market.

While the future of art investing lies at the intersection of technology and creativity, it is essential for investors to carefully consider their investment strategies. Whether you opt for fractional shares of fine art or dive into the world of NFTs, the key lies in understanding the market, leveraging technology and adapting to the rapidly evolving art investment landscape.