Key Takeaways

- The cryptocurrency market is presently caught in a stoop amid international macroeconomic pressures.

- Rising fintech adoption might appeal to the subsequent wave of crypto customers, doubtlessly serving to costs surge.

- Bitcoin might rally if the Federal Reserve modifications its hawkish stance or folks lose religion in central banks altogether.

Share this text

Crypto Briefing seems at 4 potential occasions that might revive curiosity in digital property.

A Fed Pivot Lowering Strain on Crypto

One of the broadly mentioned catalysts that might give crypto and different danger property a lift is an finish to the Federal Reserve’s financial tightening insurance policies. At present, the Fed is elevating rates of interest to assist fight inflation. When costs for items, commodities, and power attain untenable ranges, central banks step in to deliver costs all the way down to keep away from long-lasting injury to their economies.

In idea, elevating rates of interest ought to result in demand destruction. When the price of borrowing cash and repaying debt turns into too excessive, it costs out much less viable and environment friendly companies from the market. In flip, this could cut back demand and decrease the costs of important commodities like oil, wheat, and lumber.

Nonetheless, whereas the Fed goals to lift rates of interest till its goal 2% inflation charge is met, which may be simpler stated than performed. Each time the Fed raises charges, it makes it more durable for these holding debt like mortgages to make repayments. If charges go up too excessive or keep too excessive for too lengthy, it should ultimately lead to mortgage holders defaulting on their loans en masse, leading to a collapse within the housing market just like the Nice Monetary Disaster of 2008.

Due to this fact, the Fed might want to pivot away from its financial tightening coverage earlier than too lengthy. And when it does, it ought to relieve a lot of the downward strain maintaining danger property like cryptocurrencies suppressed. Ultimately, the Fed may also begin reducing rates of interest to spur financial development, which must also act as a big tailwind for the crypto market.

When the Fed is prone to pivot is up for debate; nevertheless, most pundits agree it will likely be troublesome for the central financial institution to proceed elevating charges previous the primary quarter of 2023.

Fintech Crypto Adoption

Though crypto property have made big strides lately, their advantages are nonetheless pretty inaccessible to the typical particular person. Use circumstances resembling cross-border transfers, blockchain banking, and DeFi are in demand, however the easy, easy-to-use infrastructure to mass onboard customers has not but been developed.

Because it stands, utilizing crypto is complicated—and a far cry from what most individuals are used to. Managing non-public keys, signing transactions, and avoiding scams and hacks could be intuitive for the typical crypto degen, nevertheless it stays a big barrier to adoption for extra informal customers.

There’s an enormous hole available in the market for onboarding the typical particular person into crypto. If fintech corporations begin to combine crypto transfers into their choices and make it simpler for customers to place their funds to work on the blockchain, crypto might see a brand new wave of adoption. Because it turns into simpler to make use of crypto infrastructure, extra individuals are prone to acknowledge its utility and spend money on the area, making a optimistic suggestions loop.

Some corporations have already acknowledged this imaginative and prescient and are engaged on merchandise that make it simpler for anybody to begin utilizing crypto. Earlier this yr, PayPal built-in deposits and withdrawals of cryptocurrency to private wallets, marking a big first step towards broader crypto cost adoption. Final month, Revolut, one of many largest digital banks, was granted registration to supply crypto companies within the U.Okay. by the Monetary Conduct Authority.

Nonetheless, probably the most vital growth could also be but to come back. Robinhood, the no-fee buying and selling app that fueled the so-called “meme inventory” mania of early 2021 and the following Dogecoin rally, is making ready to launch its personal non-custodial pockets. Final month, the pockets’s beta version went out to 10,000 early customers, and a full launch is scheduled for the top of 2022. The Polygon-based pockets will permit customers to commerce over 20 cryptocurrencies via decentralized change aggregator 0x, with out charges. The pockets may also let customers connect with DeFi protocols and earn yield on their property.

At its core, crypto bull runs are fueled by adoption, and merchandise like Robinhood’s new pockets might develop into the killer app to onboard the subsequent era of customers.

The Bitcoin Halving

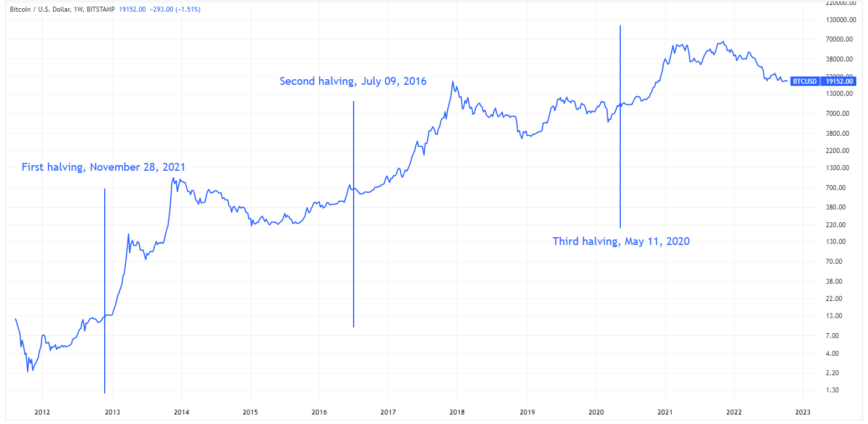

Coincidence or not, a brand new bull rally has traditionally commenced shortly after the Bitcoin protocol halves its mining rewards each 210,000 blocks. This catalyst has predicted each main bull run because the first Bitcoin halving in late 2012 and can possible proceed to take action effectively into the long run.

Following the primary halving on November 28, 2012, Bitcoin soared over 7,000%. The following halving on July 9, 2016, catapulted the highest cryptocurrency up round 2,800%, and after the final halving on Could 11, 2020, Bitcoin moved up greater than 600%.

The almost certainly rationalization for the halving rallies which have taken place roughly each 4 years is straightforward provide discount. Financial idea posits that when the provision of an asset reduces however demand stays the identical, its value will enhance. Bitcoin miners sometimes promote a big portion of their Bitcoin rewards to cowl the price of electrical energy and maintenance of their mining machines. Because of this when rewards are halved, this promoting strain is drastically decreased. Whereas this preliminary provide discount acts because the ignition, bull rallies typically take crypto a lot greater than will be attributed to only the halving.

On the present charge of block manufacturing, the subsequent Bitcoin halving is about to happen someday in late February 2024. It’s value noting that for each subsequent halving, the quantity Bitcoin rallies diminishes, and the time between the halving and the bull run peak will increase. That is possible as a result of liquidity within the Bitcoin market growing, dampening the impact of the provision discount. Nonetheless, if historical past is any precedent, the subsequent halving ought to propel the highest crypto considerably greater than its prior all-time excessive of $69,044 achieved on November 10, 2021.

One caveat to the halving thesis is that the upcoming 2024 halving might be the primary to happen beneath a bleak macroeconomic backdrop. If the world’s central banks can’t repair the present inflation disaster whereas sustaining financial development, it might be powerful for danger property like crypto to rally even with the halving provide discount.

Lack of Belief in Central Banks

The final potential bull run catalyst is probably the most speculative of the examples listed on this article, however one which’s positively value discussing.

In current months, the deficiencies in main central bank-run economies have develop into more and more obvious. Most world currencies have plummeted towards the U.S. greenback, bond yields have appreciated considerably as confidence in nationwide economies decreases, and the central banks of Japan and the U.Okay. have resorted to purchasing their very own authorities’s debt to forestall defaults in a coverage of Yield Curve Management.

The present debt-based monetary system is reliant on fixed development, and when this stops, fiat currencies that aren’t backed by something endure a really actual danger of hyperinflation. Even earlier than the present spike in inflation resulting from provide chain points, an prolonged interval of low rates of interest possible brought on irreparable injury to the U.S. economic system. The price of residing, home costs, and firm valuations soared whereas wages stagnated. As an alternative of utilizing low-cost debt to develop companies and create actual financial worth, many borrowed cash to buy actual property or spend money on shares. The result’s an enormous asset bubble that will not have the ability to be unwound with out collapsing the world economic system.

When fiat economies present weak point, gold and different valuable metals have typically been considered as secure havens from monetary collapse. Nonetheless, investing in gold-based monetary merchandise like gold ETFs isn’t a viable possibility for most individuals. Even those that do should get caught within the maelstrom if contagion hits the broader monetary markets. This leaves Bitcoin and different arduous, decentralized cryptocurrencies with fastened provides as apparent candidates to switch gold as a retailer worth if the general public loses belief in nationwide currencies.

Earlier than the present monetary disaster, buyers had began to acknowledge Bitcoin as a tough forex resulting from its fastened provide of 21 million cash, incomes the highest crypto the title of “digital gold” amongst adherents. Extra just lately, high hedge fund managers resembling Stanley Druckenmiller and Paul Tudor Jones have aired comparable views. In a September CNBC interview, Druckenmiller stated that crypto might get pleasure from a “renaissance” if belief in central banks wanes. Equally, Jones has acknowledged that cryptocurrencies like Bitcoin and Ethereum might go “a lot greater” sooner or later resulting from their restricted provide.

Disclosure: On the time of scripting this piece, the creator owned ETH, BTC, and a number of other different cryptocurrencies.