- Flare crypto bulls tried to break out but were rebuffed.

- The indications from the volume trends pointed to a continued upward movement and a recovery was still unlikely.

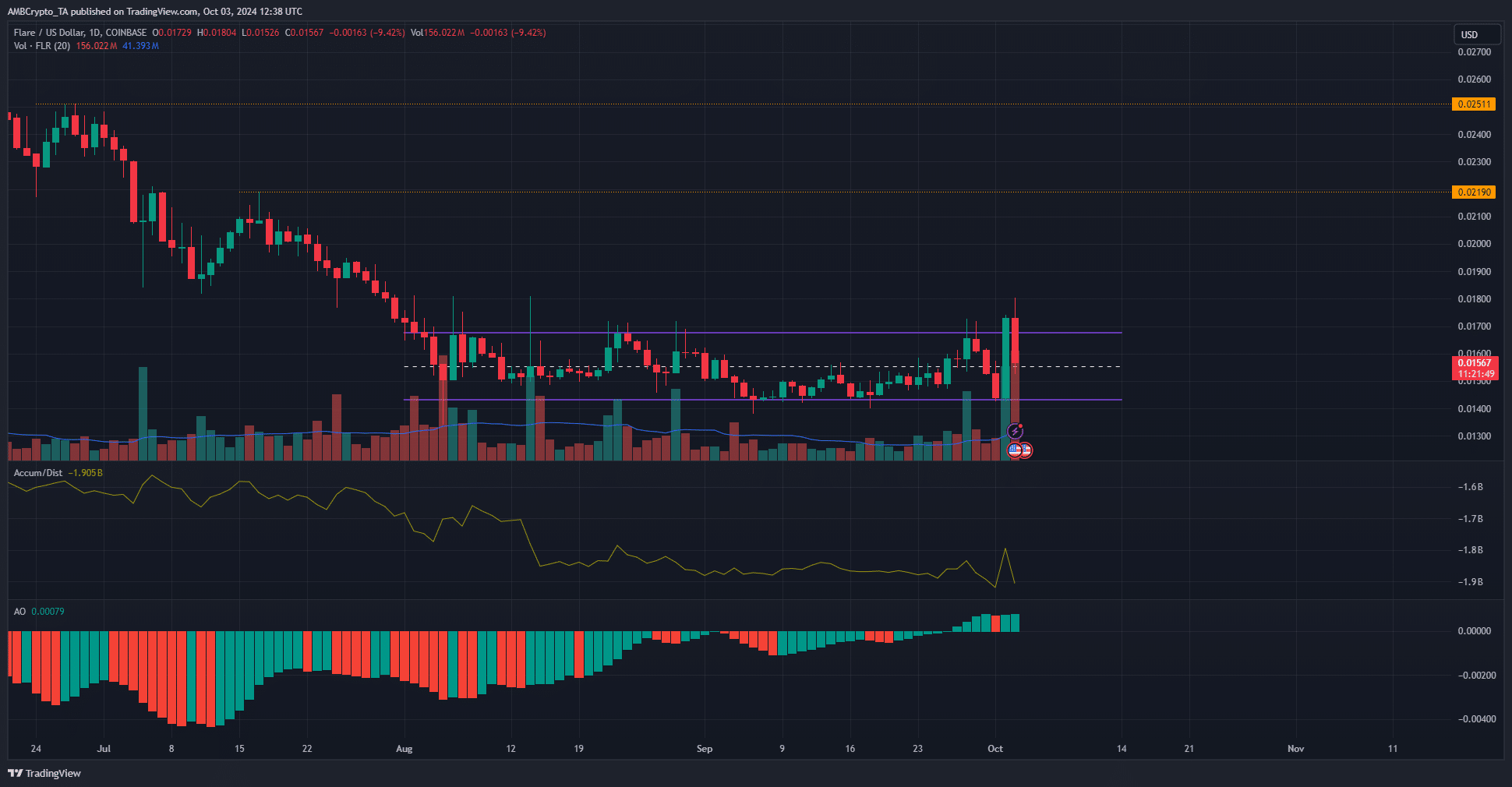

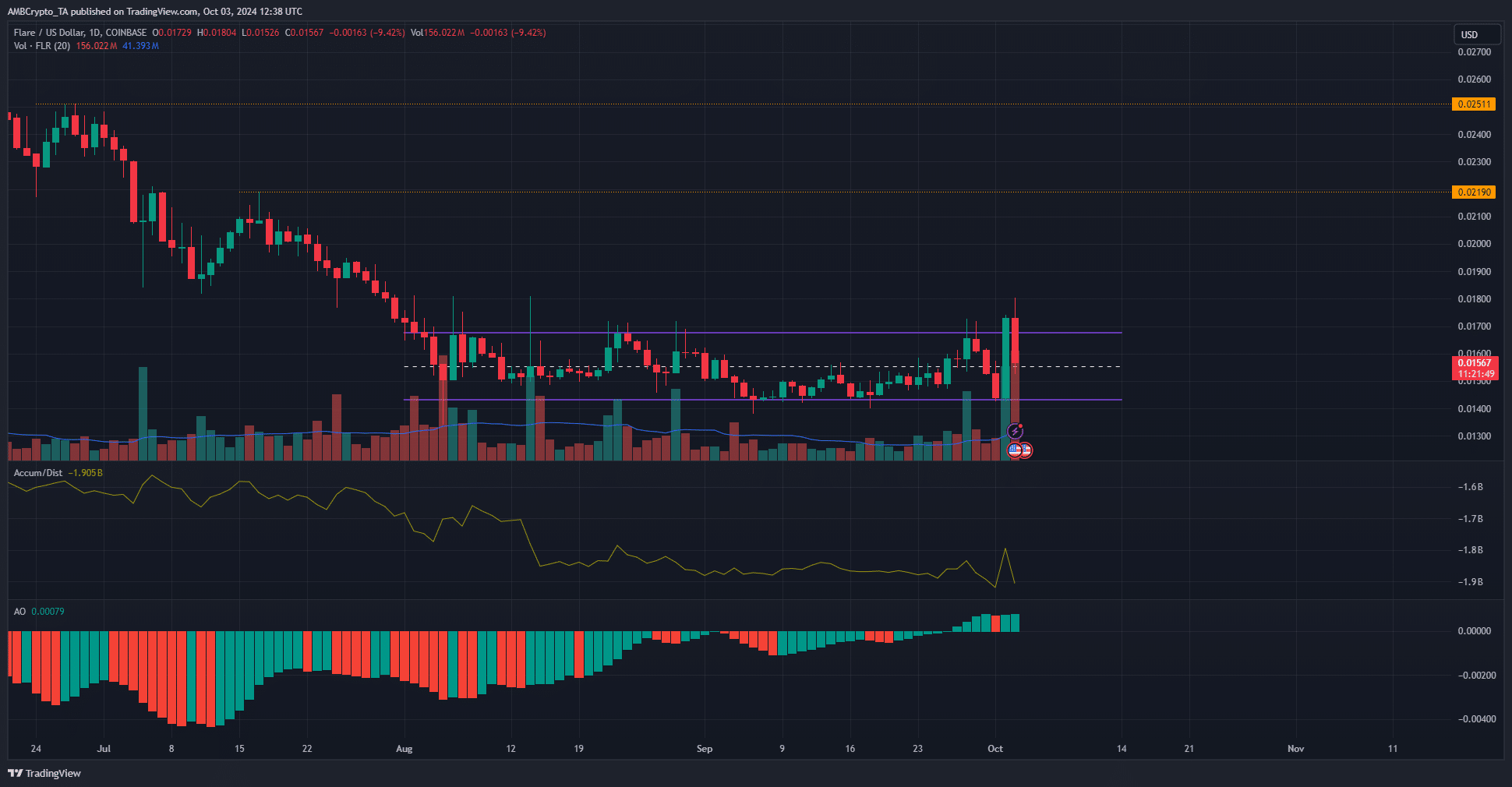

Glow [FLR] has been trading within a certain bandwidth since the beginning of August. This range extended from $0.0143 to $0.0167, with the midpoint at $0.0155. The token saw a sharp increase in trading volume on October 2.

This increase was accompanied by a sharp price increase. FLR shot up from range lows to breakout on the same day, but has since been forced to move lower.

Range breakout was emphatically denied

Source: FLR/USDT on TradingView

This price drop was 12.42% from the local high of $0.018. It returned FLR to the range formation, retesting the midrange level as support.

AMBCrypto looked at the A/D indicator to see if the price trend was likely to resume its upward momentum.

The A/D has slowly declined since mid-August. The previous day’s gain failed to break August’s highs.

The indications from this volume indicator were bearish: Flare is unlikely to stage a recovery towards March levels.

The attempted breakout into the range can be considered a failure as the treble was not turned in support.

It is possible that FLR bulls can achieve this in another attempt, but traders and long-term holders should remain cautious until the volume indicator goes up.

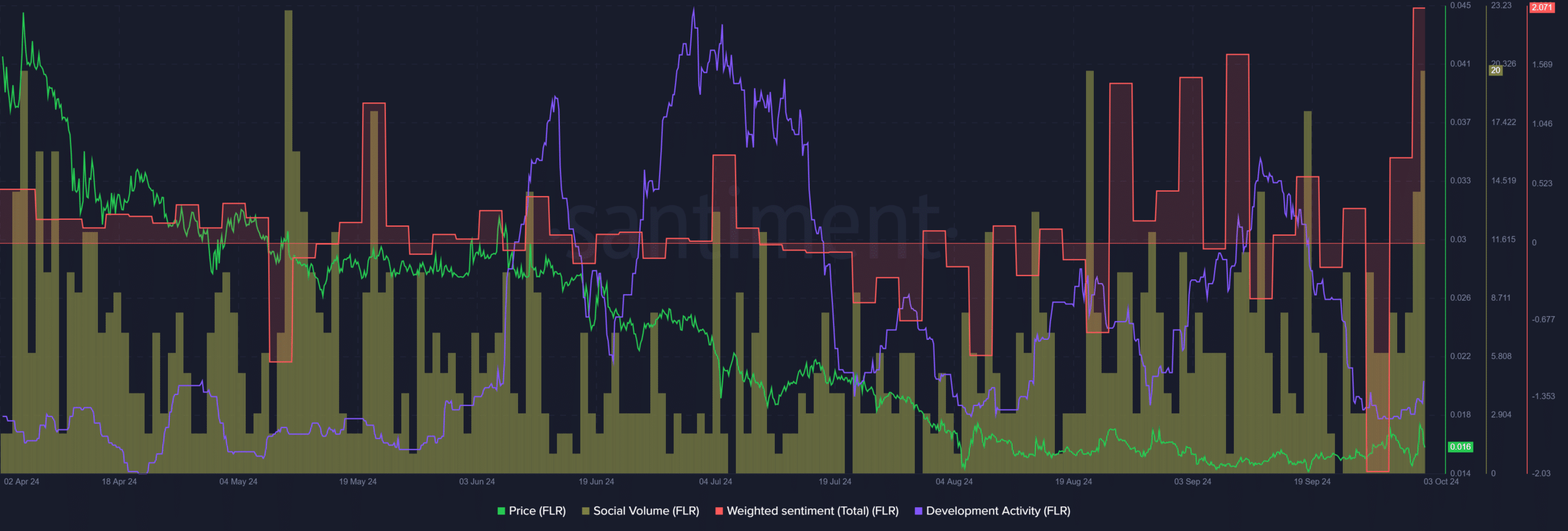

Social activity increases as a result of price activity

Weighted sentiment soared higher, hitting a high not seen since January. This reflected the intensely positive social media engagement following the Flare range breakout.

Realistic or not, here is FLR’s market cap in BTC terms

The social volume also experienced notable growth.

Development activity has been trending lower in recent weeks and is well below the highs it maintained in July and September. This could be a concern for long-term investors.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer