- Fidelity added to the weekly selling pressure by selling $213 million worth of ETH

- There may already be some short-term bullish relief

Ethereum [ETH] may be on the verge of rebounding after its latest rally, but a big selloff has put that possibility into doubt. In fact, a Fidelity address reportedly transferred a significant amount of ETH.

A recent Lookonchain analysis revealed that Fidelity transferred 64,997 ETH to Coinbase. This happened on Friday and the ETH transferred was reportedly worth more than $213 million. This transfer occurred after a bearish week and after the cryptocurrency had already experienced a major pullback during the week.

The transfer from a private wallet to an exchange suggests that Fidelity is offloading ETH. This happened on the same day that Ethereum ETFs recorded a total of $159.4 million in net outflows. Not surprisingly, Fidelity’s FETH ETF had the highest number of outflows of all Ethereum ETFs on Thursday at $147.7 million.

Is Fidelity’s ETH Selling Reflective of Market Sentiment?

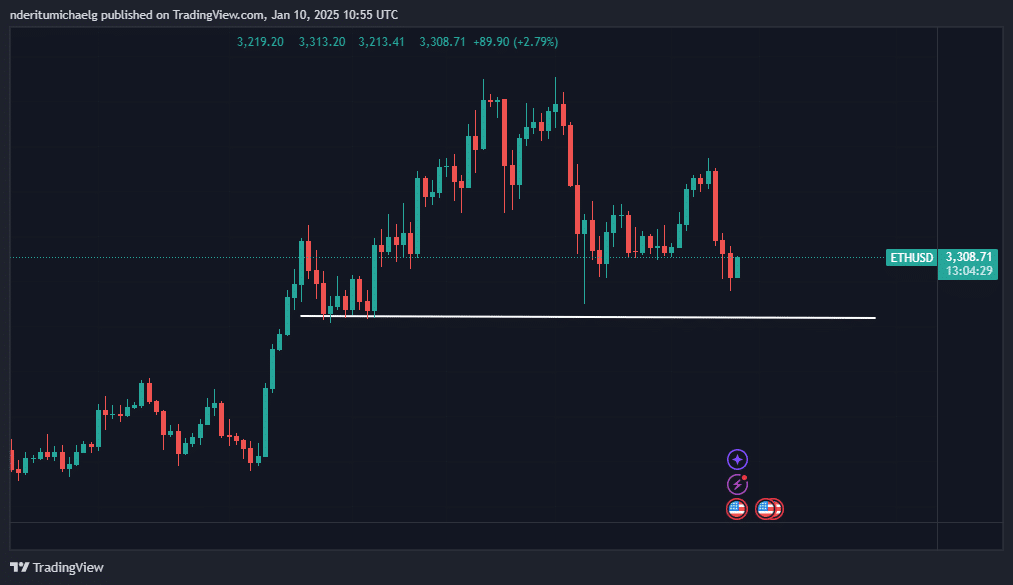

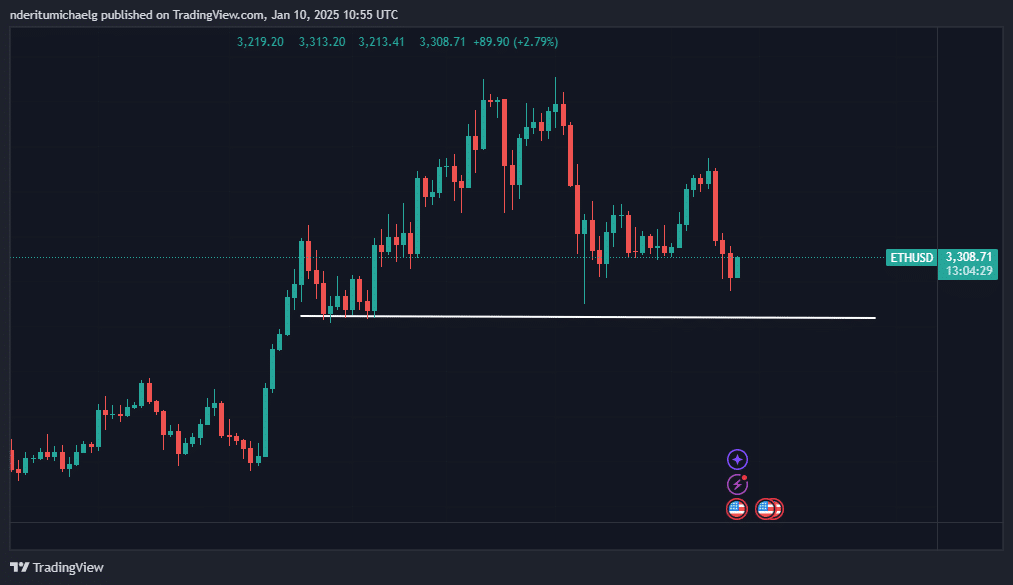

ETH has maintained net selling pressure since Tuesday, and this trend was maintained on Friday – the same day Fidelity transferred the aforementioned coins. This resulted in a 15.54% drop from the weekly high to the weekly low.

source: TradingView

ETH was valued at $3,308 at the time of writing, thanks to a 2.89% increase in the past 16 hours. This slight recovery suggested demand was making a comeback after Friday’s close. So there was some accumulation after the weekly dip.

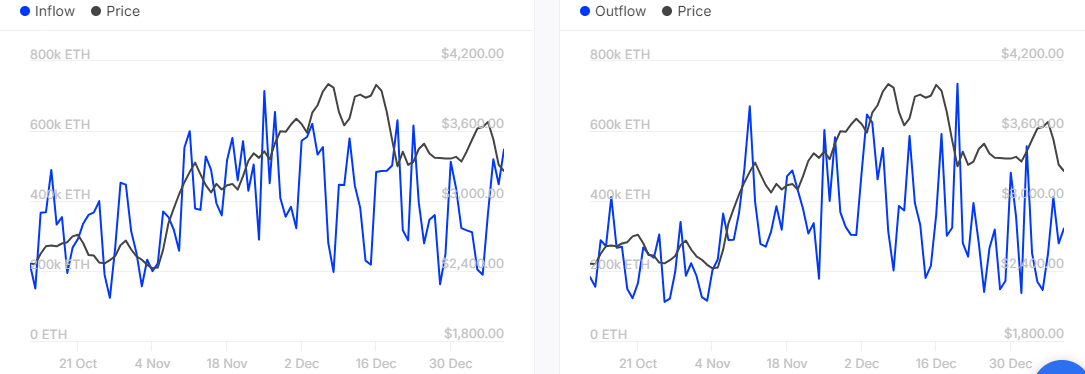

However, can the cryptocurrency sustain this rise? That would depend on the level of demand and who is buying. Onchain data confirmed that whales bought the latest dip. For example, the inflow from large holders was 547,230 ETH, while the outflow from large holders on January 9 was 321,650 ETH.

Source: IntoTheBlock

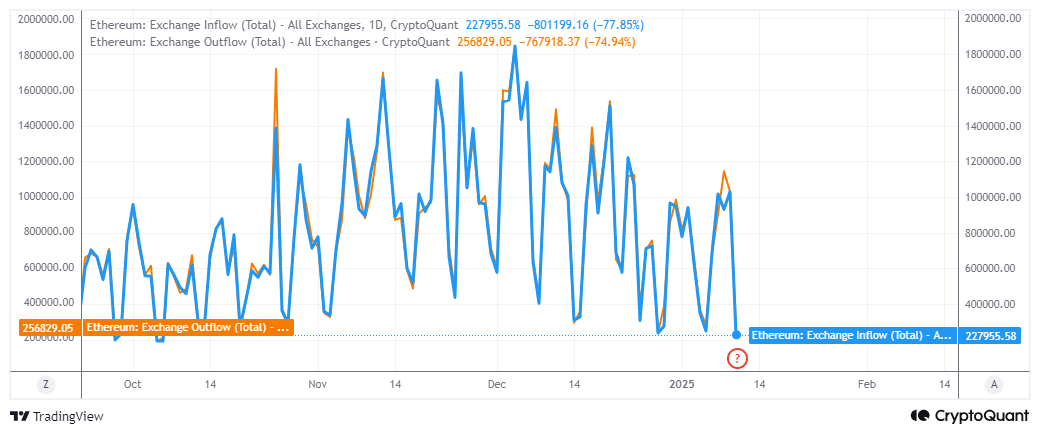

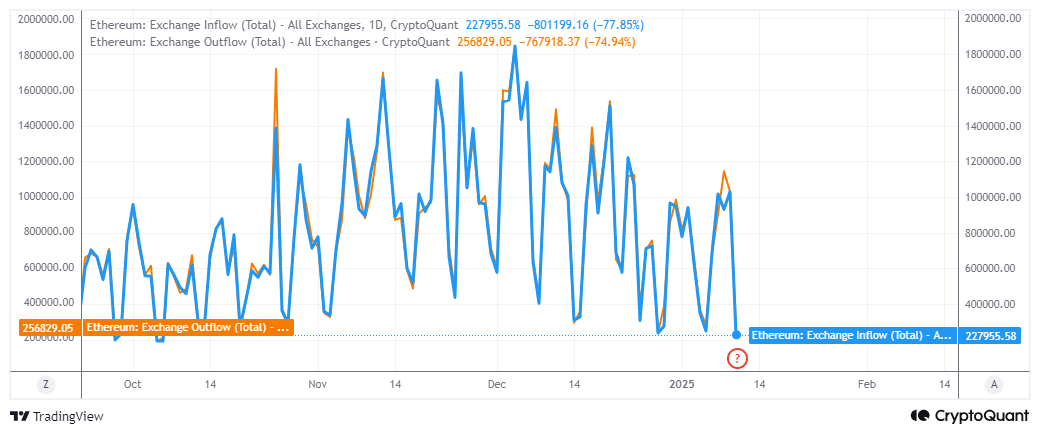

The surge in demand for whales could mean a weekend recovery for ETH. Even the exchange flows suggested that the cryptocurrency could be in a position where demand is likely to make a comeback.

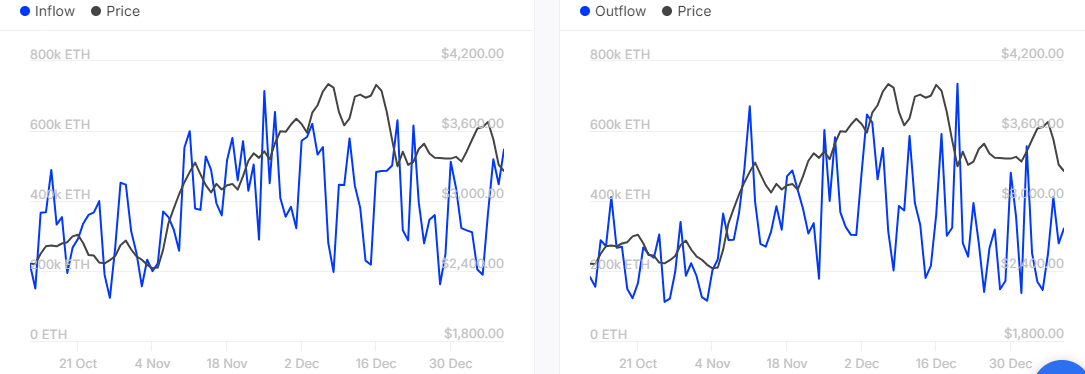

Currency flows recently fell to levels last seen in early November. According to CryptoQuant, currency outflows were slightly higher at 256,829.05 ETH, compared to 227,955.58 ETH at the time of writing.

source: CryptoQuant

The exchange rate data appeared to be in line with the recent rebound and pointed to the possibility of a recovery rebound. However, investors should consider the possibility of further negative consequences.

In fact, ETH’s daily chart placed the next major support level at the $3,033 price level. If sufficient demand cannot be secured at press time, ETH could potentially capitulate to the aforementioned support level.