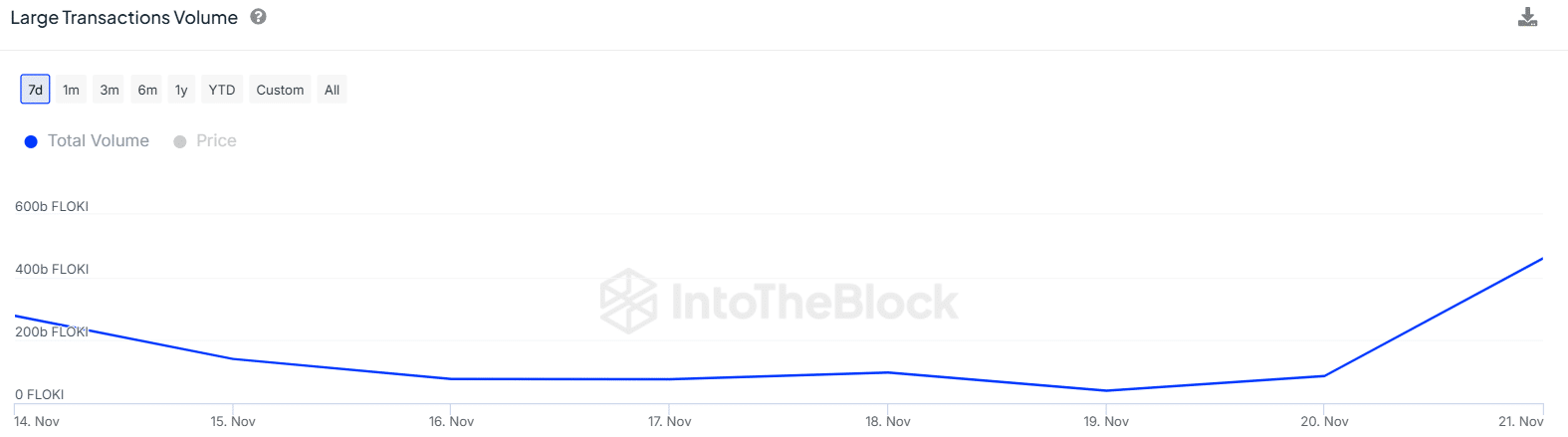

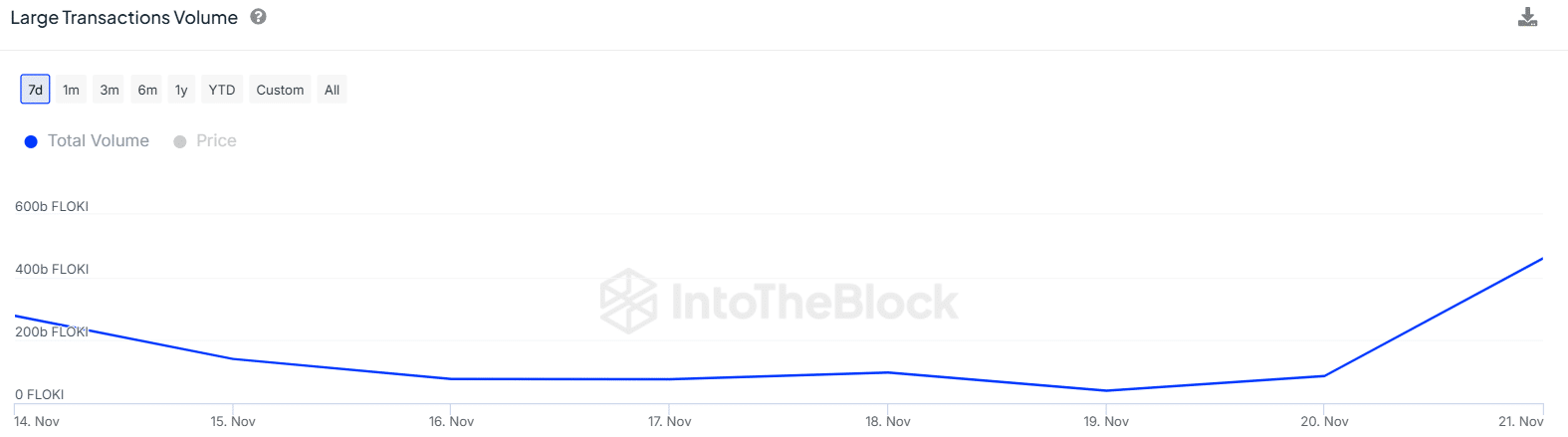

- FLOKI’s large transaction volumes increased from 39 billion to 460 billion within two days

- FLOKI is also facing strong resistance at $0.00027 despite strong bullish momentum

Floki [FLOKI]At the time of writing, it was trading at $0.000261, after a slight gain of 1% in 24 hours. FLOKI is among the best performing dog-themed memecoins, after gaining a whopping 78% in 30 days.

Despite FLOKI’s rally facing strong resistance at $0.00027, technical indicators suggest another rebound could occur in the near term.

On the one-day chart, FLOKI was even on the verge of forming a bullish crossover. The 50-day Simple Moving Average (SMA) has tilted north and has seen a crossover above the 200-day SMA.

However, given that this golden cross is happening below the price, traders may have already priced in the momentum. Nevertheless, the indicator indicates that the uptrend is gaining strength.

Source: Tradingview

The Relative Strength Index (RSI) of 70 further shows that momentum is still bullish. The RSI has returned from overbought levels, indicating that FLOKI’s rally is cooling off, creating room for price stability.

The volume histogram bars show a battle between buyers and sellers. Traders should therefore watch out for the support at $0.00024 as a drop below it could mark the start of a downtrend.

FLOKI whale activity is increasing

Whale activity around FLOKI has increased significantly over the past two days. According to IntoTheBlock, large transaction volumes for FLOKI have increased by more than 1,000% from 39 billion to 460 billion in the past two days.

Source: IntoTheBlock

FLOKI’s whale activity is at its highest level in seven days. The whale concentration around FLOKI stands at 73%, while retail holds only 14% of the supply. If these major addresses become more active, it could drive price volatility.

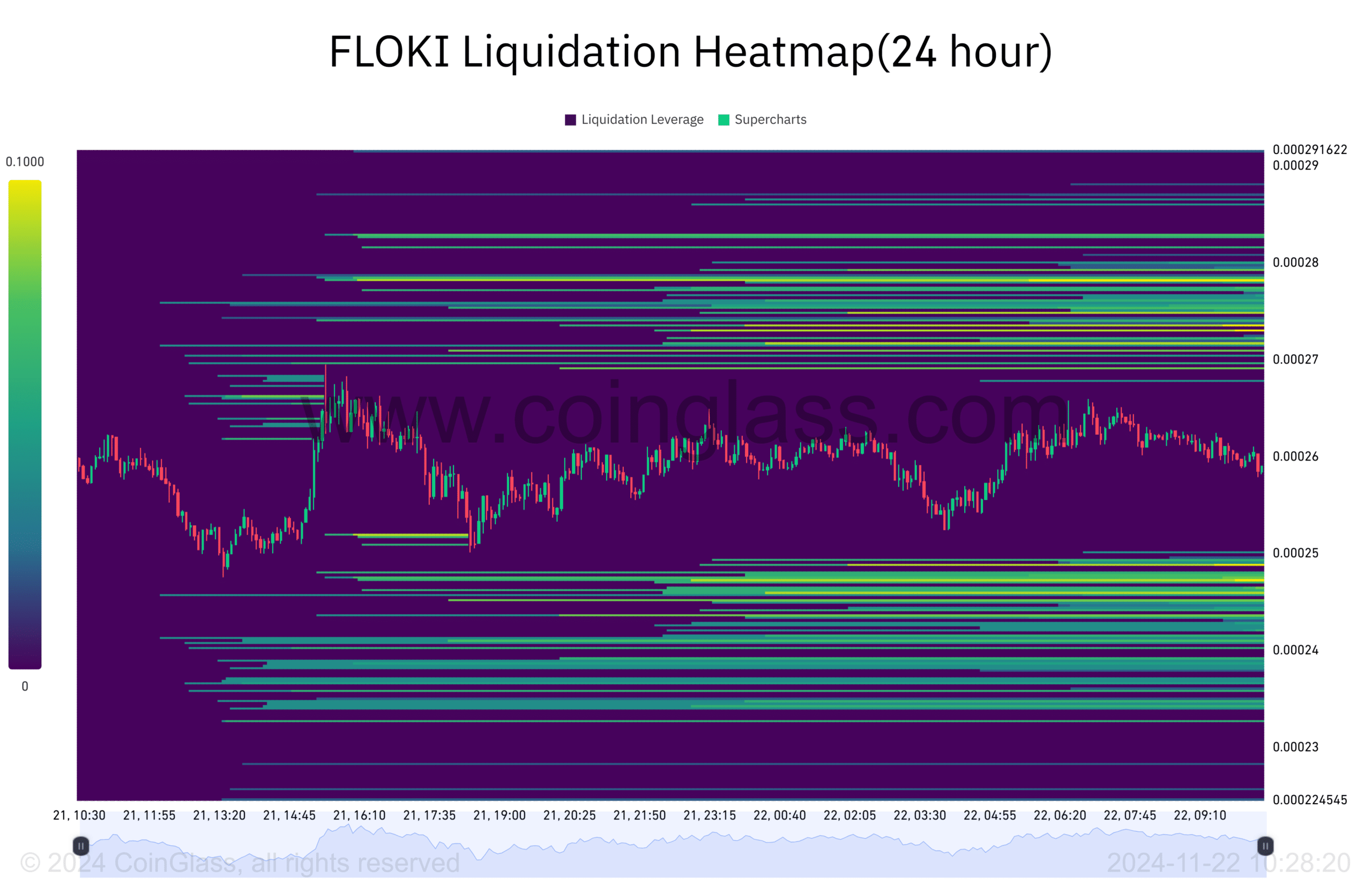

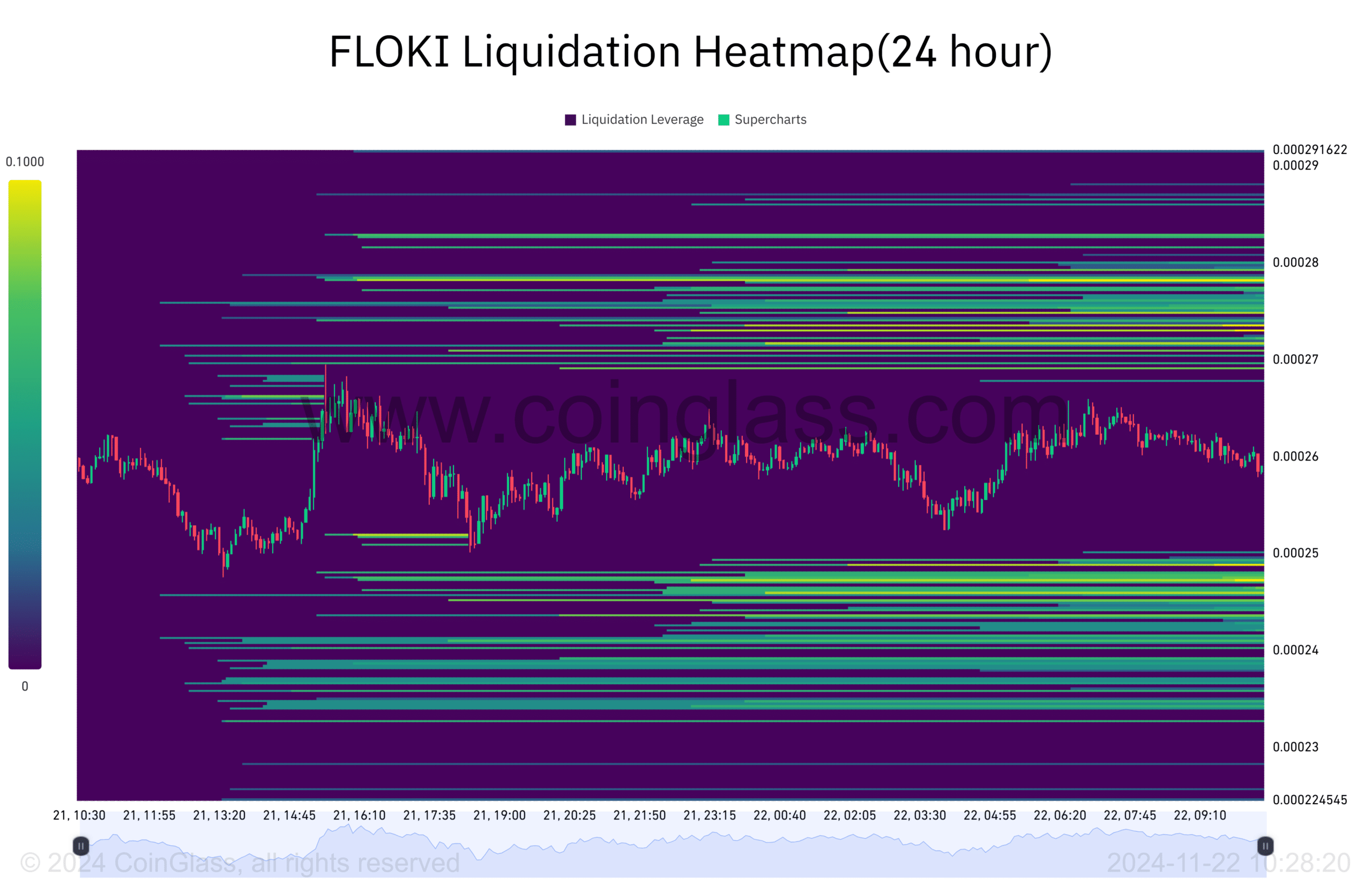

Long liquidations are increasing

A look at the derivatives market shows that long traders betting on further profits on FLOKI have registered a sudden increase in liquidations.

On November 21, long liquidations were $641,000 per Mint glasstheir highest level in over a month. These liquidations may have stalled FLOKI’s rally as traders were forced to close their positions by selling.

FLOKI’s liquidation heatmap also shows that after the price dropped to $0.000251, a significant number of longs were required.

Source: Coinglass

Realistic or not, here is FLOKI’s market cap in BTC terms

Even though these positions have been closed, there is still a huge liquidation cluster above and below the current price. FLOKI could move into one of these zones depending on market conditions.

However, the nearest liquidation is above the price, which could support an upside breakout.