- Bitcoin returns to $ 88k after a large slump, but the wallet continues to stagnate.

- Fidelity Analysters doubt the risk-corrected return of Bitcoin compared to the S&P 500.

Bitcoin [BTC] After a considerable decline, his bullish momentum recovers from a low $ 78k low after a peak of $ 109k.

Since the leading cryptocurrency makes a strong recovery, there are still worries about his underlying network growth.

Jurrien Timmer weighs in

Jurrien Timmer, director of Global Macro at Fidelity Investments, pointed From that BTC’s wallet has shown minimal expansion last year.

This raises questions about whether the latest price increase is fed by organic acceptance or short -term market speculation.

Timmer attributes Bitcoin’s stagnating wallet growth to the approval of the spot exchange-based funds (ETFs) and the aggressive accumulation strategy of microstrategy.

He explains that institutional buyers, unlike investors in the retail trade, only need a few portfolios to manage substantial companies, limiting the apparent expansion of the network.

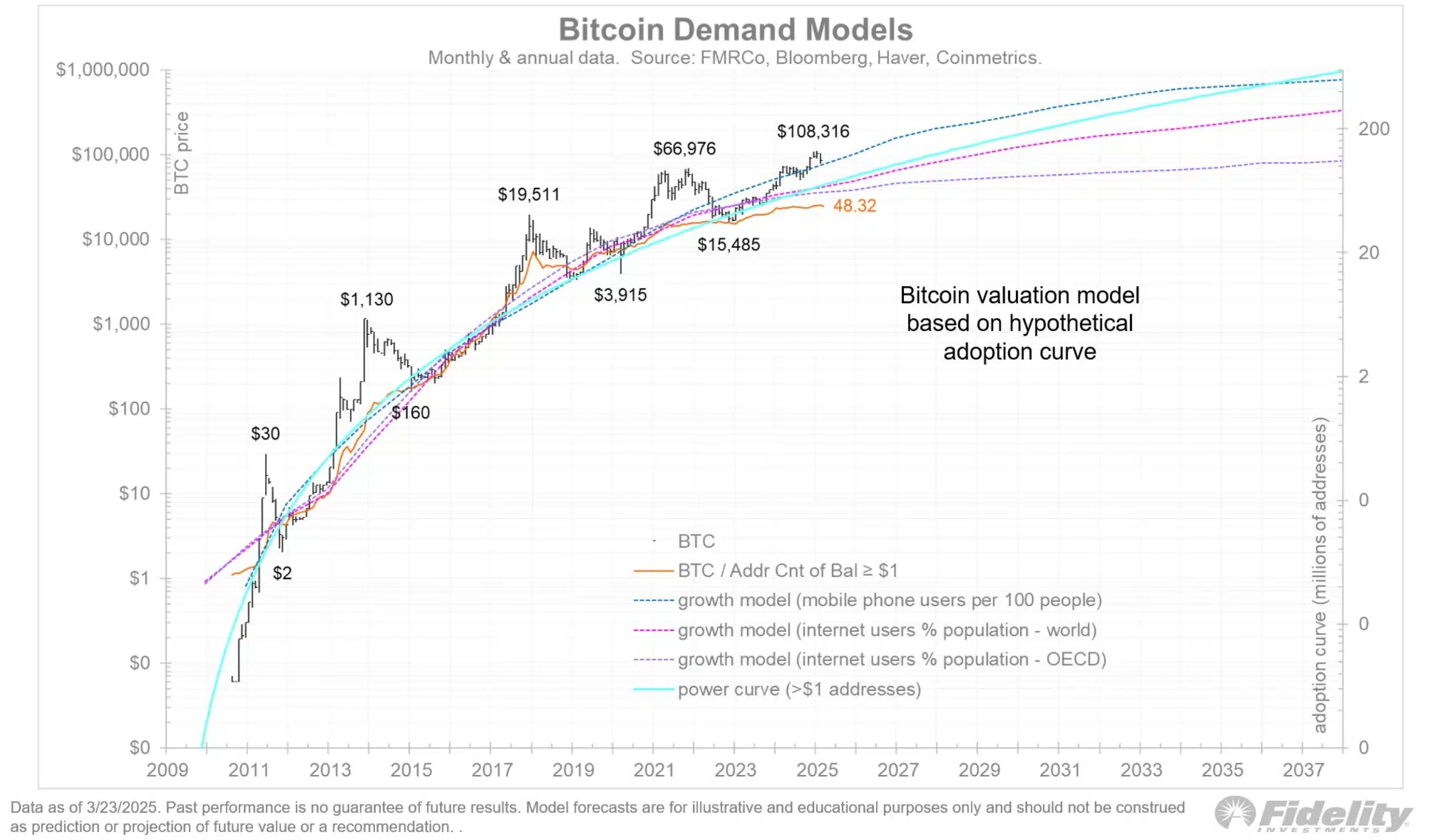

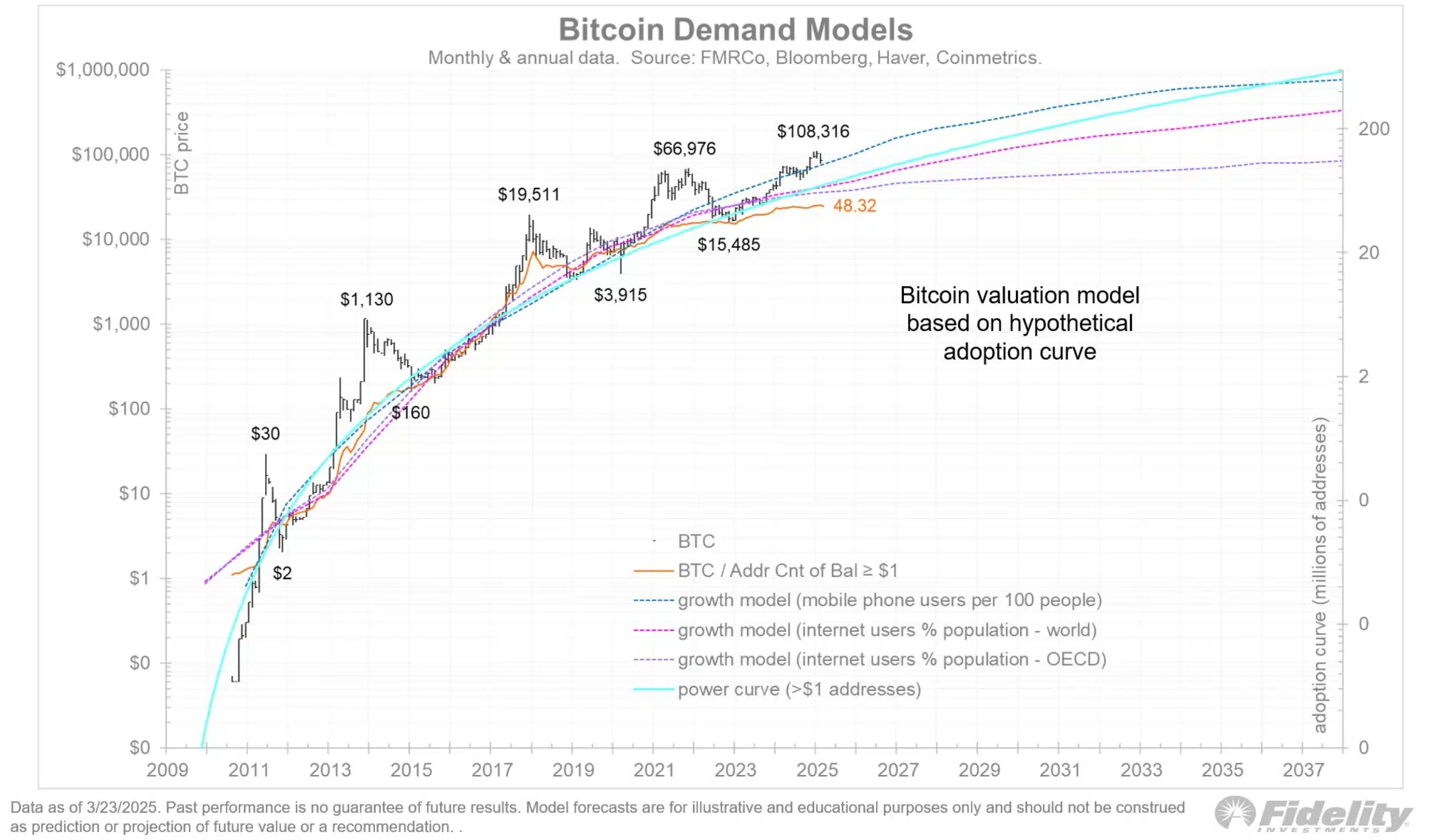

Nevertheless, Timmer remains confidence in the long-term process of BTC, and notes that its acceptance follows the S-curve that is seen in other exponential technologies.

The Power Law Model

Moreover, Bitcoin’s valuation adheres to the Power Law model, whereby its value increases as more participants deal with the network, which strengthens the potential in the long term.

To x, timer added,

“Unfortunately, this will make it more difficult to follow the adoption curve in the future.”

Source: Jurrien Timmer/X

Add to the fight, Sinaco-founder at 21stCapital, noticed,

“Good recording. Wallet addresses deviate from the ten-year trend.”

Bitcoin versus shares

In addition, Chris Kuiper, director of research at Fidelity Digital Assets, also marked Bitcoin’s overwhelming performance compared to traditional markets in the past four years.

Although Bitcoin has registered an annual growth rate of 17% (CAGR), the S&P 500 is not far behind 13%.

However, the fact that risk-corrected returns are taken into account, but BTC falls short, because investors have confronted the volatility almost four times for just a marginal higher return.

This further concerned about Bitcoin’s risk remuneration profile, especially for institutional investors looking for more stable but competitive investment options.

Kuiper said,

“So this specific period of 4 years has landed the previous cycles so far. If we really peaked earlier this year, this will be a pretty disappointing cycle.”

Kuiper recognizes the possibility of an extensive market cycle, which suggests that the BTC process may not follow rigid patterns.

Bitcoin’s current price promotion

Acting at $ 88,036.11 on a time time after a daily increase of 0.64%, Bitcoin has also registered a solid weekly profit of 4.90%, according to Mint market cap.

In particular, recent outbreak above the resistance of $ 86,800 on March 24 signals Renewed Bullish Momentum.

Therefore, while Bitcoin continues to navigate through market fluctuations, investors remain vigilant for signs of a persistent rally or potential corrections in the coming weeks.